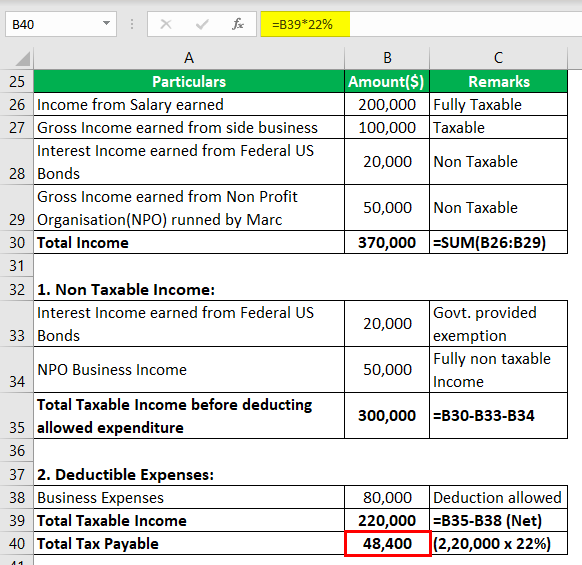

How To Calculate Taxable Income Example

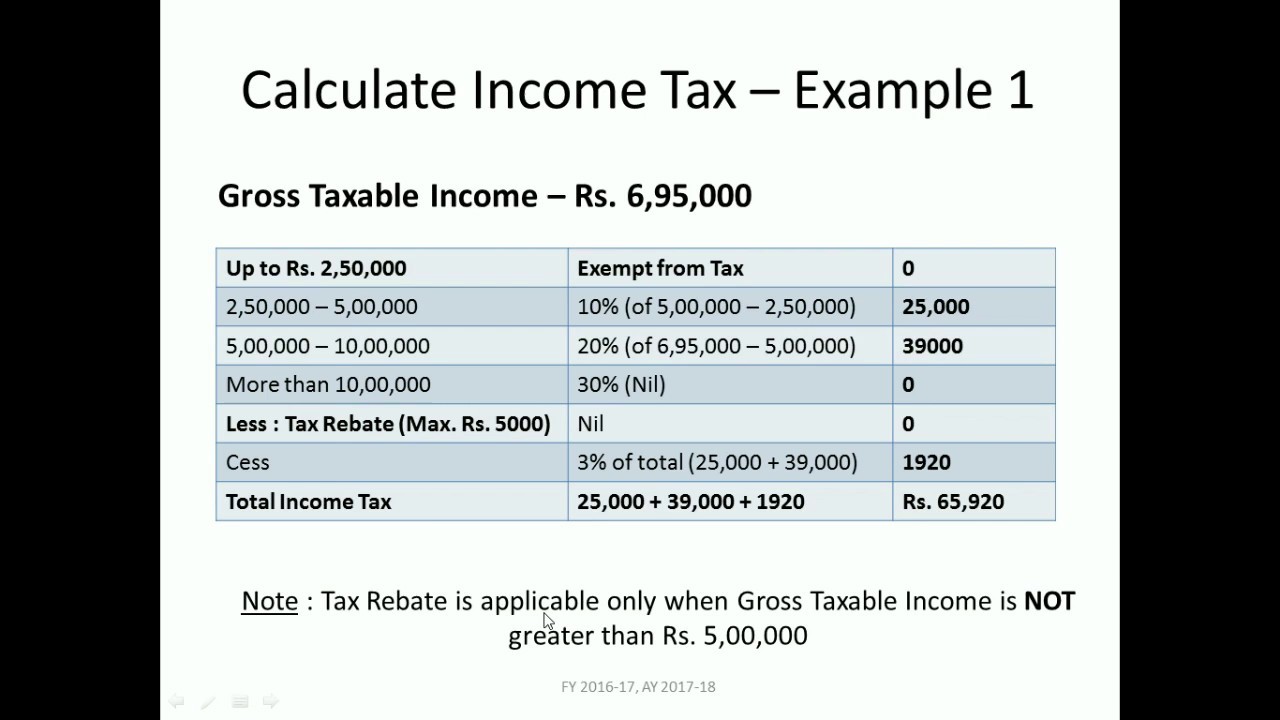

If your taxable income is equal or less than the limit of rs.

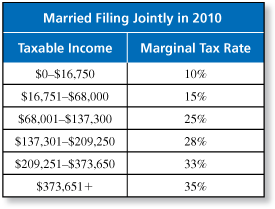

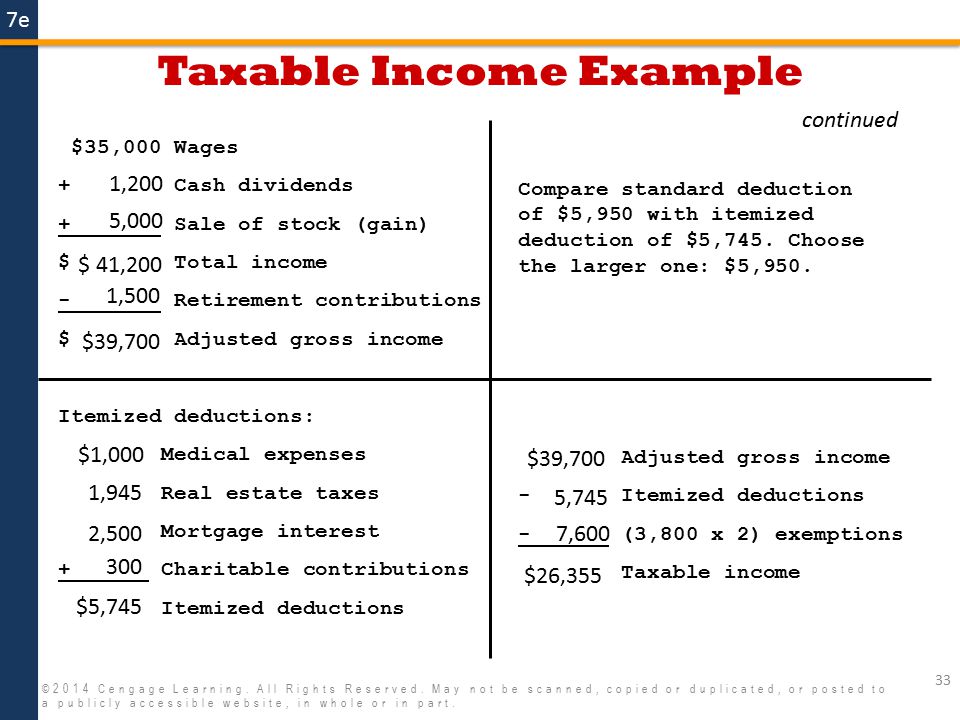

How to calculate taxable income example. After excluding all the applicable deductions and tds you can calculate your taxable income. You ll need to know your filing status add up all of your sources of income and then subtract any deductions to find your taxable income amount. Taxable income 37 000 11 400 3650 3 taxable income 37 000 11 400 10950 taxable income 37 000 22350. 2 5 lakh per year you do not have to pay any income tax.

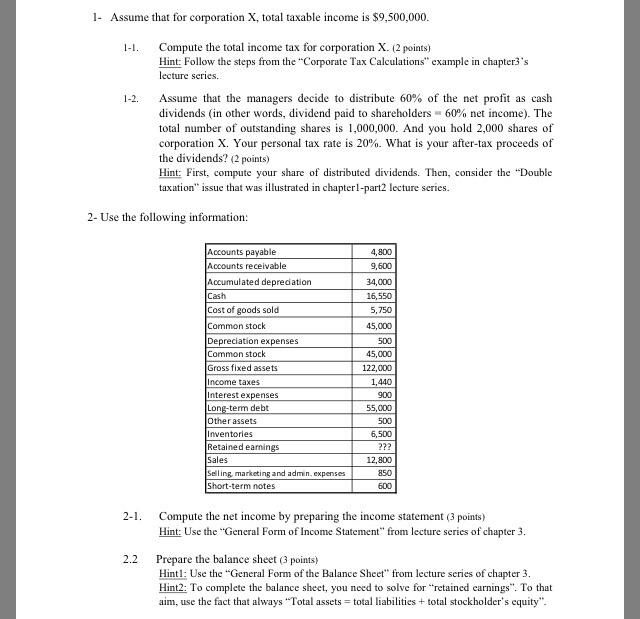

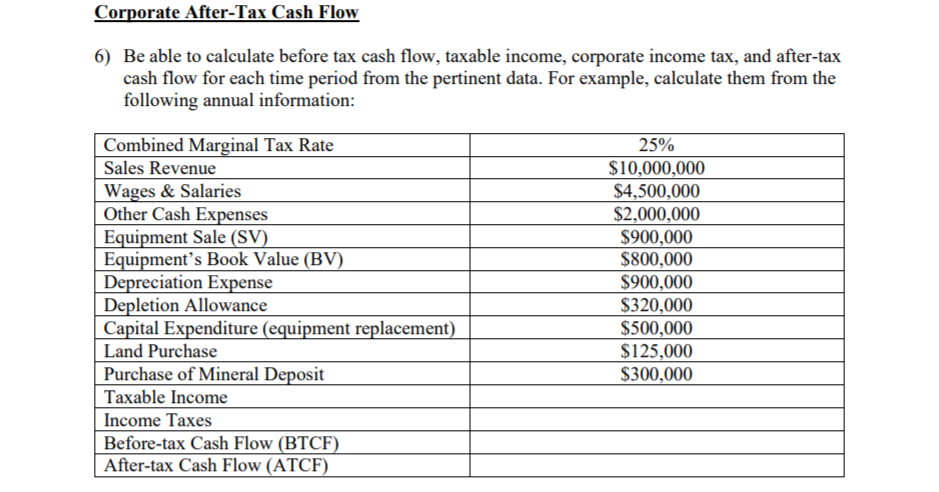

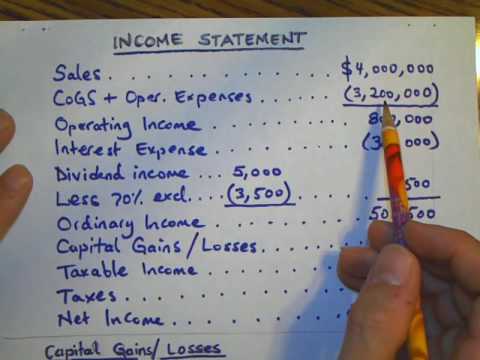

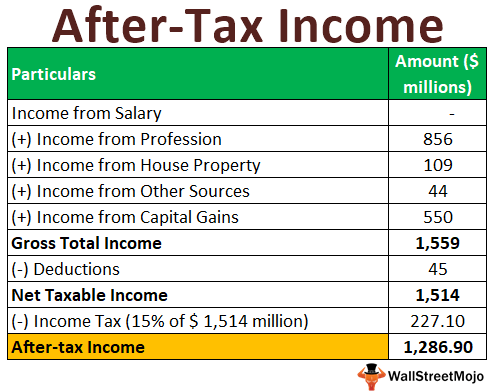

Total taxable income 395000 taxable income formula example 2. Figure out your total taxable income for the year including both earned and unearned income. Learning how to calculate your taxable income involves knowing what items to include and what to exclude. Next the cost of goods sold is determined by the accounts department.

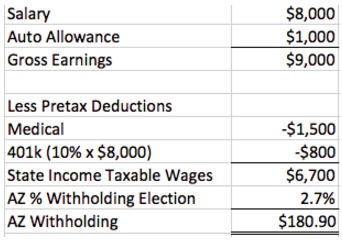

Taxable income 14650. Calculate your adjusted gross income. The taxable income formula for an organization can be derived by using the following five steps. The income tax calculation for the salaried.

In 2009 sylvia s adjusted gross income is 50 000 usd. If not you are liable to pay taxes on the income exceeding beyond this limit. Your adjusted gross income is your gross annual income with any adjustments. Firstly gross sales have to be confirmed by the sales department.

Total taxable income 395000 0. Income from salary is the summation of basic salary house rent allowance special allowance transport allowance other if any. Calculating the payable tax. Once you have your calculator in place take these steps to calculate your taxable income.

/Investopedia11-cc2db67b30a242d5a4d3e4939eb6d212.jpg)