How To Calculate Epf Contribution

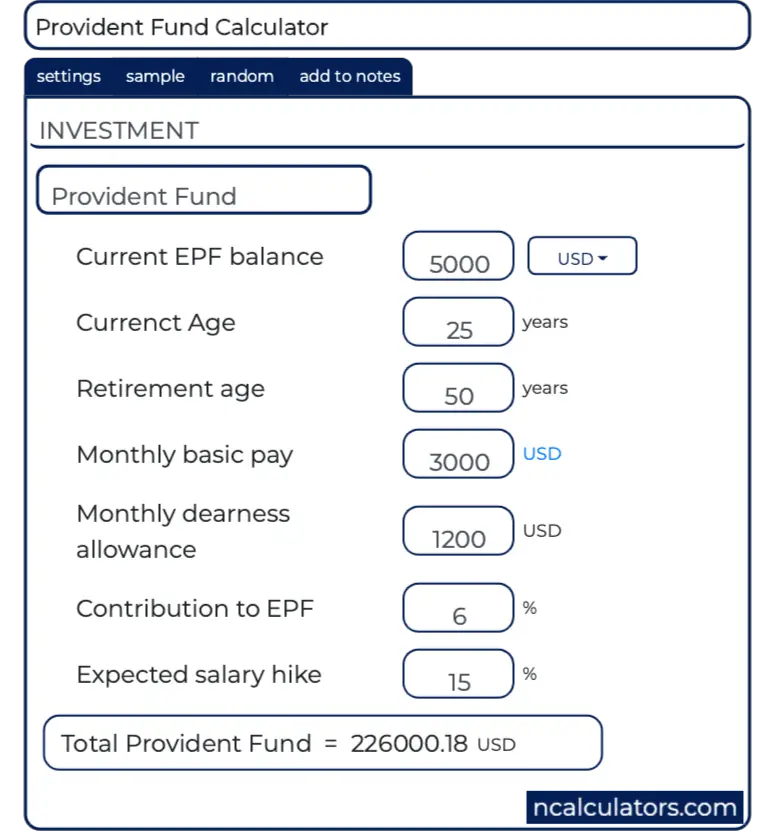

You just need to enter the current balance of your epf account or pension fund account and your employer s contribution towards your epf account.

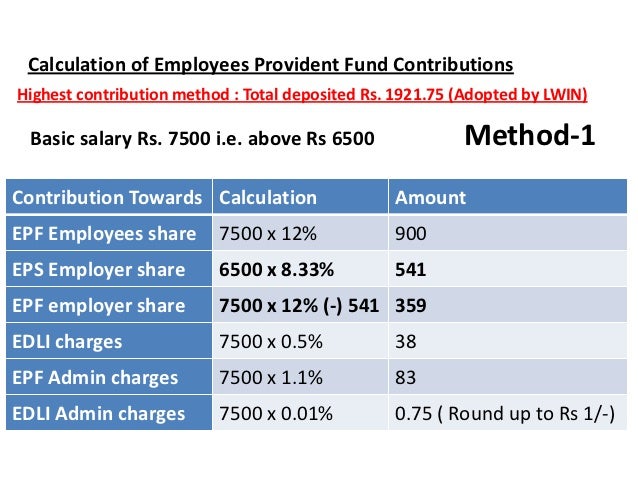

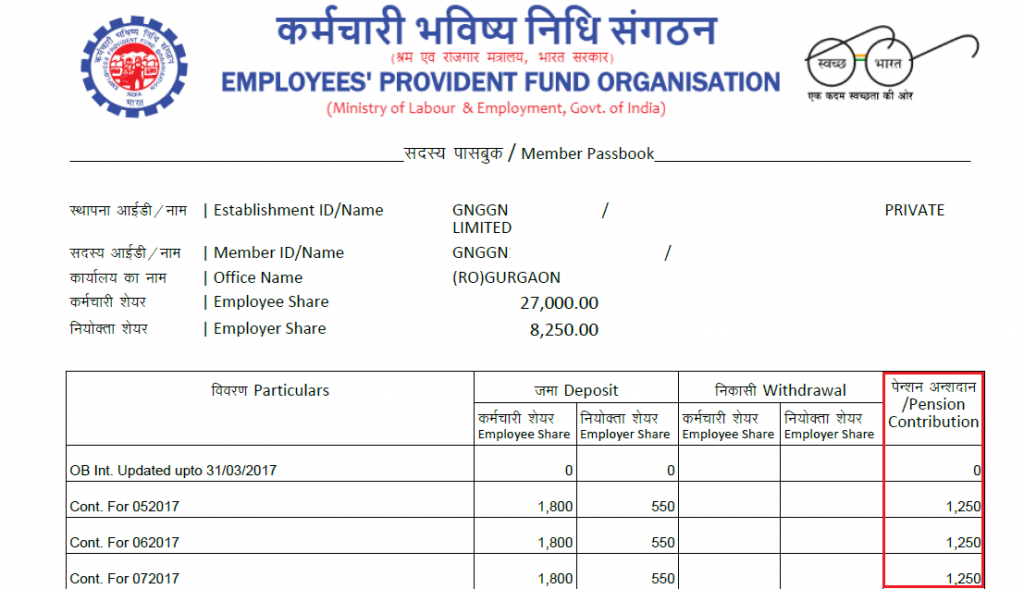

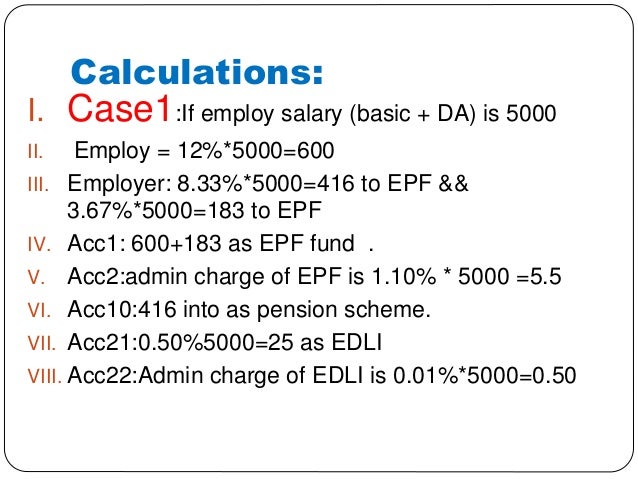

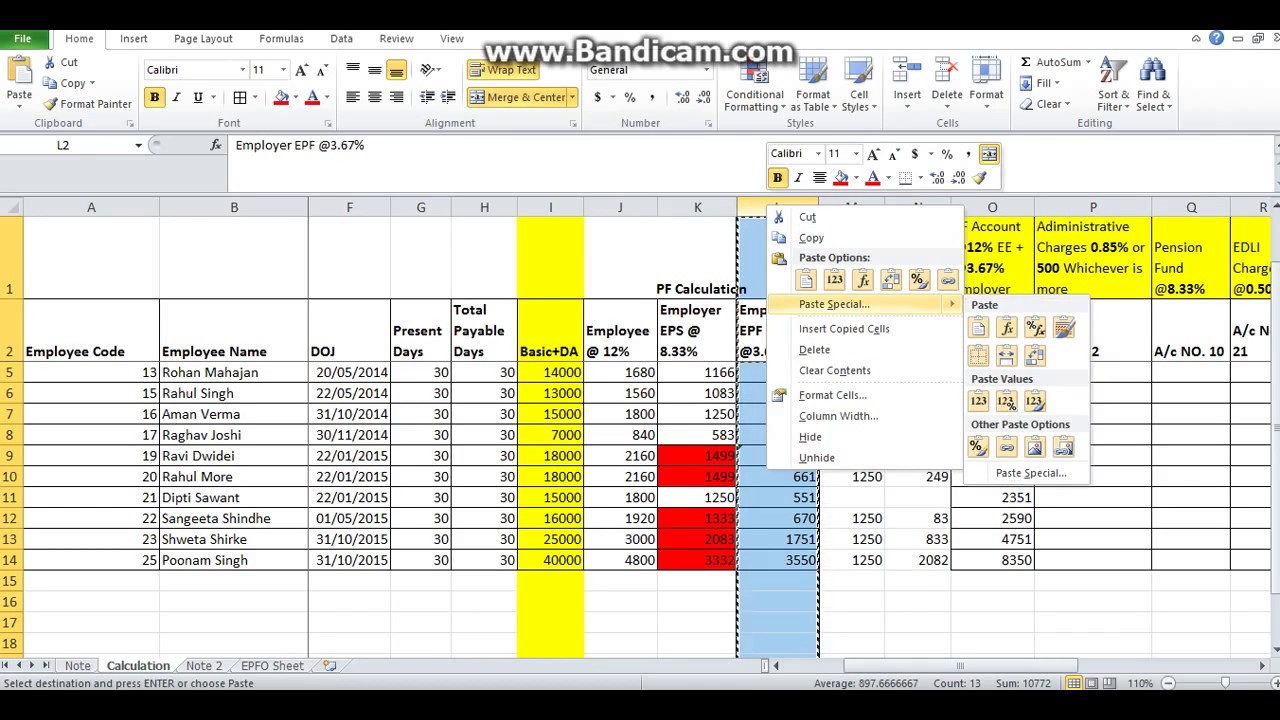

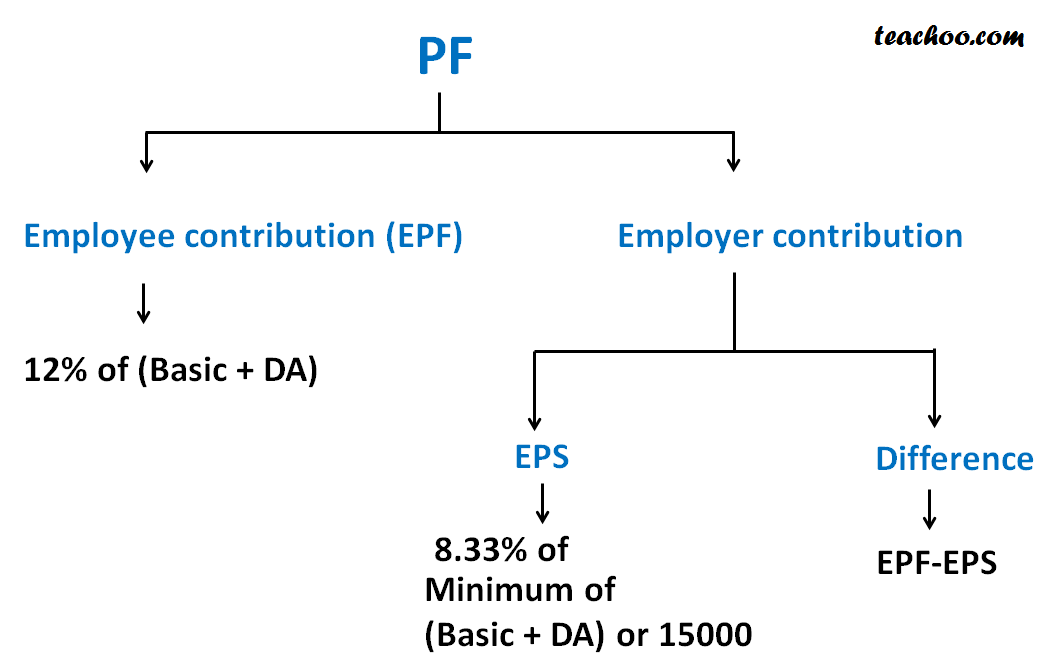

How to calculate epf contribution. Your contribution towards epf is 12 of rs 25 000 which amounts to rs 3 000 each month. Your employer s epf contribution your employer s contribution towards epf is 3 67 of rs 25 000 which comes to rs 917 50 per month. Your employee s contribution to epf and your employer s contribution. Therefore the employer s contribution towards epf will be rs 15 000 3 67 rs 550 5.

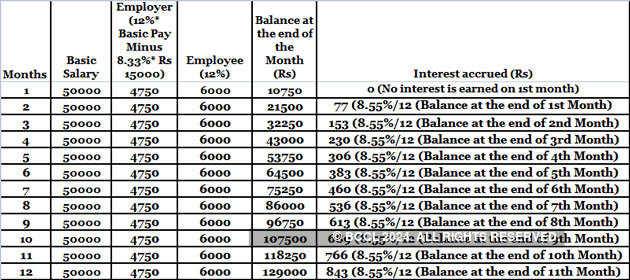

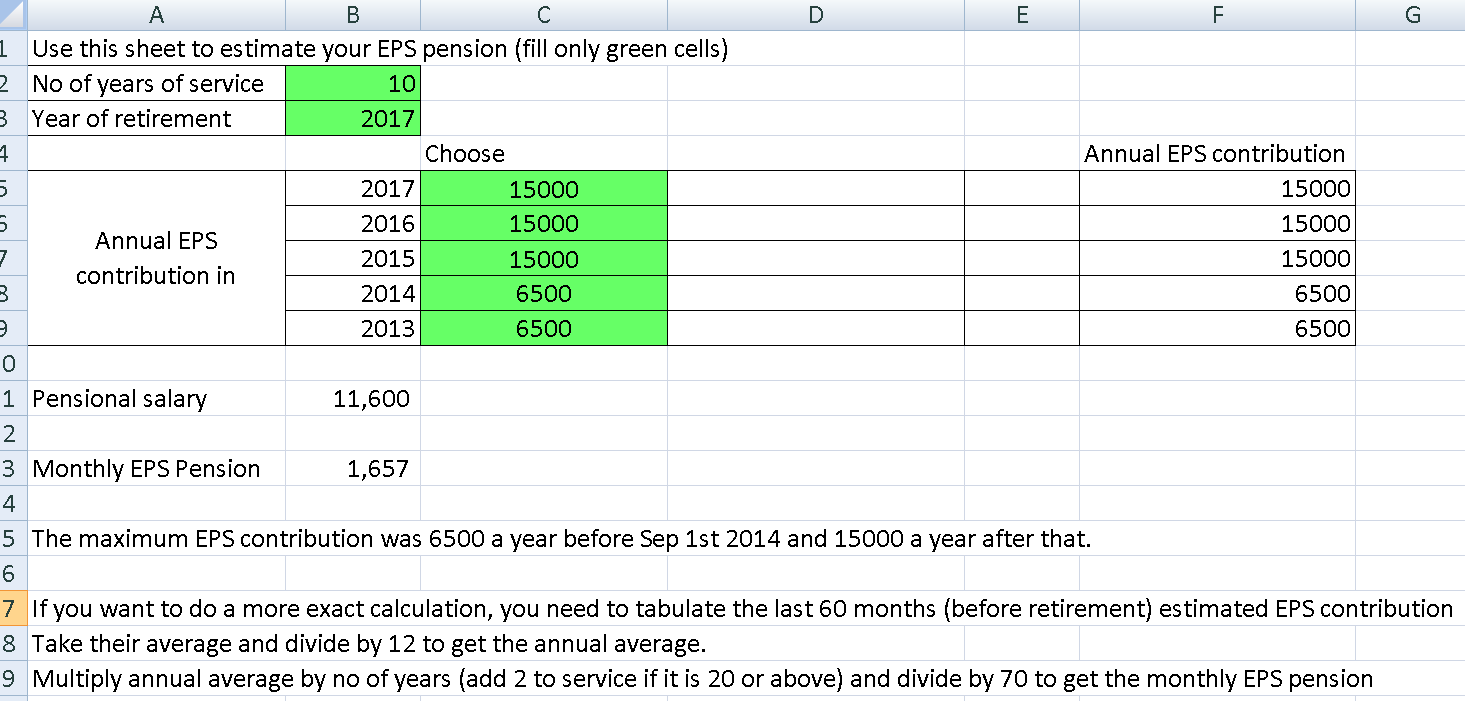

Epf is calculated as 17000 x 12 2040 eps 1250 790 the excess amount in eps is added to epf contribution method 2 in this method employer share is calculated on ceiling limit 15000 where as employee share is calculated on total of 17000. Interest on the employees provident fund epf is calculated on the contributions made by the employee as well as the employer. Your epf contribution your contribution towards epf is 12 of rs 25 000 which amounts to rs 3 000 each month. Epf contribution epf contribution consists of two parts depending on the entity that makes the contribution employee s contribution and employer s contribution.

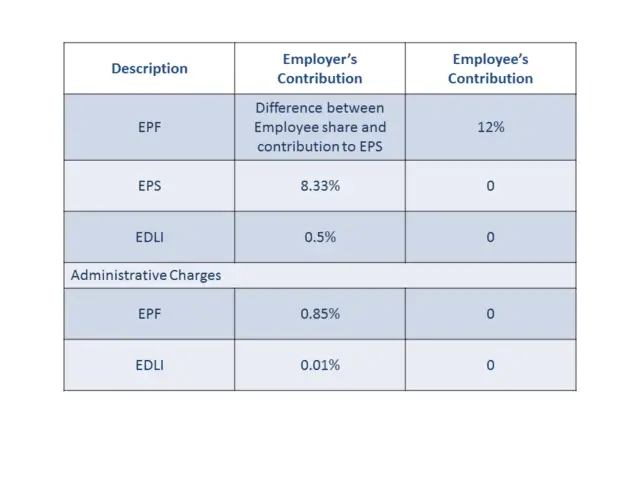

The epf by law has a minimum dividend rate of 2 5 but historically has had a much higher rate. 12 of the employer contribution will then be divided into two parts i e. Employee contribution toward epf will be 12 15000 rs 1800. How to calculate epf contribution.

For example in 2014 the dividend rate was 6 75. Your employer s contribution towards employee pension scheme eps is 8 33 of rs 25 000 which comes to rs 2 082 50 per month. 3 67 goes to employee provident fund and 8 33 set aside for employees pension scheme. Your employer s epf contribution.

To arrive at the retirement corpus you need to enter few details such as. There are several benefits to contributing to the epf namely. The employee makes a contribution of 12 of basic salary dearness allowance towards his epf account. Our epf calculator will help you to estimate your employee provident fund epf corpus at the time of retirement.

Your epf contributions are deducted from your income tax up to a maximum of rm6 000 per annum. Contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da.