Fixed Deposit Vs Asb

Banyak bank yang menawarkan produk fixed deposit ada yang.

Fixed deposit vs asb. So now you have 267k asb deposit. Asb s term deposit terms and conditions apply. Rates not available to financial institutions. Maximum amount across all term deposits held either solely or jointly with any person is 10 million.

That means your 200k asb deposit will become. Asb boleh jadi financial tool yang memaksa kita menyimpan dan dapatkan pulangan dividen yang thorbaik. With an asb term fund your share of income earned by the asb term fund is taxed at your prescribed investor rate pir of 0 10 5 17 5 or 28. With a term deposit your interest is taxed at your income tax rate.

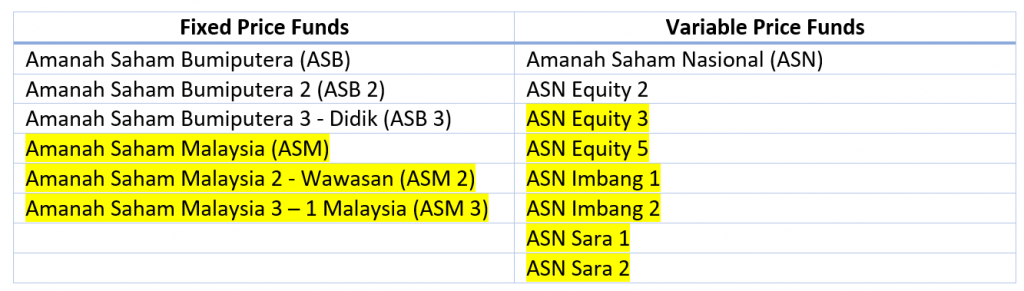

In layman s term a fixed deposit account is an investment that pays you a higher rate of interest in return for locking your money away for a fixed period of time. So if your income tax rate is more than 28 during the term of your deposit you could get a better after tax return by investing in an asb term fund. Unlike asb and asb 2 funds each individual can invest up to 200 000 units only excluding re investment of distributions. 217k deposit on second year.

Lets say you stopped paying the 1000 permonth loan at sixth year. Asb 3 didik fund in substance is no different from asb and asb 2 funds. The good news is there is no maximum limit that you can invest in asb 3 didik fund. Ia menjanjikan pulangan faedah tetap yang lebih tinggi berbanding simpanan akaun biasa.

A term deposit could be a good option if you have more than 5 000 to deposit and you want it to earn a fixed interest rate over a fixed period of time. Baiklah dalam artikel kali ini saya akan tulis berkenaan hal hal di atas. Kalau tanya tok baik lagi korang menyimpan guna asb berbanding fixed deposit sebab pulangan asb lebih lumayan kalau kita gunakan dengan cara yang betul. For more information on asb term fund refer to the asb cash fund and asb term fund terms and conditions.

Malah ada juga yang sering membandingkan antara tabung haji vs asb amanah saham bumiputera mungkin kerana kedua dua tempat ini merupakan tempat simpan duit yang menjadi pilihan kebanyakan orang. Rough estimate 267k fifth year. Money invested will not depreciate due to the fixed price. Rough estimate 250k fourth year.

How the investment is taxed. Amanah saham bumiputera 3 didik or asb 3 didik fund. 267k x 0 087 23k. I do not foresee that asnb will bankrupt.

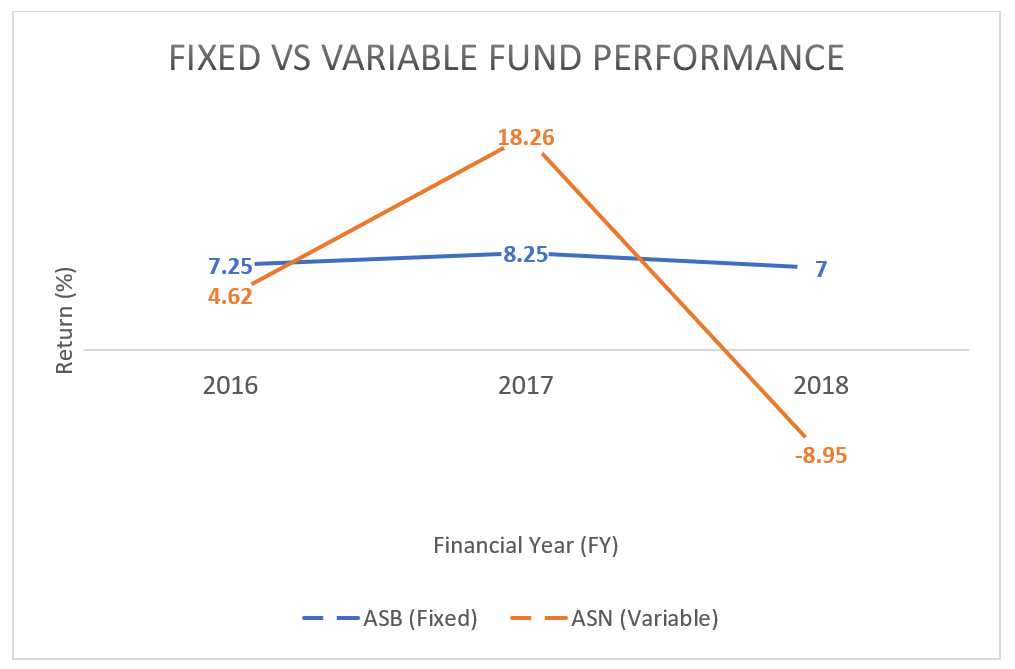

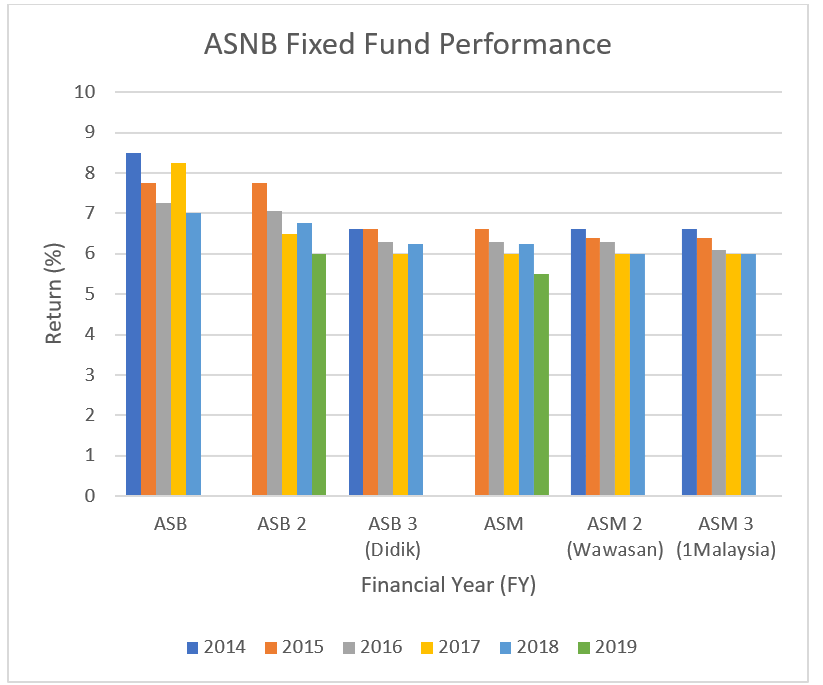

These funds can thus be regarded as saving accounts. Worst case scenario will be that the value in the account remains constant. The fixed term can vary and depending on the term you choose the interest you earn on your fixed deposit can vary as well. If you have an income tax rate of 30 or 33 have a look at an asb term fund as it may provide you with better after tax returns than a term deposit offering the same interest rate term and fees.

Fixed deposit simpanan tetap adalah merupakan salah satu instrumen kewangan yang ditawarkan oleh institusi perbankan. These funds give consistent dividend. Written by imoney editorial.