How To Do E Filing Malaysia

Login to e filing website.

How to do e filing malaysia. Existing e filing users proceed to next step. At the various options available on the. Login to e filing. If you have never.

However please be mindful to always check with your lawyers and seek professional advice on your queries regarding any legal proceedings. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Go to e filing website. Go to e filing website.

Go to e filing website. Your taxes will be automatically calculated. How to file income tax in malaysia using e filing 1. E filing malaysia court to read the full article with step by step diagrams in pdf.

Key in your nric and password 请输入ldhn个人电子报税id和密码 step 2 select e e and then select year 2019 请选择表格 e e 选择年份 2019 年 step 3 key in your company e number nombor majikan 请输入e号码. If you have balances due you can pay through fpx an atm or over the counter. H ow to apply for my income tax online for 2019. Pemberhentian pengeluaran sijil taraf orang kena cukai stokc mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc.

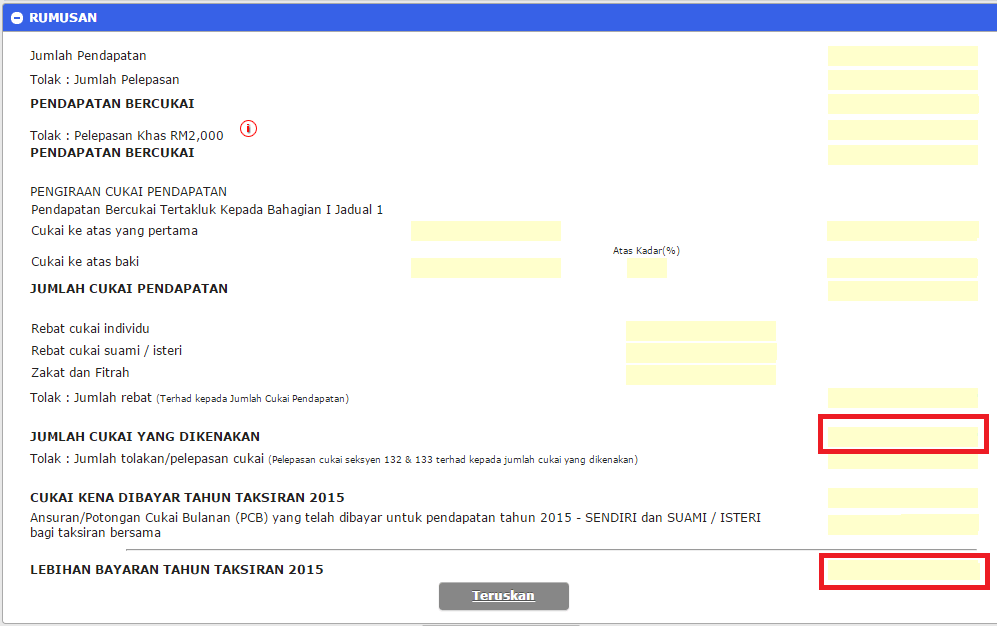

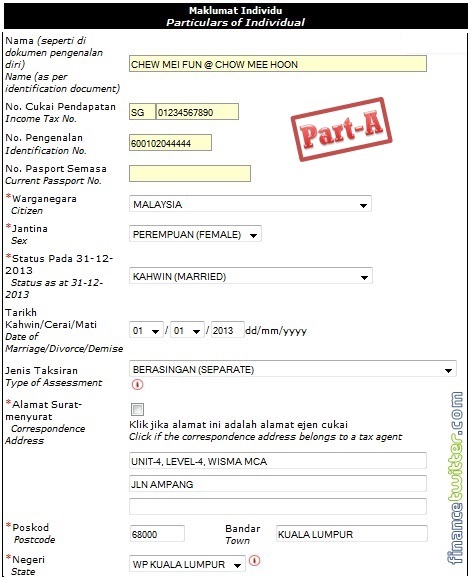

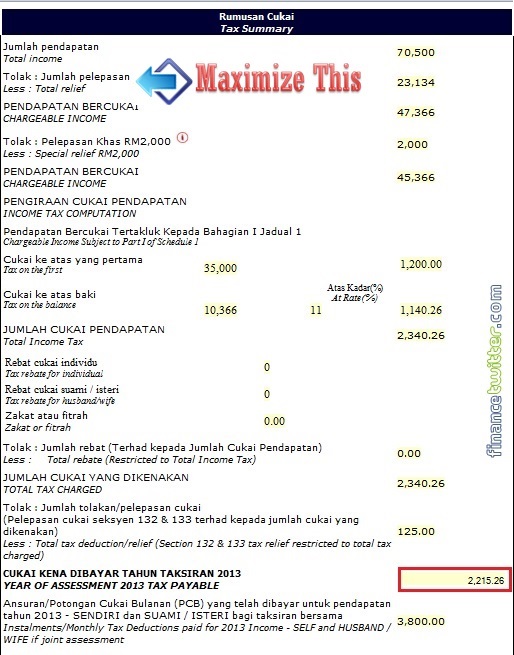

Fill up the e filing form and double check all your details in the summary section. Once you have gotten your pin here are the steps on how to file income tax in malaysia. Malaysia income tax e filing guide 1. When you arrive at irb s official website look for ezhasil and click on it.

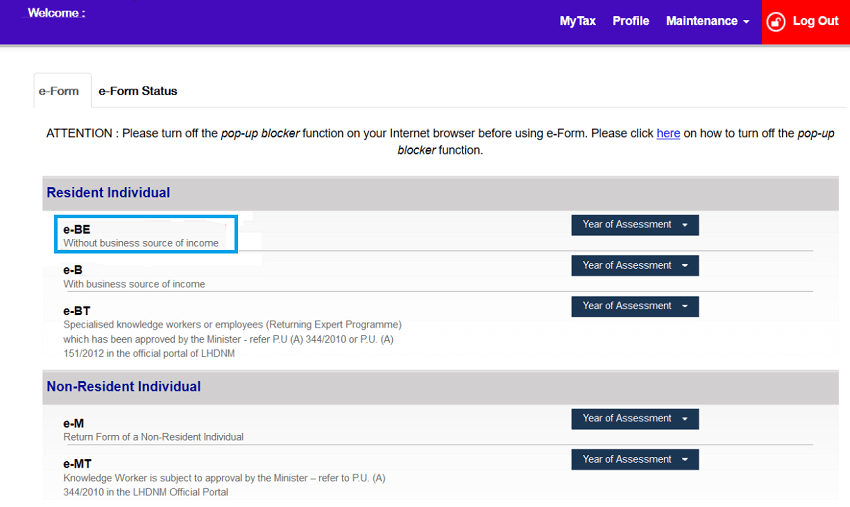

It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. Step 1 please use your personal income tax e filing id to log in. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Choose e borang for income tax 2019 form choose the right e filing lhdn forms.

We hope you have found the information on the e filing system helpful. Next key in your mykad identification number without the dashes and your password. Ezhasil e filing is a most convenient way to submit income tax return form itrf. If you have excess paid it will be paid out to you to your bank account you provide.

Go to e borang for e filing malaysia click on e borang which will take you to tax e filing lhdn forms. You just need to enter your income deduction relief and rebate only. Login to e filing website. Ensure all your individual.

Please click on this link.