Form Be Submission Deadline 2019

Bayaran cukai keuntungan harta tanah available in malay language only international.

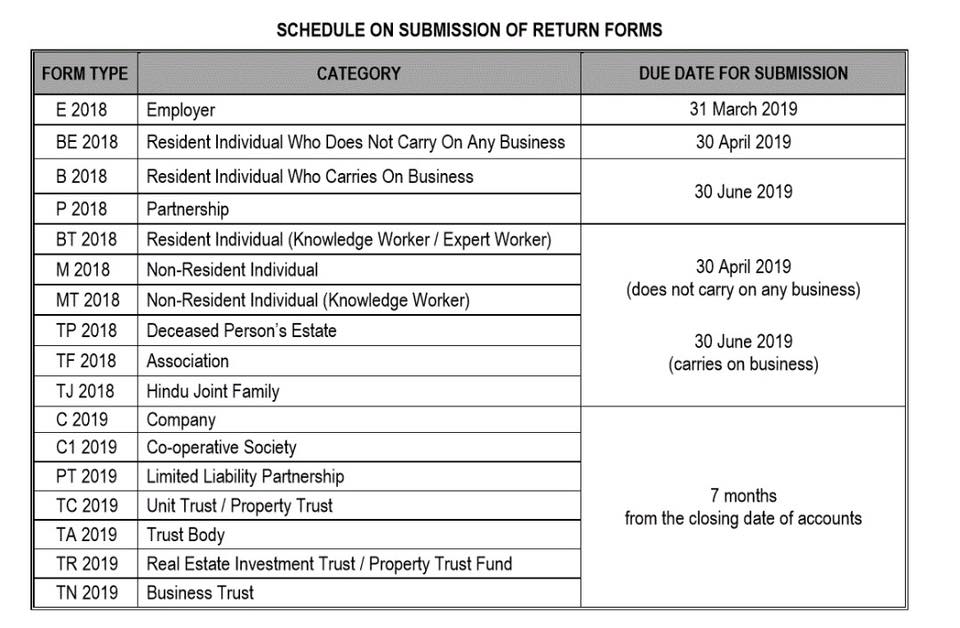

Form be submission deadline 2019. Exchange of information automatic exchange of information aeoi. 2019 27 411 904. The due date for submission of form be for year of assessment 2018 is 30 april 2019. 1 the extension from april 15 is automatic for all taxpayers who also have until july 15 to pay any taxes that would have been due on april 15.

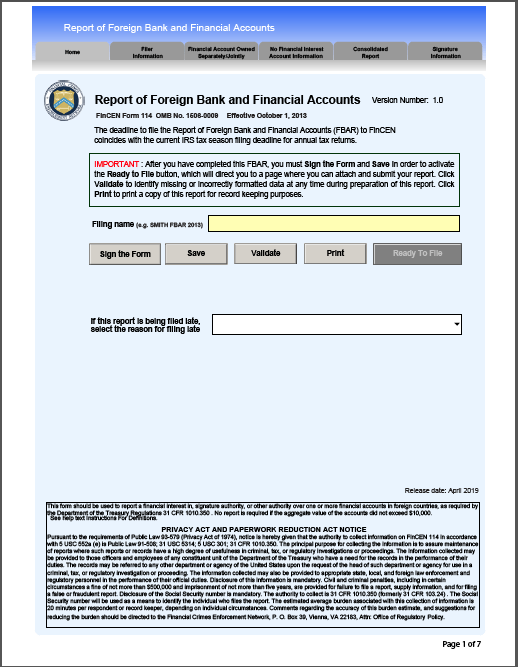

Every year under the law known as the bank secrecy act you must report certain foreign financial accounts such as bank accounts brokerage accounts and mutual funds to the treasury department and keep certain records of those accounts. Grace period is given until 15 may 2019 for the e filing of form be form e be for year of assessment 2018. You report the accounts by filing a report of foreign bank and financial accounts fbar on fincen form 114. Visitors this year.

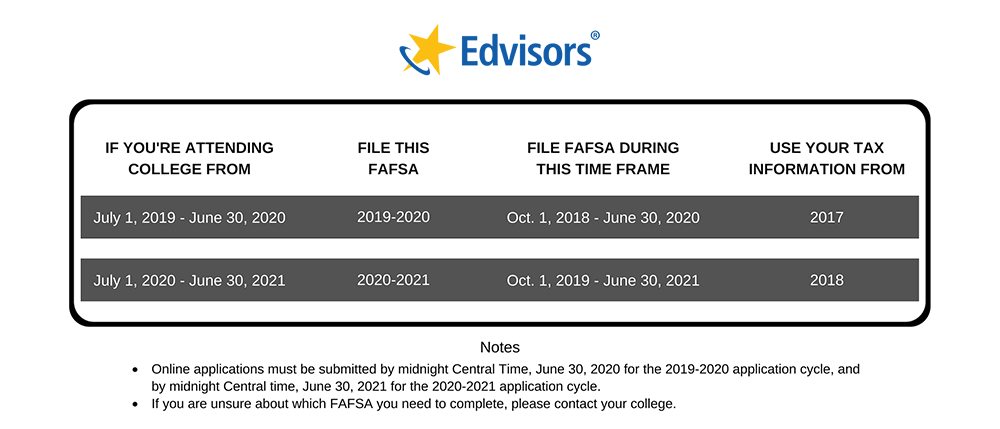

Form 1095 c is used by applicable large employers as defined in section 4980h c 2 to verify employer sponsored health coverage and to administer the shared employer responsibility provisions of section 4980h. If a taxpayer furnished his form e be for year of assessment 2018 on 16 may 2019 the. 1 2019 and the last day for students to submit the form is june 30 2021. E 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker 30 april 2020 does not carry on any business.

31 july 2019 until 31 august 2019 ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 september 2019 until 31 december 2019 two 2 months grace period from the due date of submission is allowed for those with accounting period ending 1 january 2020 until 31 march 202 0 form c companies. Thus taxpayers are strongly encouraged to make full use of lhdn s online service ezhasil when it comes to filing their taxes and also making any necessary tax payments. In support of the president s call to the covid 19 pandemic that social distancing be observed at all times and that we should at most stay indoors and limit movement sars is responding by rapidly enhancing its efforts to further simplify the tax return filing requirements for individual taxpayers and removing the need to travel to our branches in 2020. The internal revenue service has extended the 2019 federal income tax filing deadline three months to july 15 2020 in response to the global coronavirus pandemic sweeping the u s.

Information about form 1095 c employer provided health insurance offer and coverage including recent updates related forms and instructions on how to file. In the 2020 2021 fafsa cycle for example the application opened oct. Procedures for submission of real porperty gains tax form.

/income-tax-deadlines-3192862-final-d831a609c81b47ce947c2d53616a0ba9.jpg)