How To Declare Income Tax Online Malaysia

Welcome to the world of adulting.

How to declare income tax online malaysia. The final step is to declare that all the information provided is true. I register as a taxpayer on e daftar to get your income tax number and ii get your pin number from the nearest lhdn branch so you can log in to ezhasil for the first time. Here is how the short e filing process goes. In fact showing healthy earnings and responsible tax payments is proof of your creditworthiness.

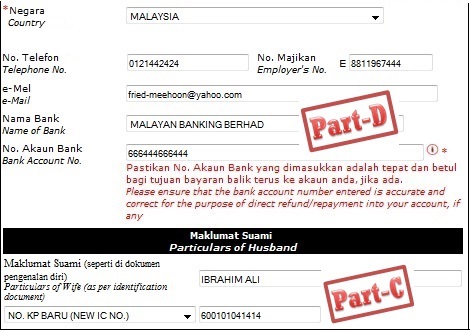

Register at the nearest irbm inland revenue board of malaysia lhdn lembaga hasil dalam negeri branch or register online at hasil gov my provide copies of the following documents. So it s best to be upfront about your taxes however staying out of trouble with the authorities isn t your only incentive to fully declare income. You can find this information in the ea form provided by your employers. Before you can file your taxes online there are two things you ll need to do first.

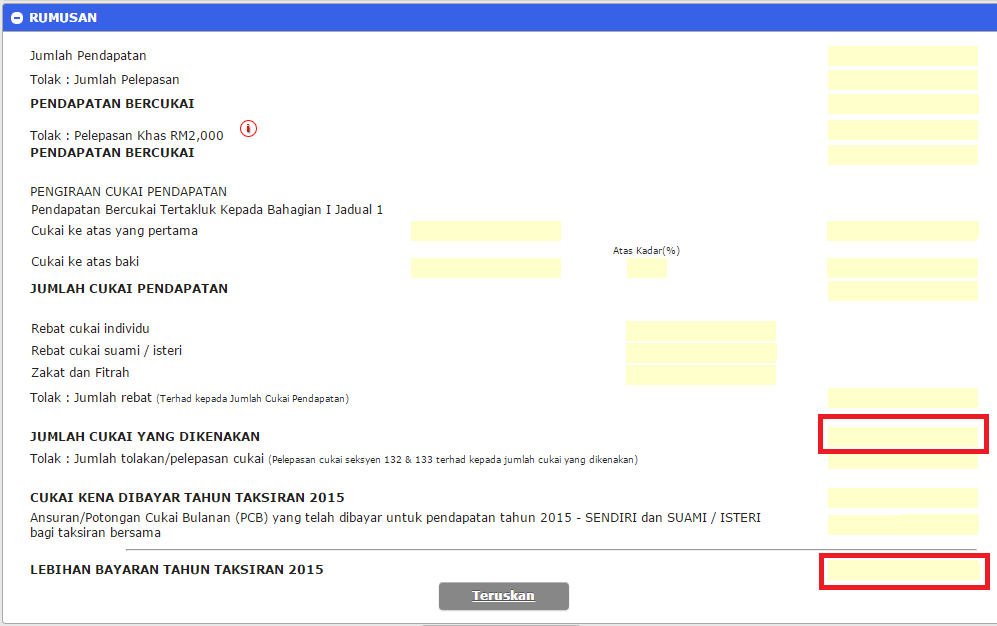

Also fill in the total of your monthly tax deductions pcb if any. Check the total taxes you are due or you have overpaid. However both ben and jerry are required to declare and pay income tax individually for their share of income derived from fitstar. It means fitstar itself does not need to declare income tax regardless whether or not it is a profitable or non profitable partnership.

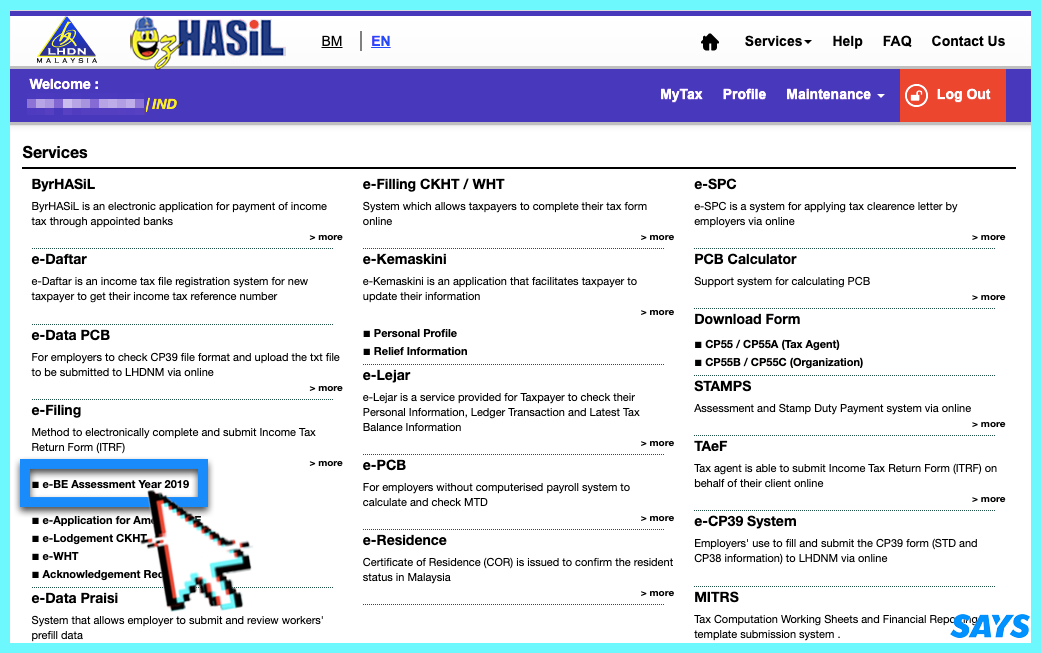

In 2010 the government introduced the super convenient ezhasil e filing system for users to submit their income tax online. Declare sign and send. Once you have gotten your pin here are the steps on how to file income tax in malaysia. You know you re officially an adult when you realise that it s high time you file your taxes.

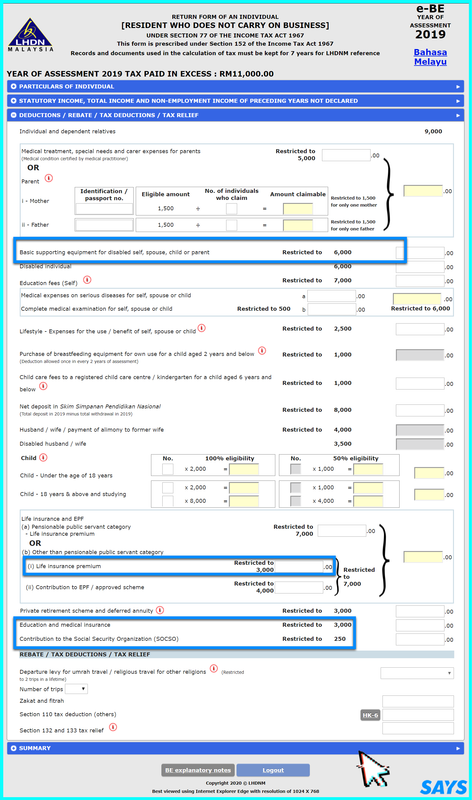

If you are newly taxable you must register an income tax reference number. If you already have the pin. Tax benefits are sometimes used encourage certain government objectives. Choose the right income tax form.

Latest salary statement ea ec form or pay slip. Key in your income details according to the relevant categories. The easiest mistake to make in claiming income tax relief. Login to e filing website.

If you ve not declared any previous years income you need to declare it under pendapatan tahun kebelakangan yang belum dilaporkan. Scenario 1 you only have a medical card which you are paying rm 2 000 annually and you put in the entire rm 2 000 under the insurance premium for medical benefit tax relief. In malaysia you can start filing your income tax starting march 1 every year. 7 things to know about income tax payments in malaysia.

Go to e filing website. Think of hefty fines up to rm20 000 imprisonment and being barred from leaving the country.