How Fixed Deposit Works

How does a fixed deposit work.

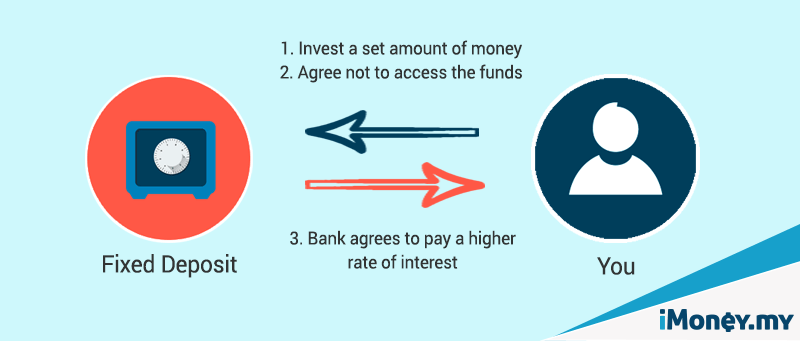

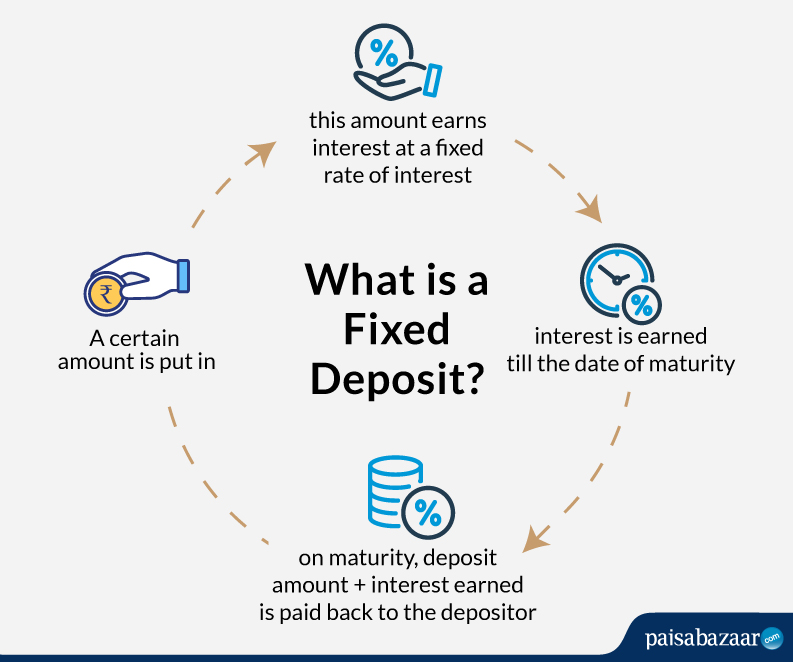

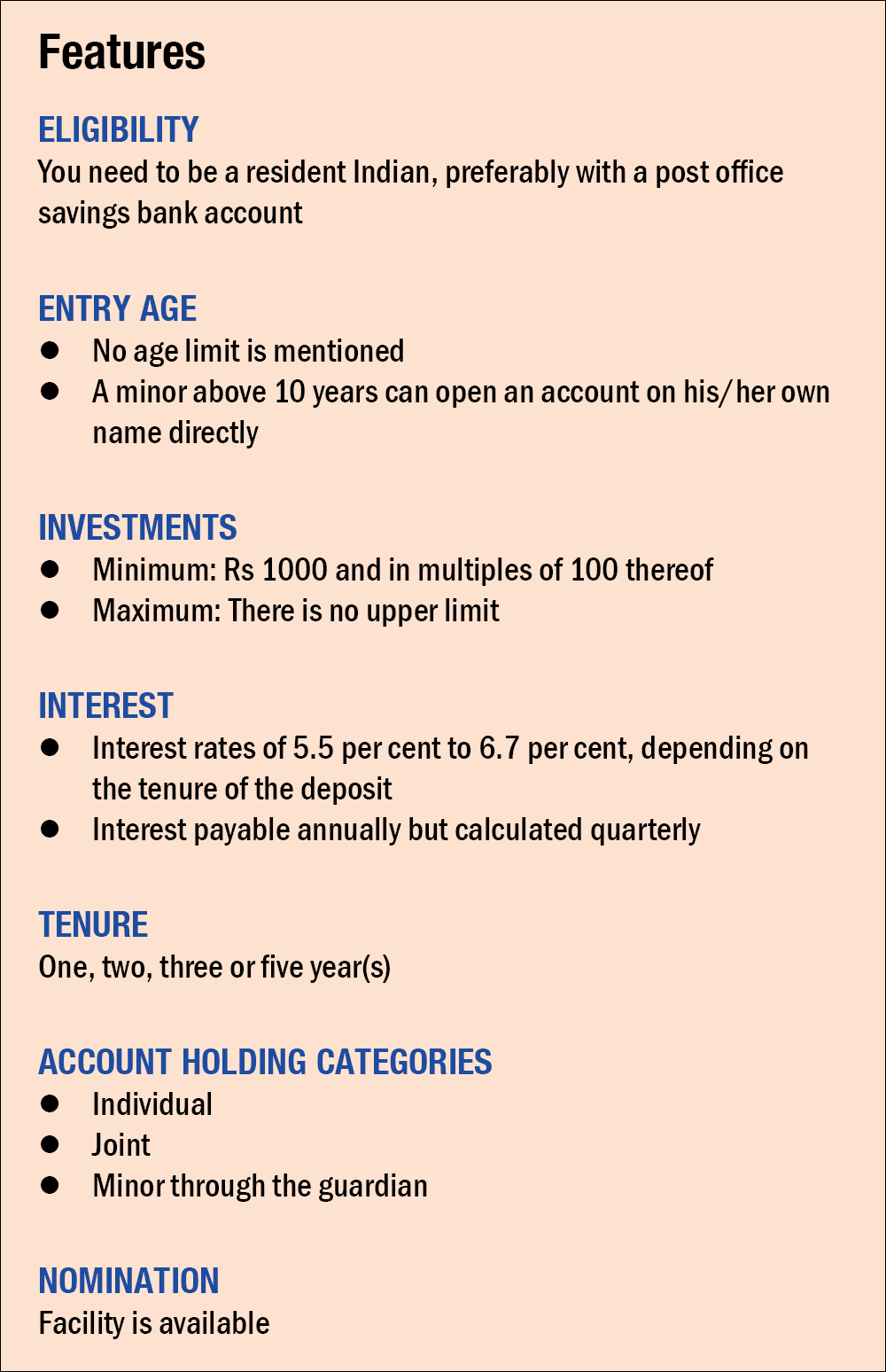

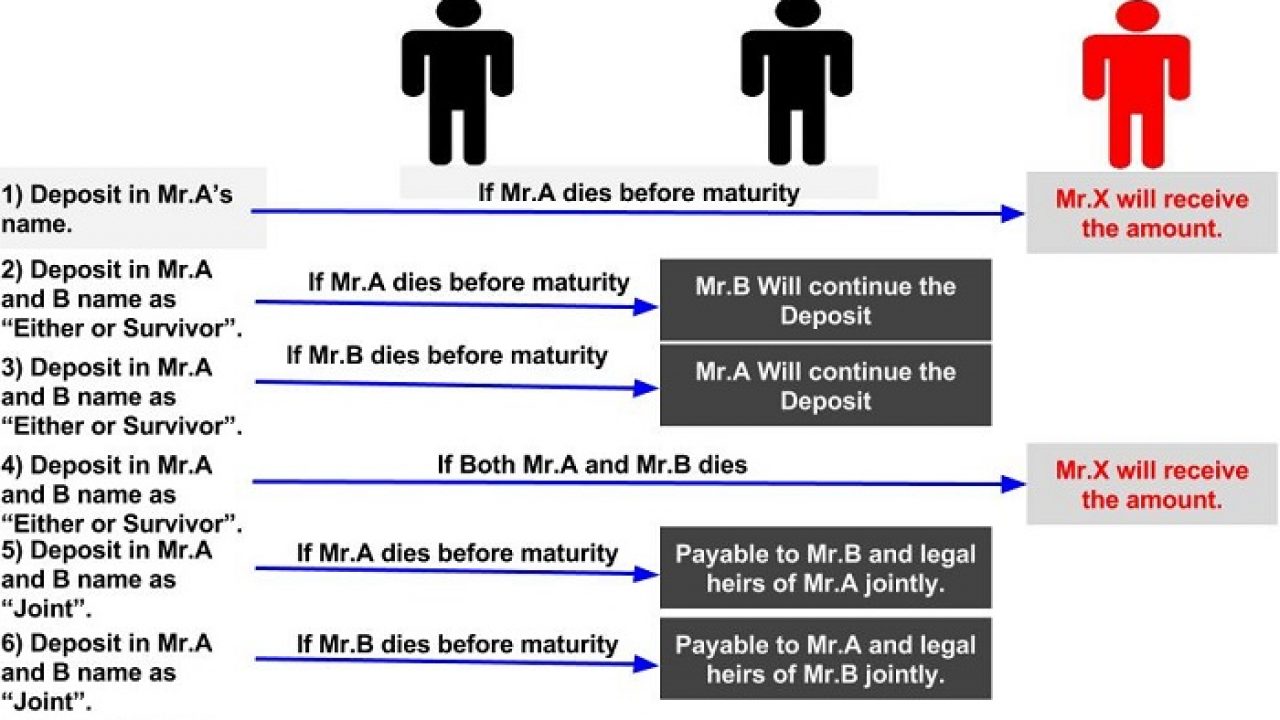

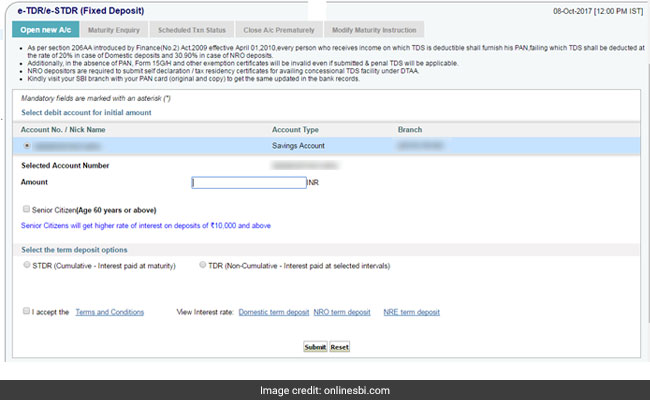

How fixed deposit works. All fixed deposit accounts are calculated with a rate of interest added. When a sum of money is deposited in an account with an agreement that it won t be withdrawn before the fixed period it gives the depositee a certain degree of freedom to invest the sum. A fixed deposit or fd is a type of savings investment account that promises the investor a fixed rate of interest. The nature of this investment is very secure and they earn interest as per the interest rate they carry.

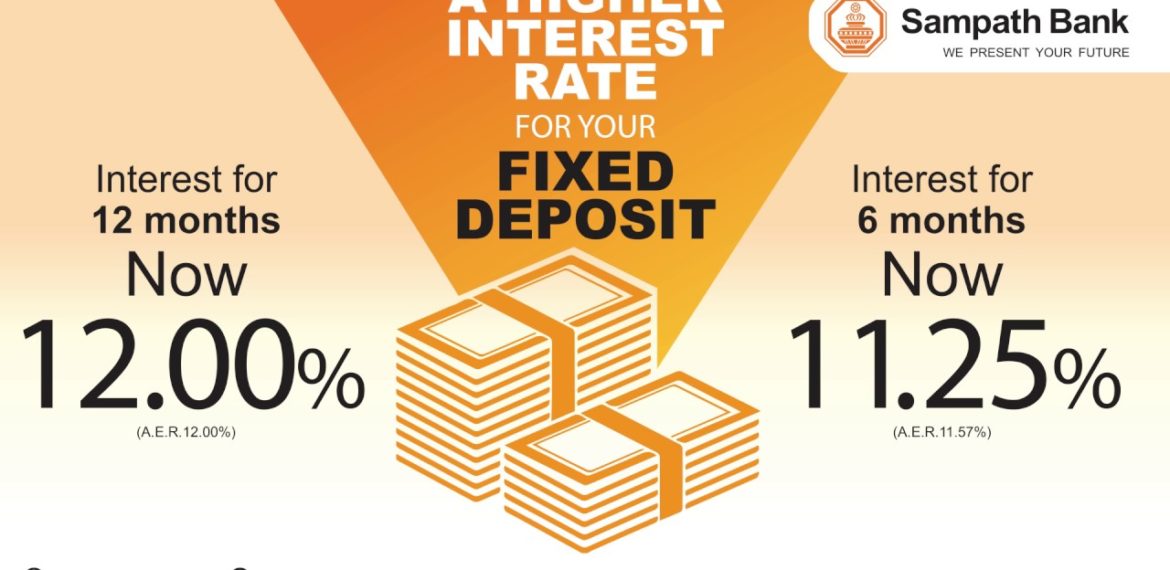

1 all deposits will be liable for a certain percentage of interest. Benefits gained from such an investment are shared by the depositee and the depositor. 2 interest levied on the basis of the tenure. Fixed deposits are an easy way to earn returns from funds that are lying idle.

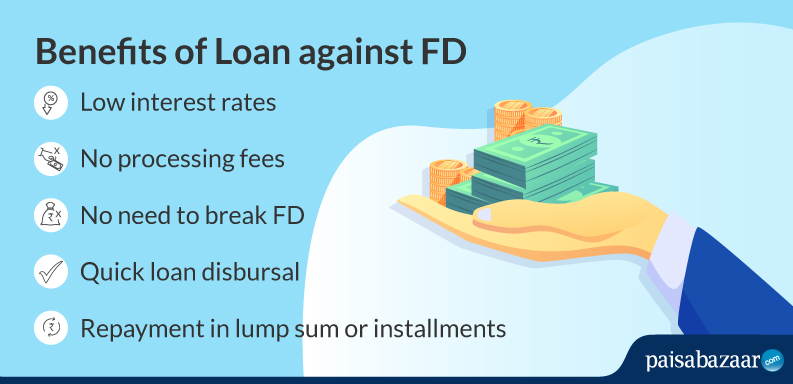

When it comes to fixed deposits it is termed as an. Fixed deposits are a form of time deposit. In return for the higher interest rate you promise to keep your cash in the bank for a specified amount of time for. Fixed deposit is a traditional investment tool preferred by investors who are looking for a secure investment option and regular income flow.

How fixed deposit works. How fixed deposit bank accounts work. As the name suggests fixed deposit offers fixed returns on the investments. A fixed deposit is a type of an account opened with a bank where an assured rate of interest is paid for keeping the funds for a particular period.

How does fixed deposits account work. In return the investor agrees not to withdraw or access their funds for a fixed period of time.