First Time Home Buyer Stamp Duty Exemption Malaysia 2019

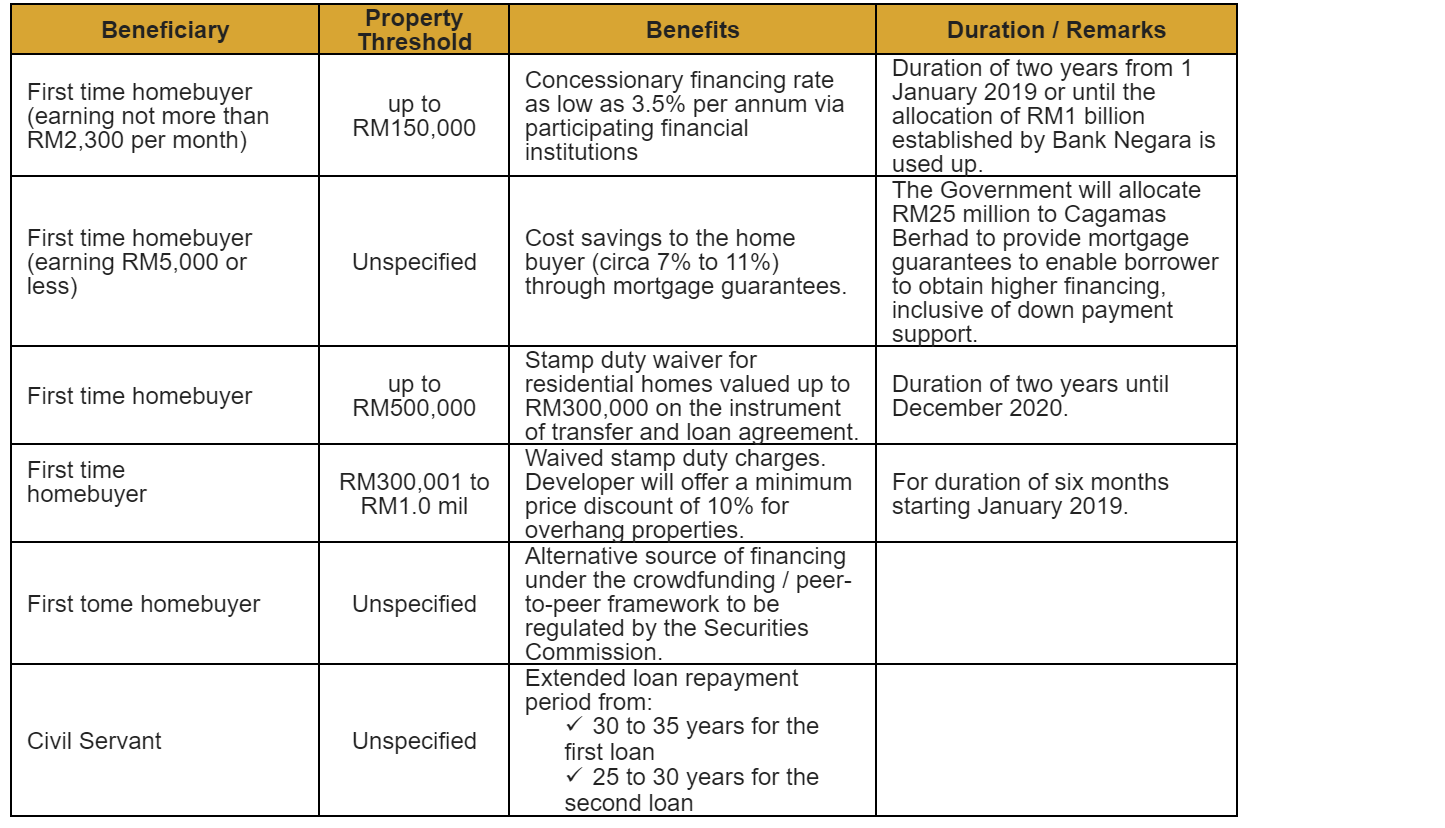

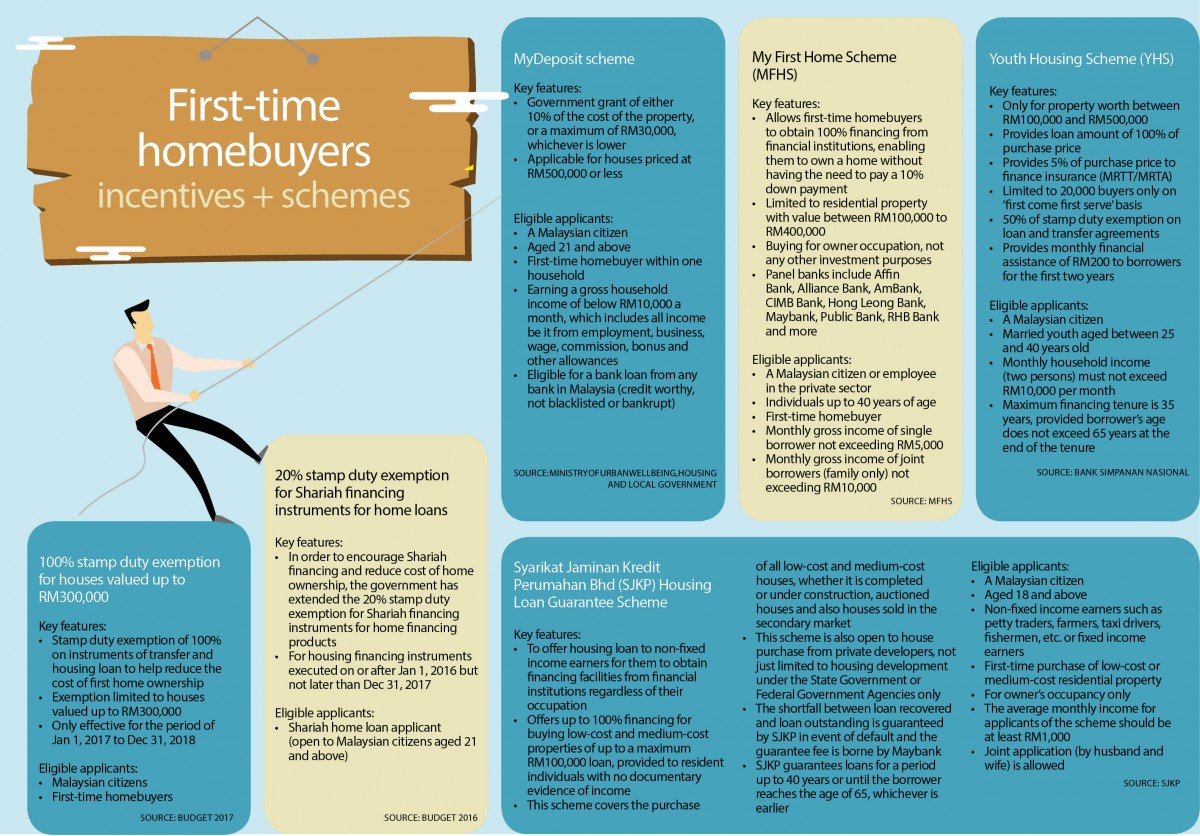

The finance minister had announced during his budget 2019 speech that first time house buyers can enjoy 100 exemption on stamp duty on residential properties if the sales and purchase agreement spa is signed between jan 1 and june 30.

First time home buyer stamp duty exemption malaysia 2019. In 2019 the government announced a stamp duty hike for properties costing more than rm1 million where the rate was increased from 3 to 4 refer to the table below. All buyers of the home or land must be at least 18 years old. It was good news for young people aspiring to purchase their first home. Must be first time house buyer.

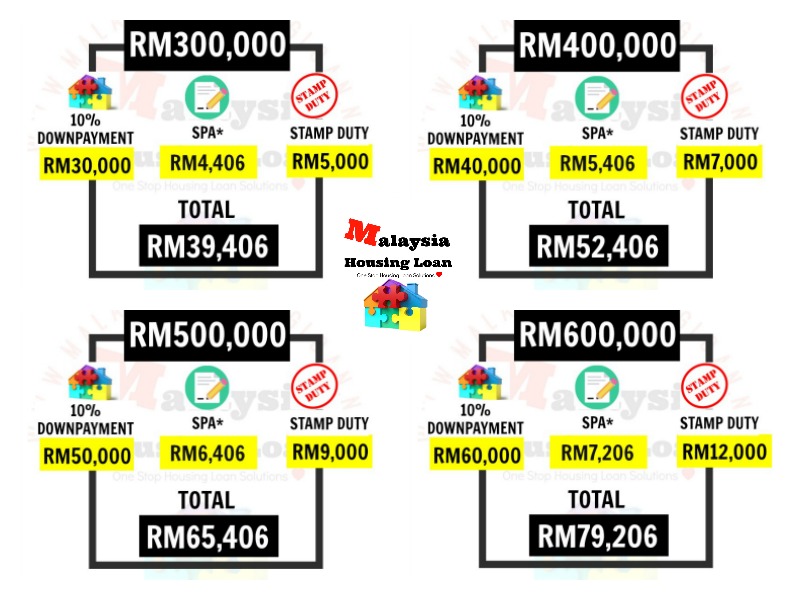

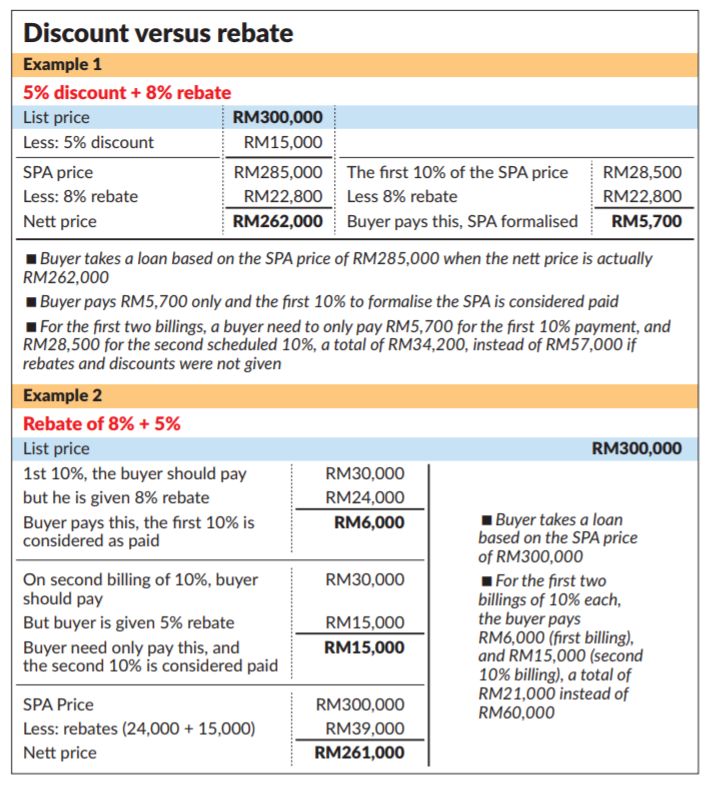

In this article we compiled a guide for you about the 2019 stamp duty exemption for first time home buyers. For purchases of between rm300 001 and rm500 000 a similar stamp duty waiver is applicable limited to only the first rm300 000 of the house price. First time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than rm300 000. The total gross income of all buyers including their partners if any must not be greater than the income threshold below.

100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty. Hence the latest stamp duty rates on the spa mot are calculated on a tiered basis as below. Criteria for first time house buyer stamp duty waiver. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020.

To pay no duty on your home purchase. They are applicable for sale and purchase agreements completed between jan 1 2019 and dec 31 2020. The above exemption is applicable for sale and purchase agreement executed from 2019 to 31st december 2020. Not sure how to calculate.

Stamp act 1949 act 378 budget 2019 for first time homebuyers stamp duty waiver up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020 for those purchasing residential properties priced up to rm500 000. In an effort to reduce the cost of ownership for malaysian first time home buyers stamp duties will be exempted up to rm300 000 on the sale purchase agreements and loan agreements for a period of 2 years until december 2020. With the generosity of malaysian government and to increase the purchasing house for first time house buyer the government had implemented a stamp duty exemption started 2019 until 31st december 2020. Good news for first time house buyer.

2020 stamp duty scale. All buyers including their partners if any must not have owned any other property in the last two years.