How To Calculate House Loan Repayment

The next item that banks will look at is your nett monthly income minus your total monthly expenses.

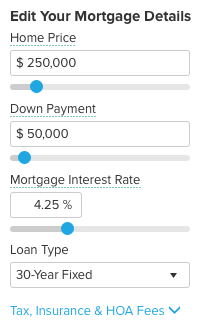

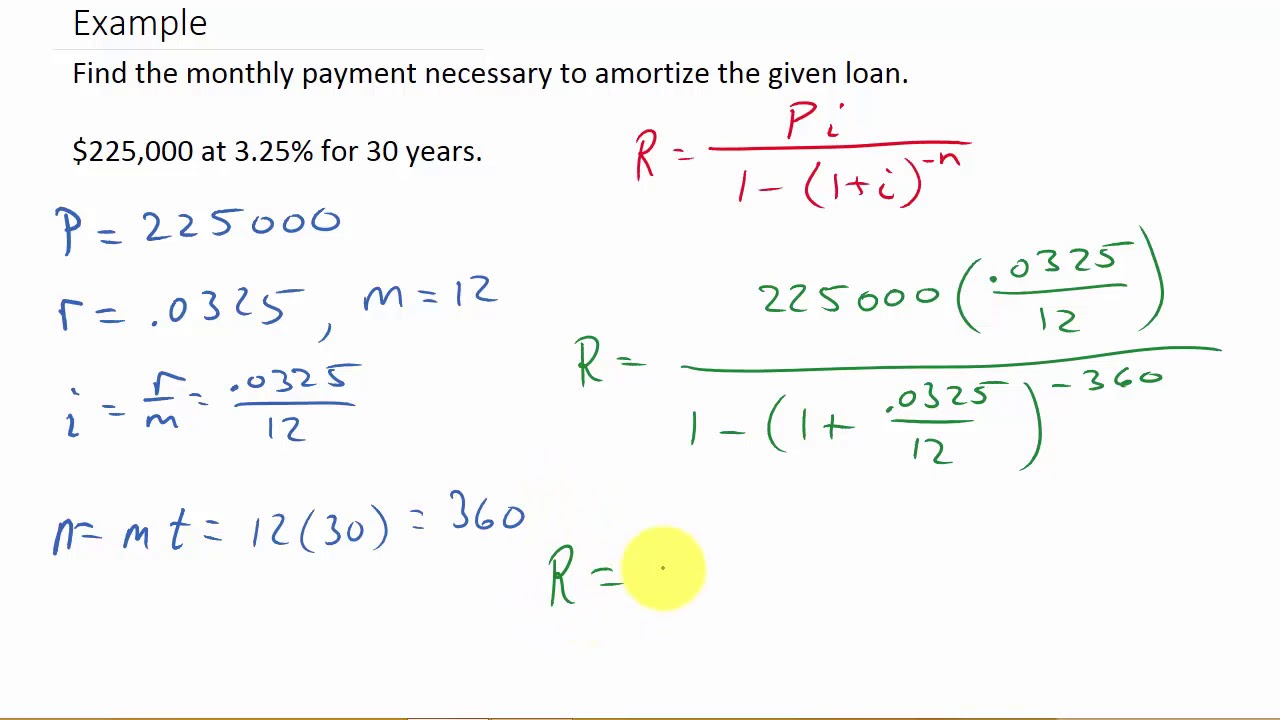

How to calculate house loan repayment. Simply enter the loan amount term and interest rate in the fields below and click calculate. Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan. Banks calculate your home loan repayment using a formula that takes into account the principal or original amount you borrowed your monthly interest rate and the number of payments over the life of the loan. Enter down payment amount in malaysian ringgit.

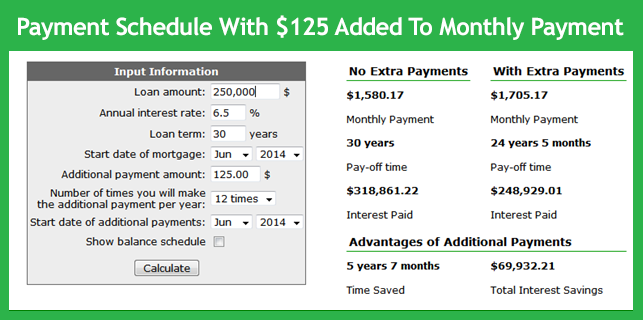

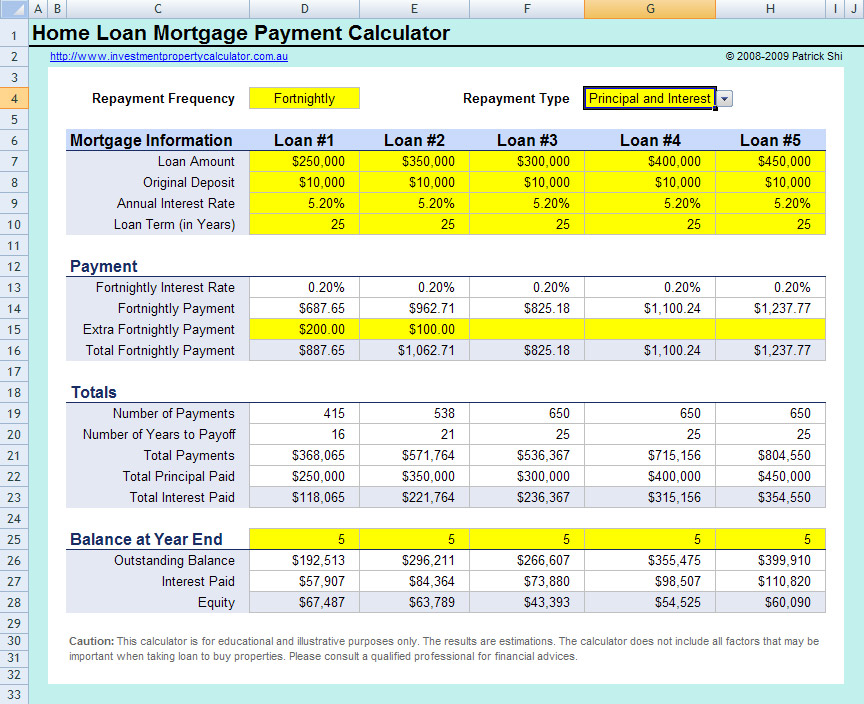

This is an additional payment of around 173 per month however the savings are huge. Remember that your number of payments is calculated by multiplying the number of annual payments by the loan duration in years. Enter housing loan period in years. The banks want to see that your disposable income will cover the monthly repayments of the home loan.

The rest of the numbers will then update. This rate is only available to investors with a principal and interest loan that has a loan to valuation ratio of less than or equal to 90. Type a7 1 into cell a8 payment 2 and drag that down to the end of your schedule. Input the desired loan amount that you wish to avail.

Still keeping the loan amount at 500 000 let s now make the payments weekly the interest rate at 4 25 and the loan term at 25 years. A longer tenure helps in enhancing the eligibility. There may be fees if your valuation exceeds this amount. A standard valuation is valued at up to 600.

If your loan payment numbers don t update down the amortization schedule. Make use of our affordability calculator above to find out what your estimated home loan amount will be. The loan amount has been calculated based on the information input by you and information sourced by third parties. Based on these pre sets your weekly repayment will be 624 61 or 2 706 64 per month.

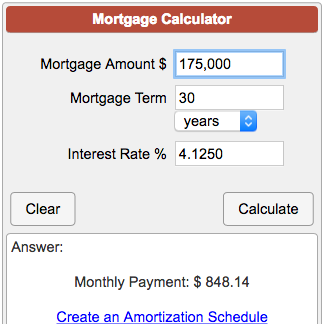

This loan calculator will help you determine the monthly payments on a loan. Interest rate p a. This calculator can be. Enter loan interest rate in percentage.

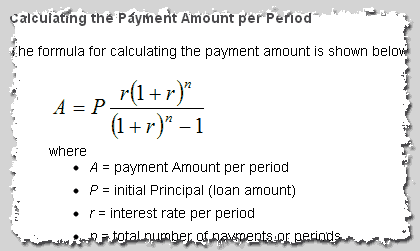

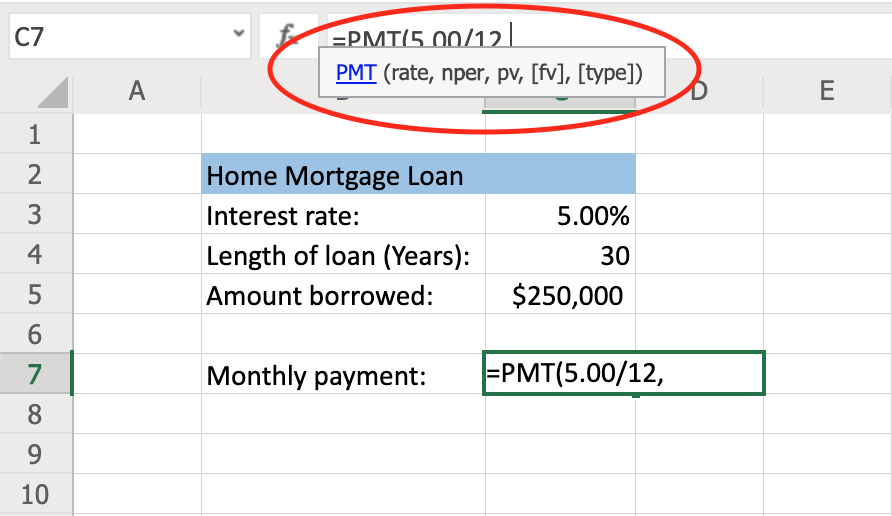

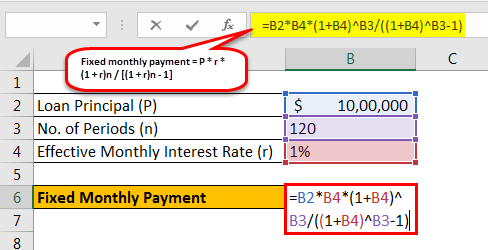

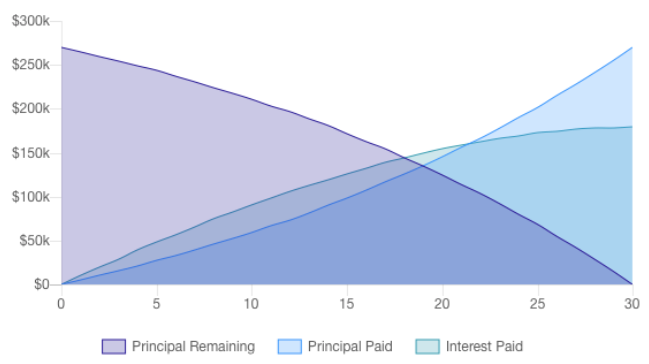

M p i 1 i n 1 1 i n. Enter property price in malaysian ringgit. For example a 30 year fixed mortgage would have 360 payments. Loan tenure in years.

B interest only.

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)

/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)