How To Calculate Rpgt

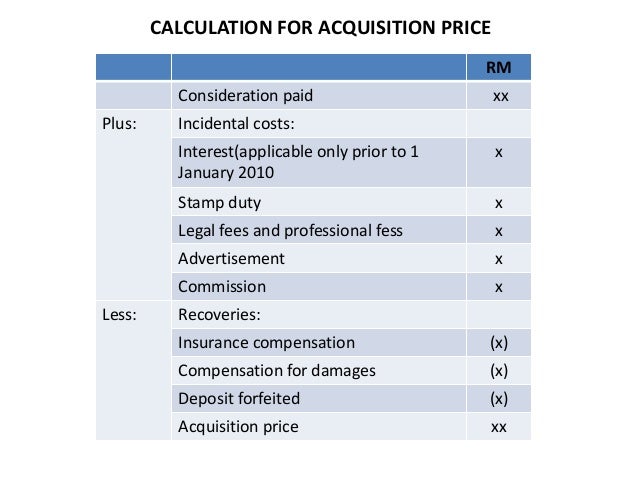

Many have raised a question on how to calculate or determine the purchase price for a property in rpgt.

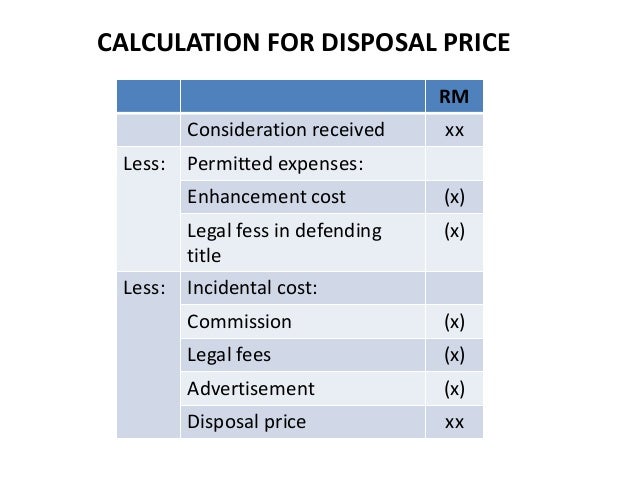

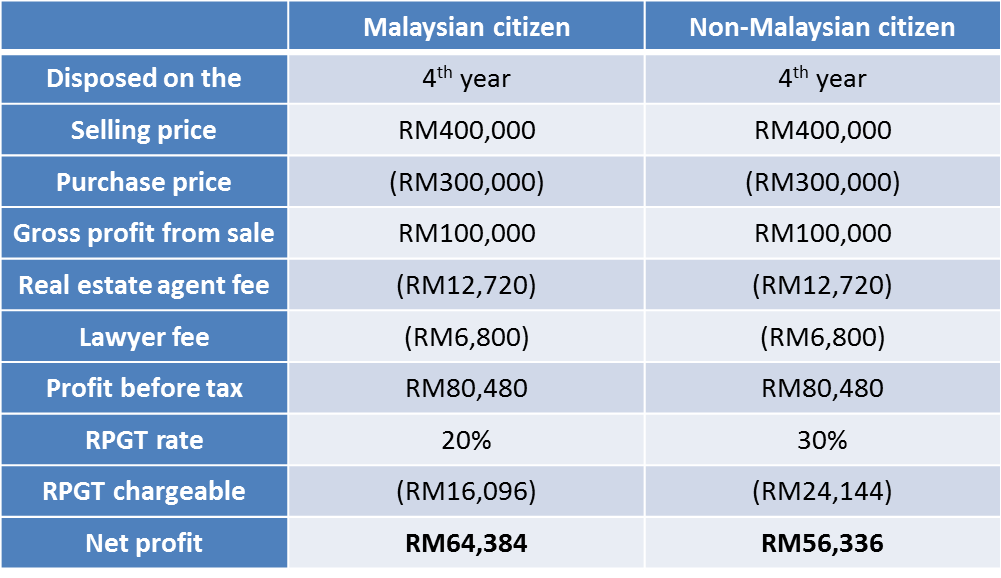

How to calculate rpgt. How to calculate rpgt. The net selling price. Selling price purchase price miscellaneous cost enhancement cost miscellaneous cost chargeable gain. Rm50 000 property gains rm10 000 waived exemption rm40 000 taxable gains rm40 000 taxable gains x 5 rpgt rate rm2 000 rpgt chargeable.

The rpgt would then be calculated by taking the chargeable gain and multiplying it by the rpgt rate. After a short while of marketing the property you sell it successfully for rm 850 000 nice one. The second step of finding out the amount of real property gains tax rpgt is. Prepare relevant documents for rpgt like the sale and purchase agreement as well as receipts from your legal fees advertising costs and.

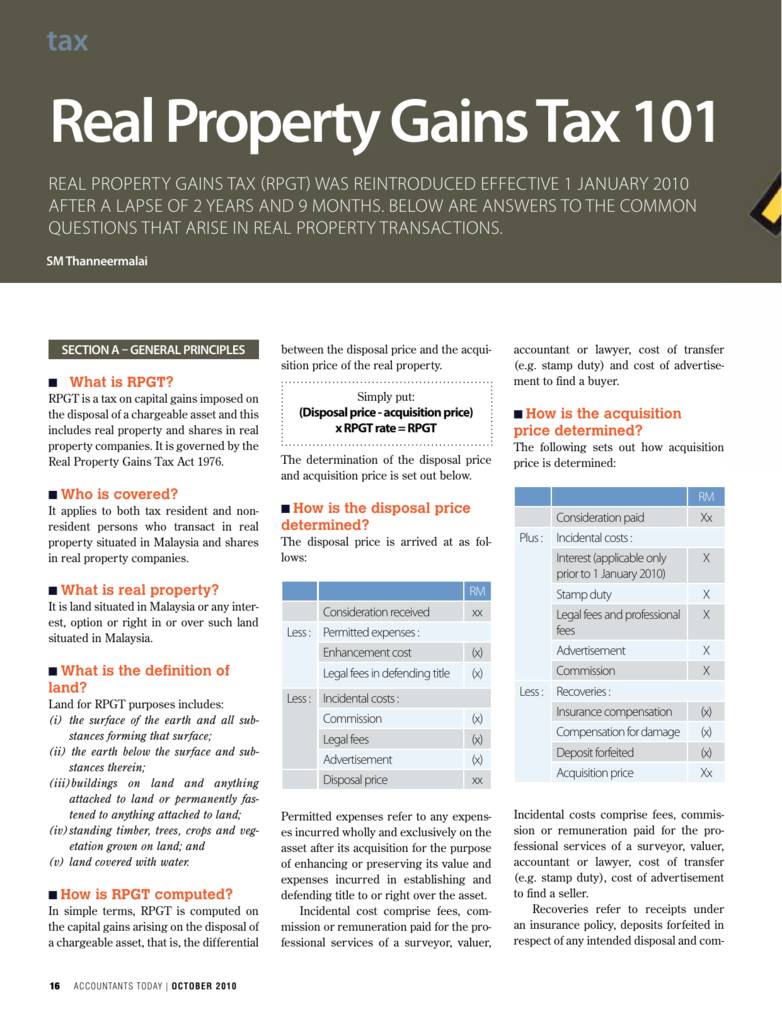

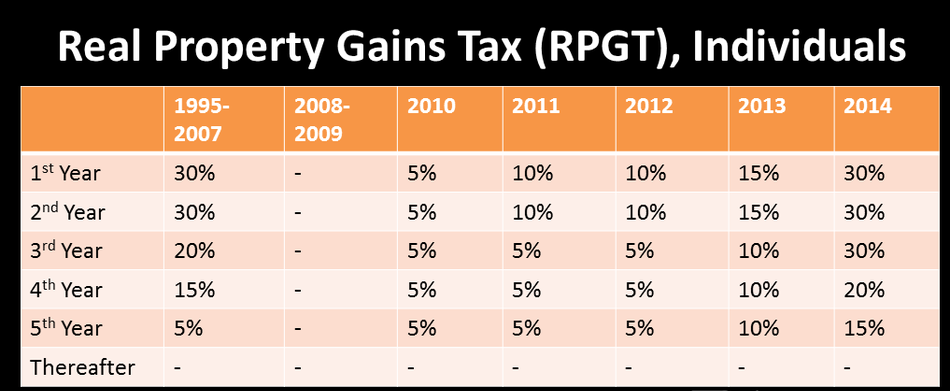

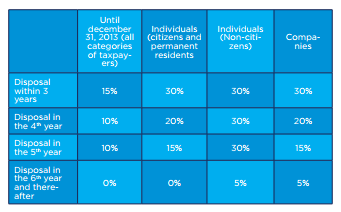

How to pay rpgt. According to the real property gains tax act 1976 rpgt is a form of capital gains tax levied by the inland revenue lhdn. Rpgt is generally classified into 3 tiers. Download forms ckht 1a ckht 3 and ckht 2a from irb s website.

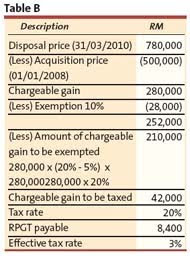

What is real property gain tax rpgt. Here is the example for the disposal of a property at the 5th year in 2014. Simply put when a property is sold a tax is chargeable on the profit gained from it and the seller has to pay it to the inland revenue board. Calculating rpgt is a fairly simple process.

Net chargeable gain see table. In order to calculate the rpgy by yourself you will need to determine the gains and the holding period. Rpgt would then be calculated by multiplying your chargeable gain with the relevant rpgt rate. To know the taxable amount first calculate your chargeable gain which is the difference between the purchase price and the sale price.

After deducted rm30 000 allowable expenses he made rm50 000 from the transaction and the gains are subject to 5 real property gain tax rpgt and the calculation will be. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. Real property gains tax rpgt is form of tax in malaysia that is payable when a property is sold. 6 steps to calculate your rpgt real property gains tax in malaysia 1.

The right and correct purchase price for your property is not only to inform the actual costs that you ve paid for your property but it is also important to reduce your possible rpgt when you have decided to dispose of your property for an awesome profit. Let s bring this to life with an example. Chargeable gain 10 of chargeable gain not for companies net chargeable gain.