How To Declare Income Tax For Enterprise

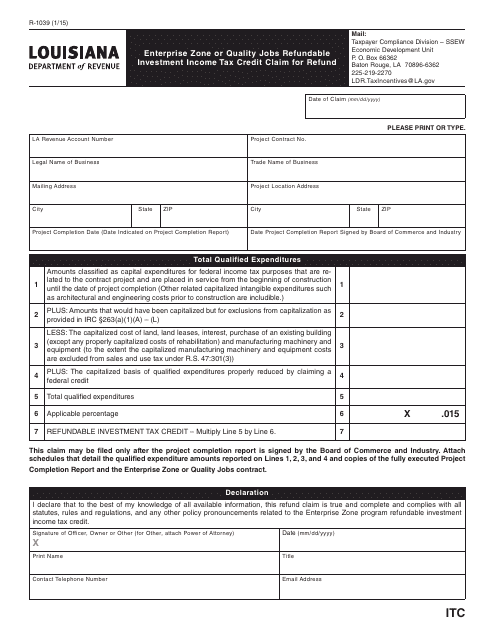

Please fill in the relevant column only or b.

How to declare income tax for enterprise. If partnership follow basis year i e 30 jun of every year. Not s b you still need to submit your tax return but your company per se is not taxable but all the partners will be tax at their personal level. If s b you will need to submit your tax return 7 months from the date of book closure. Dunno who the stupid ppl said less salaries no need to declare income tax less income will not kena tax but still need to declare declare and submit tax and need to pay tax is two different things not declare or not pay tax end up is more penalty to pay imagine if u declare u no need pay tax some more can get back some over paid pcb but u.

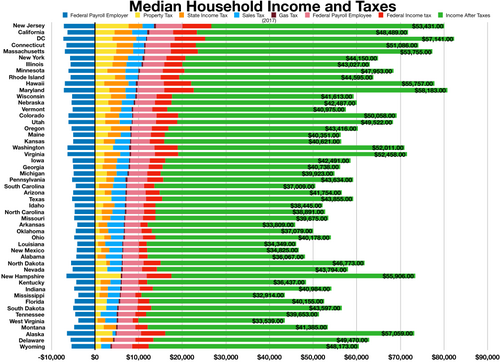

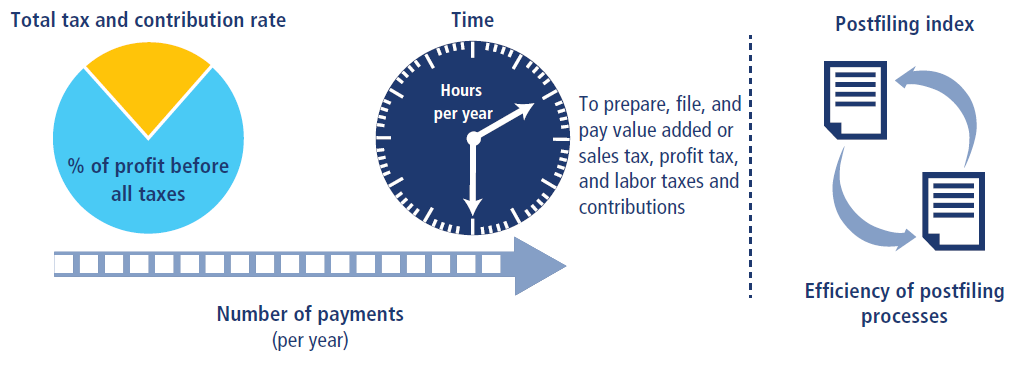

Investors that buy shares in a qualifying eis company will get 30 tax relief on the cost up to 1 million which is offset against the individual s income tax bill for the year in which the investment was made. Note that any employer with a payroll in excess of k200 000 per annum in addition to lodging an income tax return must lodge a training levy form form tl1. If your enterprise engages employees write the total of the salary and wages paid in this line. The actual rate of taxation will be that applicable under the normal rules for personal income tax and will depend on total income and the composition of the household.

The due date for submission of form be 2010 is 30 april 2011. The form used to make an income tax declaration for micro entrepreneur earnings is f2042c pro a complementary form to the main f2042 tax return. The definition of salary and wages for the purposes of training levy is. You can find this information in the ea form provided by your company.

Income tax relief against your investment in qualifying companies enterprises or vcts income tax relief against a loan or debt instrument to a social enterprise capital gains tax relief on. Declare your income details key in your income details according to the relevant categories as highlighted. However you may still be able to declare your side income using this form depending on the nature of your income source. The be form is the income tax return form used by those who do not carry a business.

That means individual investors can potentially reduce their tax bill by 300 000 per year. Use the form received to make an income tax declaration. Completion of your annual income tax return depends on the method of taxation you have adopted. Change the form to form be at any of the irbm branch or you can file your income tax return form using the e filing application.

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)