Guidelines On Real Property Gains Tax

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19430294/Screen_Shot_2019_12_04_at_1.44.54_PM.png)

This is because short term capital gains are taxed at the same rate as ordinary income.

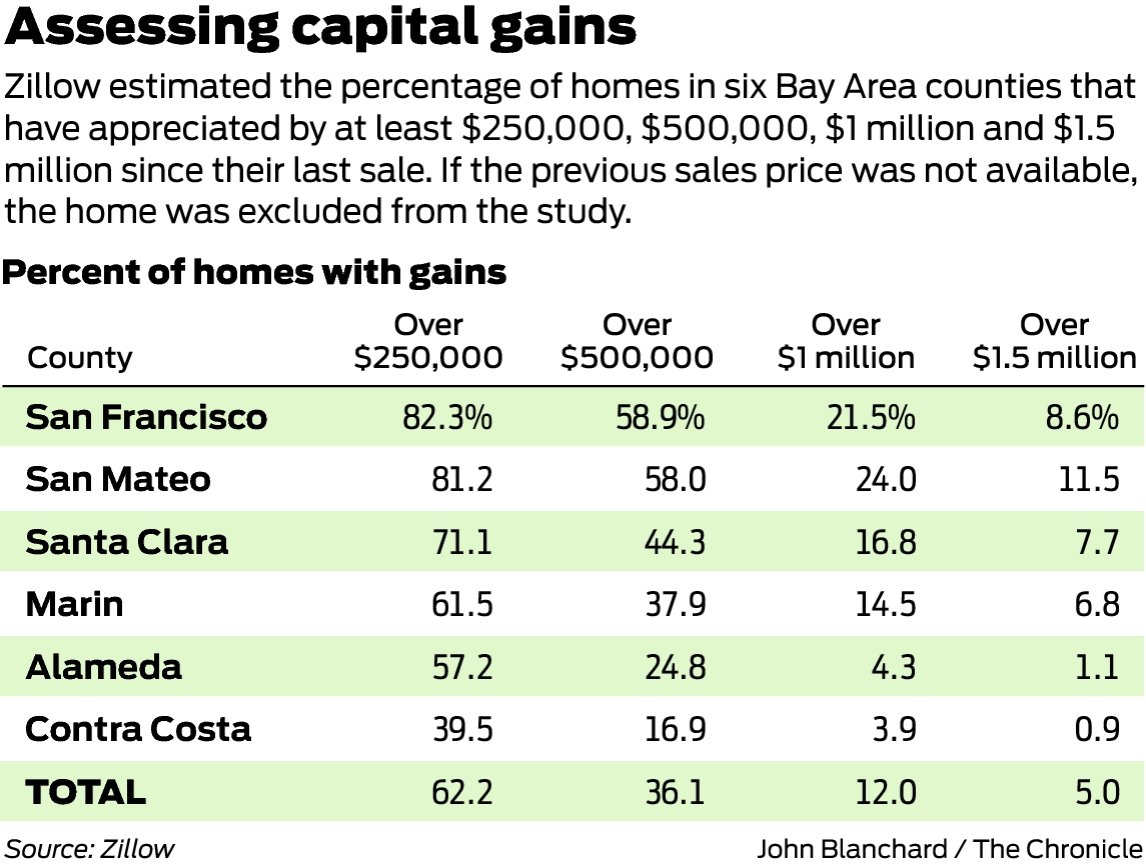

Guidelines on real property gains tax. If you 39 re selling a property you need to be aware of what taxes you 39 ll owe. Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens. If you have a gain from the sale of your main home you may be able to exclude up to 250 000 of the gain from your income 500 000 on a joint return in most cases. In general you ll pay higher taxes on property you ve owned for less than a year.

The rates are much less onerous. If you have gain that cannot be excluded it is taxable. Read on to learn about capital gains tax for primary residences second homes investment properties. The 0 bracket for long term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels.

The capital gains tax rate is 15 if you re married filing jointly with. Your basis for figuring a gainis the same as the donor s adjusted basis plus or minus any required adjustments to basis while you held the property. Your basis for figuring a lossis the fmv of the property when you received the gift plus or minus any required adjustments to basis while you held the property. Real property gains tax exemption is now gazetted.

If you receive form 1099 s proceeds from real estate transactions you must report the sale of the home even if the gain from the sale is excludable under the irs section 121 exclusion. In 2017 that rate is between 10 and 39 6 of your profit but most people pay around 25. Your tax rate is 15 on long term capital gains if you re a single filer earning between 39 376 and 434 550 married filing jointly earning between 78 751 and 488 850 or head of household. Long term capital gains tax rates typically apply if you owned the asset for more than a year.

Many people qualify for a 0 tax rate.

/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73.png)

/what-is-the-capital-gains-tax-3305824_v3-b4d960afdf8f427192af57be51e4adc1.png)

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png)

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

/82680959-F-57a6332e3df78cf459196f1c.jpg)