How To Claim Eis

The shares must be paid for in full in cash by the date of issue.

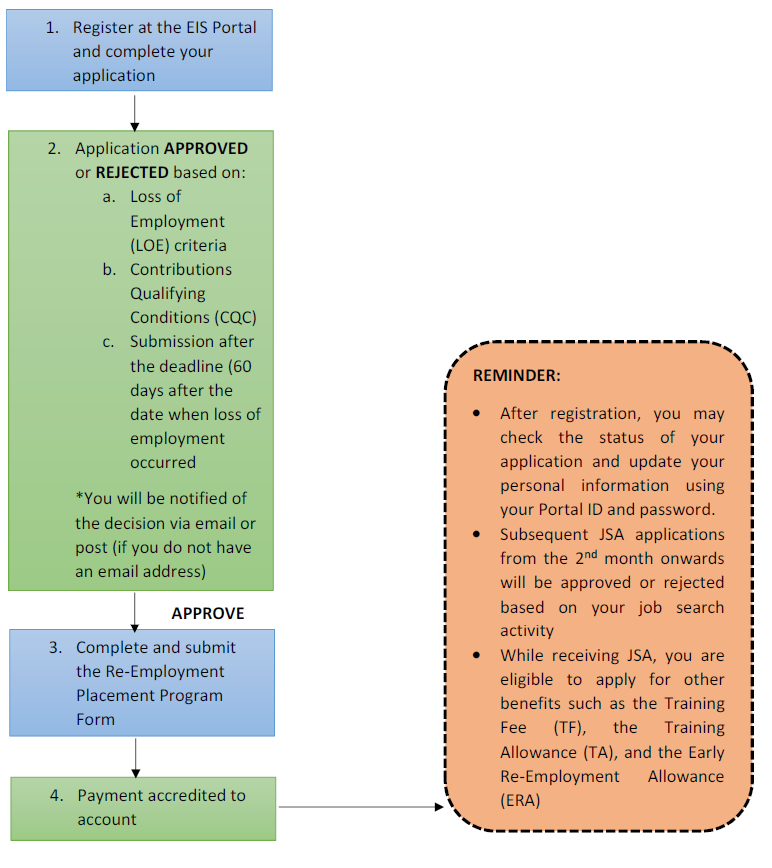

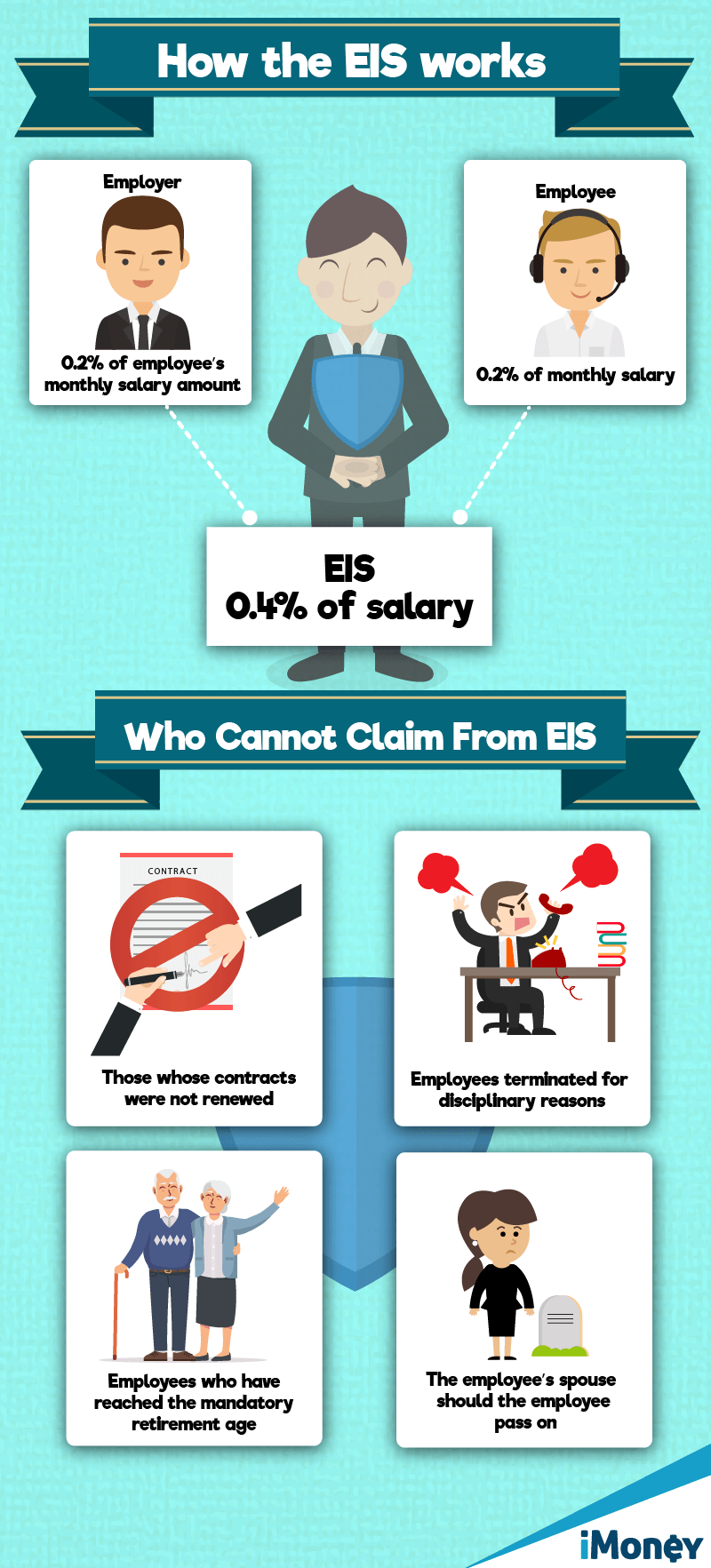

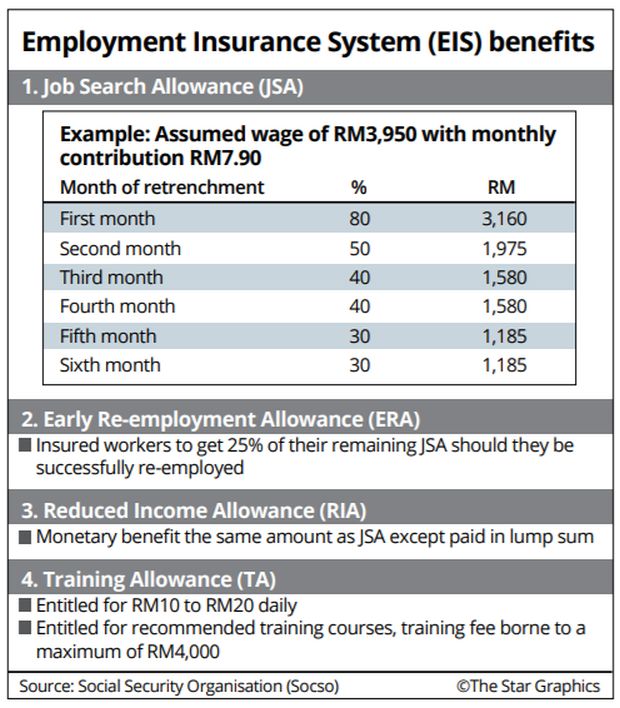

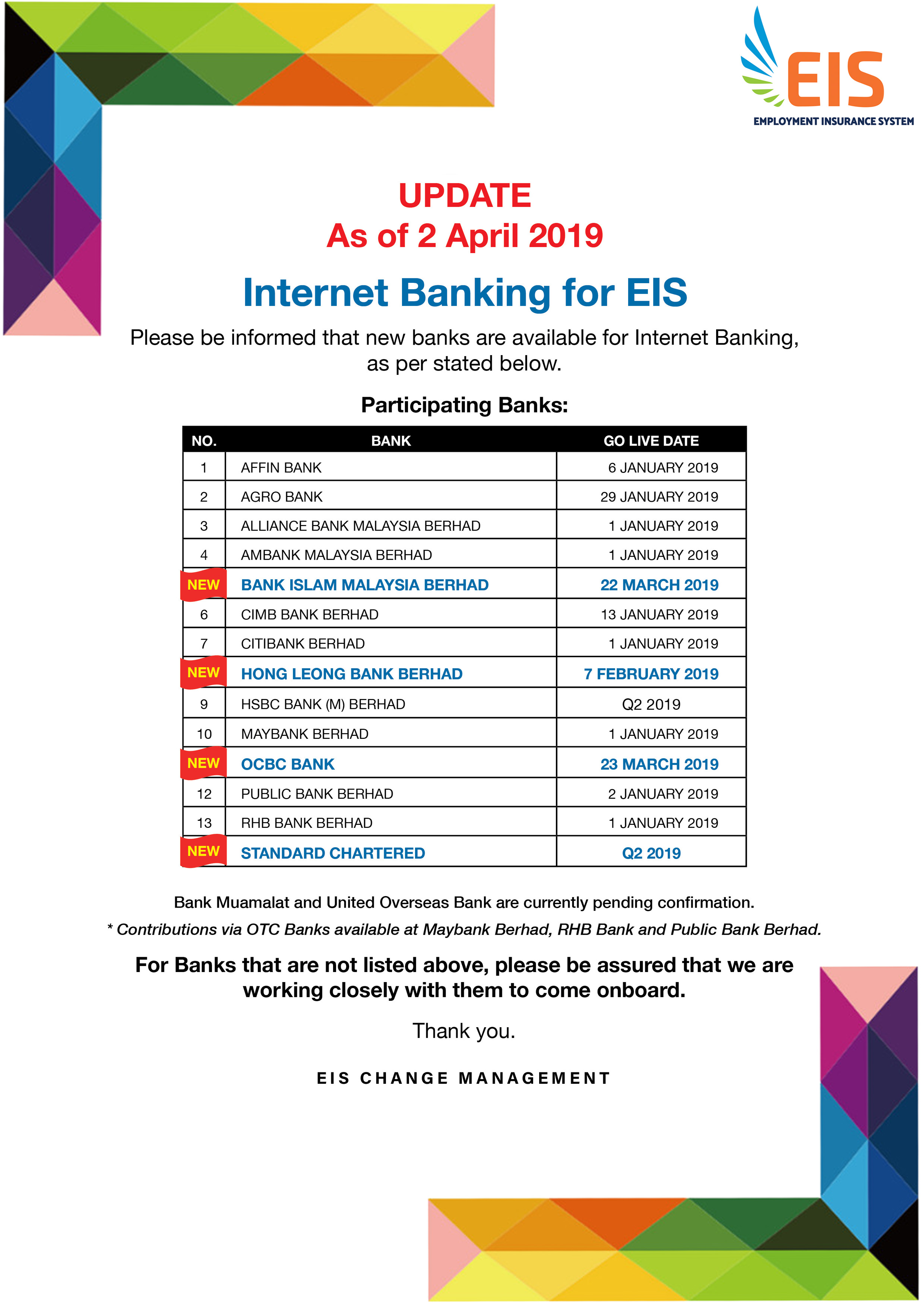

How to claim eis. The claimant must be a uk taxpayer. Here s how much you can claim from eis if you get retrenched. A copy of your nric. To successfully apply for benefits employees covered by the eis act should fulfill the following conditions.

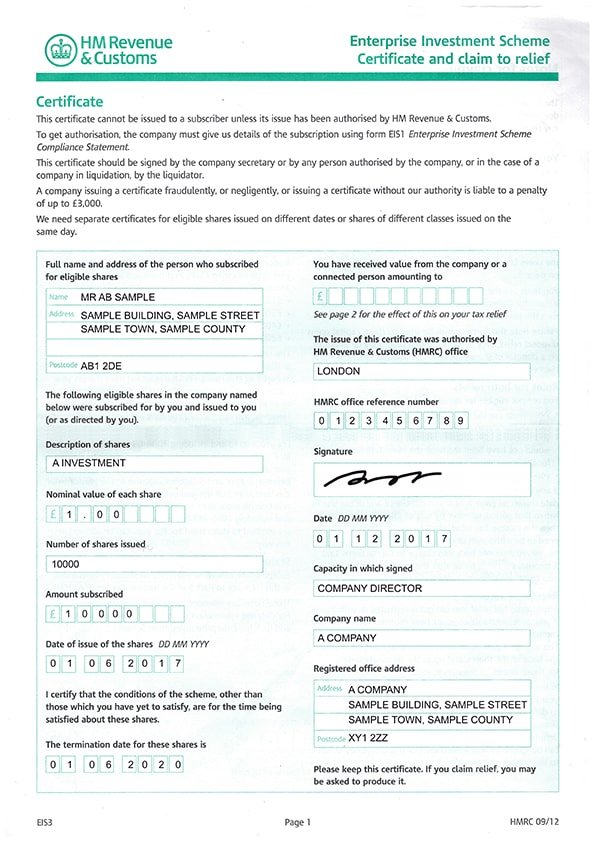

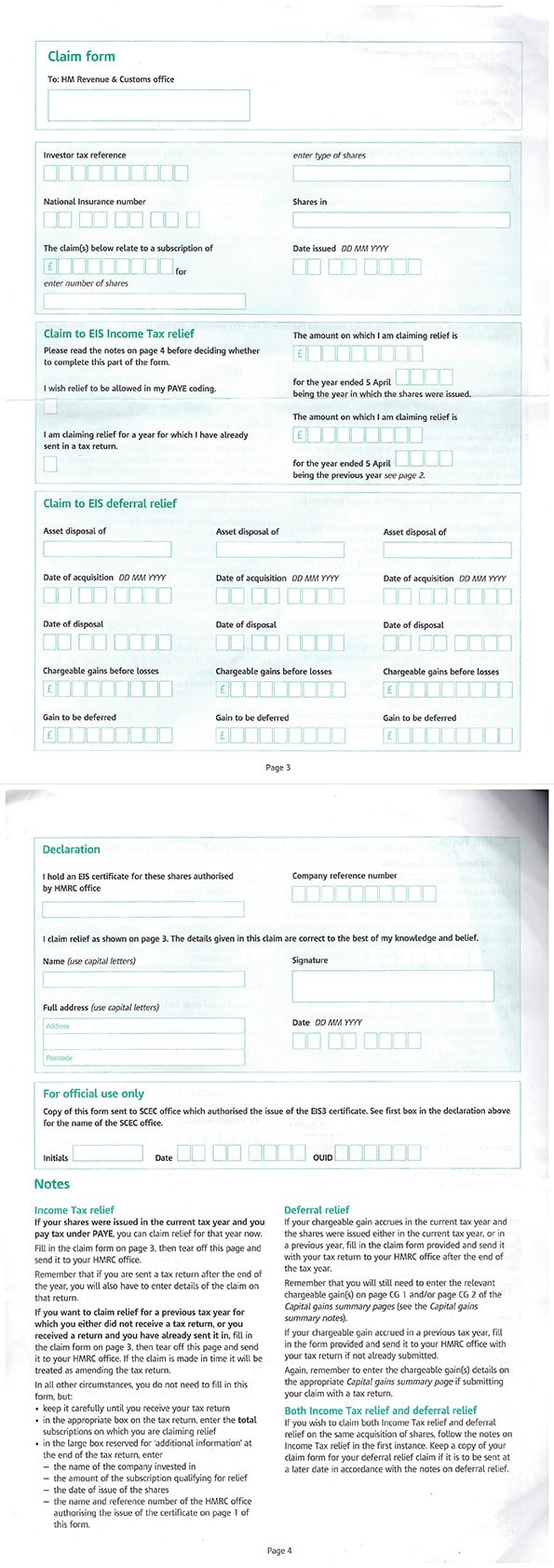

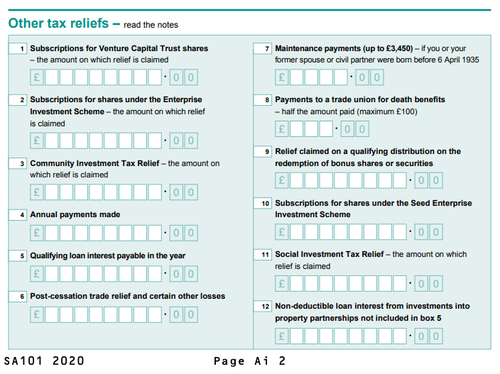

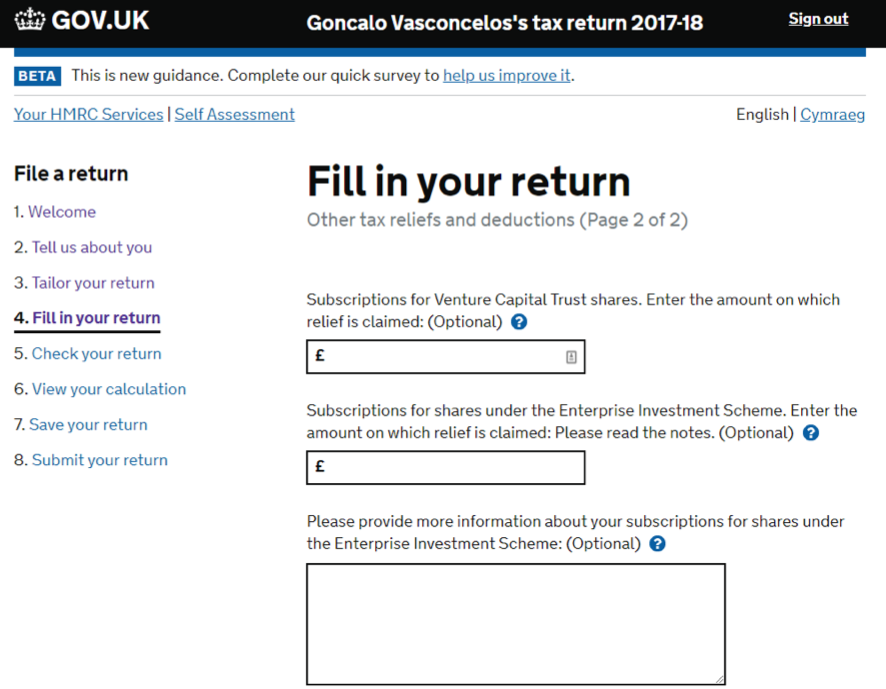

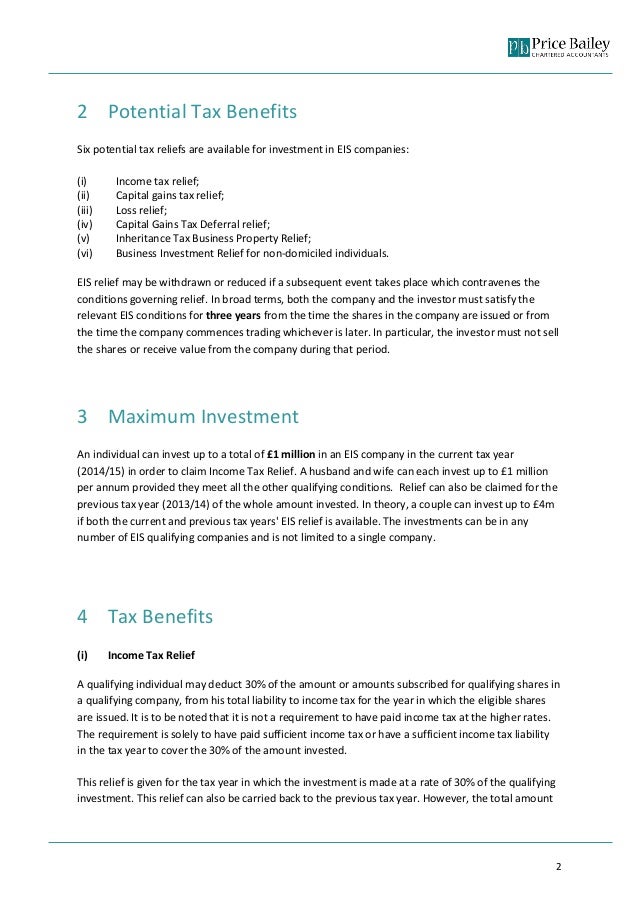

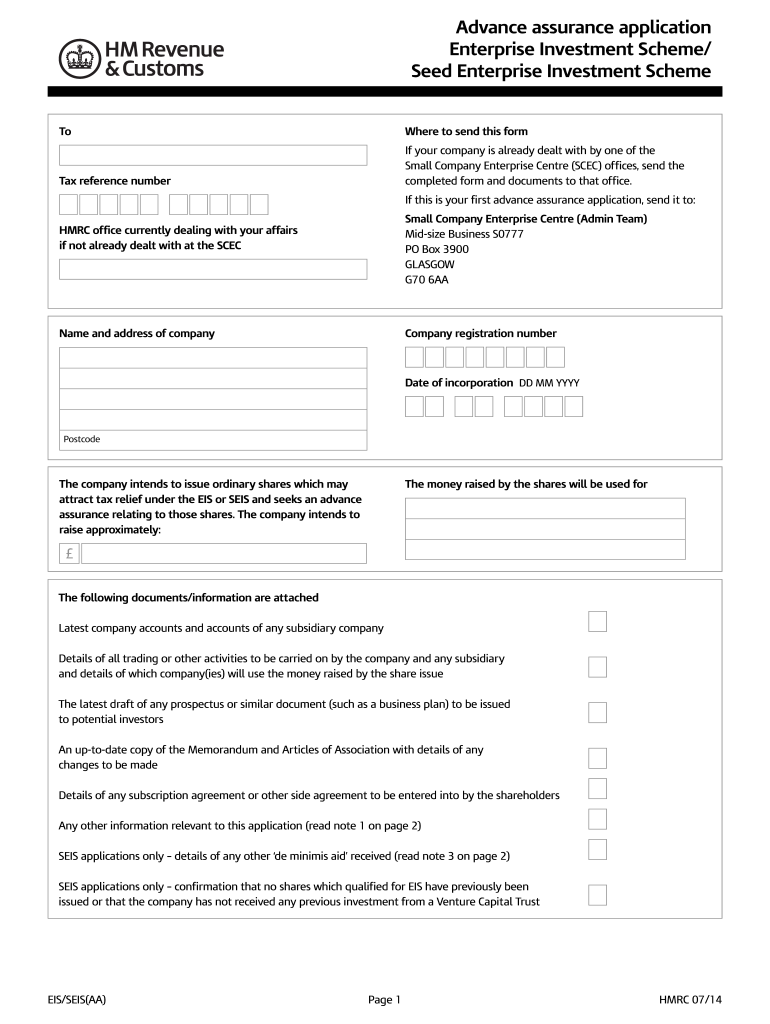

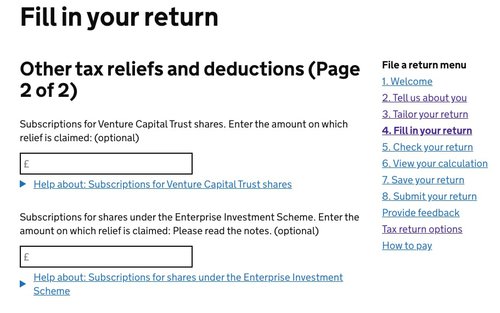

Pay slips for the last 6 months. Eis income tax relief. When you invest into an eis eligible company you can receive tax benefits in the following ways. How to claim eis tax relief on your paper tax return you will need to complete the additional information sheet form sa101 and enclose it with your return.

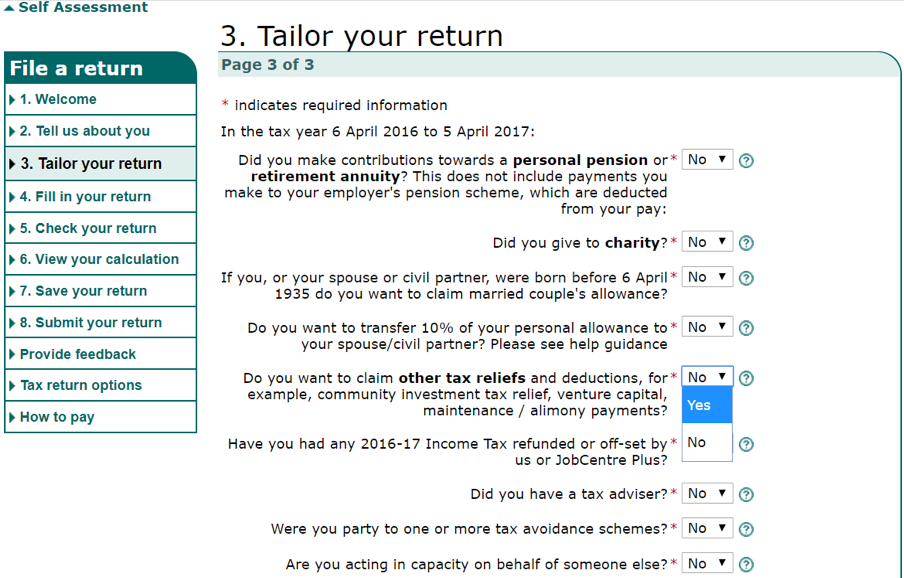

The shares bought by the investor must be new shares which are not on the market. When you log in to do your 2019 20 tax year return you ll get an initial 3 page questionnaire. Generally speaking you will need to enter each individual investment separately although some funds hold hmrc approval which means that your investment in the fund is treated as a single investment regardless. Apply within 60 days after their loss of employment loe.

Meet our contributions qualifying conditions cqc i e. You can claim back up to 30 of the value of your investment in the form of income tax relief. Claiming seis eis tax relief by self assessment claiming back via the self assessment route could not be more straightforward. Proof of loss of employment loe e g.

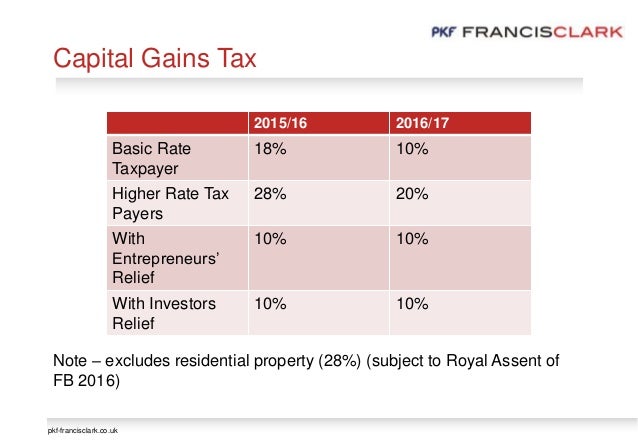

What are the eis tax relief benefits for investors. Because eis caps contributions at rm4 000 he will receive a job search allowance based on this lower amount. You just need to look out for the right section when you are filling out your self assessment. As with many official hmrc processes applying for eis tax relief can be a confusing endeavour.

To claim capital gains tax relief on a typical eis investment you must have claimed income tax relief and held the shares for at least three years. The investor must not be connected to the eis company either as an employee partner or remunerated director. You should consult a tax advisor. Must have paid contributions to socso eis for a minimum number of months.

His last drawn salary was rm6 000 before he was retrenched. Much will depend on how many eis eligible investments you are claiming tax relief for. There are rules that also apply in specific circumstances. In box 2 subscriptions for shares under the enterprise investment scheme of the other tax reliefs section on.