Epf Withdrawal For Personal Loan

As per the epf withdrawal rules a member can withdraw an amount equal to three months of basic salary and dearness allowance da or 75 of the credit balance in the account whichever is lower.

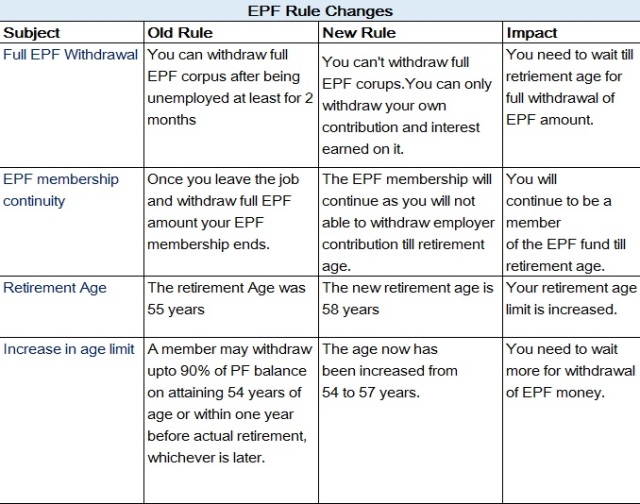

Epf withdrawal for personal loan. 90 of the epf balance can be withdrawn after the age of 54 years. The withdrawal amount that is admissible for this reason can be least of the below. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. You can withdraw up to 75 per cent of your epf account balance or three months basic wages or the amount that you actually need whichever is lower.

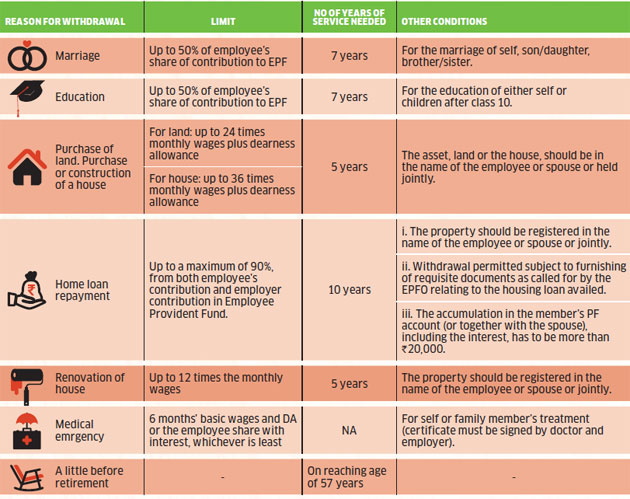

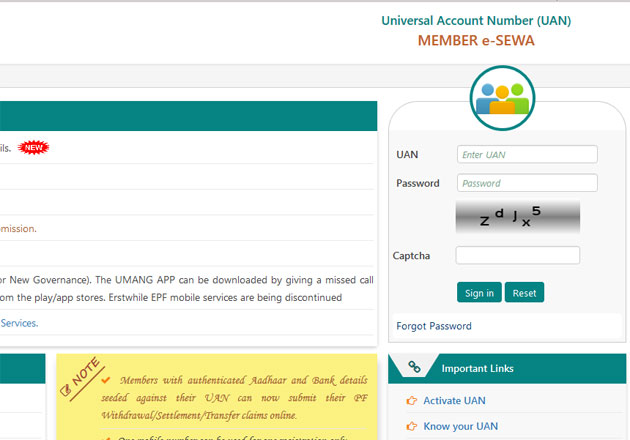

Provident fund or pf is considered one of the most important investments that aims to accumulate retirement funds for an employee. A member can view the passbooks of the epf accounts which has been tagged with uan. Usually people withdraw the epf money whenever they feel like. While one can withdraw the full amount if one is unemployed for more than two months epfo also permits withdrawal for various purposes including for repayment of home loan principal up to 90 of.

Your rs 6 27 lakh epf balance withdrawal can lead to rs 18 12 lakh loss post retirement pf balance calculator. The epf money sometimes proves to be a blessing in disguise when you are in need of some corpus. Here are the main amendments to epf withdrawal rules. However some fail to receive the epf money through the normal withdrawal process.

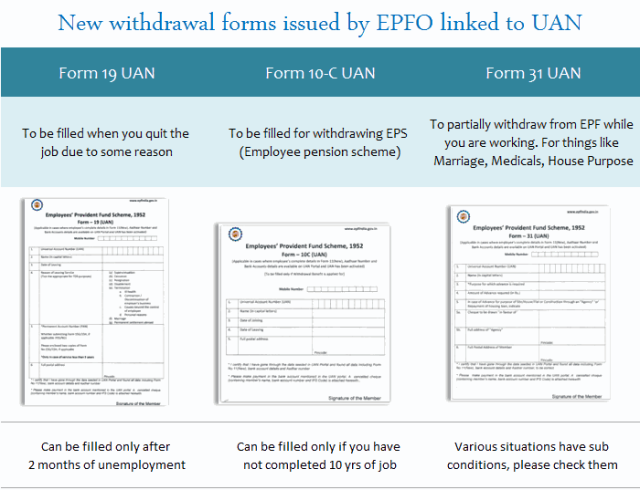

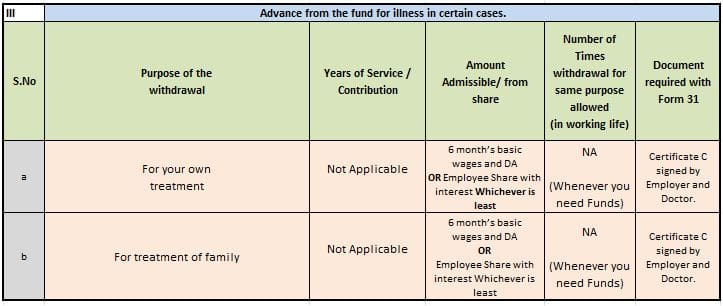

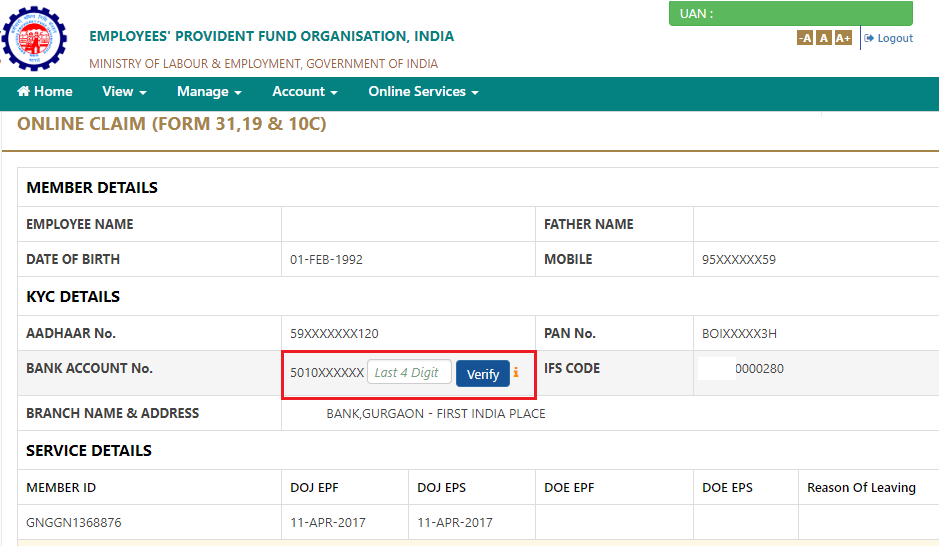

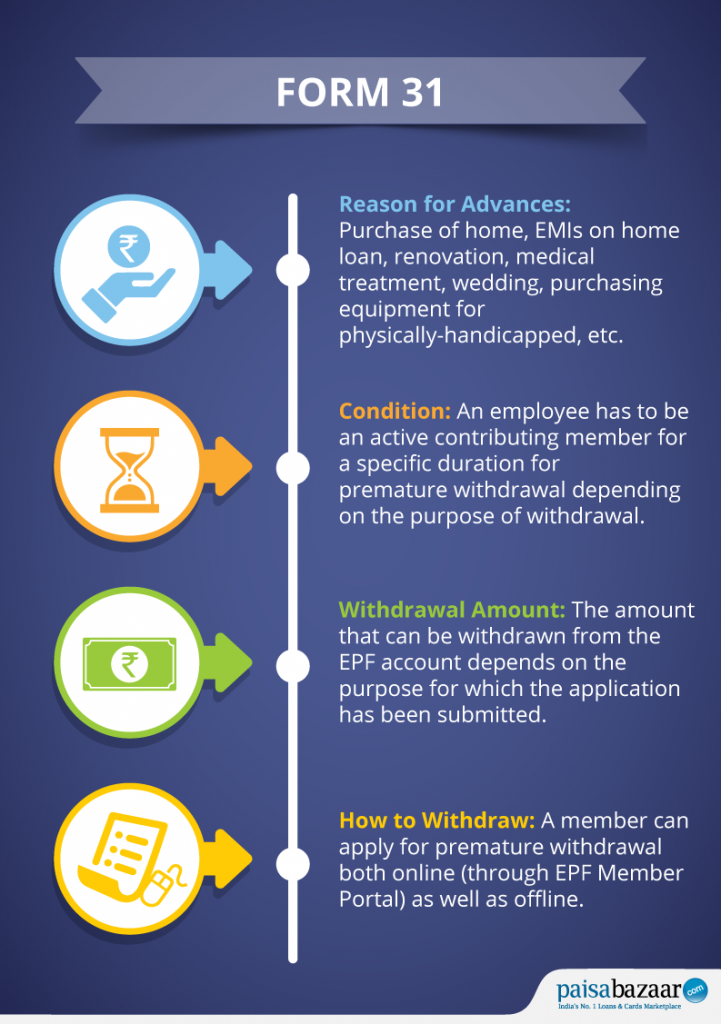

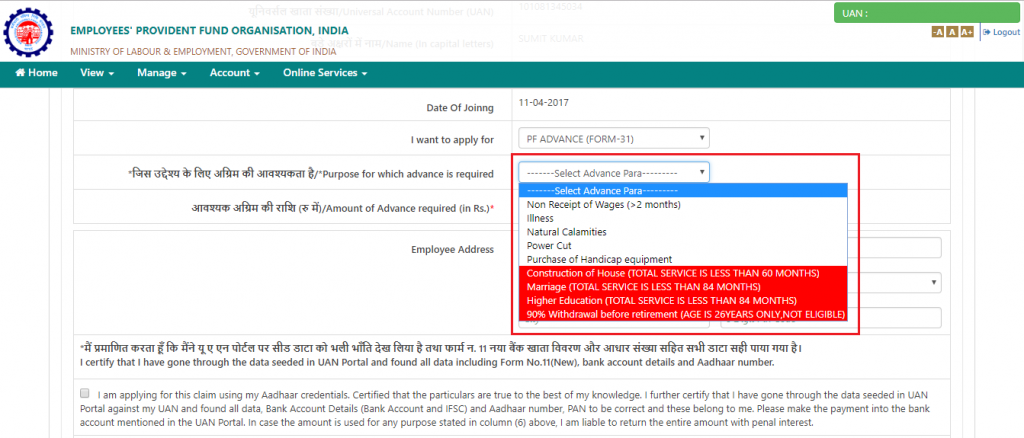

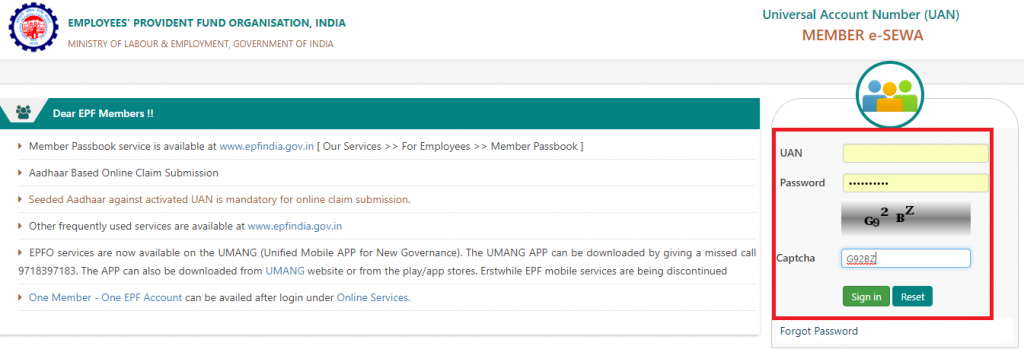

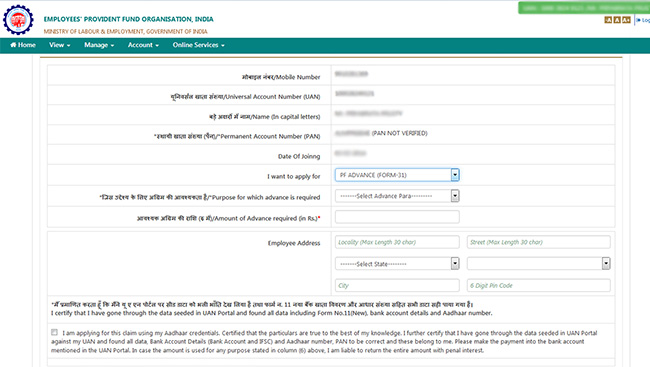

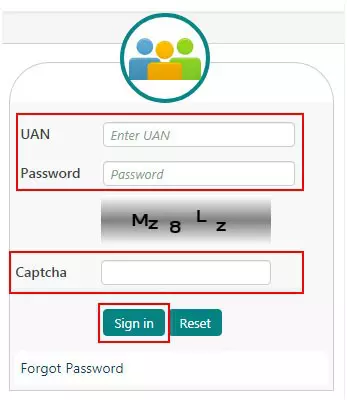

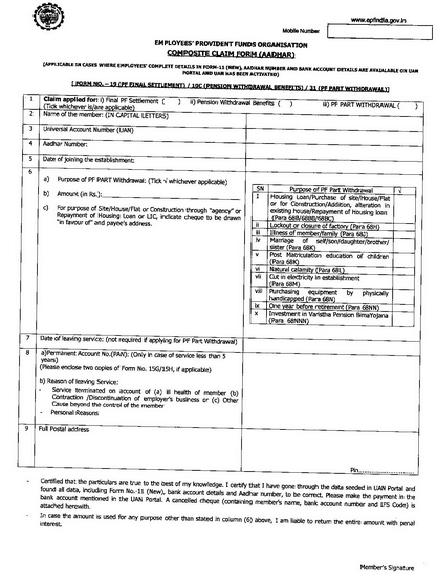

Note that this withdrawal is only possible if one has been in the service for 5 years. The employees provident fund organisation epfo allows individuals to withdraw money from their provident fund pf against a loan. The epfo has recently introduced new pf withdrawal forms for employees for members. Members with authenticated aadhaar and bank details seeded against their uan can now submit their pf withdrawal settlement transfer claims online.

Withdrawals from epf a c for repayment of home loan. To avail this provision you need to submit loan certificate statement to your employer along with from 31 form for epf partial withdrawal. One mobile number can be used for one registration only. One can partially withdraw the amount if they have applied for a loan for purchasing or renovating house.

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.