How To Calculate Effective Tax Rate 2019

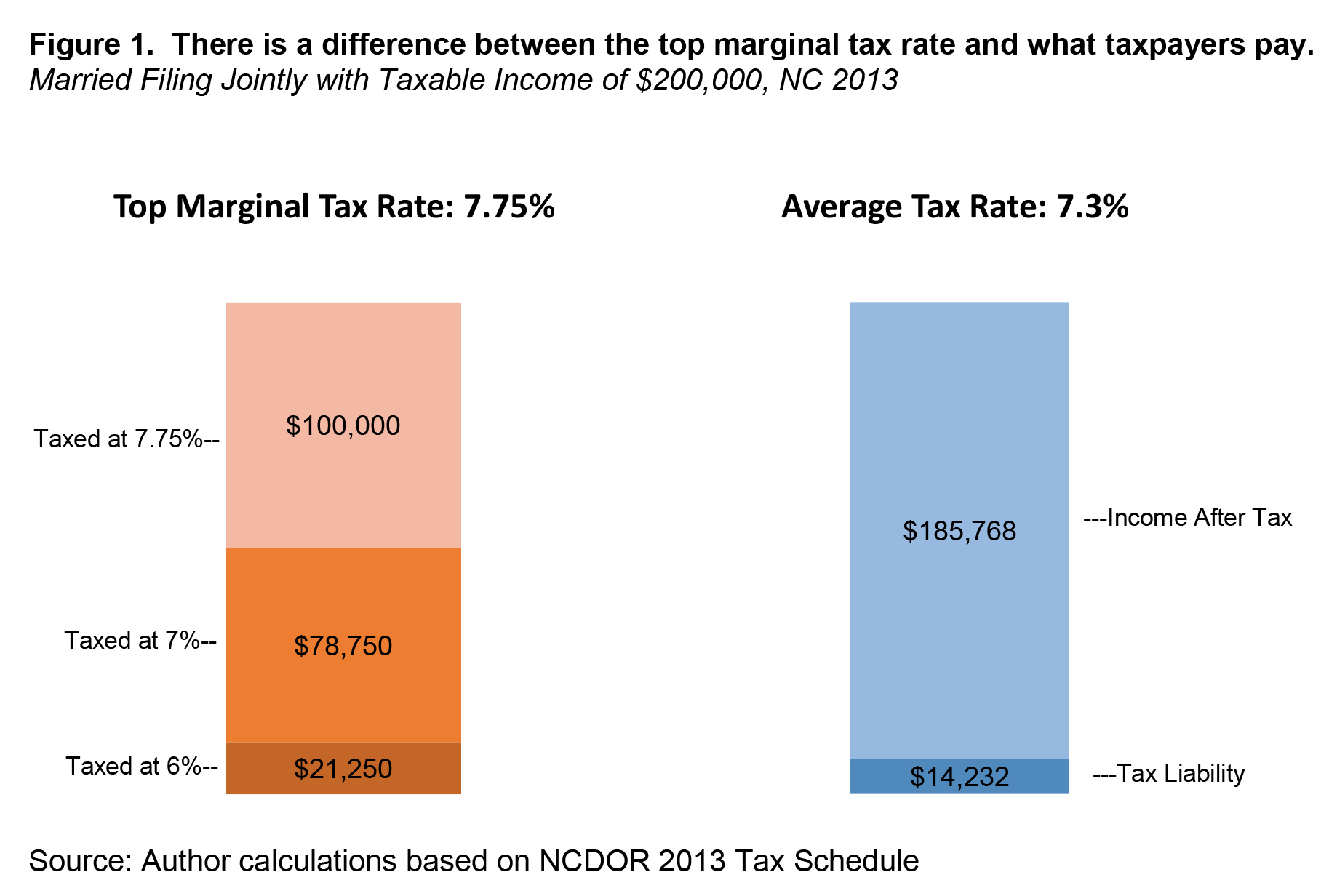

Yet you both have the same marginal tax rate of 22.

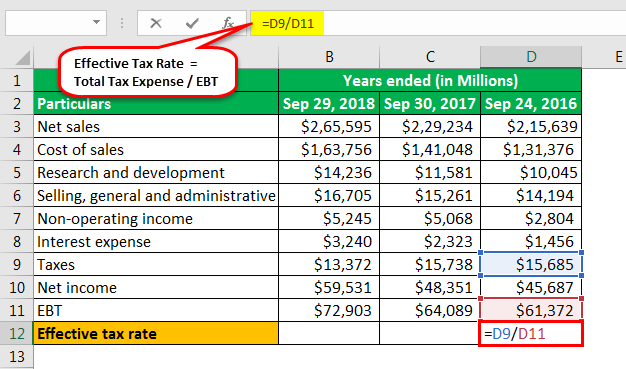

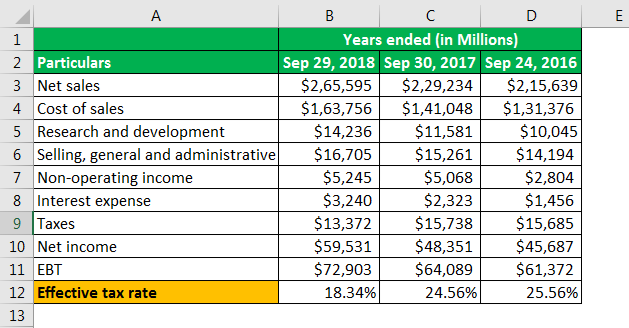

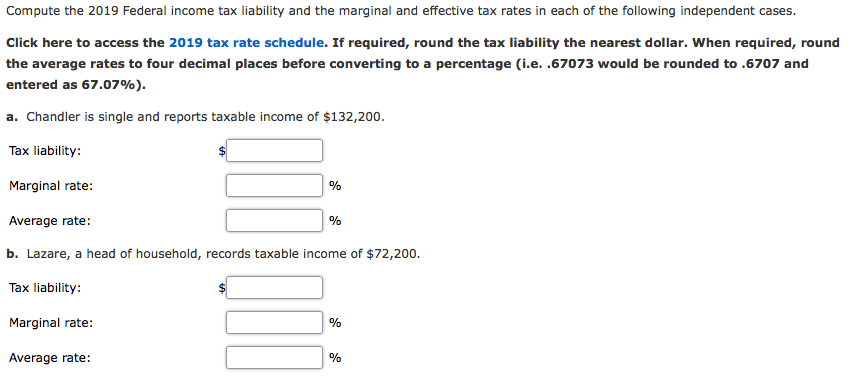

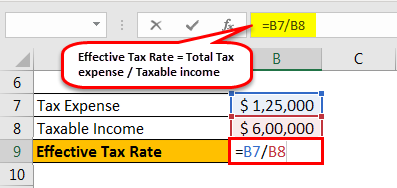

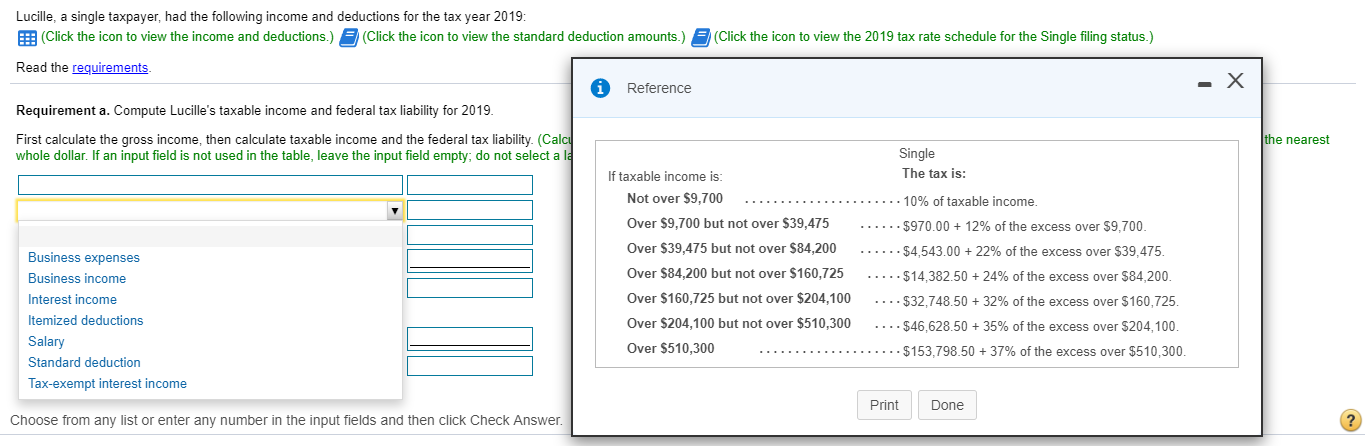

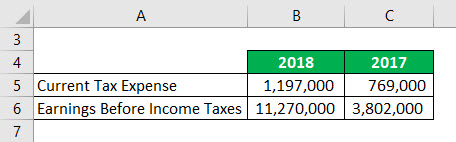

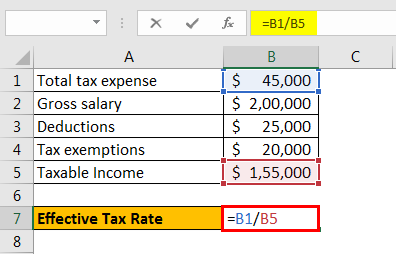

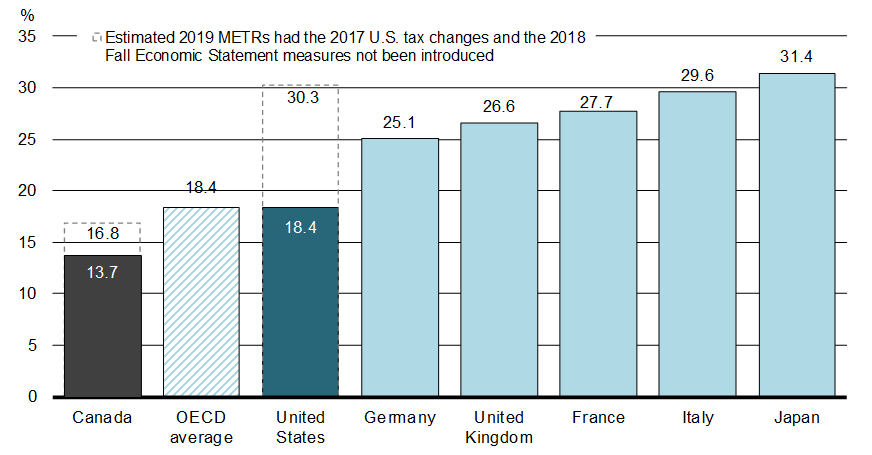

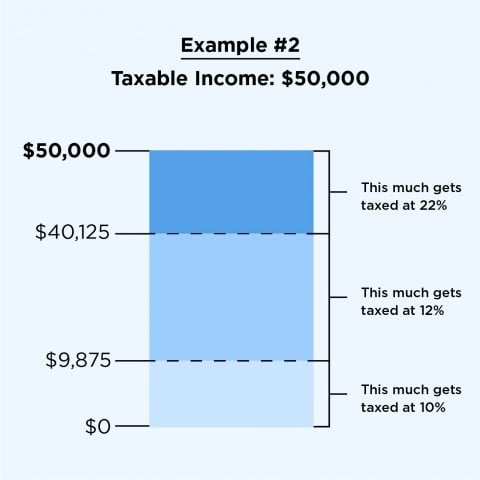

How to calculate effective tax rate 2019. For example if you are single and your taxable income was 50 000 in 2019 9 700 will be taxed at 10 income from 9 701 to 39 475 will be taxed at 12 and the rest will be taxed at 22. Down towards the bottom of the statement locate the income tax expense usually called provision for income taxes divide this number by the company s earnings before taxes or ebt. For example if a company earned 100 000 and paid. Calculating your income tax rate is fairly simple as long as you have all the information in front of you.

The most straightforward way to calculate effective tax rate is to divide the income tax expenses by the earnings or income earned before taxes. Updated to include the 2018 tax reform with new tax brackets. Total estimated 2019 tax burden. Line 15 on the new form 1040 shows the total tax you paid for this year.

Your effective federal income tax rate changed from 10 22 to 10 00. Your federal income taxes changed from 5 818 to 5 693. Quickly find your 2019 tax bracket with taxact s free tax bracket calculator. The taxpayer with 80 000 in taxable income would have an effective tax rate of 16 7 or 13 119 divided by 80 000.

Your marginal federal income tax rate remained at 22 00.