How To Calculate Statutory Income Malaysia

Create an epf item via payroll statutory contribution new.

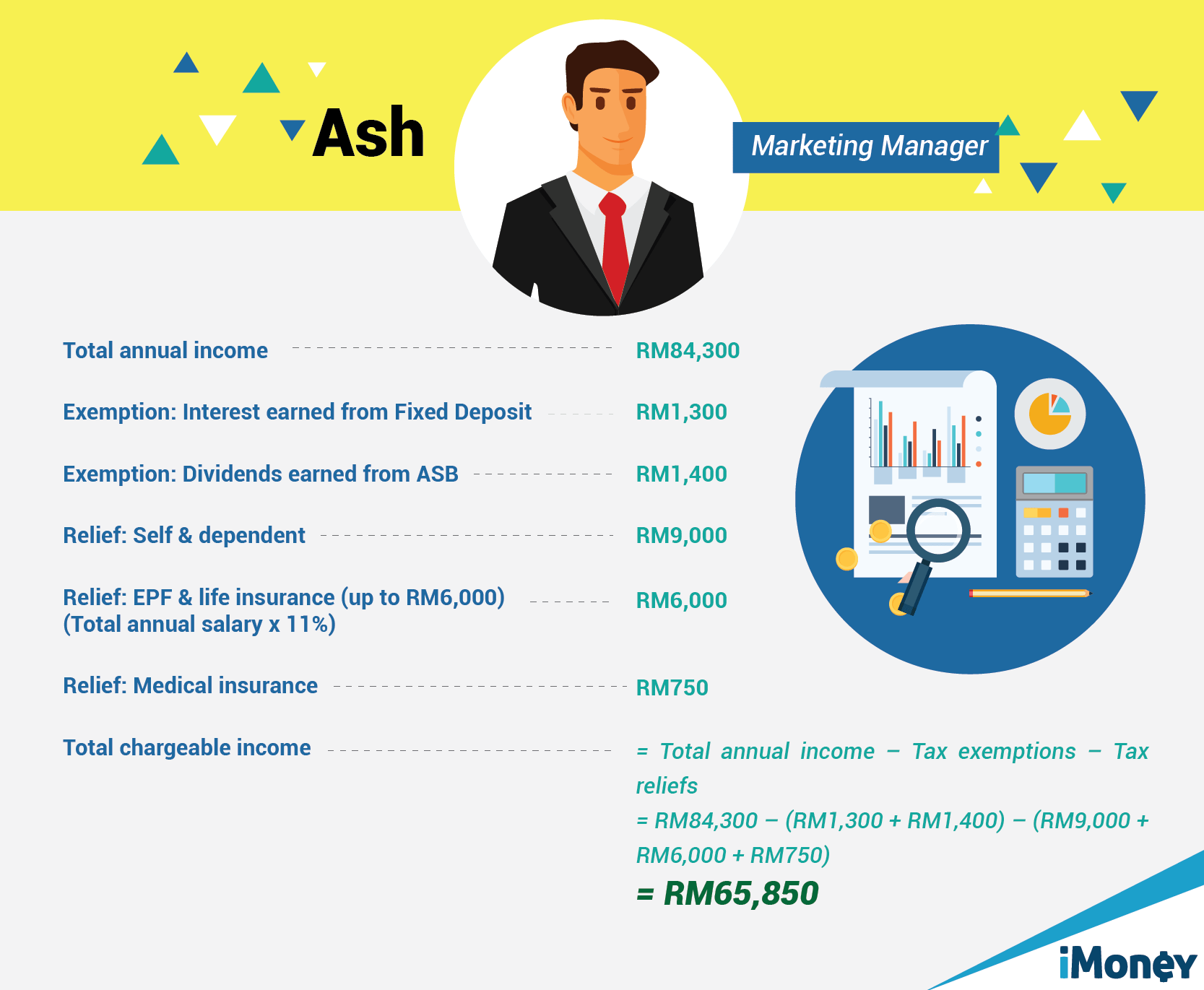

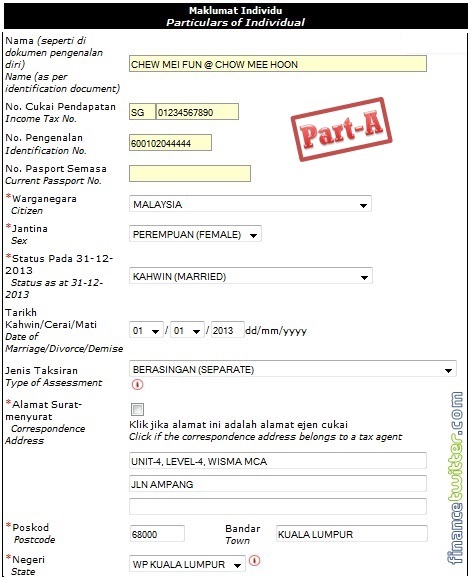

How to calculate statutory income malaysia. The second most important part is knowing which tax reliefs apply to you. How to file your taxes manually in malaysia. What is income tax return. This is where your ea form comes into play as it states your annual income earned from your employer.

Fill in the approved donation and gifts amount. When it comes to the season of income tax in malaysia that s when people tend to leave things till the last minute are you one of them and then make careless mistakes out of panic. Income tax facts in malaysia you should know. Malaysia income tax e filing guide.

The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent. Add the created epf item in the statutory contribution tab and click ok. Leave the employer and employee portions as zero and amount type as amount. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you.

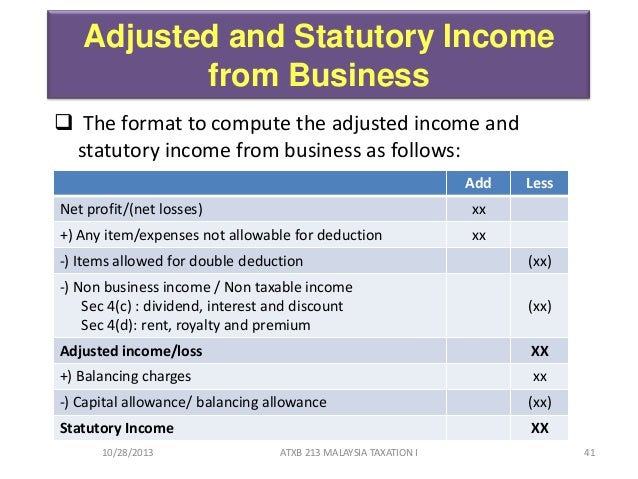

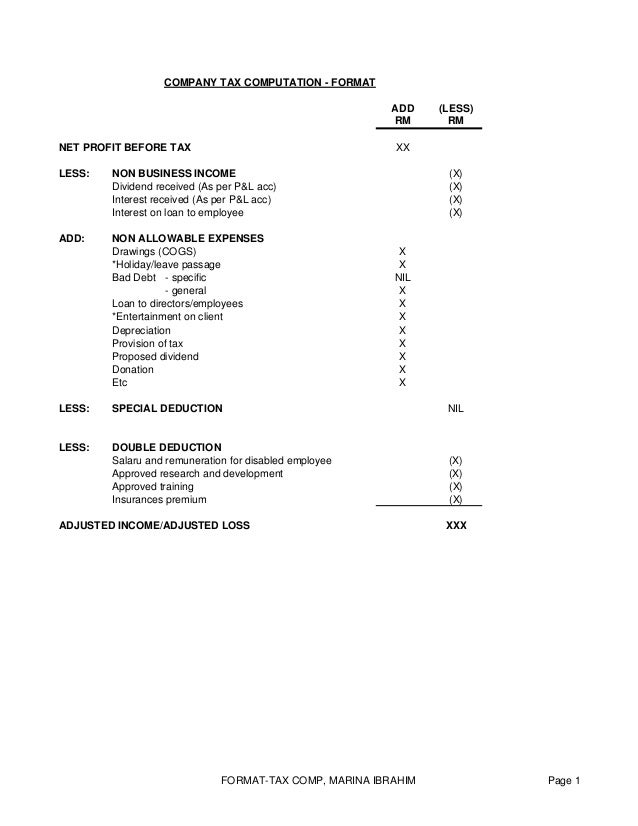

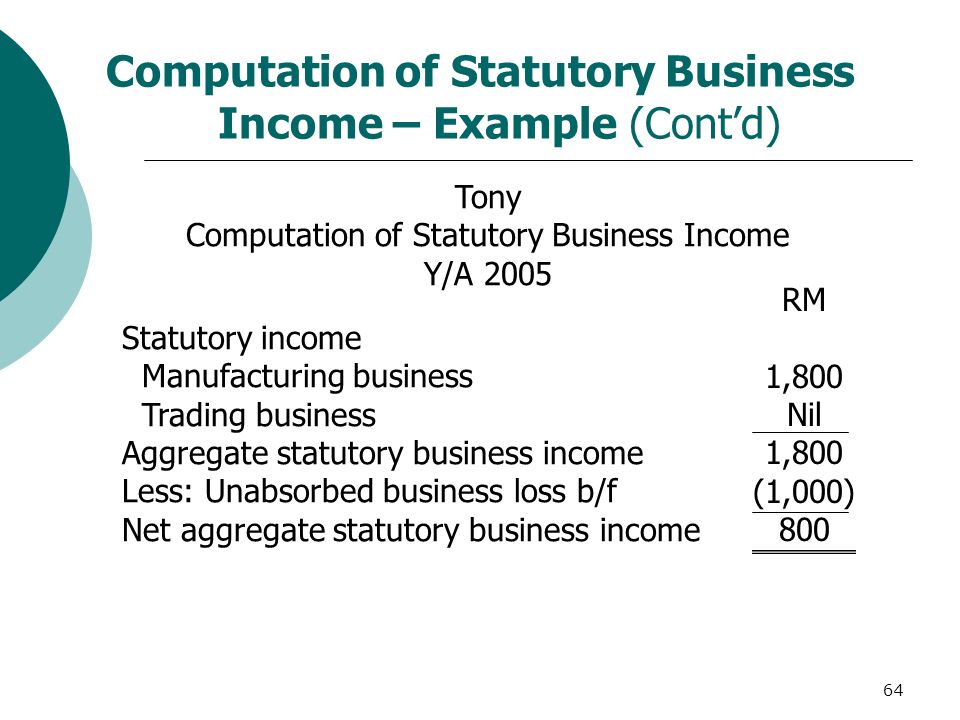

The system is thus based on the taxpayer s ability to pay. The form will automatically calculate your aggregate income for you. This is where your ea form comes into play as it states your annual income earned from your employer. Under statutory income fill out all the money you earn from employment rents and other sources in the respective boxes.

Pcb epf socso eis and income tax calculator. Tax offences and penalties in malaysia. There s also an exemption of 50 on the statutory income of rental received by malaysian citizens who live in malaysia. How to file income tax as a foreigner in malaysia.

Klik sini untuk versi bm. In order to promote affordable accommodation to the needful the malaysian government through budget 2018 offered a tax exemption of 50 on statutory income of rental received by malaysian. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. How to pay income tax in malaysia.

The form will automatically calculate your aggregate income for you. Change the specified employee s salary profile via payroll salary adjustment edit. The most important part of income tax is knowing how much you owe the inland revenue board. Especially as new reliefs are included while old ones get removed every year.

This means that low income earners are imposed with a lower tax rate compared to those with a higher income. Salary calculator malaysia.