Epf Employer Contribution Rate 2020 Table

During this period your employer s epf contribution will remain 12.

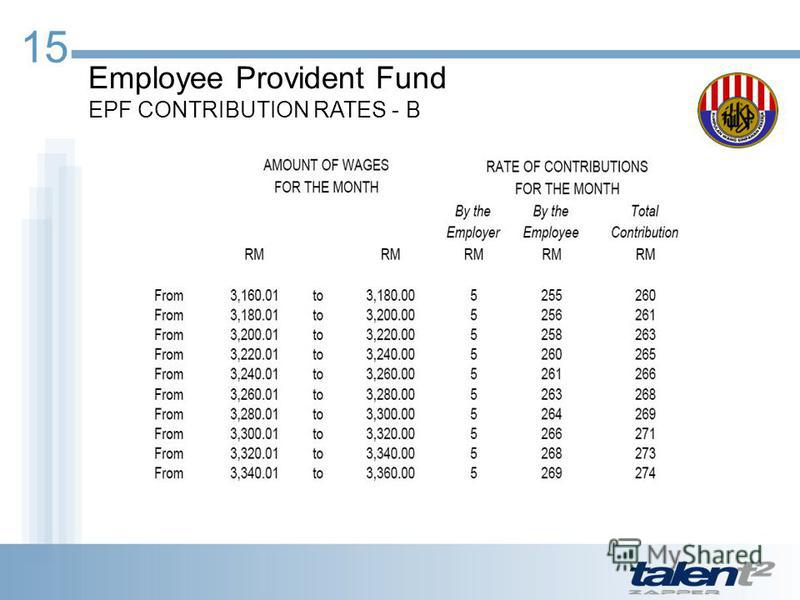

Epf employer contribution rate 2020 table. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. 15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.

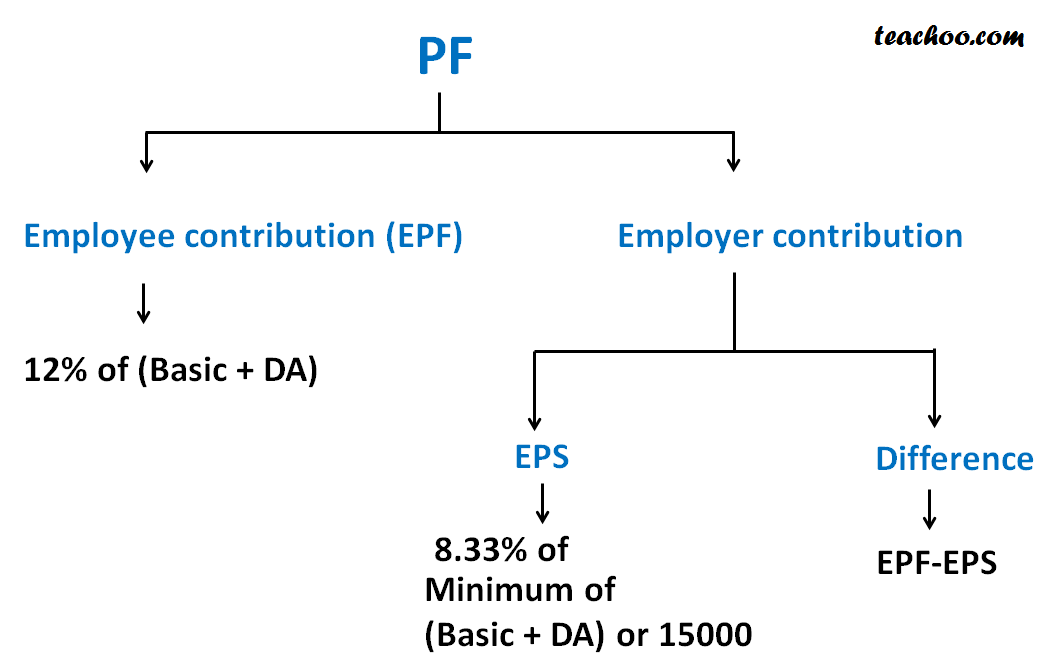

For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary. This is boost spending to mitigate the economic impact of the covid 19 outbreak. Posted on may 19 2020 under the self reliant india package announced by the hon ble finance minister fm on 13 may 2020 the rate of employees provident fund epf contribution for both employer and employee will be reduced to 10 from existing 12. To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme.

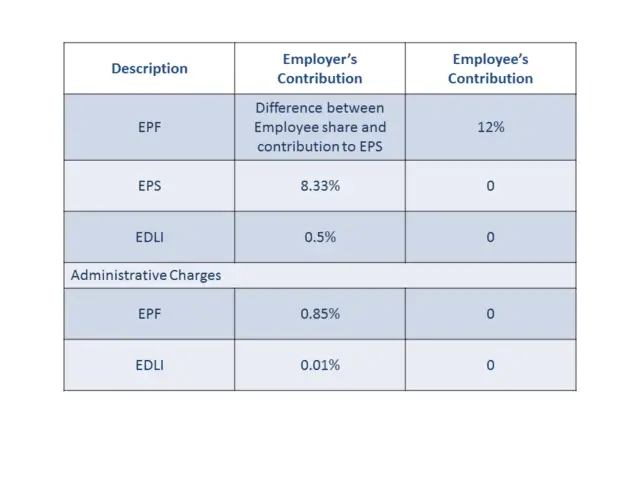

In case you are a woman you only need to contribute 8 of your basic salary for the first 3 years. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. Under epf scheme an employee has to pay a certain contribution towards the scheme and an equal contribution is paid by the employer. The establishments which were already entitled to reduced rate of contribution 10 through the so 320 e dated 09 04 1997 are not eligible for any further reduction in rate of contribution.

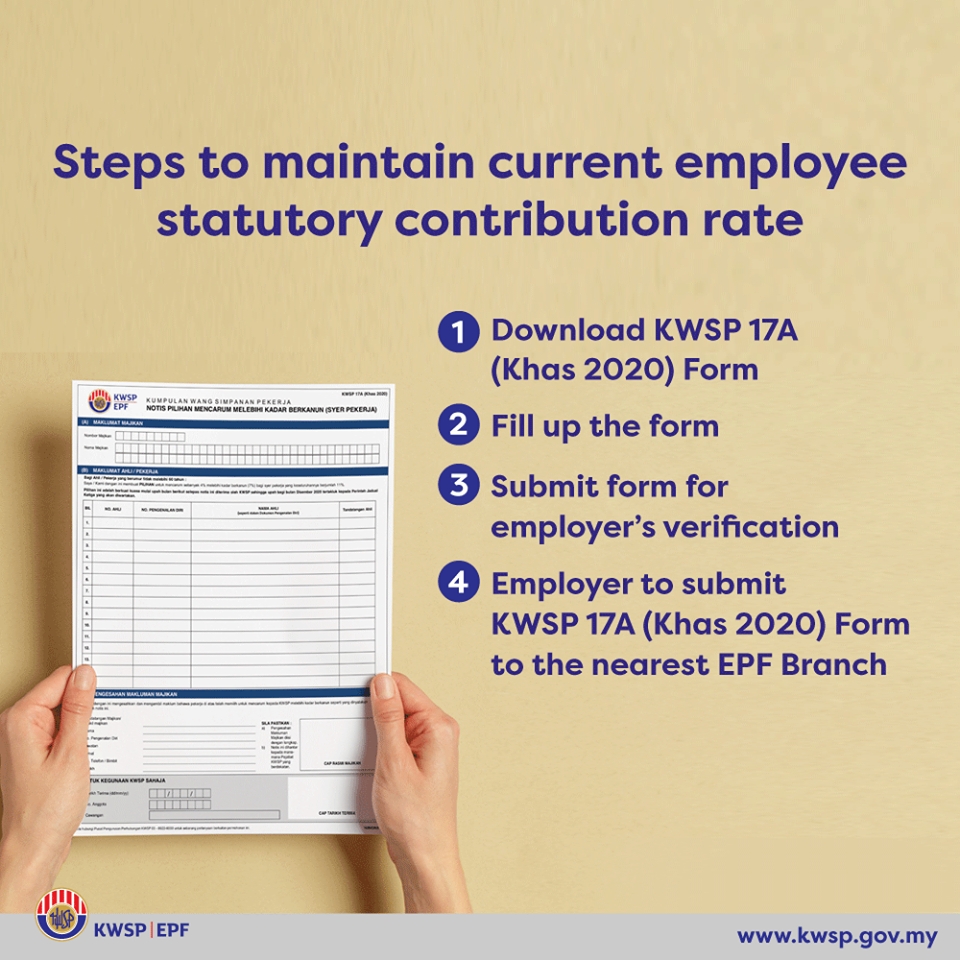

With reference to the government s announcement on the 2020 economic stimulus package on 27 february 2020 with regards to the new statutory contribution rate for employees the employees provident fund epf would like to clarify that the employee s share of the statutory contribution rate will be reduced from 11 per cent to seven 7 per cent. However contribution rates for employees aged 60 years old and above remain unchanged. Pursuant to the government s recent 2020 economic stimulus package the new minimum epf contribution rate for employees below 60 years old will be reduced from 11 to 7. The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution.

Kwsp epf contribution rates. Yes the rate of contributions is 10 for the three wage months may 2020 june 2020 and july 2020 irrespective of date of payment. As announced by the former interim prime minister the employees provident fund epf contribute rate will be reduced from 11 to 7 as part of the initiative under the economic stimulus package 2020.