How To Calculate Salary In Malaysia

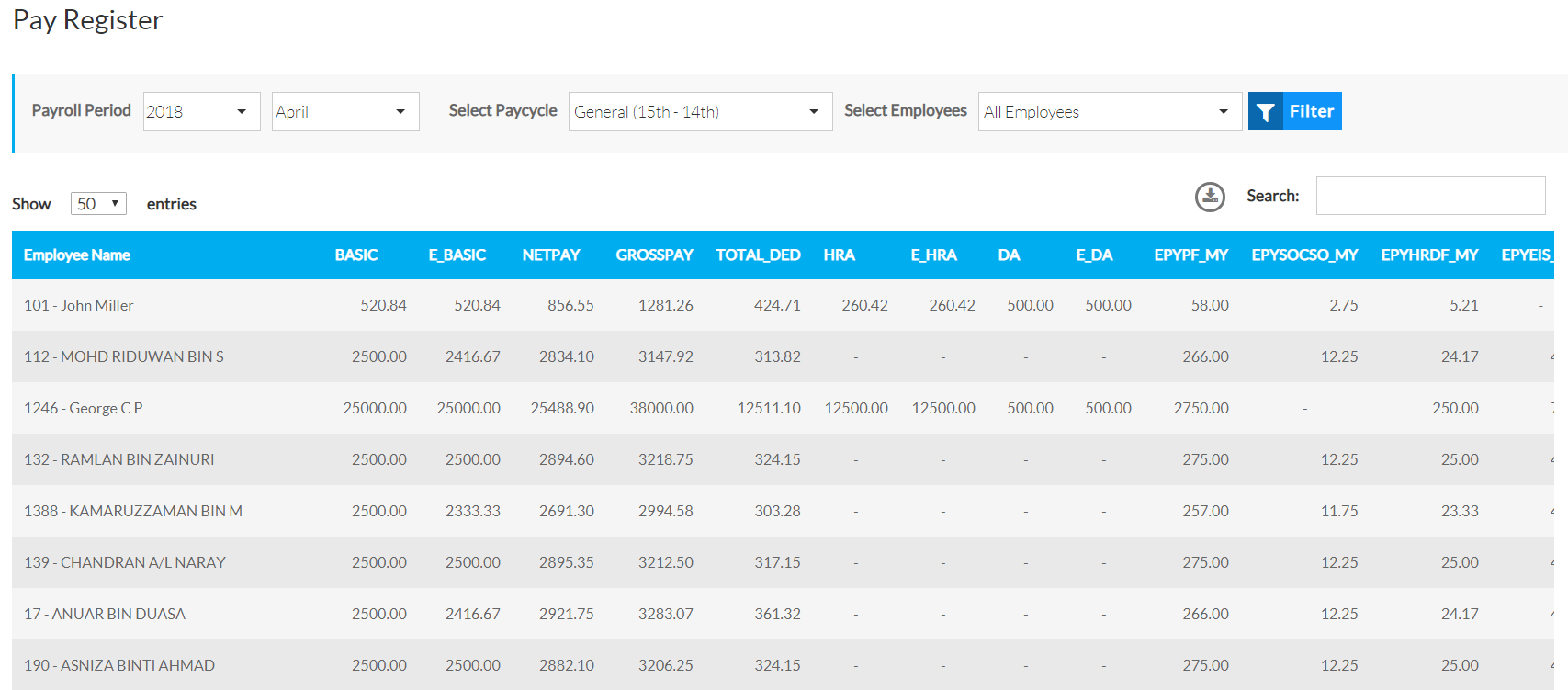

Salary calculator malaysia.

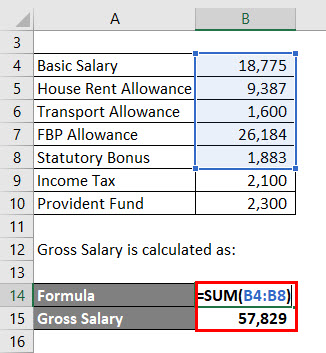

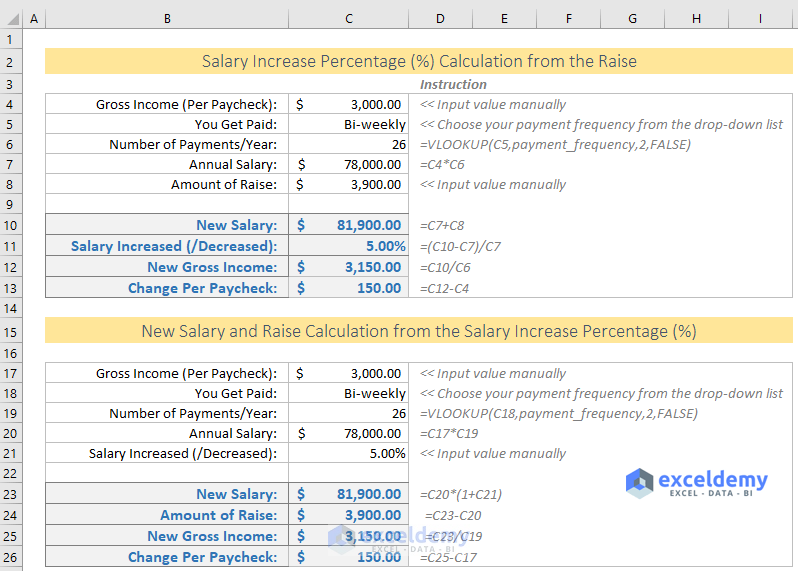

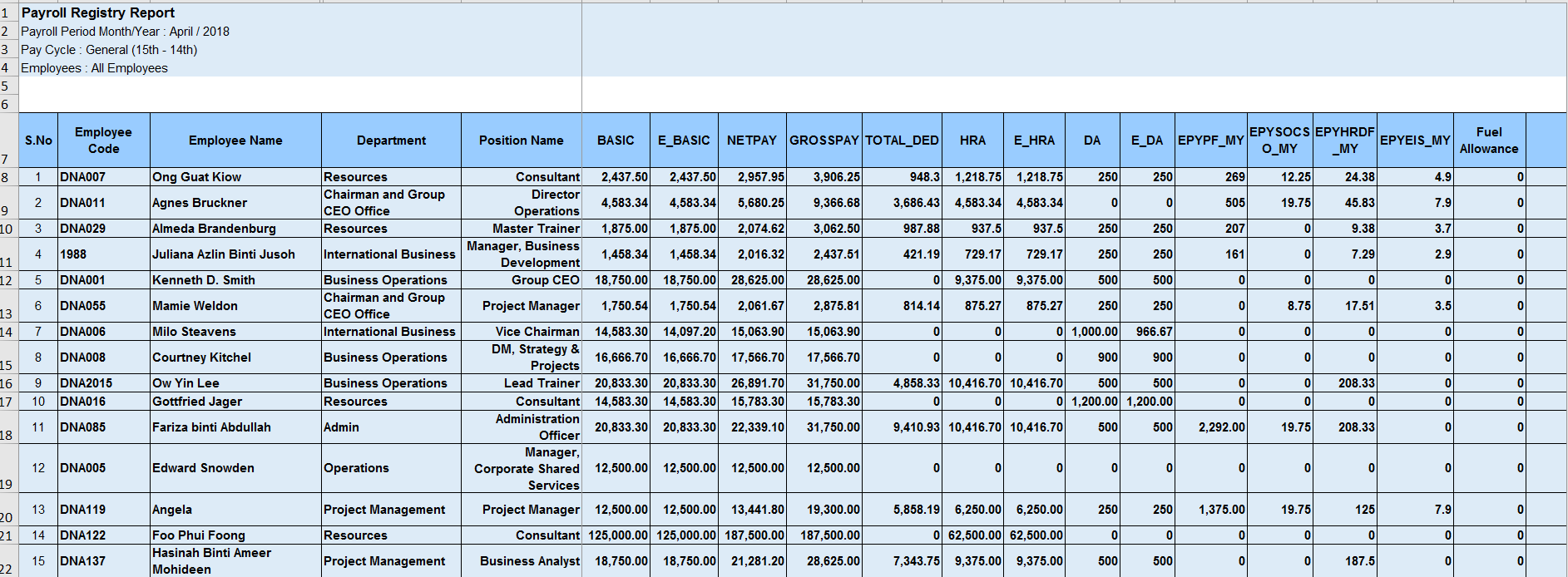

How to calculate salary in malaysia. Salary definition is a salary calculator malaysia an online application that provides salary calculator information to the user based on laws calculation for payroll system johor bahru. Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. If monthly salary is rm 5 000 with a yearly bonus of rm 5 000 then for an employee who. How unadjusted and adjusted salaries are calculated using a 10 hourly rate with inputs resulting in an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week annual unadjusted salary can be calculated as.

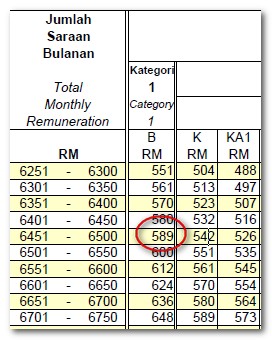

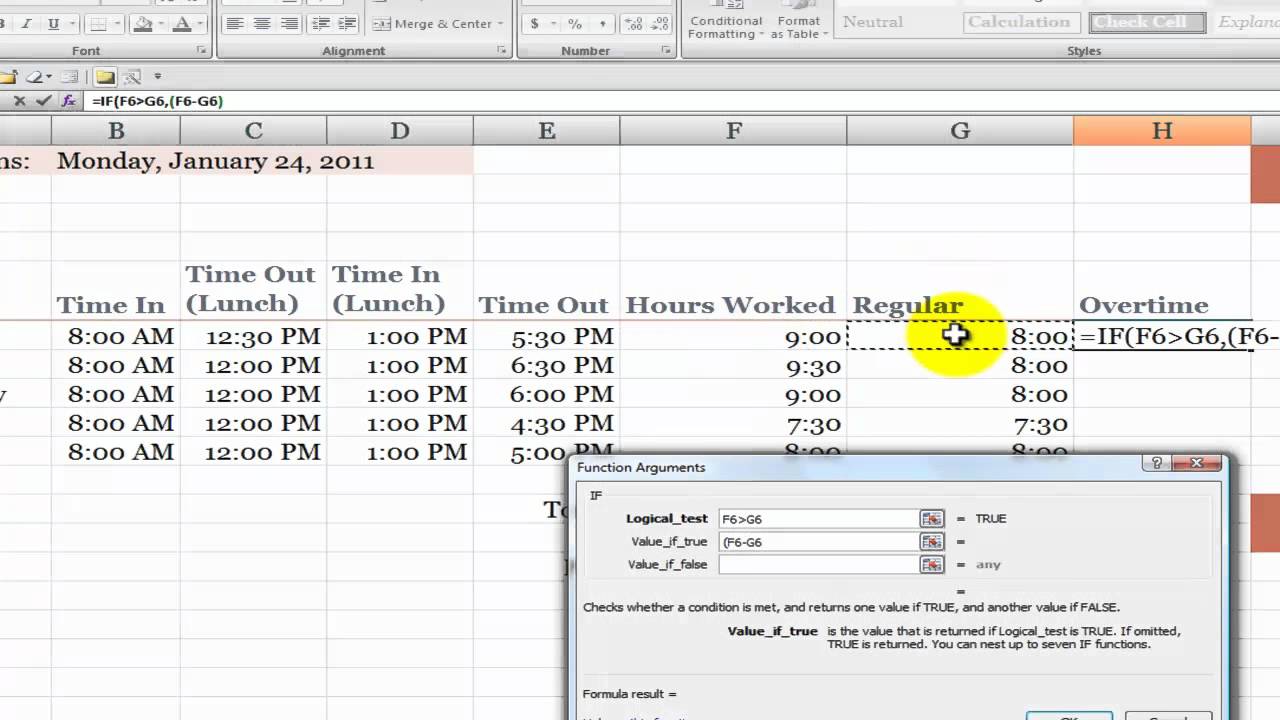

Any payment for work done on a rest day or any gazetted ph granted by the employer or on any day substituted for the gazetted public holiday. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax. Enter your salary and the malaysia salary calculator will automatically produce a salary after tax illustration for you simple. 1 where an employee is employed on a monthly rate of pay the ordinary rate of pay shall be calculated according to the following formula.

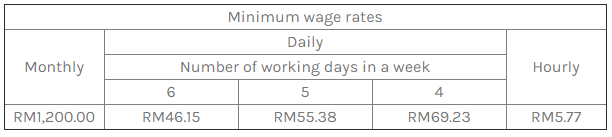

10 8 260 20 800. It s also can called monthly salary calculator for employees in a company in payroll malaysia. If you wish to enter you monthly salary weekly or hourly wage then select the advanced option on the malaysia tax calculator and change the employment income and employment expenses period. National wages consultative council act 2011 act 732 minimum wages order 2012 guidelines on the implementation of the minimum wages order 2012 minimum wages amendment order 2012 minimum wages amendment order 2013 minimum wages amendment no 2 order 2013 minimum wages amendment no 3.

Ordinary rate of pay opr any payment made under an approved incentive payment scheme or. Just two simple steps to calculate your salary after tax in malaysia with detailed income tax calculations. How to calculate your salary after tax in malaysia follow these simple steps to calculate your salary after tax in malaysia using the malaysia salary calculator 2020 which is updated with the 2020 21 tax tables. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month.