How Does Credit Card Work

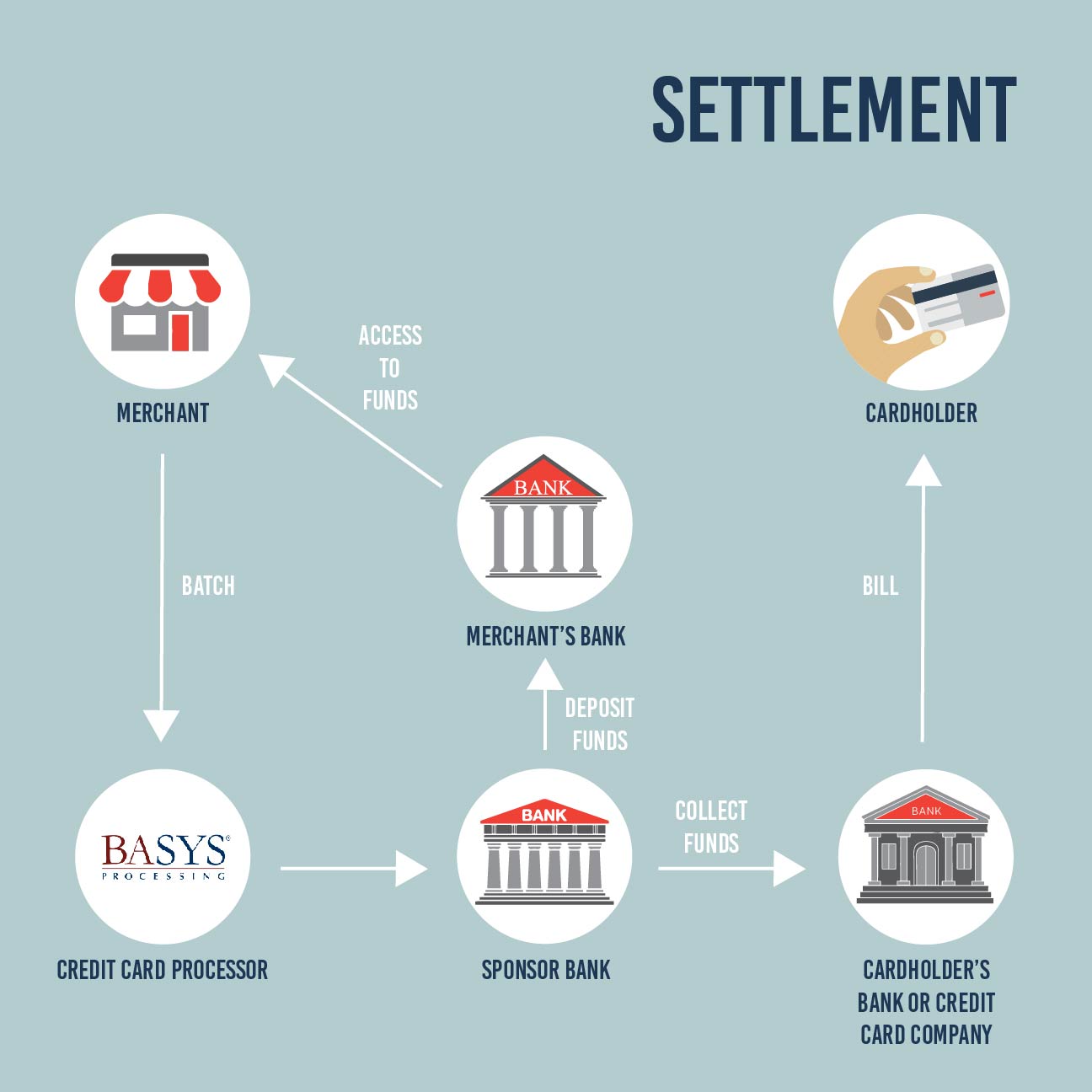

This also makes them a stronger ally in cases of fraud.

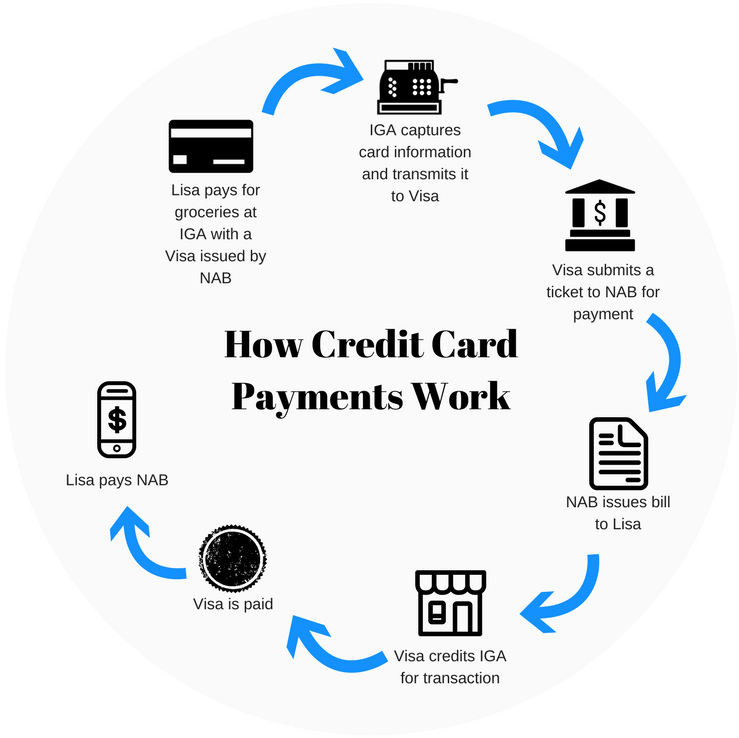

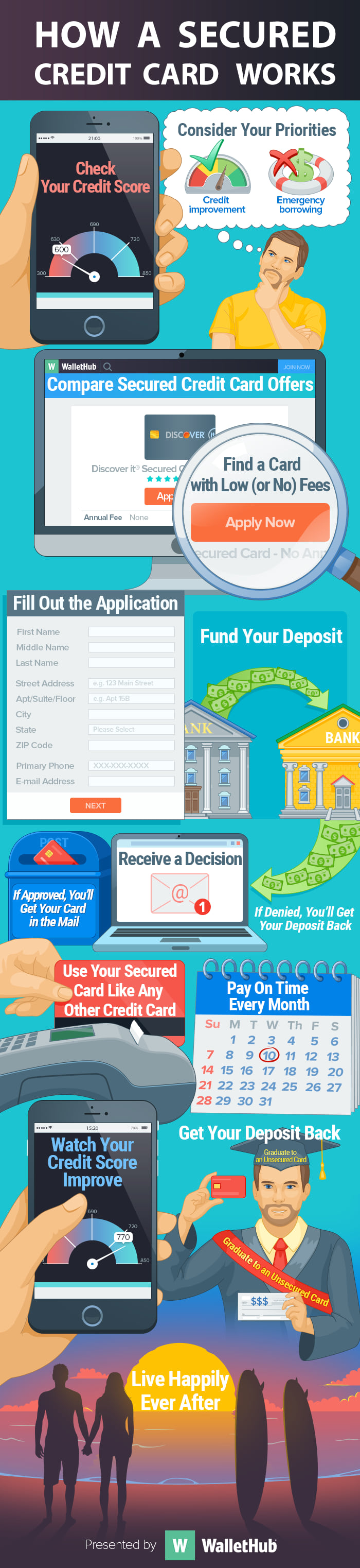

How does credit card work. How does a credit card work. A credit card stated simply is a form of loan. Credit cards work by letting you borrow up to a certain amount of money and repay it at your own pace. As a credit card holder you agree to certain terms and limits on your borrowing and pay interest on the amount you borrow.

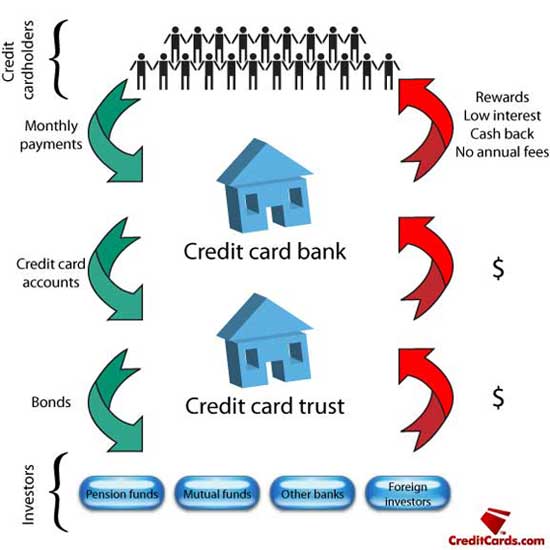

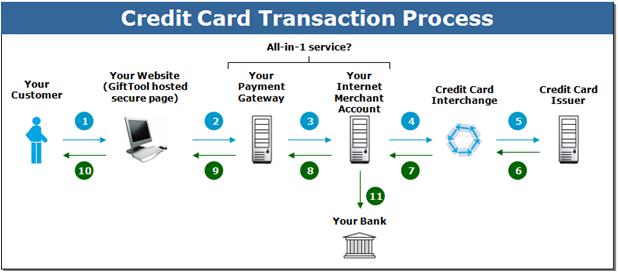

Credit cards offer you a line of credit that can be used to make purchases balance transfers and or cash advances and requiring that you pay back the loan amount in the future. For credit cards apr is directly equal to the annual interest rate for the account. You can think of a credit card like a short term loan from a credit card issuer. Apr works differently on loans where it often includes standard fees for the loan.

The bank or credit card issuer extends you a line of credit money that you otherwise would not have. Credit card apr typically ranges between 10 30. Credit card interest is charged when you don t pay off purchases balance transfers or cash advances in full by the end of your billing cycle. Because the apr is an annualized percentage it is.

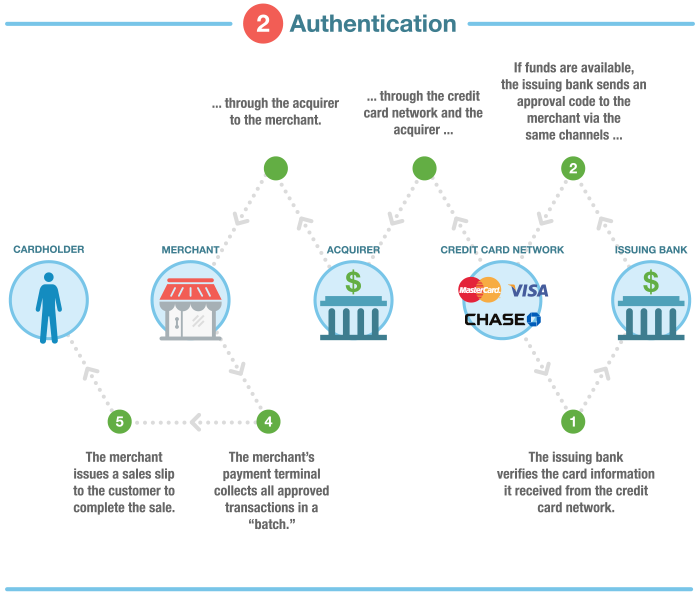

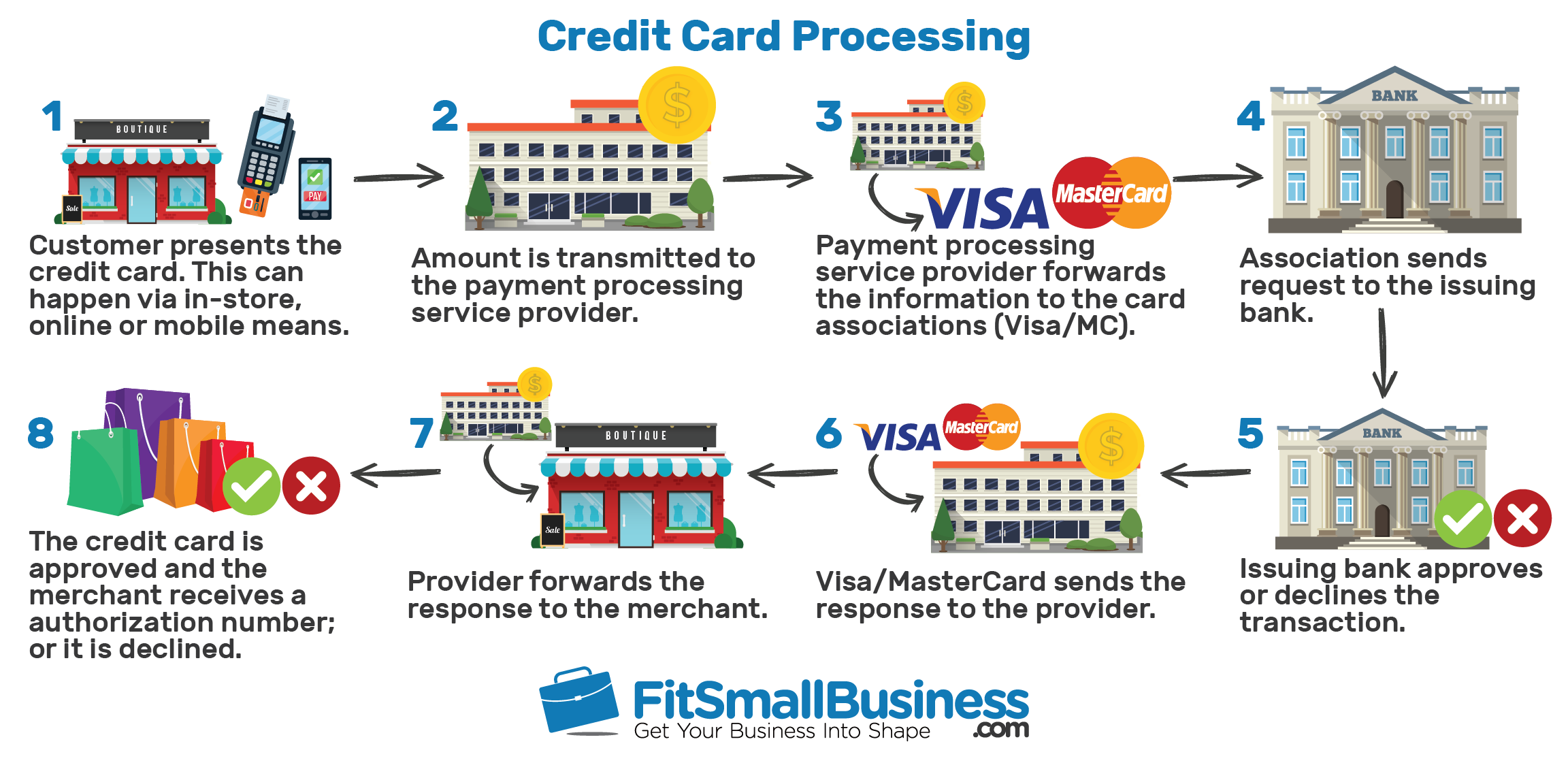

You can use a credit card to purchase goods. When using a credit card you will need to make at least the minimum payment every month by the due date on the balance. How does credit card interest work. How do credit cards work.

A credit card is tied to a credit account with a bank and when you use the card you re borrowing money from the issuing bank. In exchange you pay them back either by the monthly payment due date or over time. Unlike a debit card which takes money from your checking account a credit card uses the issuer s money and then bills you later. How credit card interest rates work.

/_How-does-a-prepaid-card-work-960201_Final2-a914cdbc7901430d80de45153461af0a.png)

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/debit-and-credit-card-tips-in-canada-1481710-Final2-5c2f73e546e0fb00015cfd9b.png)

/how-credit-card-skimming-works-960773-FINAL-5bc4cb084cedfd005148215d.png)