Epf 11 Form

Epf form 11 is a self declaration form that needs to be filled by the employee at the time of joining an organization which is covered under the employees provident fund epf scheme as per the epf act 1952.

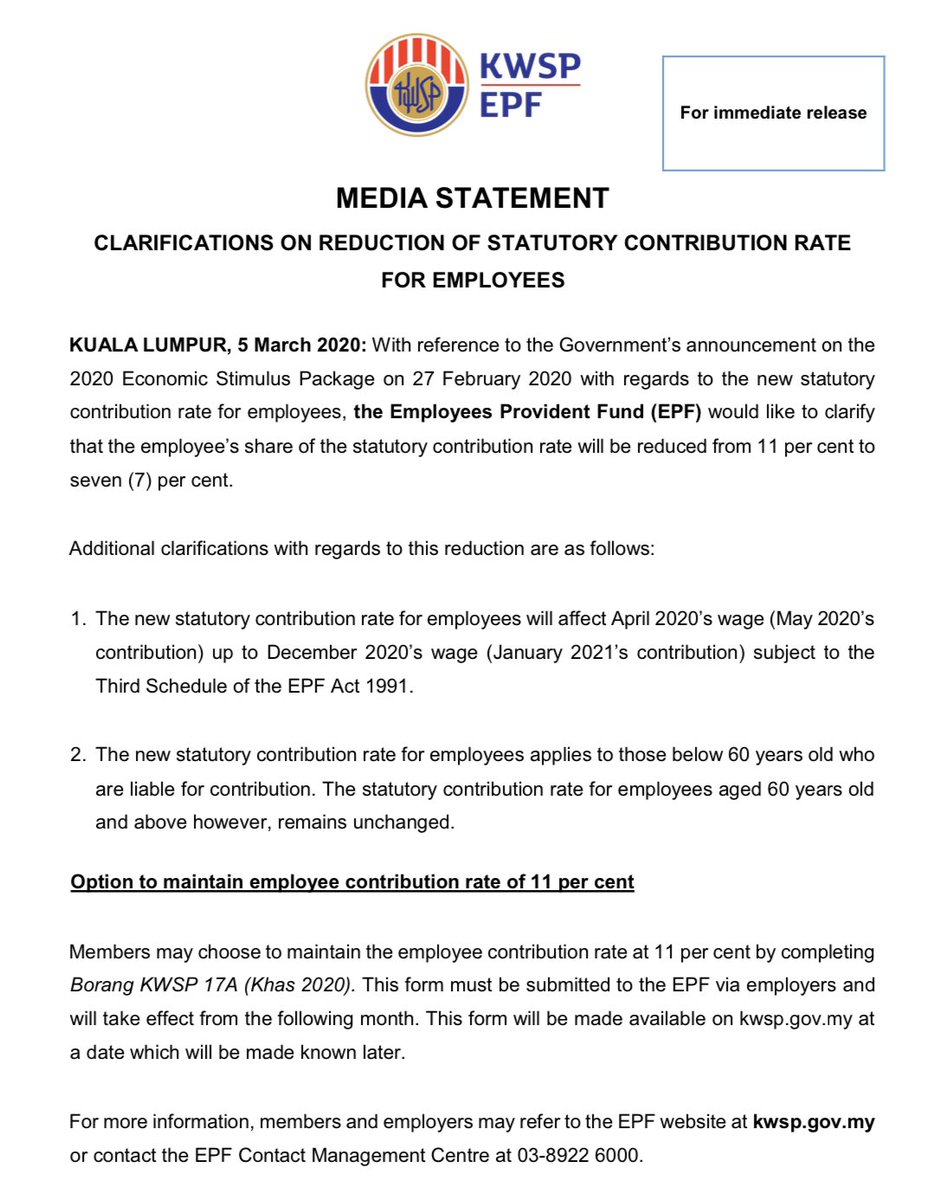

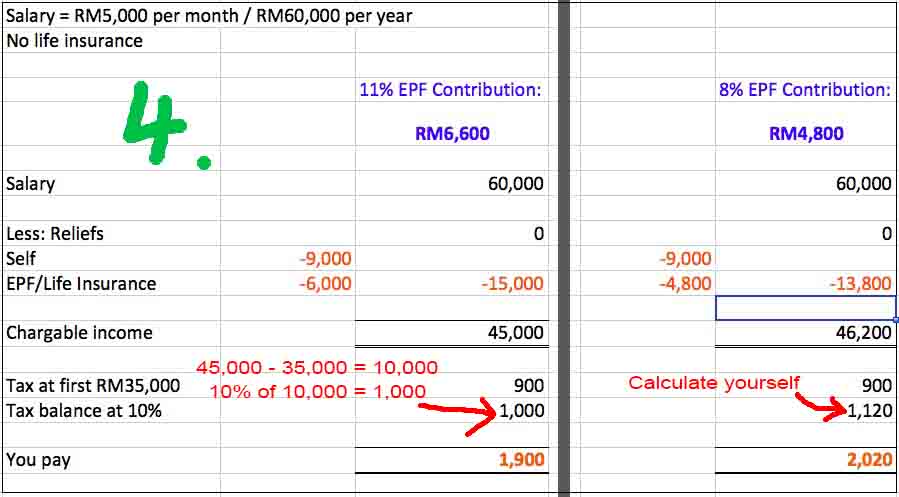

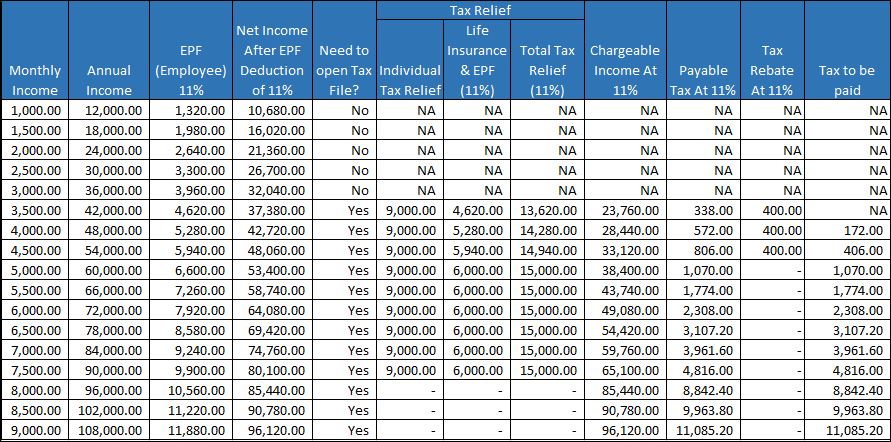

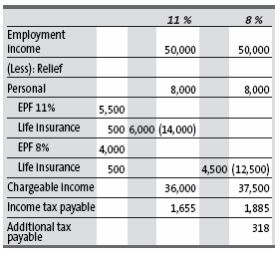

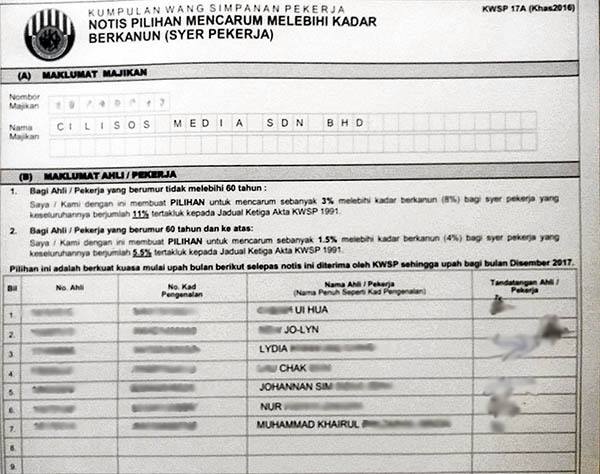

Epf 11 form. Kuala lumpur 1 dec 2008. Under certain circumstances the epf will make an assessment of the contribution. The government recently announced the 2020 economic stimulus package apart from tourism related tax reliefs and digital vouchers part of the package also includes lowering the minimum employee provident fund epf contribution by employees from 11 to 7. Members may choose to maintain the employee contribution rate at 11 per cent by completing borang kwsp 17a khas 2020.

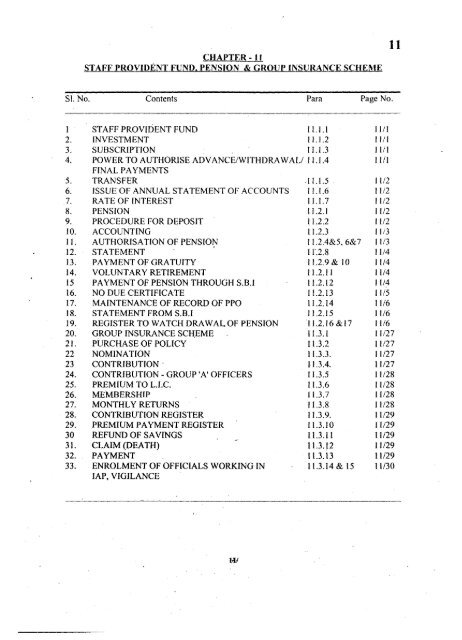

The latest contribution rates for employees and employers can be referred at the third schedule epf act 1991. My boss wrote a piece about why he s choosing the 11 contribution while he makes some good points i m still. Epf helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. For unpaid outstanding contributions payments can be made using form a online.

Form above must be submitted to the epf by employersand will take effect from the following month april 2020. Payment must then be made using form kwsp 8 form f. Employers can now easily access all the forms you need when it comes to registration updates and also contribution in one central location. Employees provident fund epf members who wish to maintain their monthly contribution rate at 11 can obtain the forms from all epf branches or download it from the myepf website at www kwsp gov my beginning today.

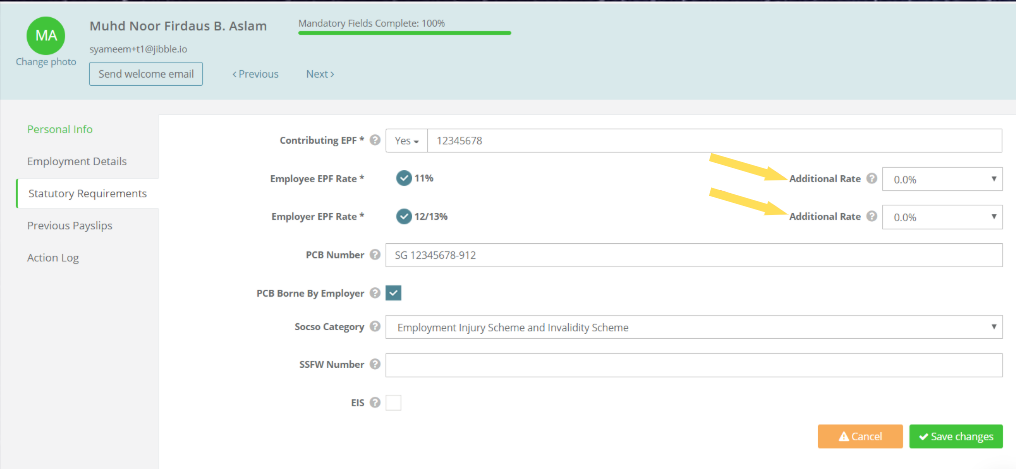

Employees who want to maintain their share of the statutory contribution to the employees provident fund epf at 11 can opt to fill the kwsp 17a khas 2020 form available at its website www kwsp gov my. This form will be made available on kwsp gov my at a date which will be made known later. The epf officer will provide form kwsp 7 form e and form kwsp 8 form f. Some forms may not be available online and can only be found at the epf counters or through written notices to employers.

Written by jen li lim. If you have staff who opt for 11 employees need to fill up the borang kwsp 17a khas2020 to maintain the current contribution rate of 11 updated as of 17th march 2020 which is available now at https www kwsp gov my to download. Firefox 61 and later safari 11. Kuala lumpur march 10.

.bmp)