Epf Employer Contribution Rate 2018

Also as per budget 2018 the rate of interest applicable on epf is 8 65.

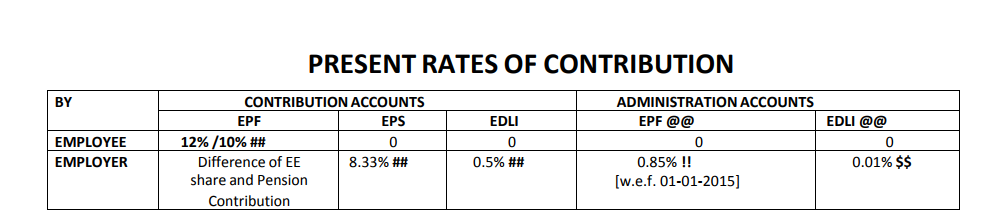

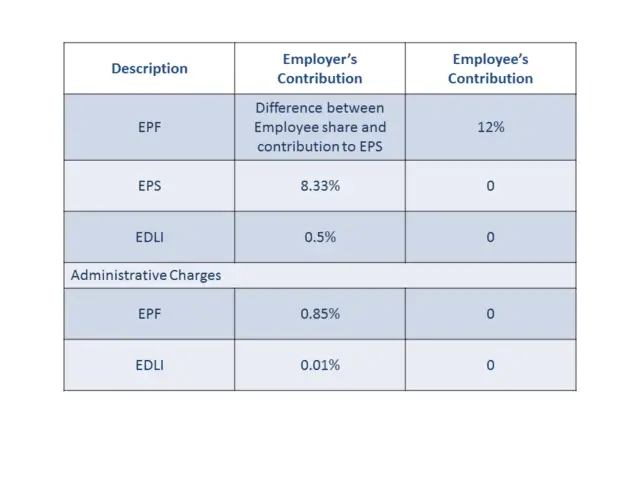

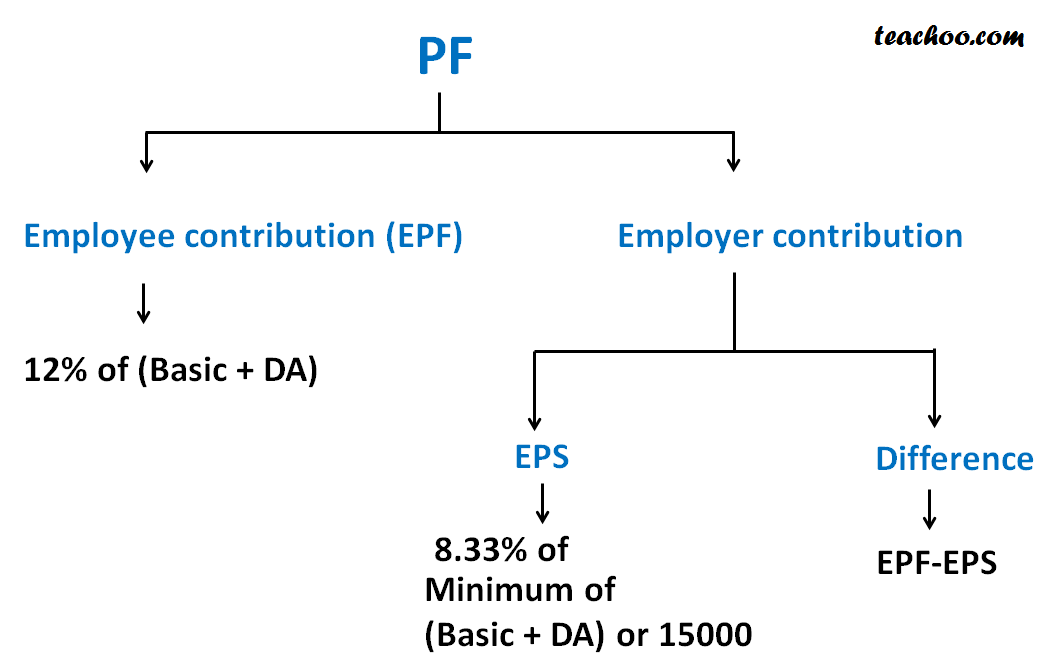

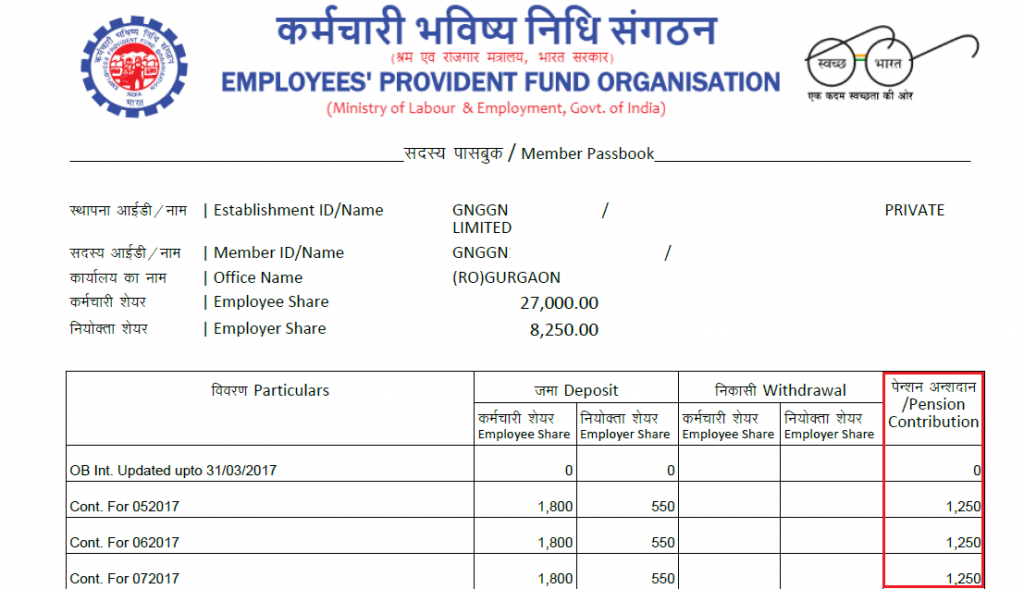

Epf employer contribution rate 2018. During this period your employer s epf contribution will remain 12. Thus total 24 goes to the retirement saving. Present rates of contribution by contribution accounts administration accounts epf edlieps employee 12 10 0 0 0 0 employer difference of ee share and pension contribution 8 33 0 5 0 50. 12 is also deducting from employer out of which 3 66 is going to your epf account and then remaining 8 33 in your eps employee pension scheme account with a limit of max rs 1250.

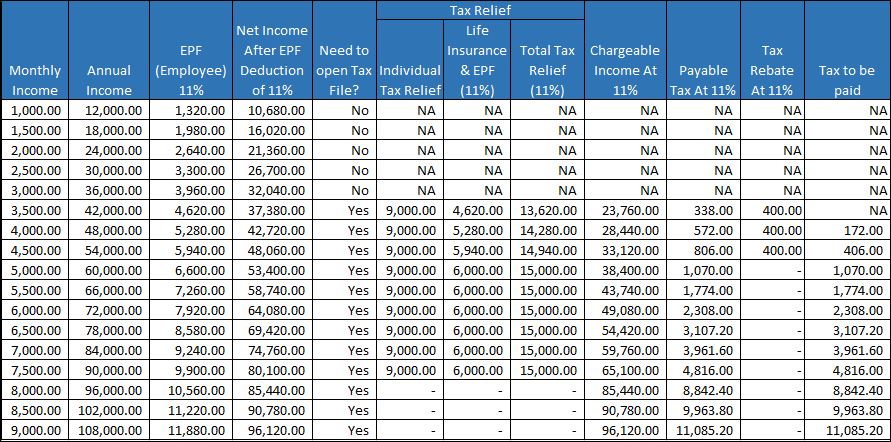

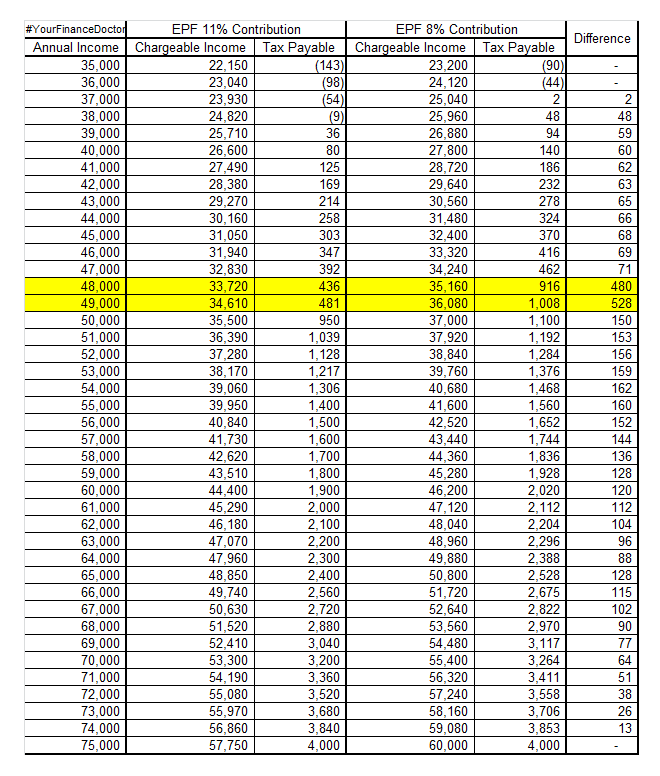

The total percentage of the amount goes to this account is 0 5 and this 0 5 of the contribution is being paid by the employer. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website. The government has fixed 12 of the basic salary as the contribution rate of the epf scheme. For sick units or establishments with less than 20 employees the rate is 10 as per employees provident fund organisation s epfo guidelines.

The employer also makes 0 50 of contribution towards the edli employees deposit linked insurance account of the employee. The employer has to pay an additional charge for administrative accounts at a rate of 0 50 with effect from 1st june 2018. You should know that employee pension scheme is also funded from this contribution. Employee 12 of employee provident fund epf.

01 04 2017 10 rate is applicable for any establishment in which less than 20 employees are employed. In addition to 12 of employer pf ps contribution the employer also has to pay other charges. The main reason to reduce this amount from 0 85 to 0 50 is that of the online services provided by the epfo. Another 3 67 is added to the epf account of the employee.

Earlier this contribution was 0 85 than reduced to 0 65 and now from 01 06 2018 the edli charges are 0 5. In line with the recent amendment reduction in pf admin charges notified by the epfo the revised rates of contribution to various pf accounts applicable w e f. In certain cases 10 pf rate is applicable wherein employee share to a c no. The full break up of the percentage of contribution is as seen below.

1 june 2018 are as under. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.