How To Calculate Tax Burden On Buyers And Sellers

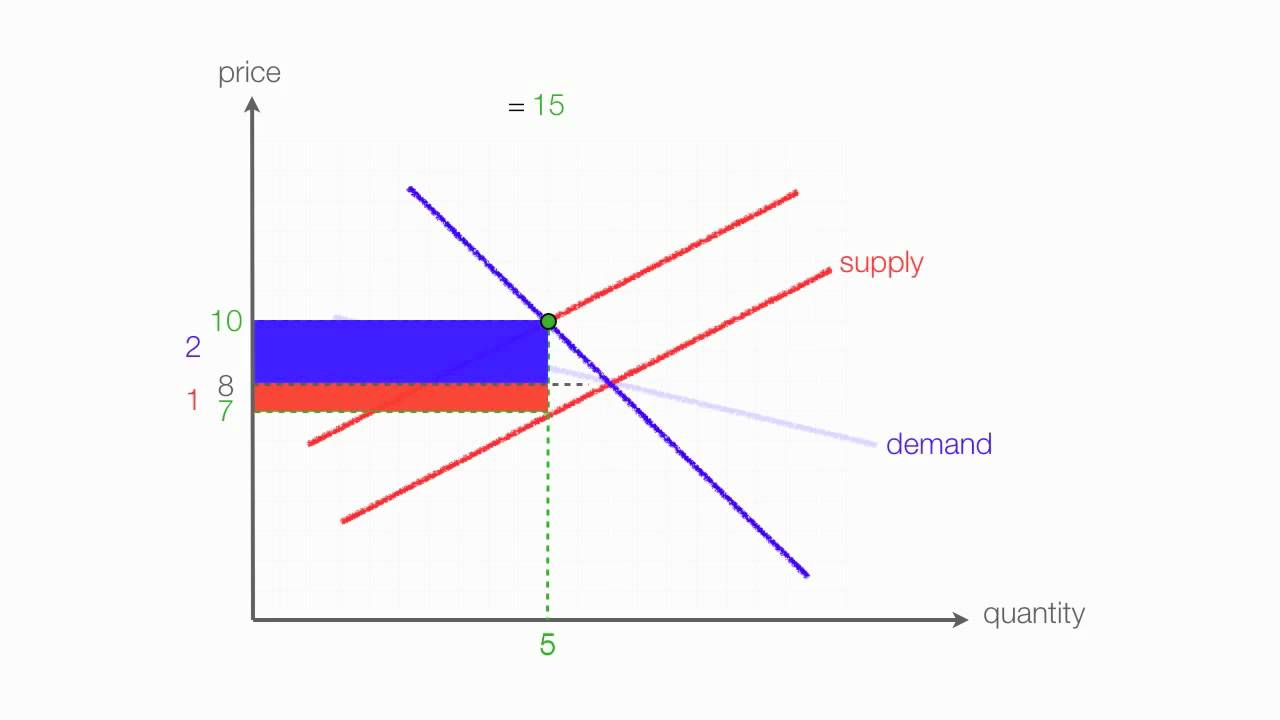

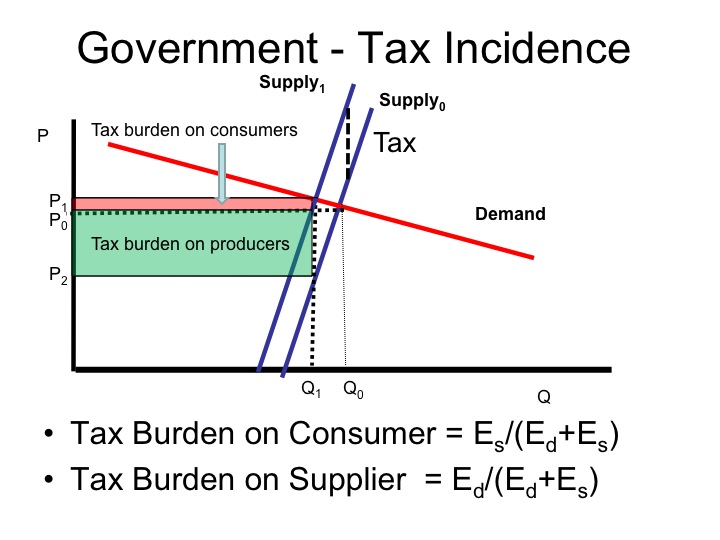

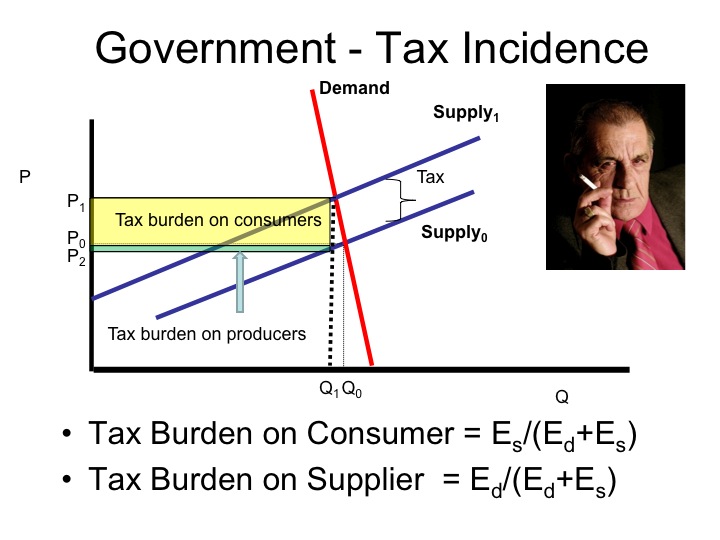

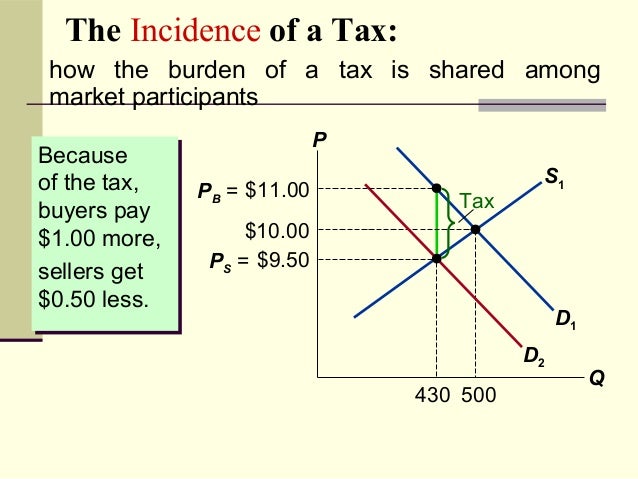

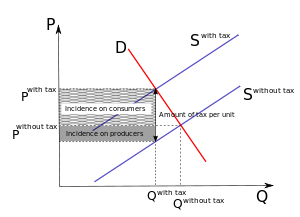

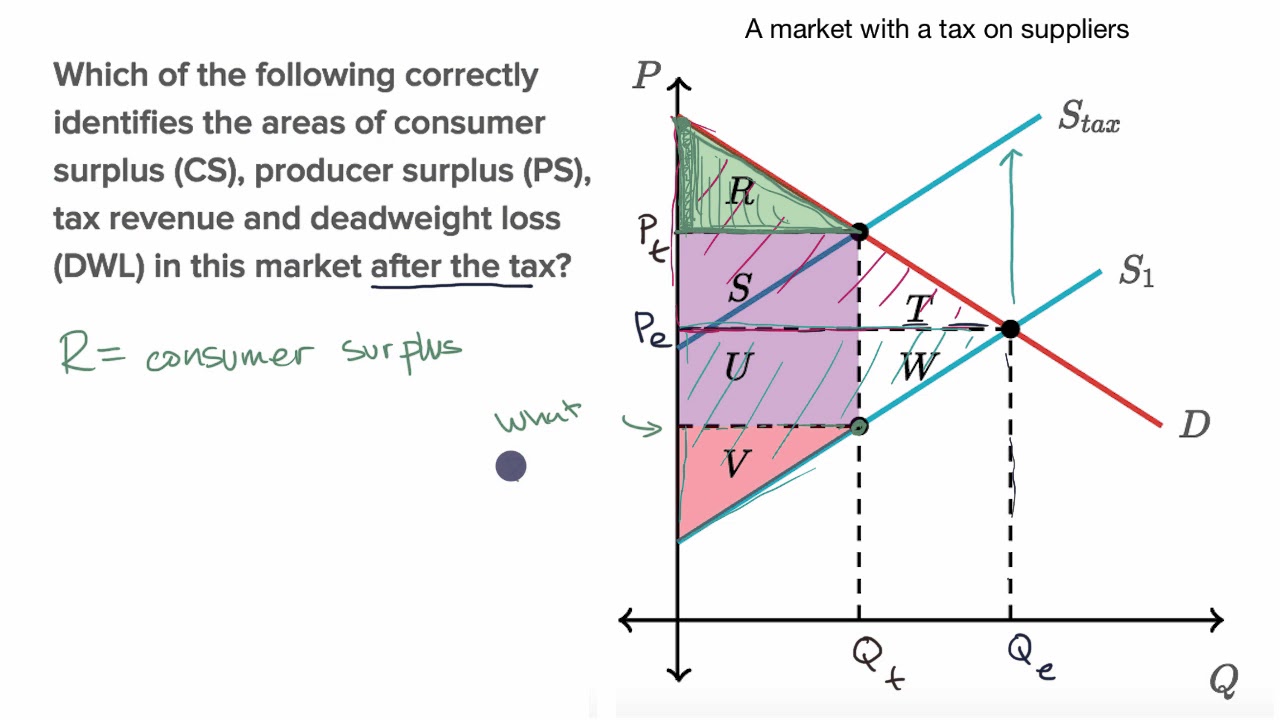

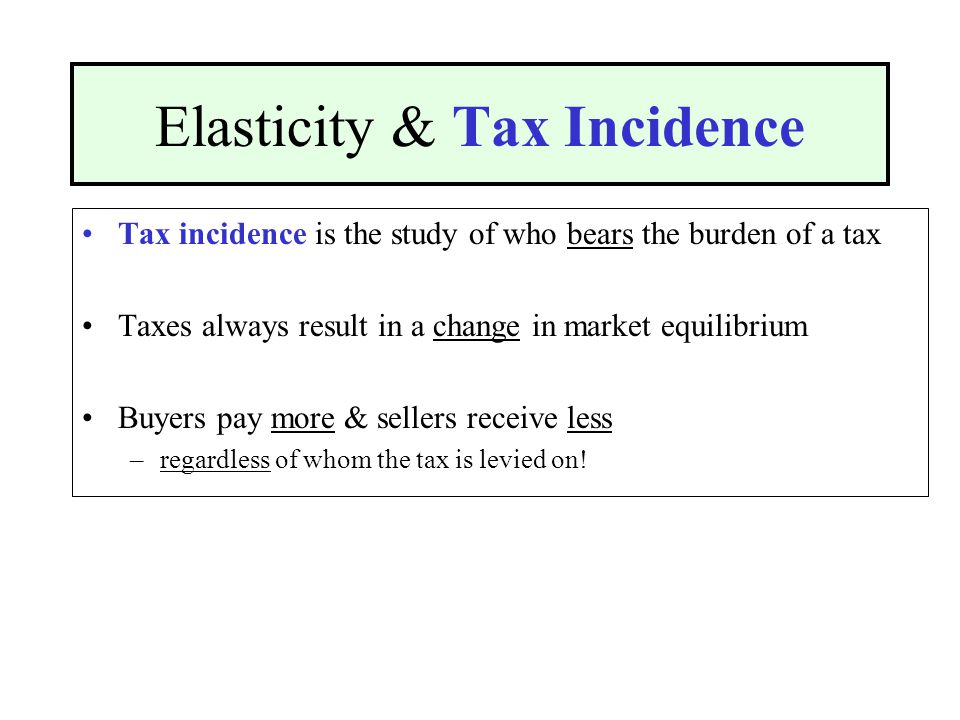

The tax incidence on the sellers is given by the difference between the initial equilibrium price pe and the price they receive after the tax is introduced pp.

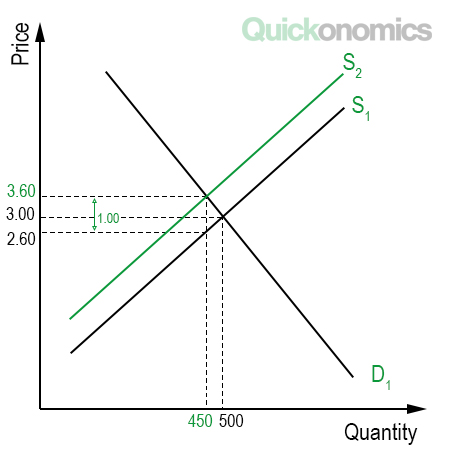

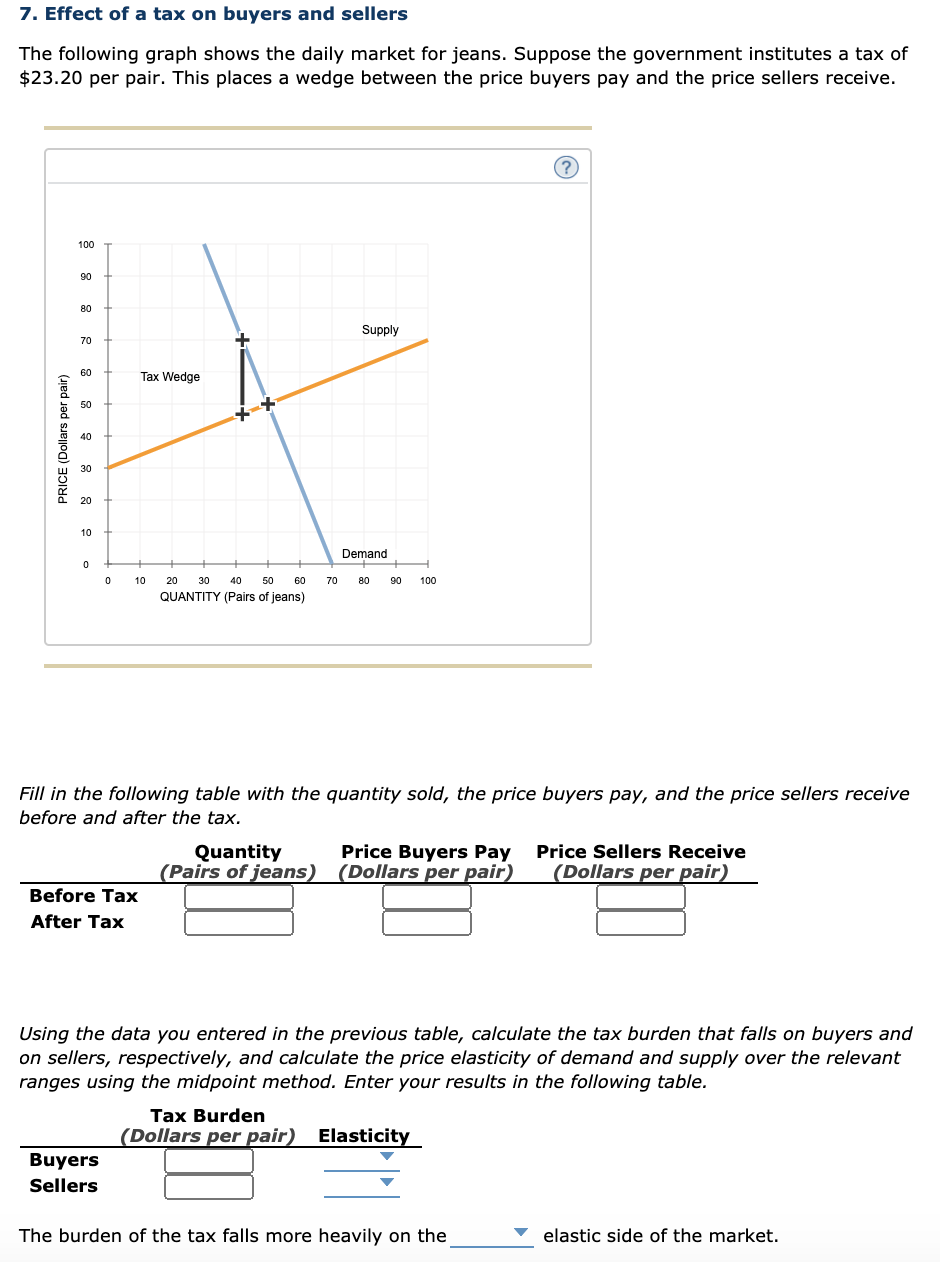

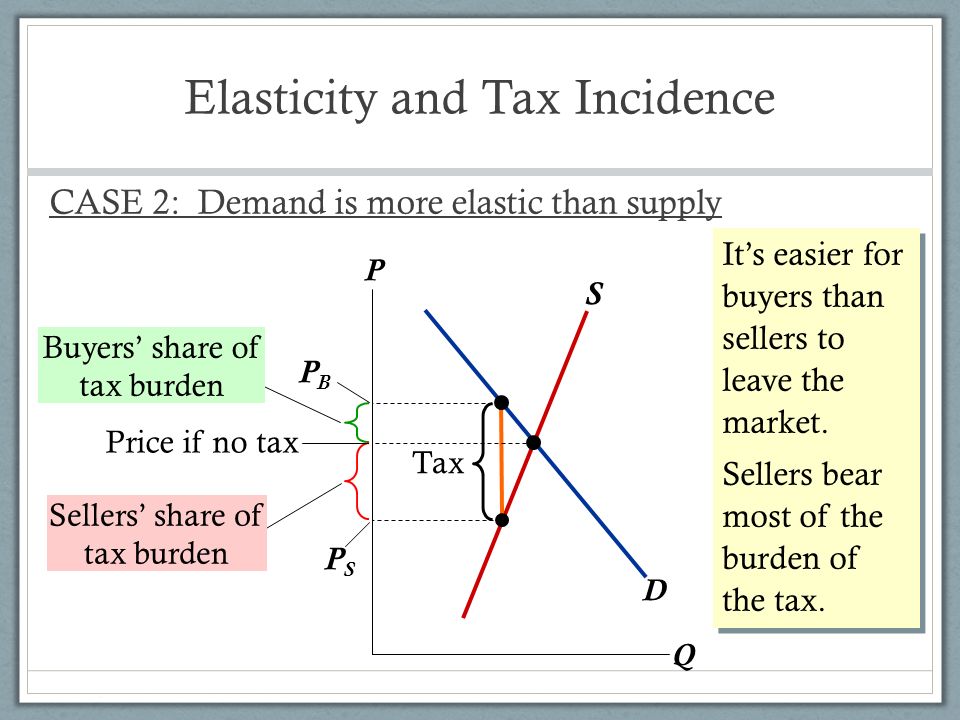

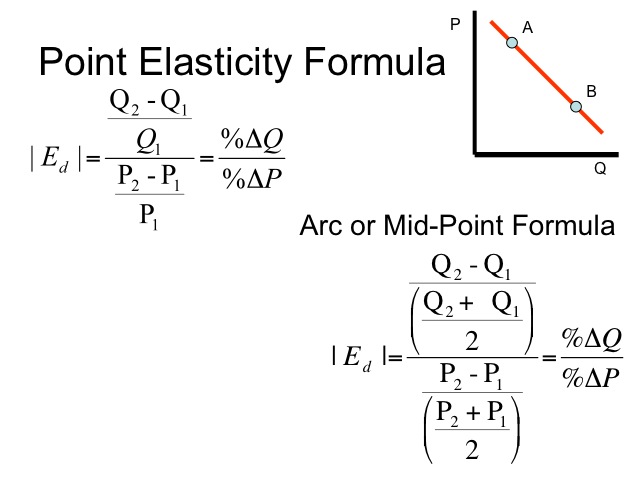

How to calculate tax burden on buyers and sellers. Hence buyers carry 60 of the tax burden and sellers carry 40. Use this calculator to see how your income stacks up and what portion of the tax burden. In graph 3 demand is inelastic but supply is elastic causing the tax burden to fall mostly on the buyer. Buyer s tax burden price buyer pays market price without the tax p b p m.

Do not sell my. Seller s tax burden market price without the tax price seller receives p m p s. This can be verified by studying the ratio of elasticity of demand symbolized by e d and elasticity of supply symbolized by e s. Out of rl buyers will pay re and sellers will pay el pp 2.

Thus the burden of tax is distributed between buyers and sellers. Tax incidence is related to the price elasticity of supply and demand and when. Find out what portion of the tax burden you bear according to your income status. A tax incidence is an economic term for the division of a tax burden between buyers and sellers.

E d e s seller s burden of tax buyer s burden of tax.