Freelance Income Tax Malaysia

If you already have a tax file registered from previous employment do submit your return form even if your annual or monthly income falls below the chargeable level rm34 000 after epf deduction.

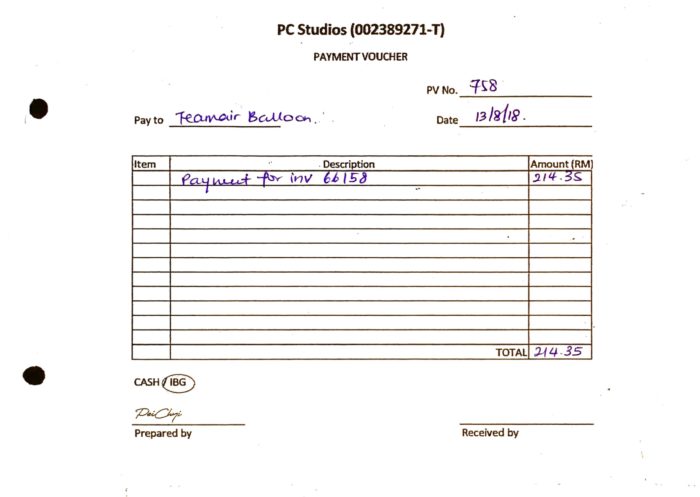

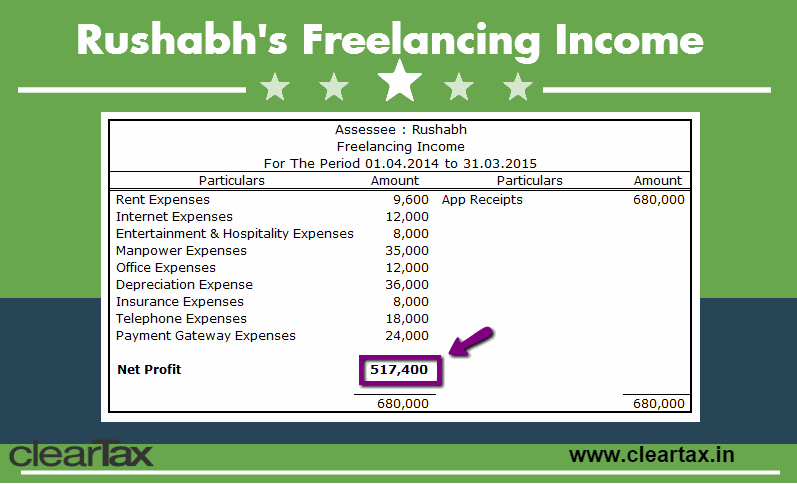

Freelance income tax malaysia. So yes if you are a freelancer you are subject to income tax and therefore must file your income tax. Freelancers may enjoy different tax laws such as a lower rate for any royalties they earn and any income they receive working overseas is 100 exempt from malaysian income tax we ll cover more exemptions in a future article. Hiring tax preparation freelancers in malaysia is quite affordable as compared to a full time employee and you can save upto 50 in business cost by hiring tax preparation freelancer in malaysia. Freelance accountant jobs in malaysia check out latest freelance accountant job vacancies in malaysia for freshers and experienced with eligibility salary experience and companies.

As of year of assessment 2004 any income earned from outside malaysia by a resident individual is exempted from tax. We provide professional company secretary services payroll set up of limited liability partnership services in affordable fee. Deputy communications and multimedia minister zahidi zainul abidin has shared that the malaysian government is planning to introduce a new service tax for online shopping. Rm10 000 for royalties received for use of copyrighted and patented work such as publications of artistic works.

Review and filing of local income tax returns and tax computations for clients of bps malaysia br br. Some other tax exemptions include. As reported by harian metro and malaysiakini the proposed rate is about 0 02.

The deputy minister said the proposed charge.