How To Calculate Fd Interest Formula In Excel

The manual formula is annuity value payment amount x present value of an annuity pvoa factor.

How to calculate fd interest formula in excel. Average return is the simple average where each investment option is given an equal weightage. For a sanction of rs 5 lakh with an interest rate of 14 60 taken over a tenor of 48 months the values for the excel formula are. Improve your cibil score. Hence the interest expense net of tax works out to 50 15 35.

Present value factor formula in excel with excel template in this example we have tried to calculate a present value of the home loan emi using the pv factor formula. In the example shown we want to calculate accrued interest for a bond with a 5 coupon rate. Savings on tax at an effective tax rate of 30 would be as follows. The yearly interest expense incurred by the company would be as follows.

For instance if you want to find emi value for a loan amount of 100 000 which is payable in say 5 years i e 60 monthly instalments with an interest rate of say 12 p a the emi can be calculated by placing the following formula in a cell in excel spreadsheet. As illustrated b we have assumed an annual interest rate of 10 and the monthly emi installment for 30 years. Pmt 0 01216666 48 500000 0 0 these will yield the result 13 814 which is the accurate emi amount. Calculate loan emis using excel.

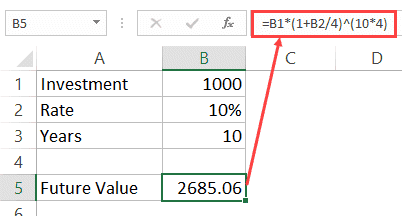

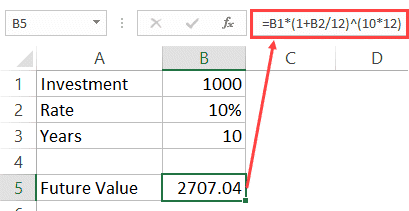

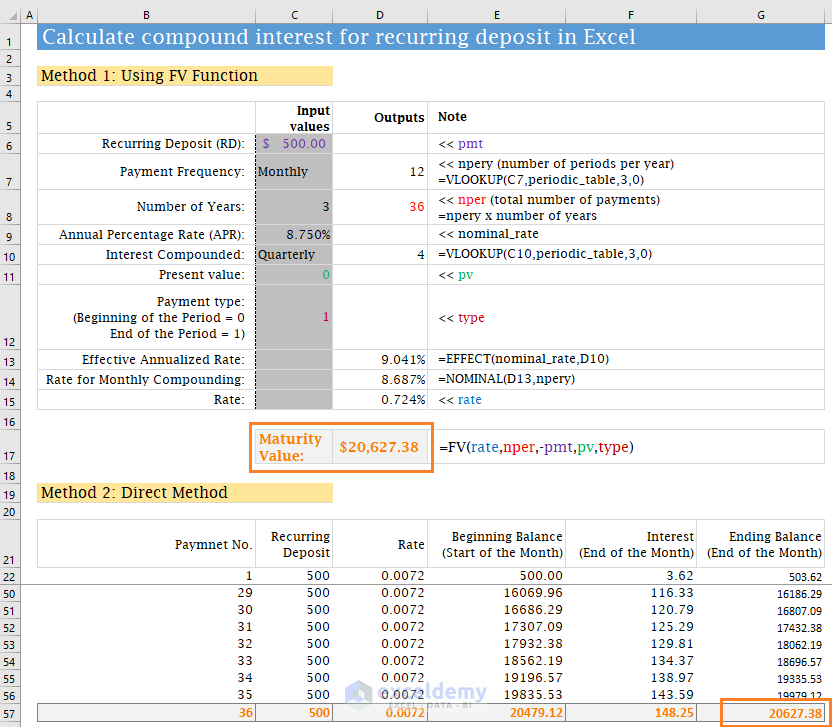

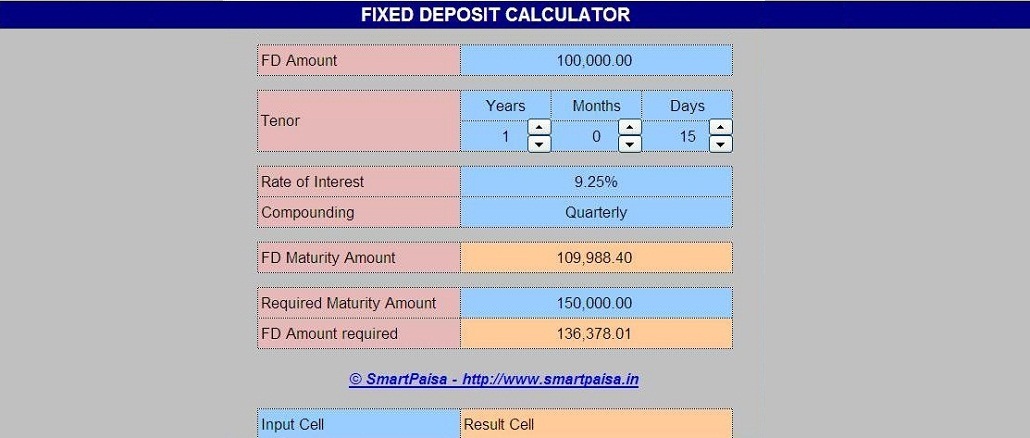

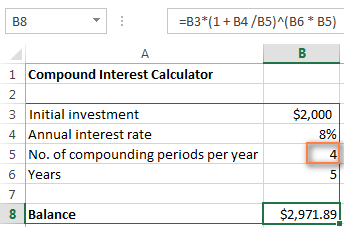

Several forms of returns are derived through different mathematical calculations and among these average or arithmetic return is widely used. The pvoa factor for the above scenario is 15 62208. To calculate the maturity value of an investment you can use the following formula. Calculate the amount of the payments based on your specific situation.

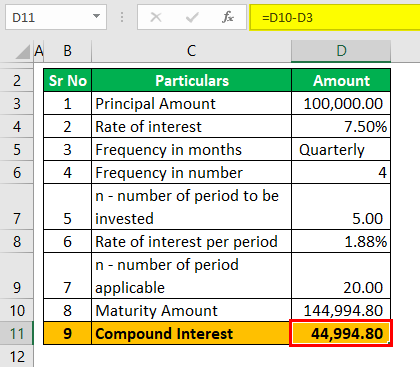

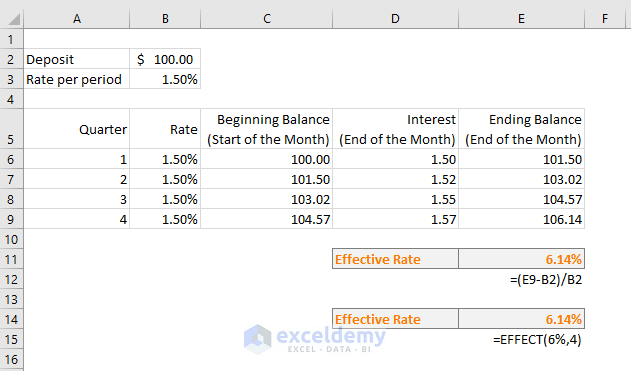

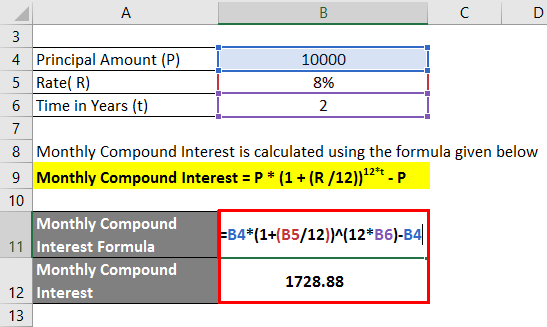

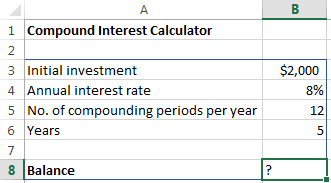

We want accrued interest from october 15 2018 to february 1 2019. Principal amount p rs 15000 rate of interest amount r 5 0 05 number of period t 2 years compounded interest n 4 quarterly to find. The variables in the above formula are. Consider the following example.

The issue date is 5 apr 2018 the settlement date is 1 feb 2019 and the last coupon date is 15 oct 2018. Return is defined as the gain or loss made on the principal amount of an investment and acts as an elementary measure of profitability. I e the firm has deducted 15 from taxable income. The post tax cost of debt is.

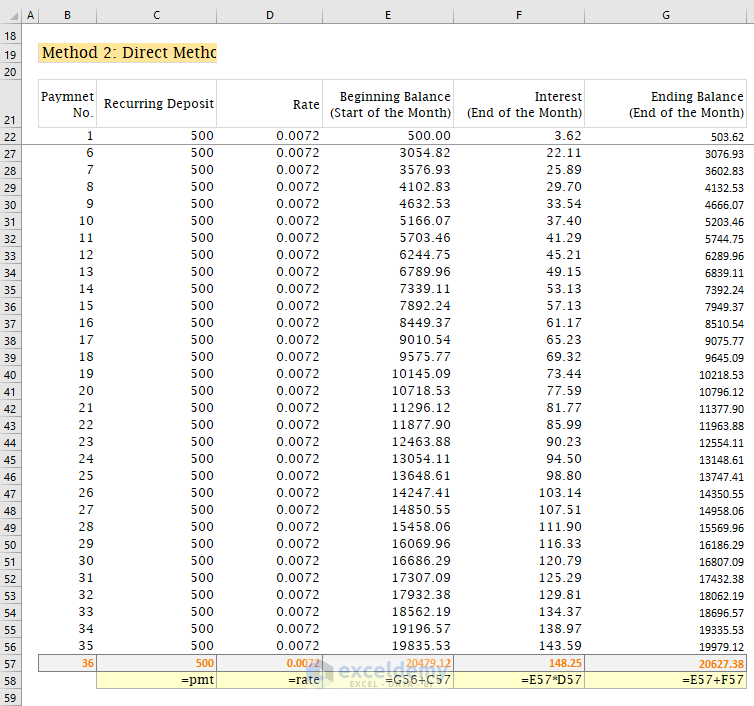

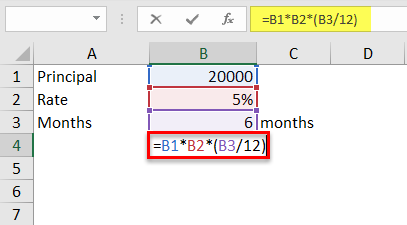

You can also calculate your emis using the excel spreadsheet. I e the interest expense paid by the firm in 1 year is 50. Pmt rate nper pv. An amount of rs 15000 is deposited in a bank for 2 years and paying an annual interest rate of 5 compounded quarterly.

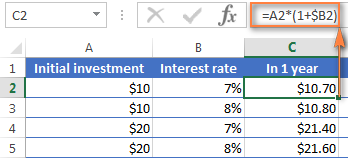

The formula in f5 is. In excel you need to use the function pmt for calculating emis. Rate interest rate for the loan. For example assume a 500 000 annuity with a 4 interest rate that will pay a fixed annual amount over the next 25 years.