How Credit Card Works In Us

Credit cards offer you a line of credit that can be used to make purchases balance transfers and or cash advances and requiring that you pay back the loan amount in the future.

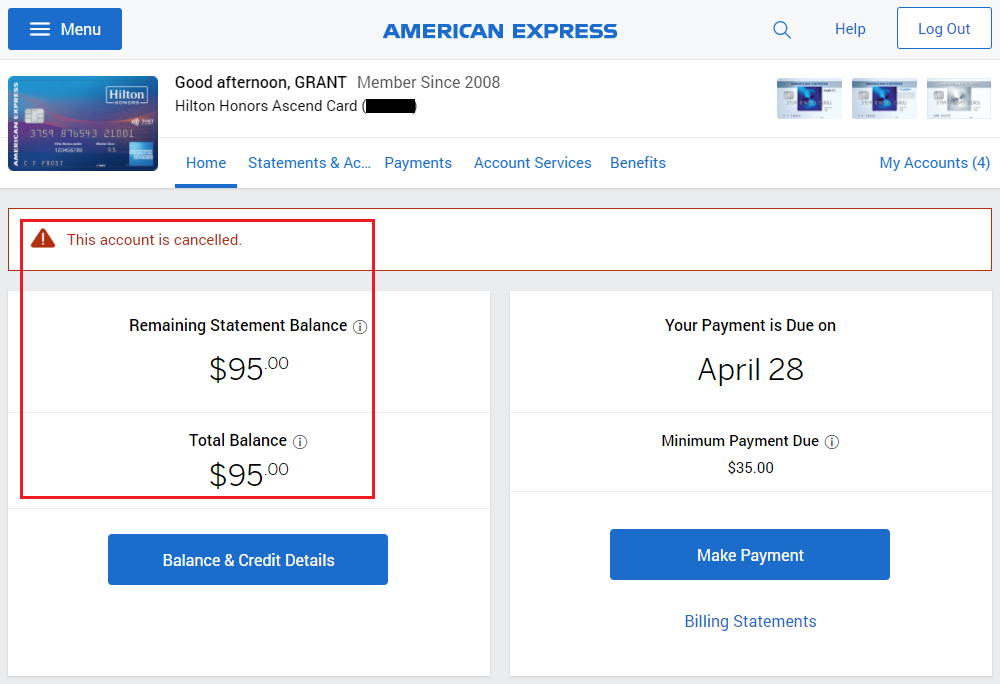

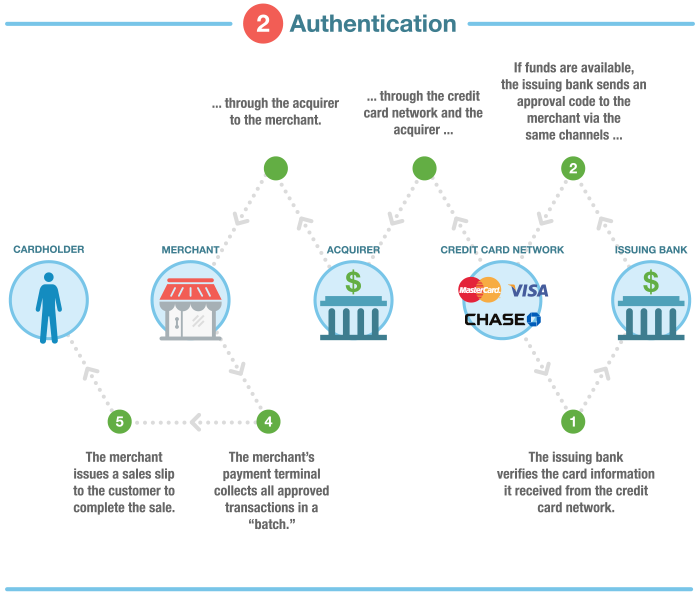

How credit card works in us. Secured credit cards typically report your account. The primary job of the credit card processing cycle is to determine whether a purchase has the necessary funds to be completed. How does a credit card work. For the most part each of these steps is involved with transferring a cardholder s payment information and authorization from one party to another.

This also makes them a stronger ally in cases of fraud. How credit card processing works. Most credit cards use a variable apr so your interest rate will vary based on the fluctuations of the prime rate which is set by the federal reserve. How a credit card works let s say you use a visa card issued by credit one bank the issuing bank to buy your coffee.

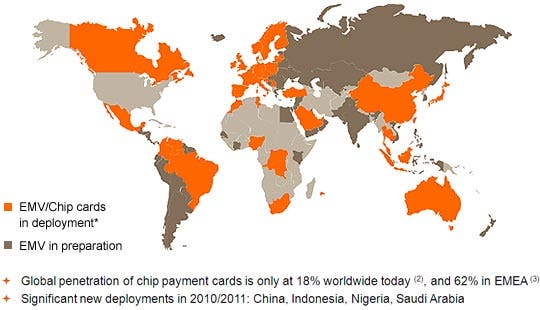

A credit card is a thin plastic card usually 3 1 8 inches by 2 1 8 inches in size that contains identification information such as a signature or picture and authorizes the person named on it to charge purchases or services to his account charges for which he will be billed periodically. It is usually two to three percent of your credit card balance or the outstanding interest you owe plus one percent of the balance. When using a credit card you will need to make at least the minimum payment every month by the due date on the balance. Major credit card networks in the u s.

Credit card processing can be reduced to one of six steps. Information about your credit cards loan accounts and credit inquiries is reported electronically to the three main national credit bureaus transunion equifax and experian by lenders and creditors roughly every 30 days. Include visa mastercard discover and american express. Most credit card issuers also have a flat amount that is the smallest they ll charge on a credit card each month typically 15 to 35.

Unlike a debit card which takes money from your checking account a credit card uses the issuer s money and then bills you later. You can use a credit card to purchase goods or services with any. For example if the prime rate is 4 75 and. The bureaus collect and store your credit information in your credit file for future reference.

You can think of a credit card like a short term loan from a credit card issuer.

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

/creditcardnumbers-ff8c97d0d6684abc9227d9c70849253a.jpg)

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)

/creditcardnumbers-ff8c97d0d6684abc9227d9c70849253a.jpg)

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)