How To Calculate Tax In Excel Using Formula

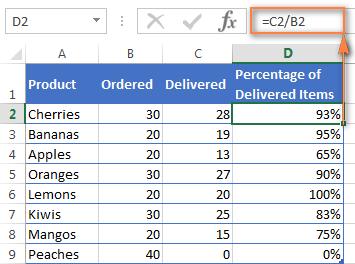

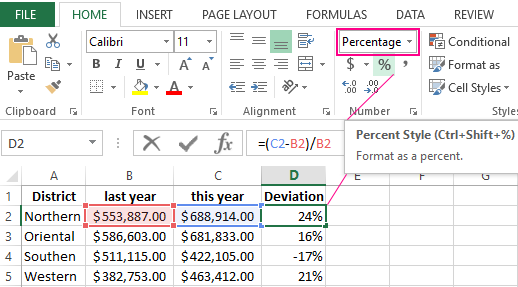

Formula to add the price and the tax.

How to calculate tax in excel using formula. Explanation to calculate a tax rate based on a simple tax rate table you can use the vlookup function. Select the cell you will place the sales tax at enter the formula e4 e4 1 e2 e4 is the tax inclusive price and e2 is the tax rate into it and press the enter key. Excel advanced training 14 courses 23 projects excel for hr training 5 courses 10 projects step 3. The following tax rates apply to individuals who are residents of australia.

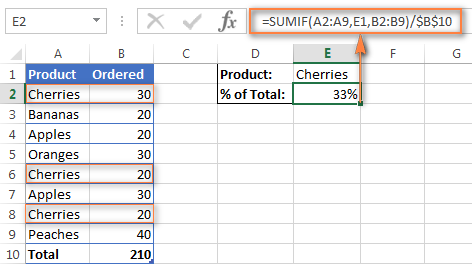

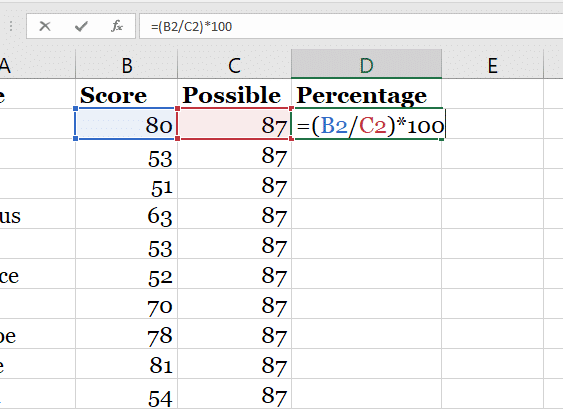

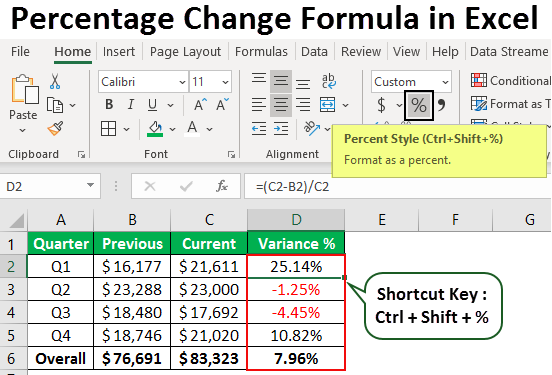

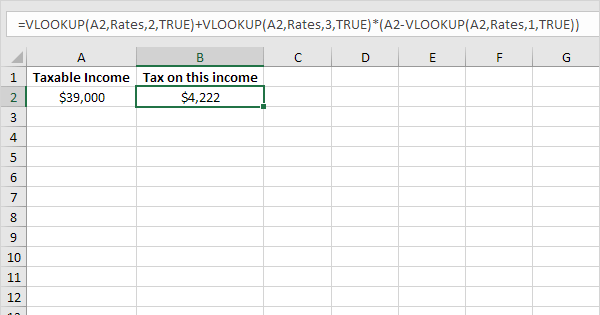

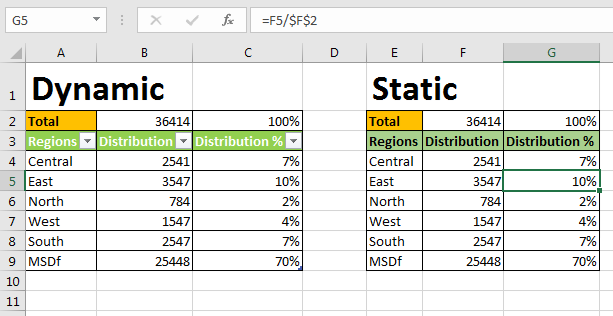

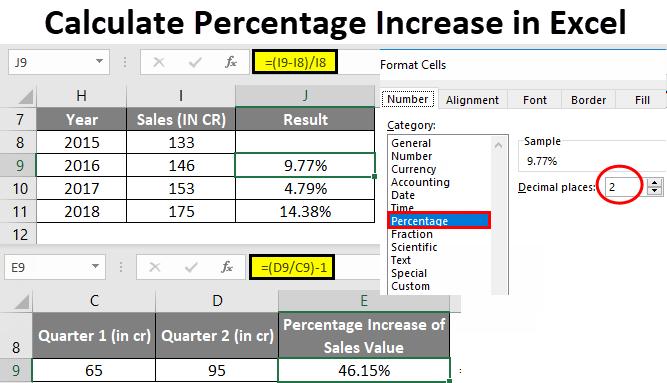

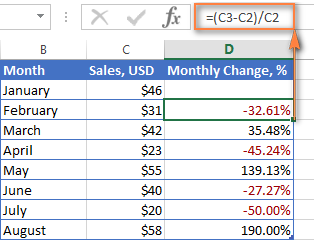

In the cell d6 type 10 in the cell d7 type the formula c7 c6. If income is 39000 tax equals 3572 0 325 39000 37000 3572 650 4222 to automatically calculate the tax on an income execute the following steps. First a user needs to calculate the taxable income click on cell b6 subtract the exemptions and deduction amount from the total income write the formula in b6 b2 b3 b4. The helper column will compute the cumulative tax for each tax bracket as shown below.

Vlookup inc rates 3 1 inc vlookup inc rates 1 1 vlookup inc rates 2 1. Press the enter key. This example teaches you how to calculate the tax on an income using the vlookup function in excel. The formula in g5 is.

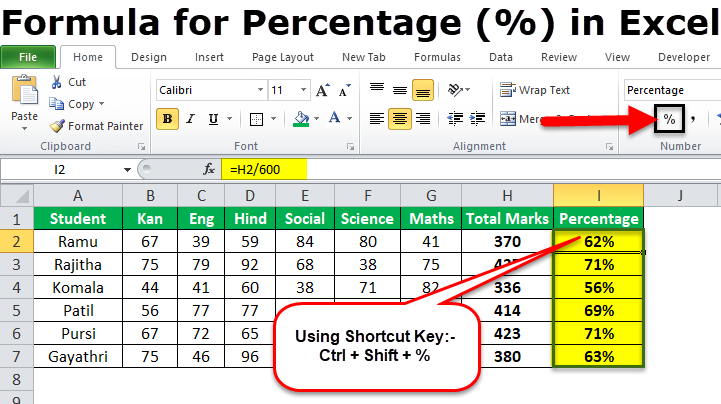

You can also calculate the value of your product with tax in a single formula. In the condition you can figure out the sales tax as follows. Price including vat price tax to calculate the price including vat you just have to add the product price the vat amount. Now you can calculate your income tax as follows.

In some regions the tax is included in the price. The cumulative helper column formula is straightforward we simply apply the marginal rate to the bracket income. And now you can get the sales tax easily. Add a differential column right to the tax table.

The sample file below contains the formula for reference. Add an amount column right to the new tax table.