Epf Rate Of Contribution

This section 6 of the epf act states that pf contribution rate will be 10 of the basic wages i e.

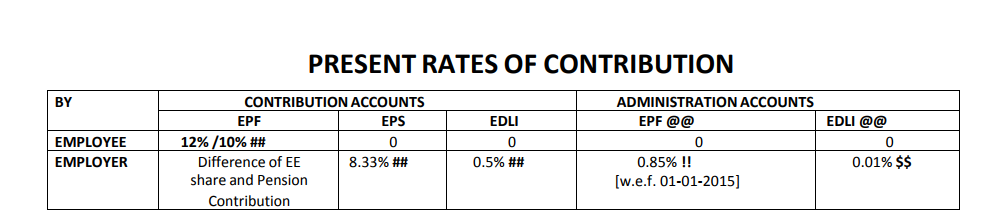

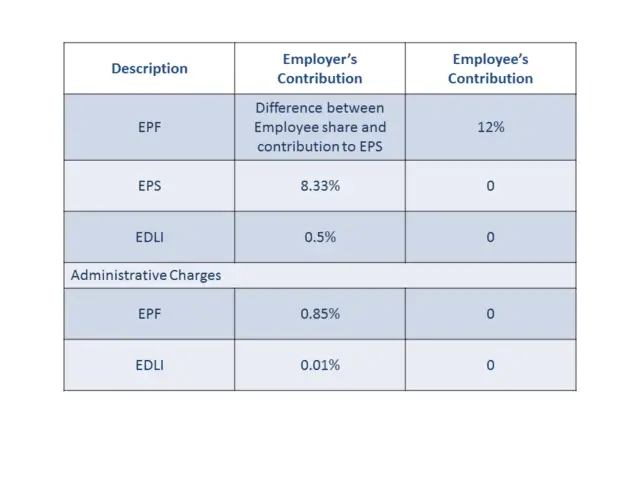

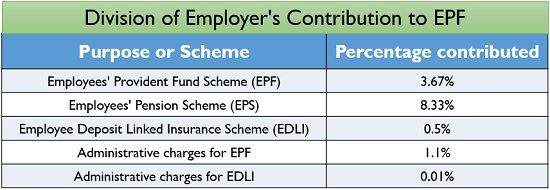

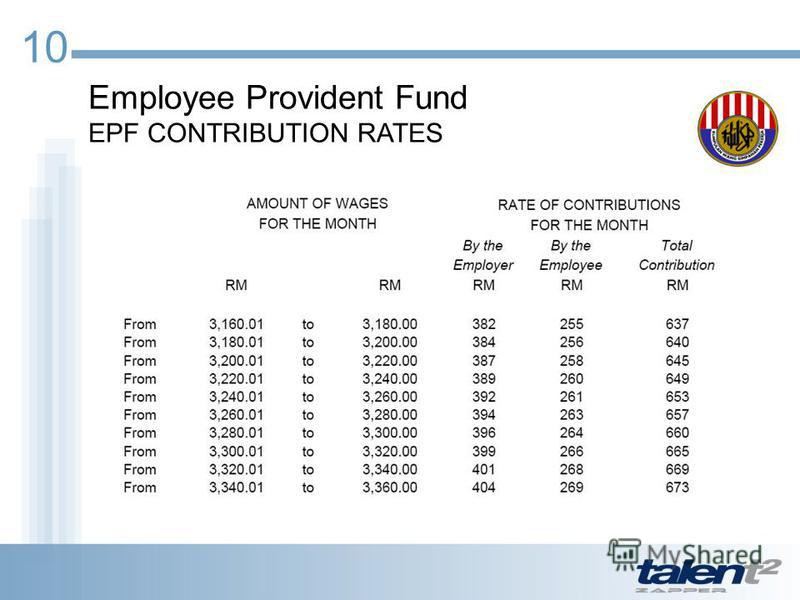

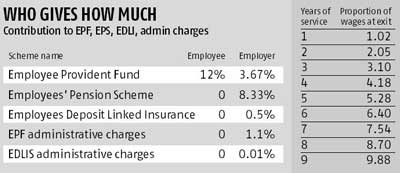

Epf rate of contribution. Employee contribution can be increased to 100 per cent of basic da depending on his her convenience. Present rates of contribution by contribution accounts administration accounts epf edlieps employee 12 10 0 0 0 0 employer difference of ee share and pension contribution 8 33 0 5 0 50. The reduced rate of epf contributions to 10 will not reduce the pension contributions or benefits. So in total 24 per cent of the employee s pay goes towards his her epf account.

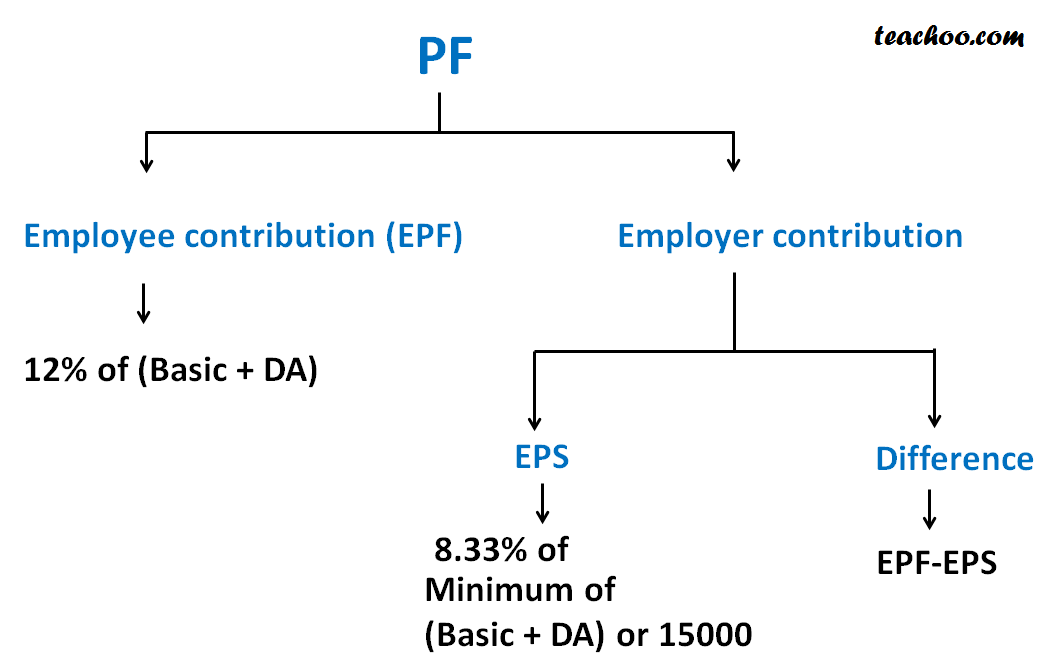

According to the epf scheme rules the employee contributes 12 per cent of basic wages plus dearness allowance from his salary every month towards his epf account and the employer matches the contribution of 12 per cent. My establishments will not be able to remit dues timely during the scheme period. Although the employee s contribution rate will be same as the employer s contribution rate. Epf contribution rate reduction for may 2020 to july 2020.

May 20 june 20 july 20. Employees generally contribute only 12 percent of their basic salary towards the employee provident fund epf. The eps contribution 8 33 of wages subject to ceiling of 15 000 is diverted from employer s share of epf contributions. However if the employee wants to contribute more than 12 percent of the basic salary then he she can do so.

01 04 2017 10 rate is applicable for any establishment in which less than 20 employees are employed.