How To Declare Income Tax

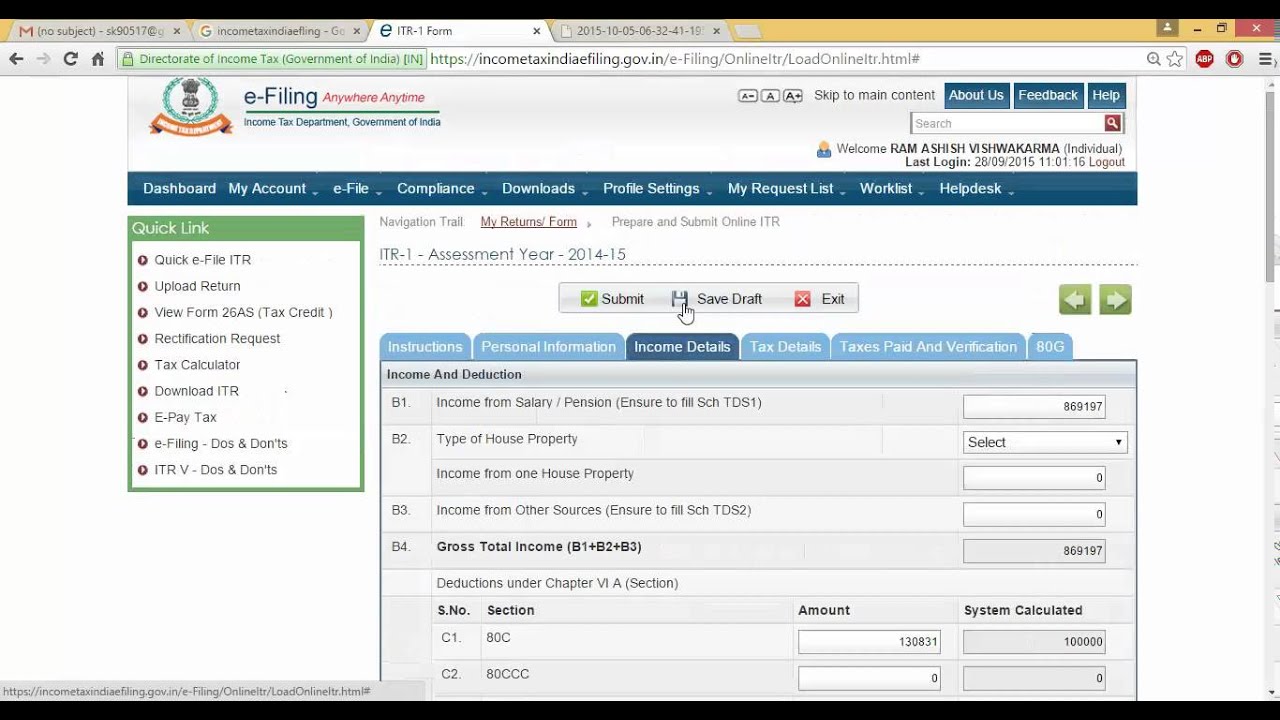

Step by step income tax e filing guide 1.

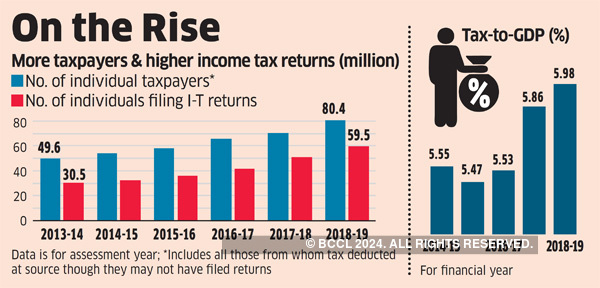

How to declare income tax. It means fitstar itself does not need to declare income tax regardless whether or not it is a profitable or non profitable partnership. Log in to mytax portal with your singpass iras unique account iua. The lower the income the lower the tax liability and those who earn less than rs 2 5 lakh p a. Your employment income will be taxed at a flat rate of 15 or the progressive resident rates whichever results in a higher tax amount.

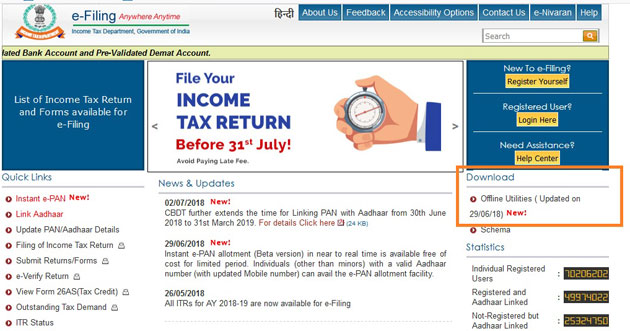

Depending on the age of the individual the three. The figures mentioned above are indicative. Go to e filing website. If you do not usually send a tax return you can register for self assessment to declare any income you have not paid tax on from the last 4 years.

Steps to file a tax return. When filing income tax please fill in form. Other earning and interest statements 1099 and 1099 int forms receipts for charitable donations and medical and business expenses if you are itemizing your return. Existing income tax slabs for fy 2020 21 alternative the income earned individuals will determine the income tax slabs under which they fall.

Login to e filing website. Next key in your mykad identification number without the dashes and your password. You must declare the income you have received for each financial year on your annual tax return. You ll need to fill in a separate tax return for.

When you arrive at irb s official website look for ezhasil and click on it. However both ben and jerry are required to declare and pay income tax individually for their share of income derived from fitstar. In the my self grid box click my compensation and on the left pane of salary page click income tax declaration. Click on individuals file income tax return to start.

Are exempt from tax. In the home page do any of the following. Choose your filing status. Your session will expire if you leave it idle for more than 20 minutes.

A w 2 form from each employer. On the my self menu under my compensation click income tax declaration. Income tax is the normal tax which is paid on your taxable income. 7 things to know about income tax payments in malaysia.

These rates are optional. However there may be some information you will need to enter manually. Most income is pre filled from information we receive from employers and financial institutions. This electronic tax form may take you 5 10 minutes to complete.

The types of income you need to declare are. Examples of amounts an individual may receive and from which the taxable income is determined include remuneration income from employment such as salaries wages bonuses overtime pay taxable fringe benefits allowances and certain lump sum benefits. Gather your paperwork including.

:max_bytes(150000):strip_icc()/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

/income-tax-deadlines-3192862-final-d831a609c81b47ce947c2d53616a0ba9.jpg)