Fixed Deposit Interest Income Taxable In Malaysia For Company

Accommodation provided by your employer.

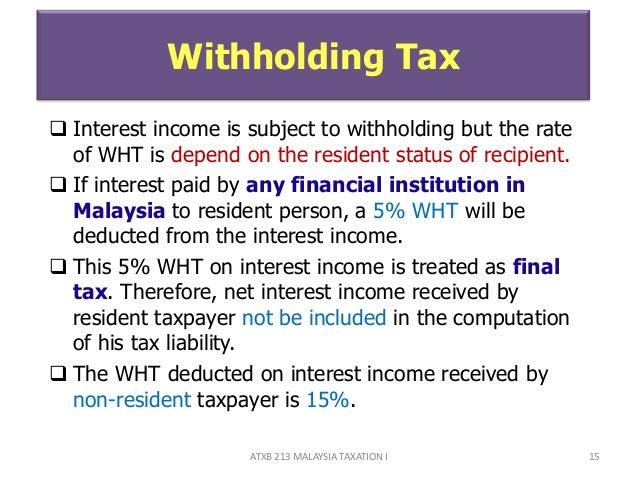

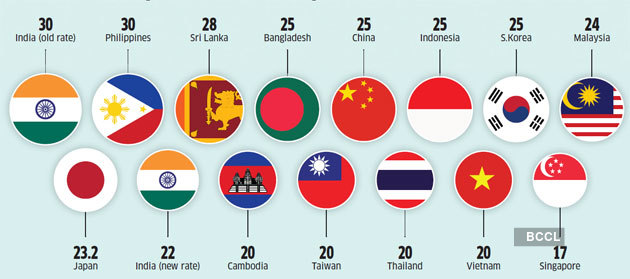

Fixed deposit interest income taxable in malaysia for company. Malaysia personal income tax rates two key things to remember. Interest paid to a non resident individual by commercial banks merchant banks or finance companies operating in malaysia is exempt from tax. Any benefits used only for the performance of your job duties. Tax rates are progressive so you only pay the higher rate on the amount above the rate i e.

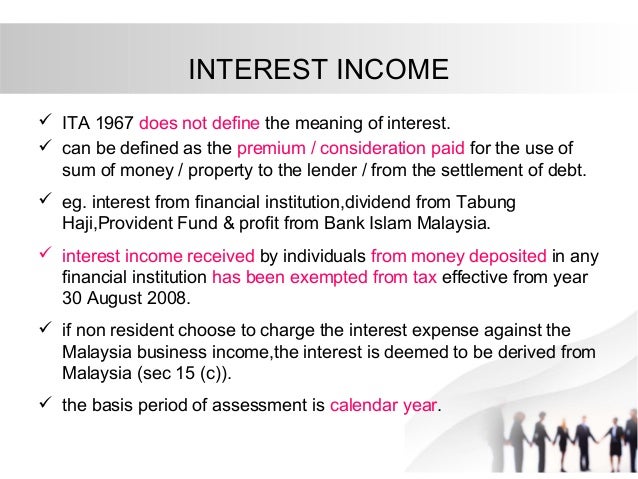

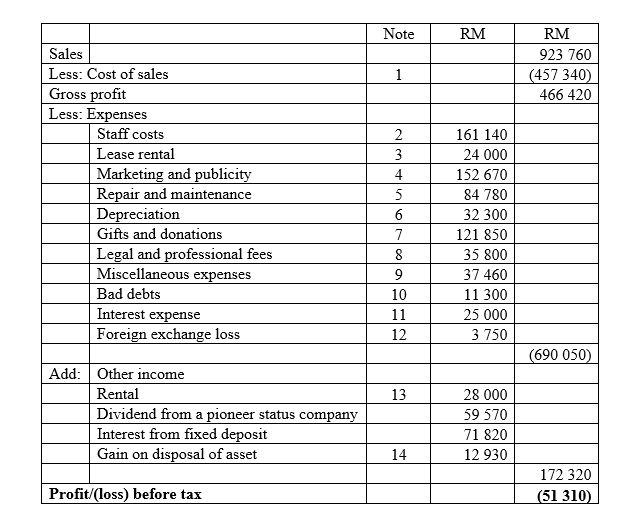

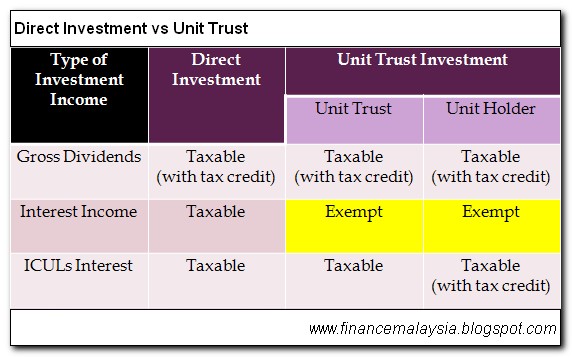

Interest received from certain types of bonds or securities is also exempt from tax. 5 2 interest income assessed under paragraph 4 c of the ita interest income received by a person from the carrying on of a business other than those mentioned in paragraph 5 1 is taxed as interest income under paragraph 4 c of the ita. The taxpayer who has no business income is required to file their tax return form be and pay their balance of tax by 30 april of the following year. Tax rates are on chargeable income not salary or total income chargeable income is calculated after tax exemptions and tax reliefs more below.

Effective date 21 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board malaysia. The determination of the source of interest income is significant as only interest derived from malaysia is taxable in malaysia. 1 company trip outside malaysia for up to rm3 000. Such interest income includes.

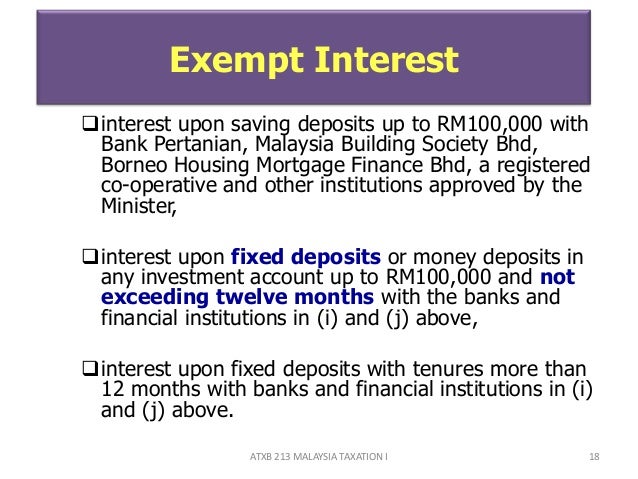

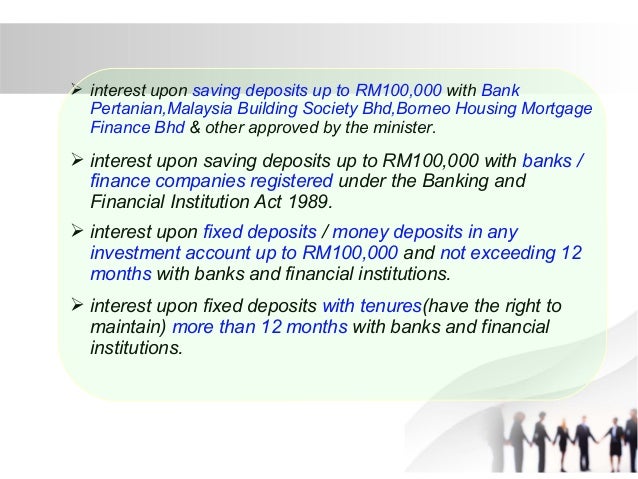

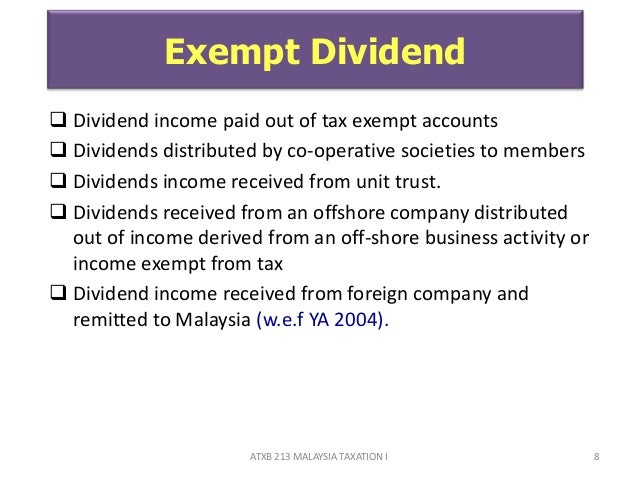

Foreign sourced interest income is specifically tax exempt. Income in respect of interest received by individuals resident in malaysia from money deposited with the following institutions is tax exempt with effect from august 30 2008. Treatment of interest expense attributable to dividend income received by a company 19 21 12. A interest charged due to delay in payment of trade debt example 1.

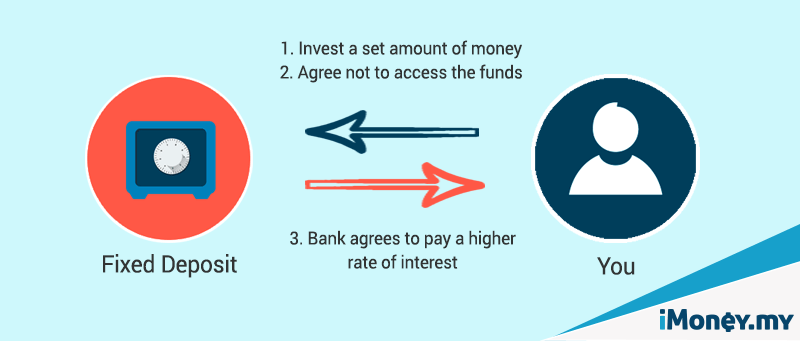

Additionally where interest is paid to a non resident the interest derived or deemed derived from malaysia is subject to withholding provisions. Interest earned from fd no need to pay tax even the earned interest is few millions. Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt. Interest which accrues in respect of any fixed deposit account including negotiable certificates of deposits for a period exceeding twelve months with bank pertanian malaysia bank kerjasama rakyat malaysia bhd bank simpanan nasional borneo housing mortgage finance bhd malaysia building society bhd or a bank or finance company licensed.

A bank or a finance company licensed or deemed to be licensed under the banking and financial institutions act 1989. Anything not covered by the above list or exceeds the limits of the list will be considered part of your income and will be taxable as normal. 4 as for a taxpayer who has business source income the deadline for filing the tax return form b and payment of balance of tax payable is 30 june of the following year. It is now exempted as per the lhdn website.