How To Calculate Interest Expense On A Loan In Excel

Cumipmt 5 12 60 30000 1 12 0.

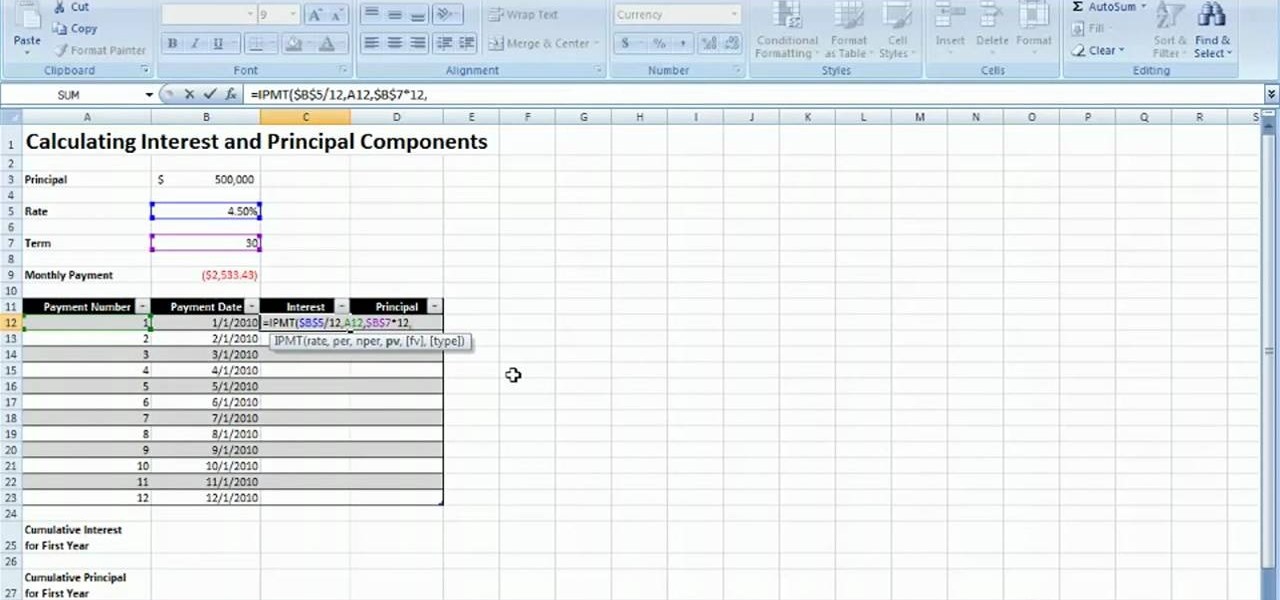

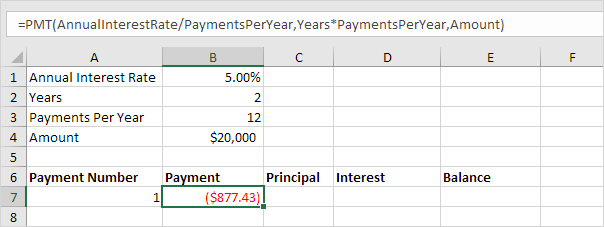

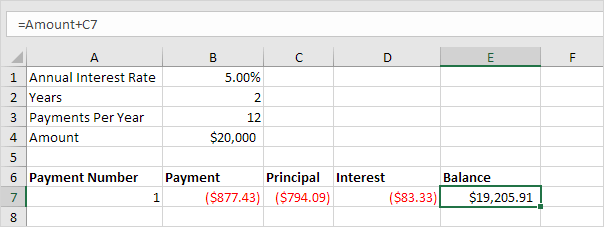

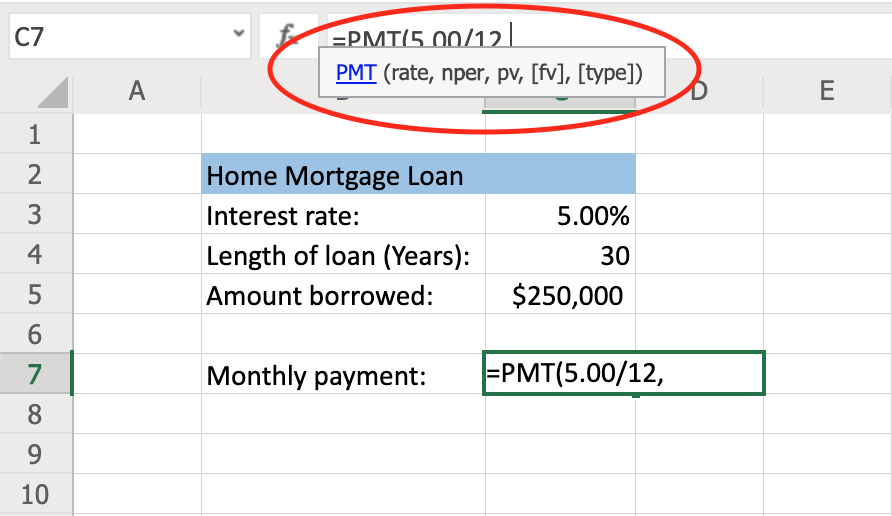

How to calculate interest expense on a loan in excel. Enter the interest payment formula. In the example shown the total interest paid in year 1 is calculated by using 1 for start period and 12 for end period. If you make weekly monthly or quarterly payments divide the annual rate by the number of payment periods per year as shown in this example. Ipmt c6 12 1 c8 c5 how this formula works.

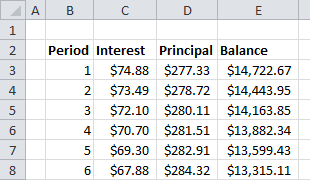

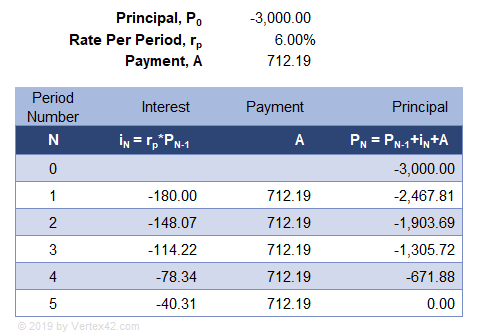

Proper interest rate no of days from your most recent interest payment total number of days in a payment period. This doesn t give you the compounded interest which generally gets lower as the amount you pay decreases. To calculate the interest portion of a loan payment in a given period you can use the ipmt function. Doing so will calculate the amount that you ll have to pay in interest for each period.

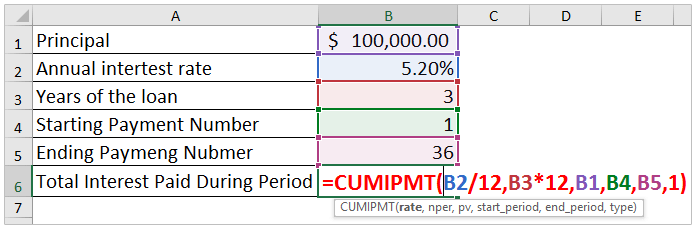

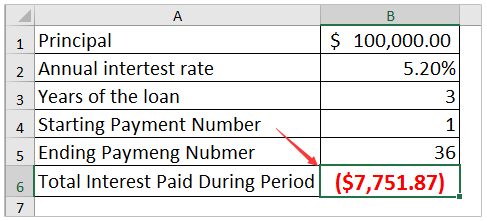

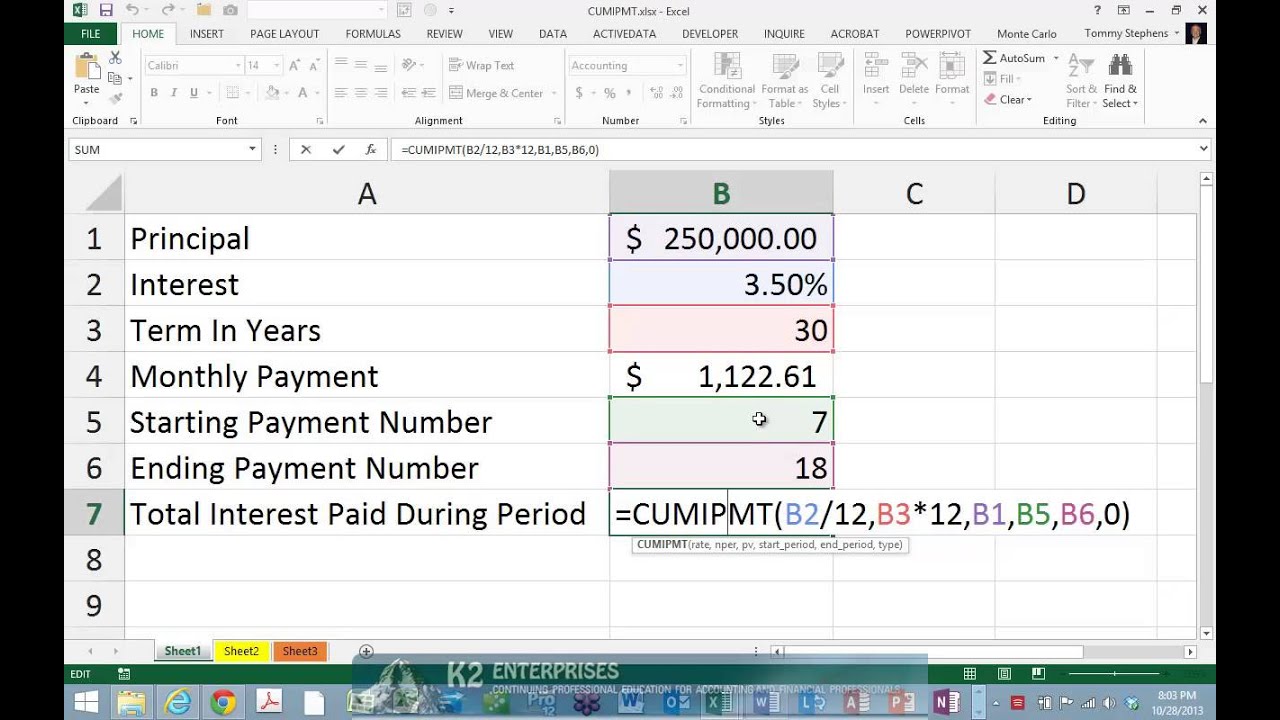

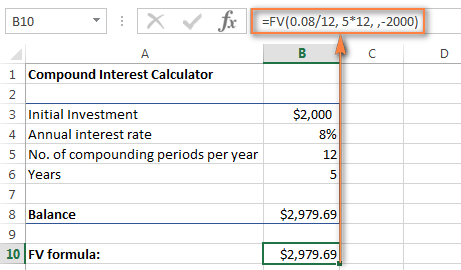

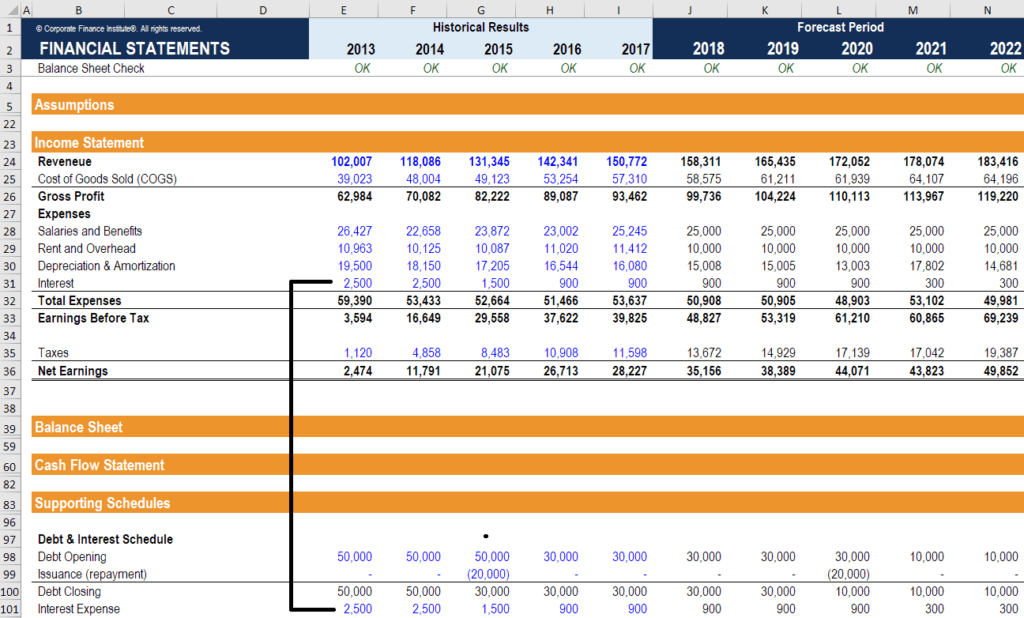

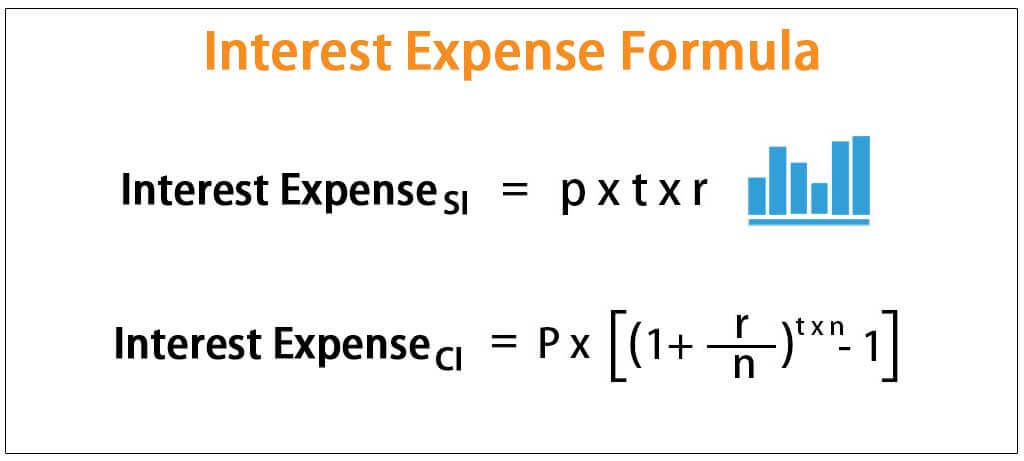

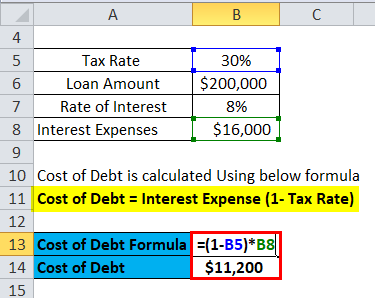

Interest expense principal amount total borrowed amount rate of interest time period. For example if you make annual payments on a loan with an annual interest rate of 6 percent use 6 or 0 06 for rate. Sometimes you may want to calculate the total interest paid on a loan. To calculate the total interest for a loan in a given year you can use the cumipmt function.

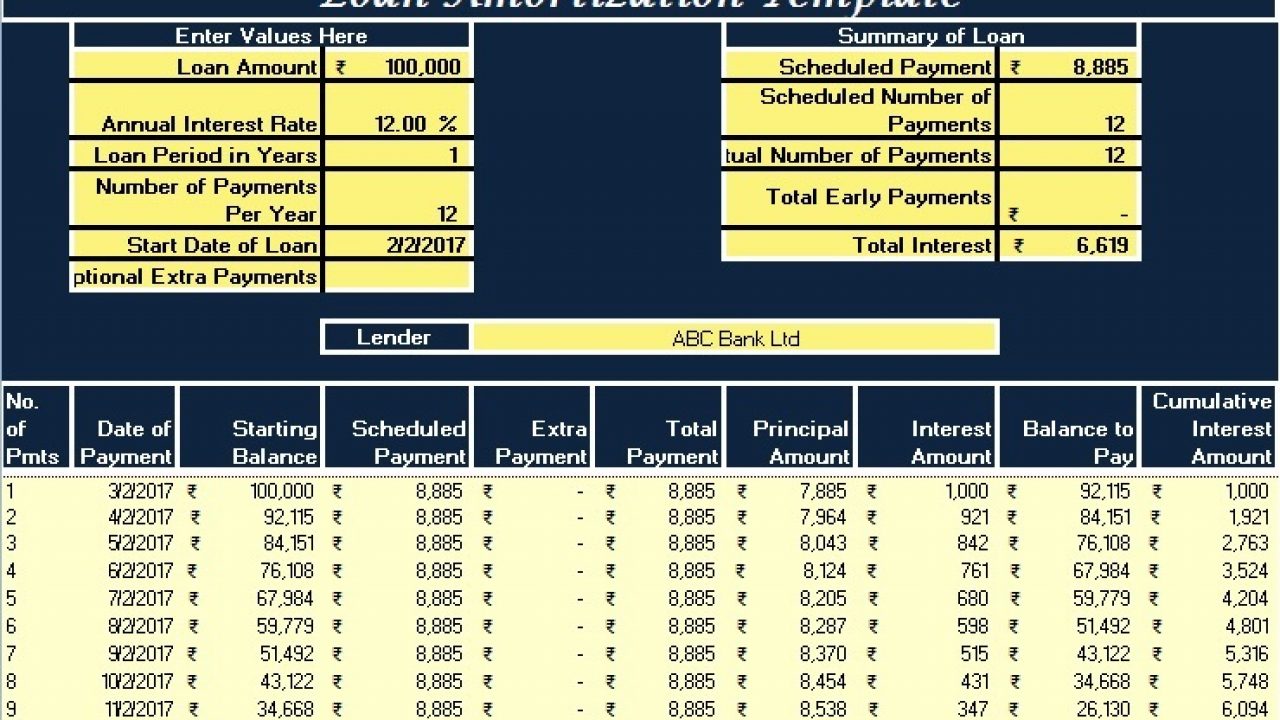

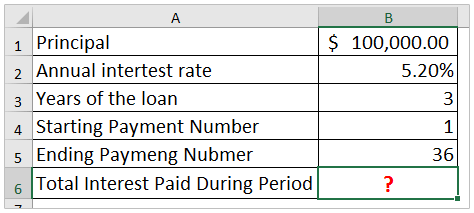

Calculate total interest paid on a loan in excel for example you have borrowed 100000 from bank in total the annual loan interest rate is 5 20 and you will pay the bank every month in the coming 3 years as below screenshot shown. Interest expense long term inr 18 36 cr. Accrued interest bond face value time of the accrued interest proper interest rate. The the formula in f5 is.

Interest expense for short term loan is calculated using the formula given below. Interest expense long term inr 216 cr 8 5 1. Type ipmt b2 1 b3 b1 into cell b4 and press enter. After getting all the necessary values of the variables it is applied in the below formula to calculate the accrued interest.

Rate required the constant interest rate per period you can supply it as a percentage or decimal number.

/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

:max_bytes(150000):strip_icc()/CalculateCardPayments2-544eed4848c94d4bb6f1f9956822af38.jpg)