How To Calculate Tax Incidence

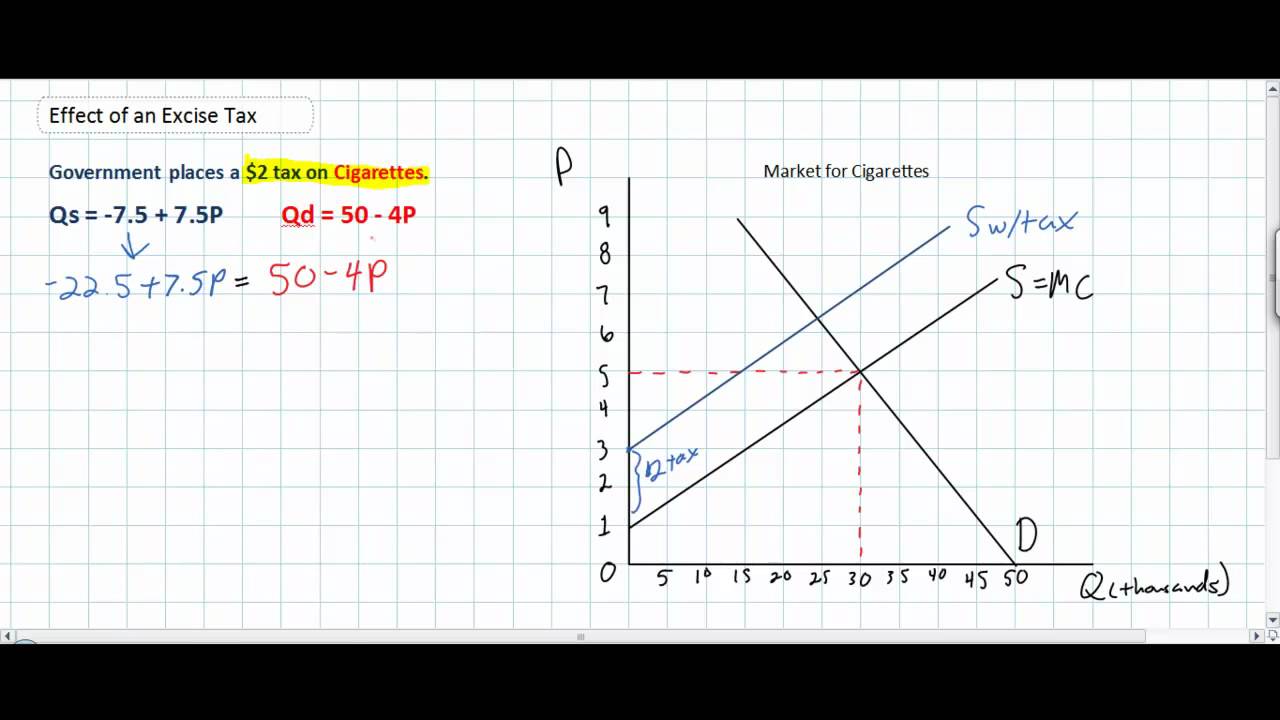

This video shows how to find tax incidence when given supply and demand curves.

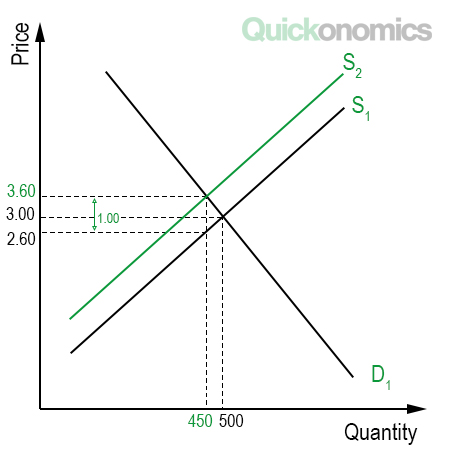

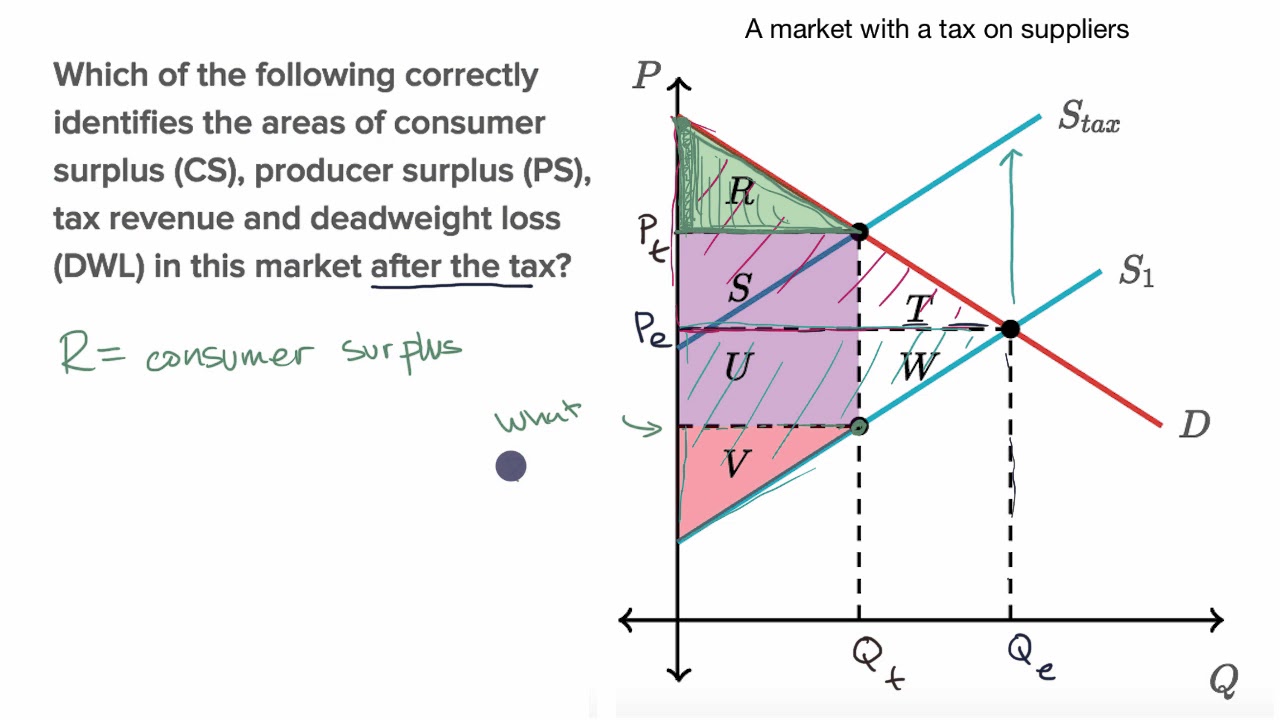

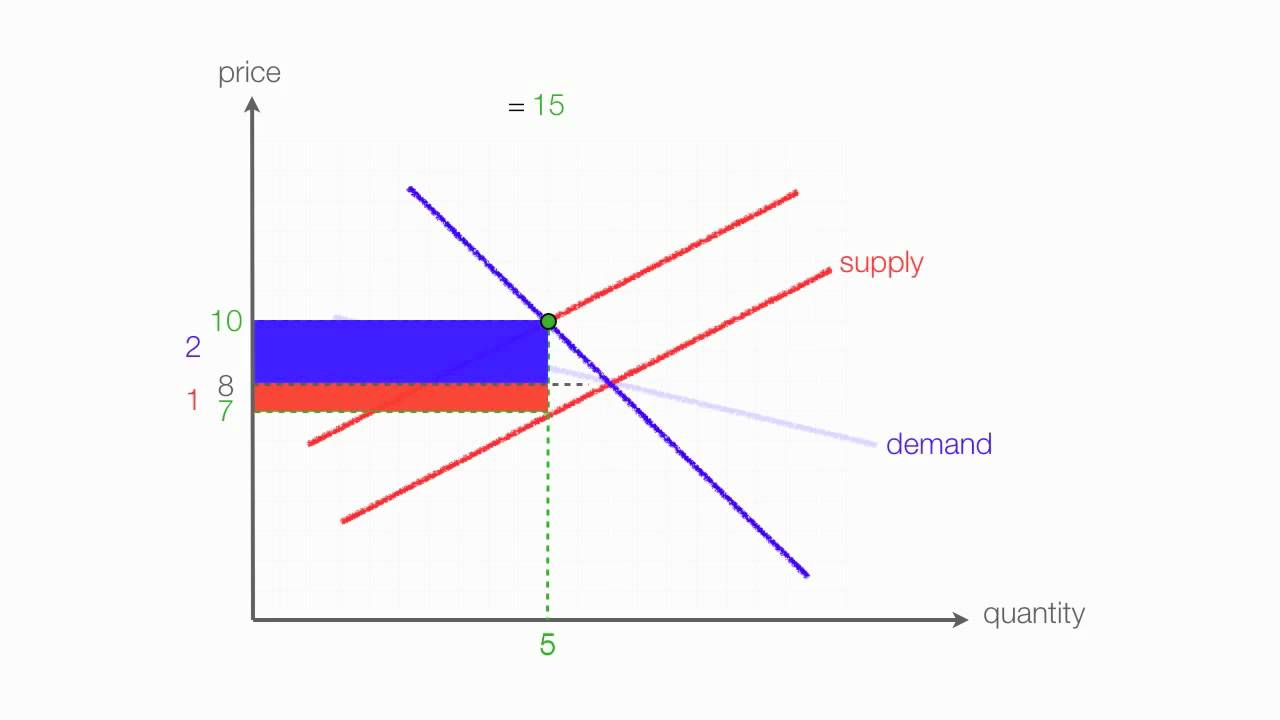

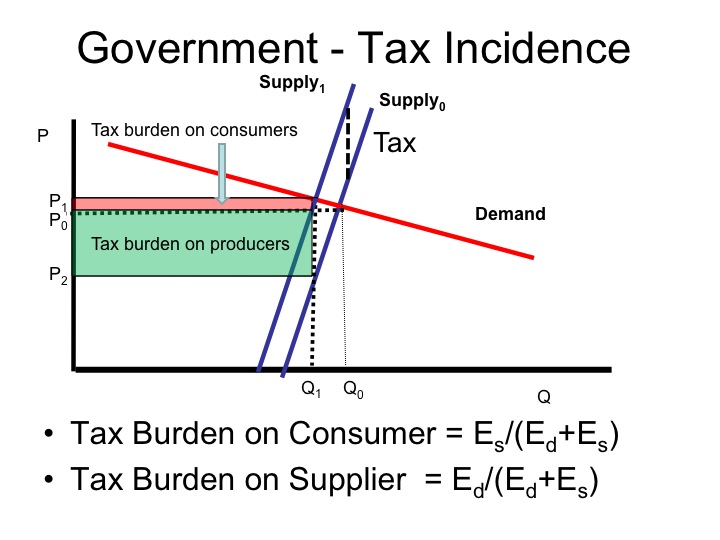

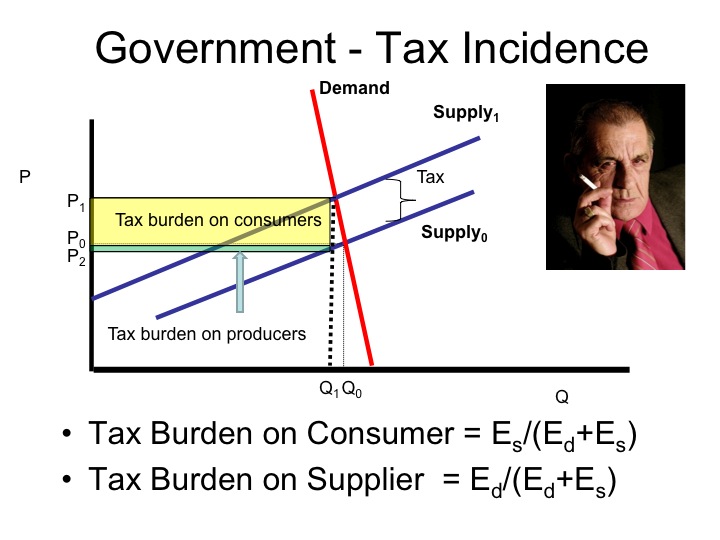

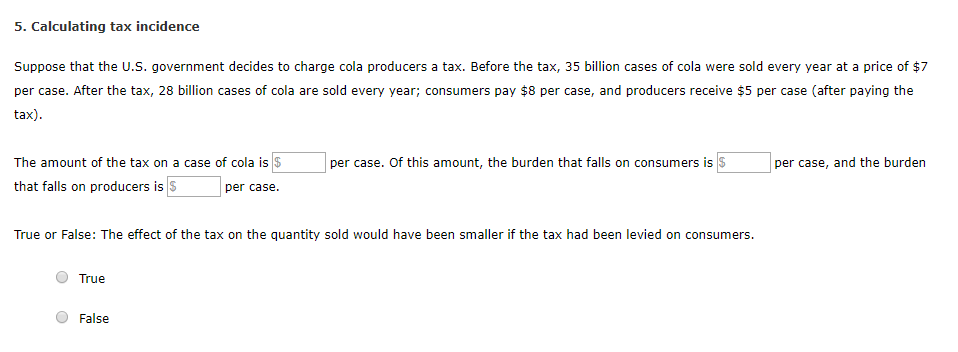

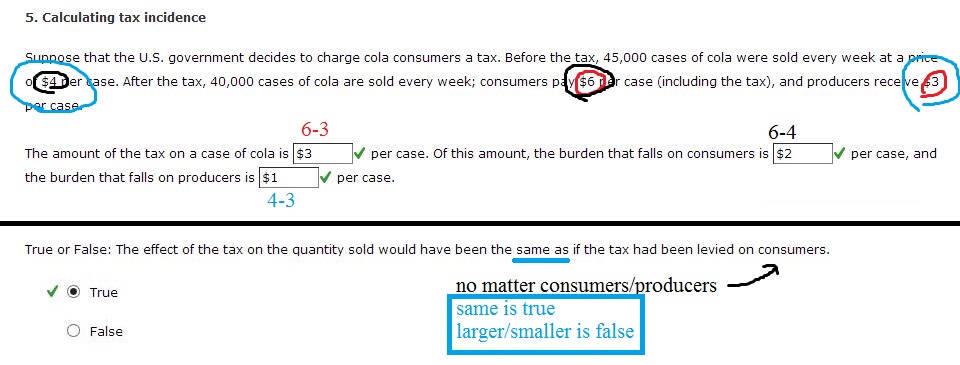

How to calculate tax incidence. Example of tax incidence. However taxes decrease both supply and demand in the market because buyers have to pay a higher price and sellers receive a lower price for their product. Producer tax incidence 100 ed ed es to check your work make sure that the solutions to those two. The tax revenue is given by the shaded area which we obtain by multiplying the tax per unit by the total quantity sold qt.

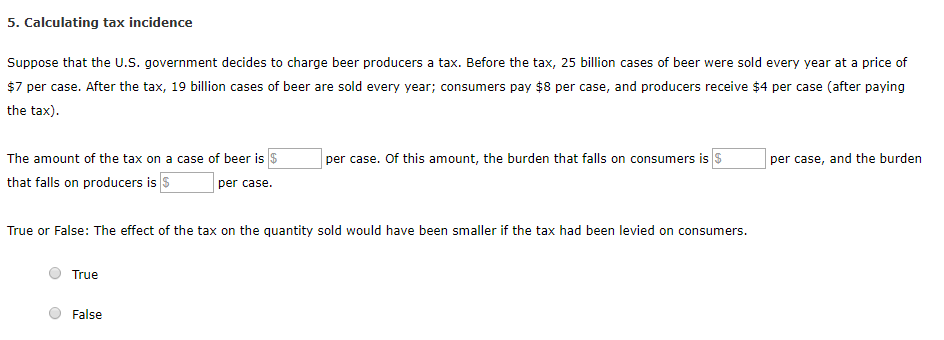

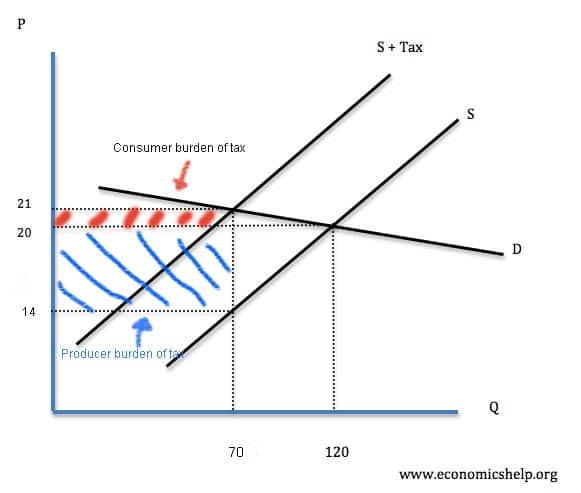

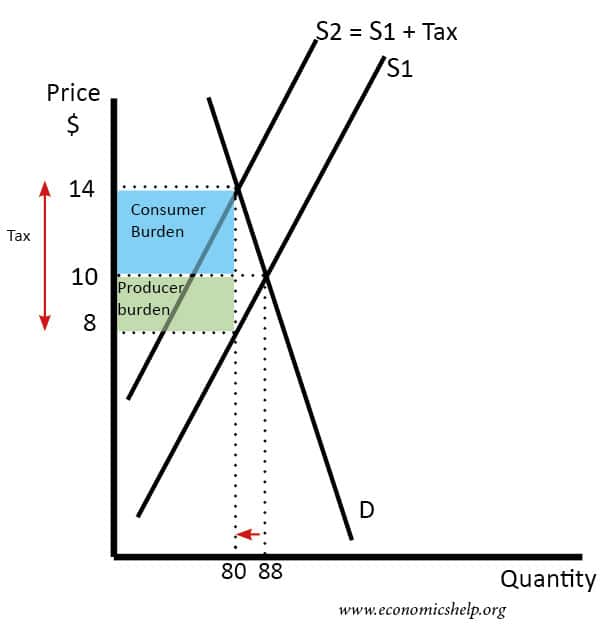

A tax of 6 causes the price to rise from 10 to 14. To calculate tax incidence we first have to find out whether the tax shifts the supply or the demand curve. How the tax burden is shared between buyers and sellers. Taxes are an important source of revenue for the government.

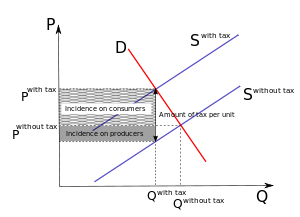

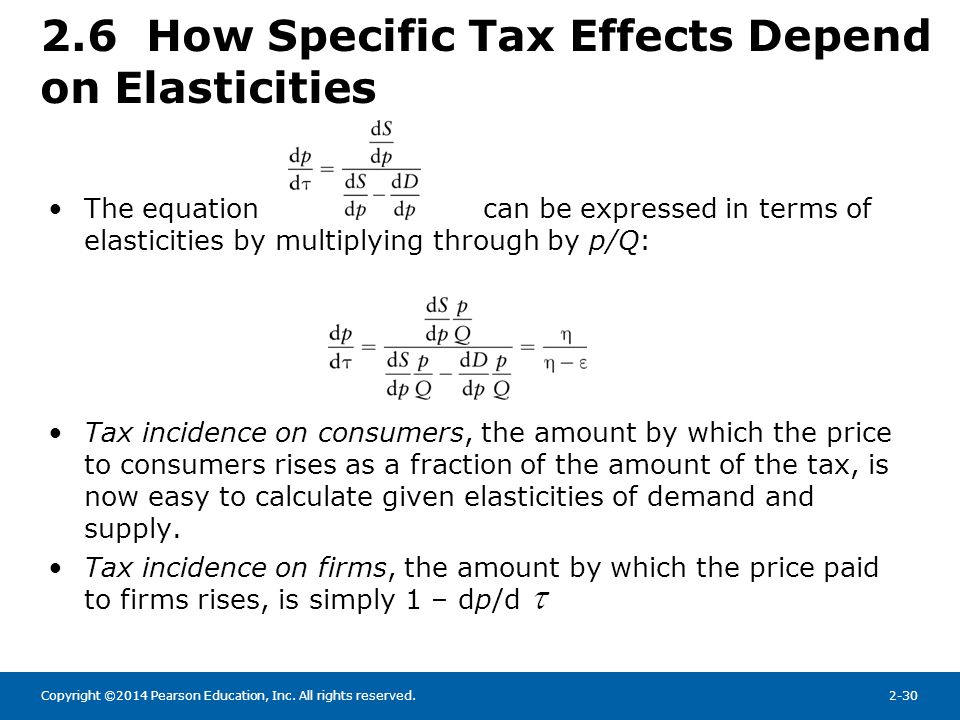

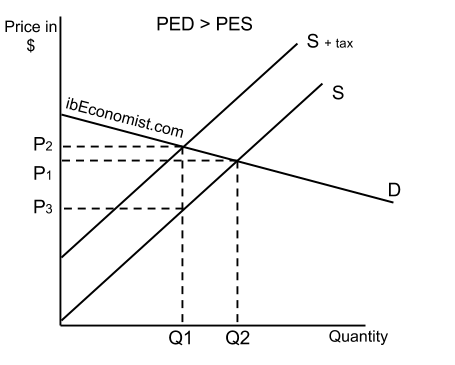

Next we can determine in which direction and by how much the curve shifts which finally allows us to find the new equilibrium and measure the tax incidence. A tax incidence is an economic term for the division of a tax burden between buyers and sellers. To calculate the incidence of tax formula you can use the pass through method. Tax incidence is related to the price elasticity of supply and demand and when.

The producer burden is 10 8 2 x 80 160. In the diagram on the left demand is price inelastic. Practice what you ve learned about tax incidence and deadweight loss when a tax is placed on a market in this exercise. Practice what you ve learned about tax incidence and deadweight loss when a tax is placed on a market in this exercise.

You can then use this following formula to determine the producer tax incidence. 100 56 44 is the amount of tax incidence paid by the seller. The tax incidence on the consumers is given by the difference between the price paid pc and the initial equilibrium price pe.