Entertainment Expenses Tax Deductible Malaysia

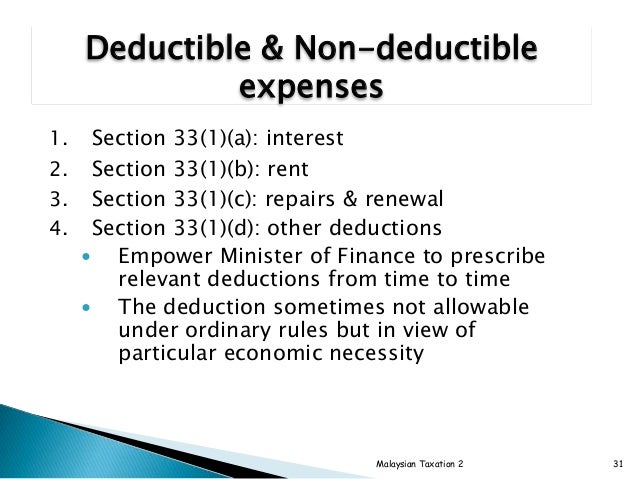

Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross.

Entertainment expenses tax deductible malaysia. To be clear expenses for entertaining clients are no longer deductible as business entertainment expenses. Fully deductible meals and entertainment. Double deduction expenses allowable under income tax act 1967. Food included as taxable compensation to employees and included on the w 2.

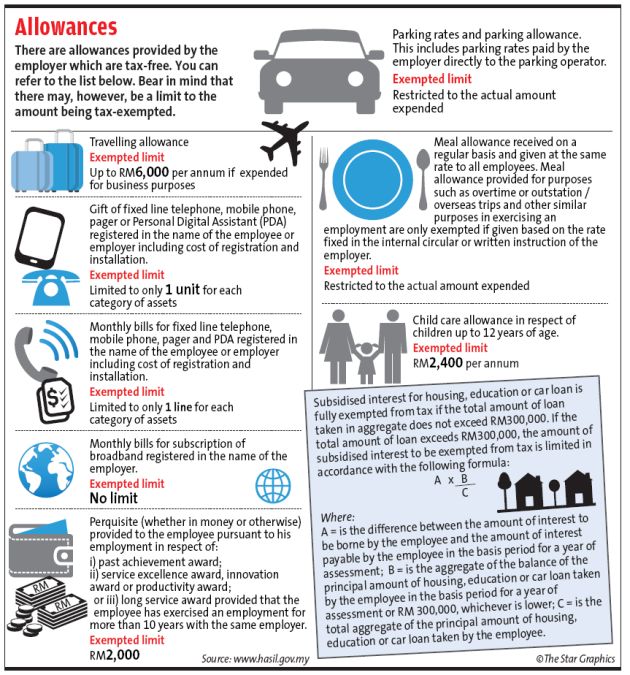

Non business expenses for example domestic or household expenses and taxes are not deductible. 2018 2019 malaysian tax booklet income tax. Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid on the day the return is furnished. Food and drinks provided free of charge for the public.

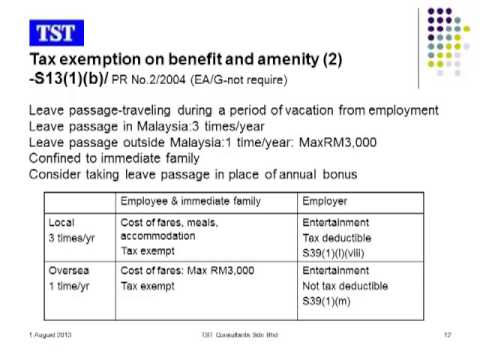

Examples costs of travel to facilitate yearly event within malaysia which involves employer employee and immediate family members of the employee. Within 1 year after the end of the year the payment of withholding tax is made. Is derived from gross income after deduction of business expenses such as. Expenses incurred on the following entertainment will qualify for full tax deduction.

Donations to approved institutions or organisations are deductible subject to limits. The provision of entertainment by a person who carries on a business of entertaining. Here are some common examples of 100 deductible meals and entertainment expenses. Mortgage interest incurred to finance the purchase of a house is deductible only if income is derived from.

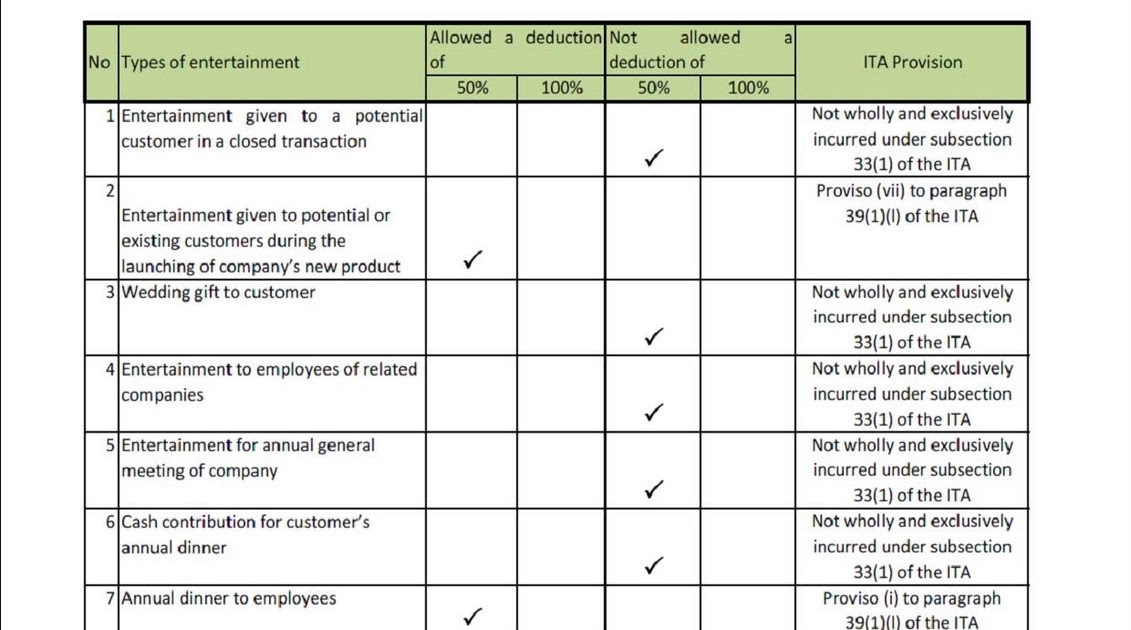

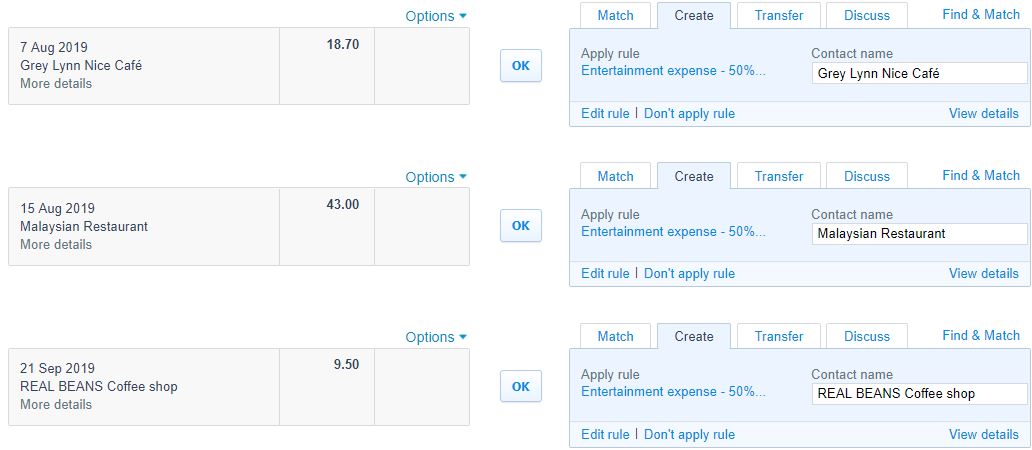

Examples of such expenses include free meals and refreshments annual dinners outings and family day. An entertainment expense that is wholly and exclusively incurred in the production of gross income under subsection 33 1 of the ita is allowed a deduction of fifty percent 50 only unless that expense falls within any of the specified categories in provisos i to viii of paragraph 39 1 l of the ita then it qualifies for a deduction of one hundred percent 100. However there are specific deductions allowed such as incorporation expenses and recruitment expenses conditions apply. Entertainment expenses which qualify under steps 1 and 2 but which do not fall under any of the above categories of expenses are only allowed 50 deduction.

The provision of entertainment to employees. The 2017 tax law pub. 115 97 the law that is often referred to as the tax cuts and jobs act tcja eliminated the deduction for any expenses related to activities generally considered entertainment amusement or recreation.