How To Declare Dividend In Malaysia

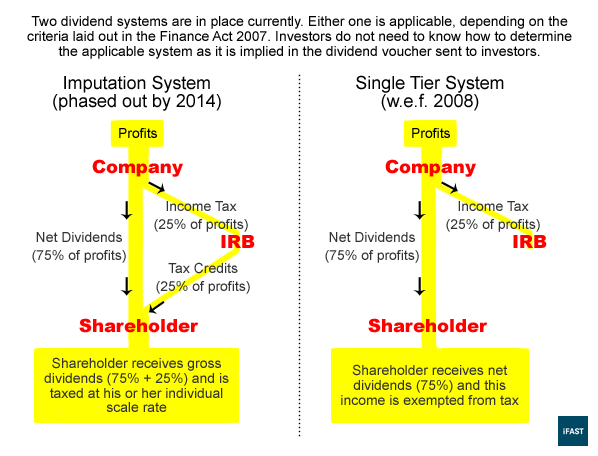

75 1 3 tax payer is require to declare gross dividend income 100 in the income tax return.

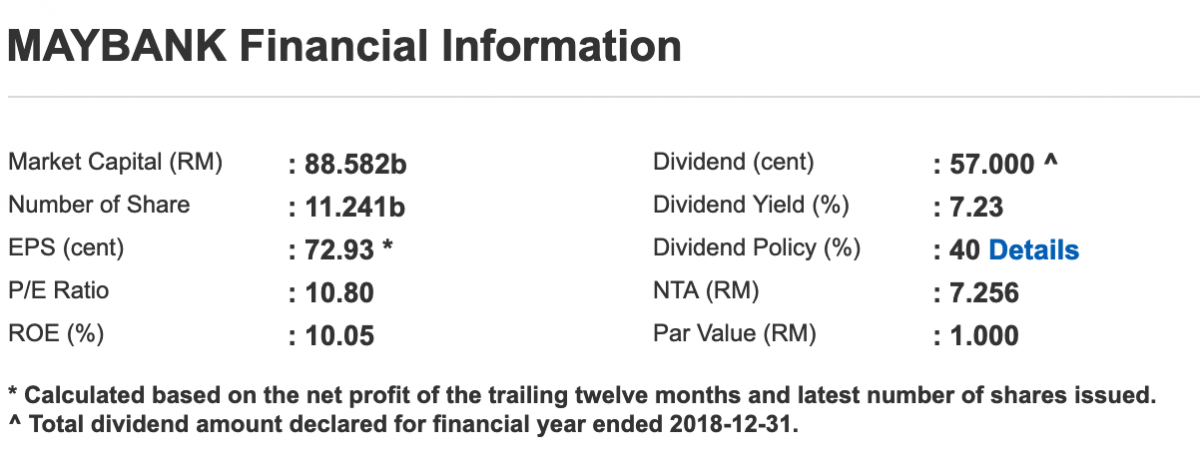

How to declare dividend in malaysia. Dividend yield get this ratio by dividing the company s annual dividend by its stock price. Where shareholders received dividends have been tax deducted as source e g 25 and received a net dividend e g. For example if a stock has a 4 dividend yield and you have bought rm10 000 worth of shares you ll get rm400 in dividends. Price to cash flow ratio.

Price to book ratio p b ratio price to sales ratio. The dividend yield shows you how much dividends you ll get if you buy a certain amount of the company s stock. Most recent full year dividend current stocks price for instance rm 1 rm 20 x 100 5. The brand new registered enterprises in malaysia can postpone the dividend payment to the shareholder for the first two years retaining the profits to a further development of the company.

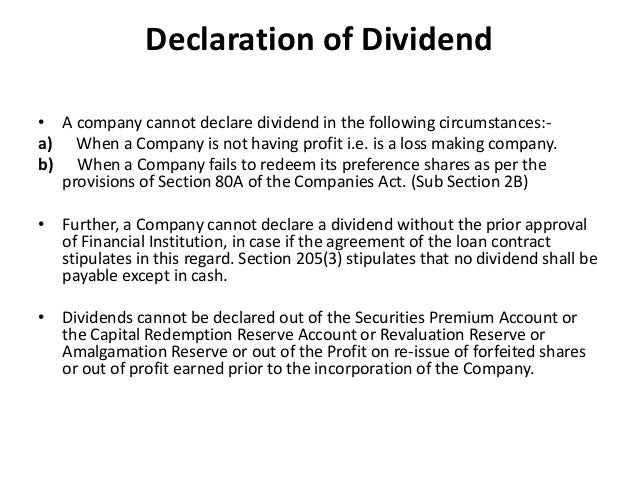

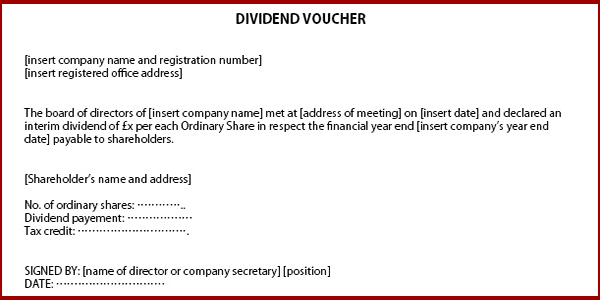

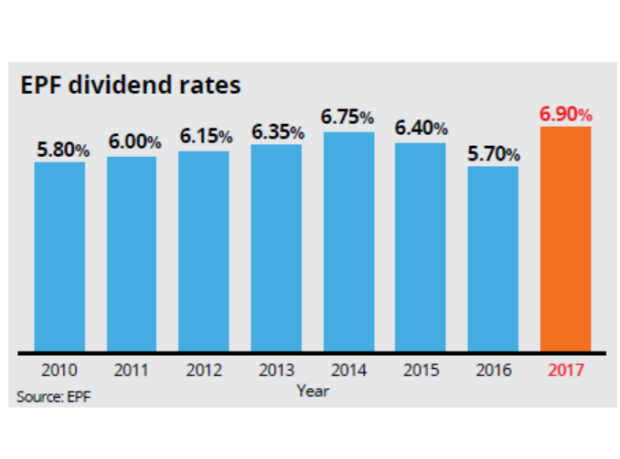

Right to declare a dividend only the shareholders in the annual general meeting can declare the dividend. The dividends in malaysia can be distributed once twice per year or quarterly according to the rules of the company and considering the financial status. This is usually done to compute trailing dividend yield. Key changes to the dividend regime.

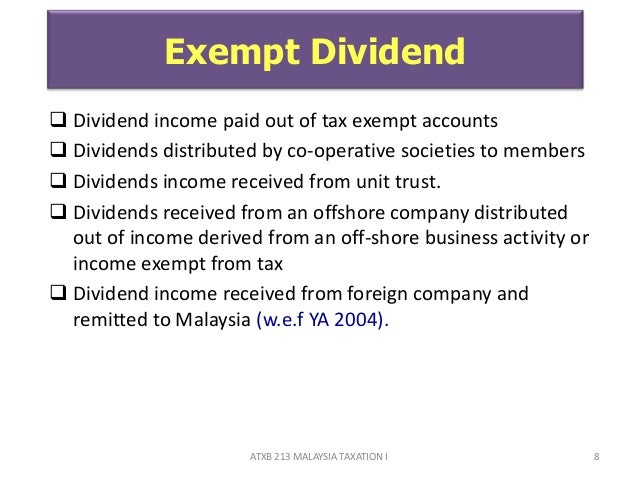

There are few factors which determine the intrinsic value of a share. The general formula for dividend yield. If the tax payer is in the lower tax bracket e g 19 then the tax payer is entitle for a refund of 6. Pursuant to the application of a company s share premium account towards payment of dividends if such dividends are satisfied by the issue of.

In accordance with the provisions of sub section 3 of section 123 the board of directors of a company may declare interim dividendduring any financial year out of the surplus in the profit and. The board of directors determines the rate of dividend to be declared and recommends it to the shareholders.