Housing Loan Interest Rate Malaysia

Public bank housing loan interest rates.

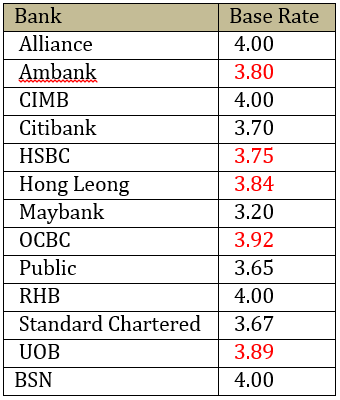

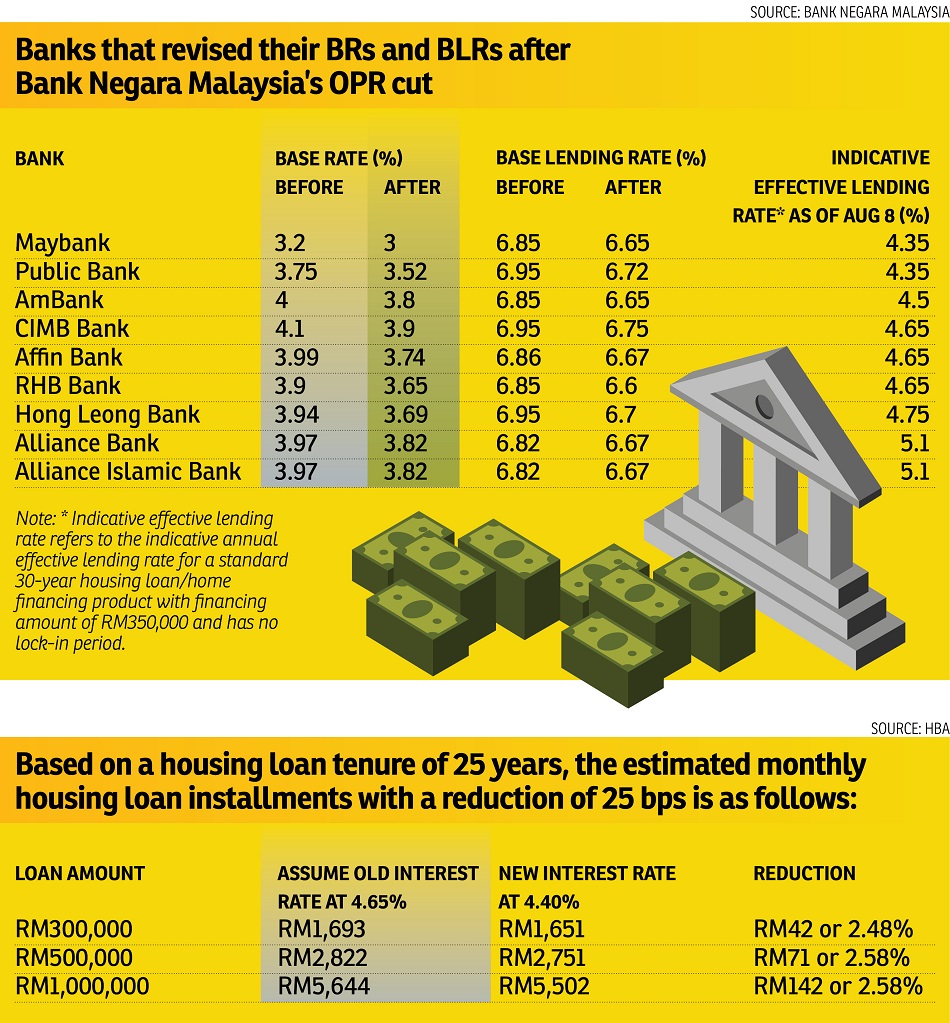

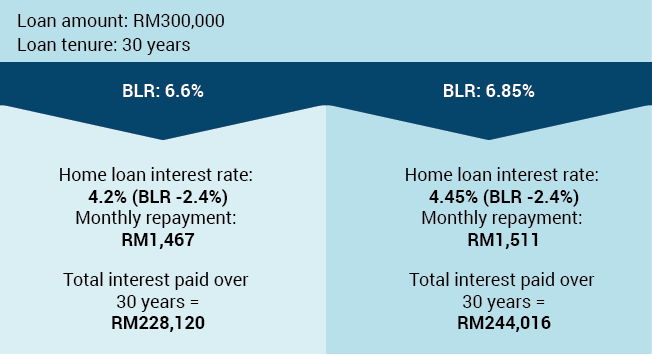

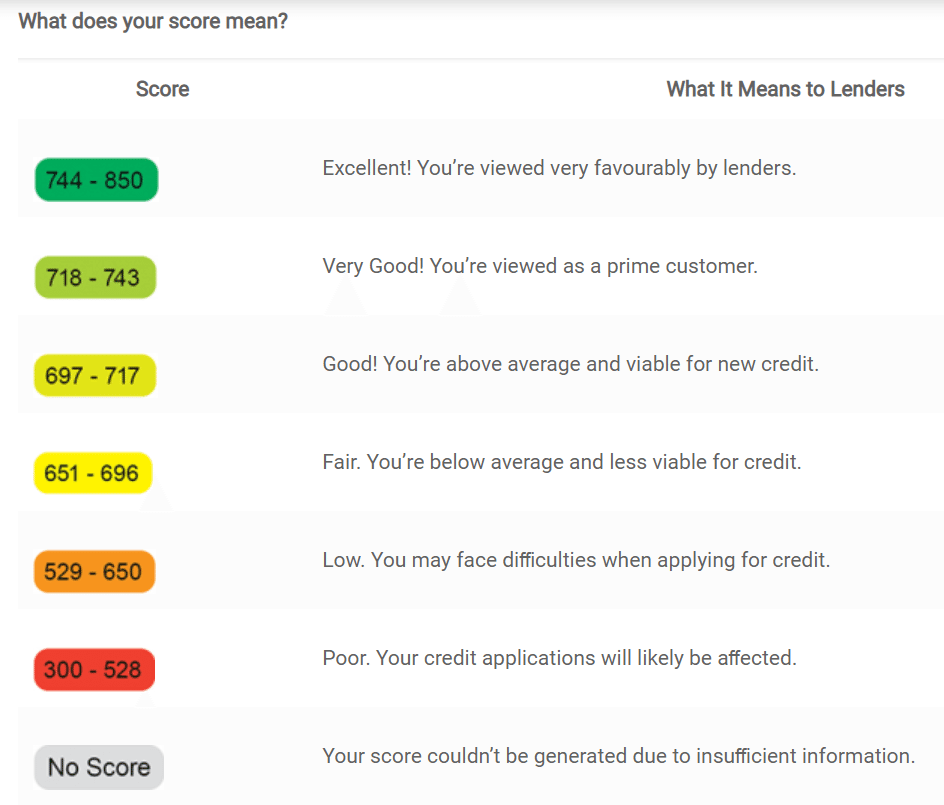

Housing loan interest rate malaysia. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45. Read more apply now. Borrowing rm 450000 over 20 years. Br 2 52 0 70 3 22 special approval rates br 2 52 0 63 3 15 subject to special terms and conditions by the bank.

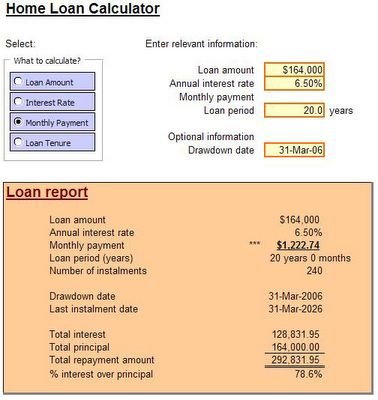

Terms conditions apply. Monthly repayment rm 2540 98. Enter loan interest rate in percentage. Estimated interest rate 3 2 p a.

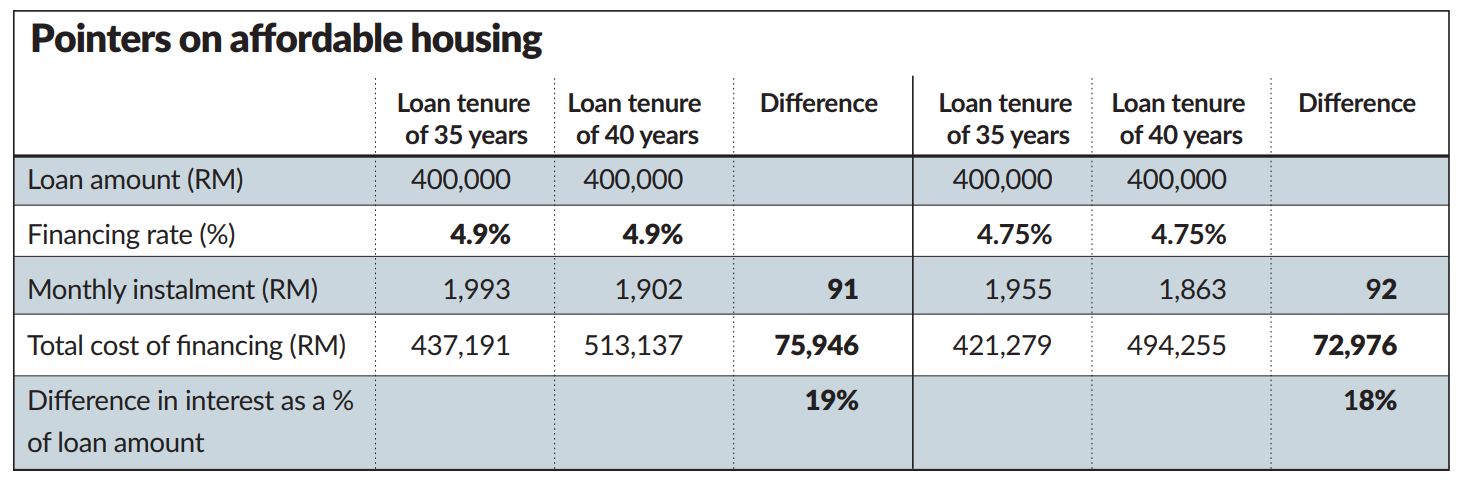

For example if the current br rate is 4 00 update. Margin of finance mof. The best home loan rate malaysia interest rates. A typical housing loan in malaysia would see the borrower making monthly payments for a certain period of time also known as the loan tenure until both the principal amount of the loan and interest are fully paid.

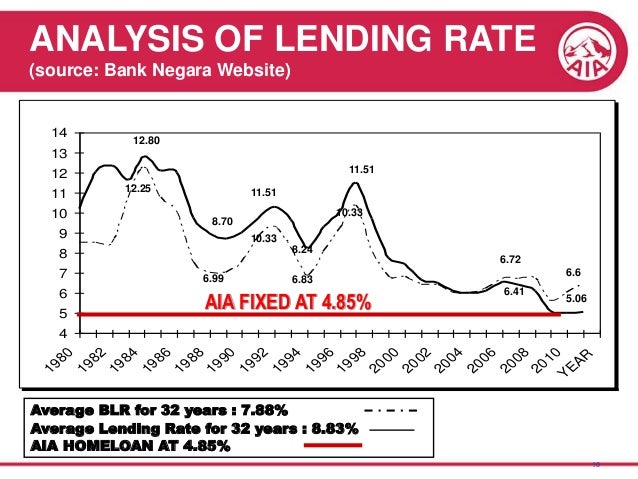

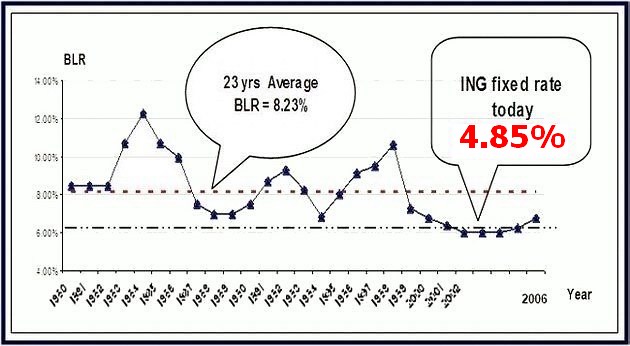

Base lending rate blr 6 6 maximum loan amount 90 of property price. Interest rate as low as 4 15 p a. Flexible to choose term loan overdraft or both higher loan eligibility repayment period of up to 35 years or age of 70 higher loan margin of up to 95 flexibility to revise monthly installments flexibility to redraw advance additional payments. You ll benefit from bsn s giro home loan with low interest rates and package options for just about everyone.

Interest rates for housing loans in malaysia are usually quoted as a percentage below the base rate br. Compare the cheapest home loans from over 18 banks in malaysia. Max up to 90 5 compulsory mrta. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more.

Malaysia housing loan interest rates.