How To Calculate Fixed Deposit Interest Formula

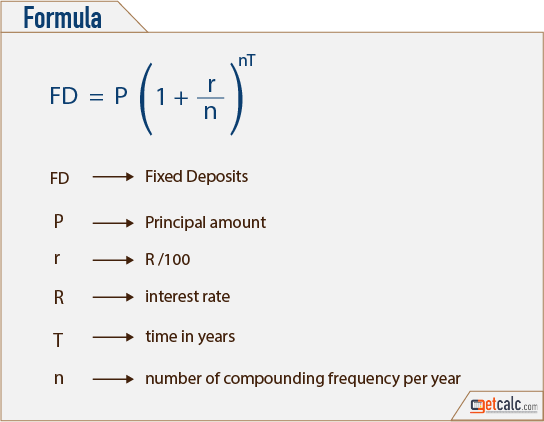

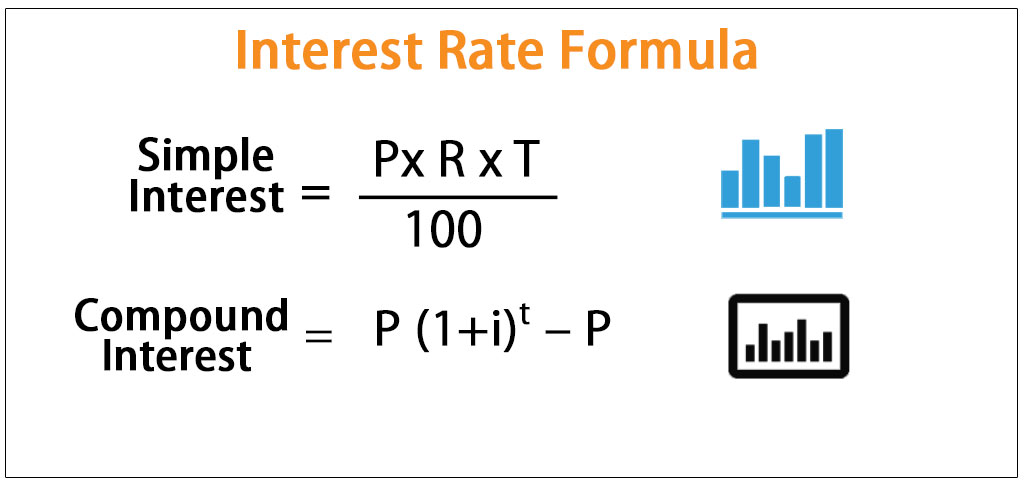

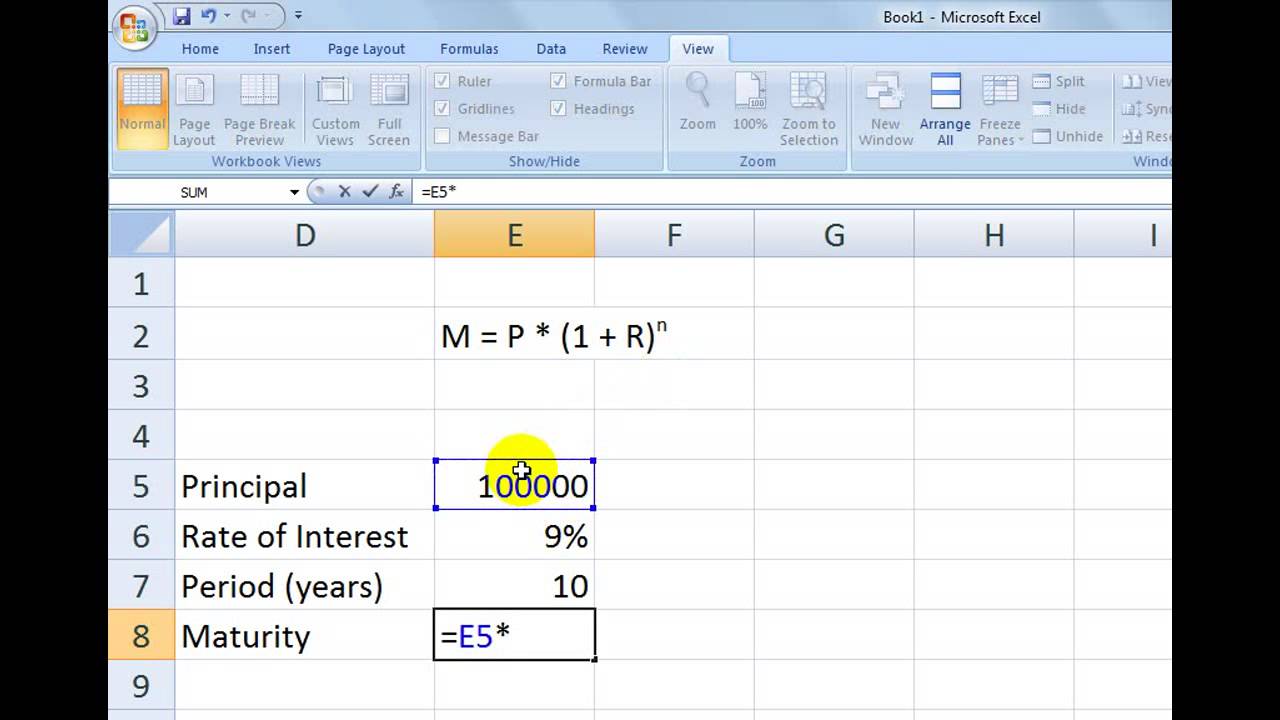

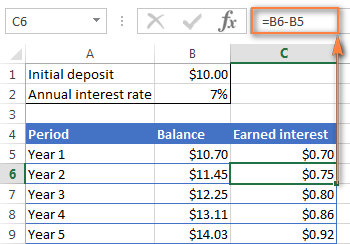

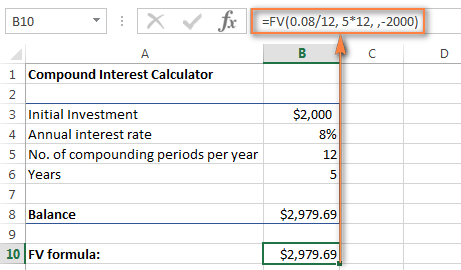

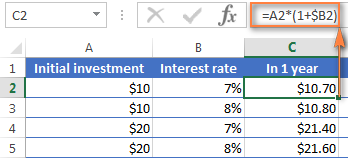

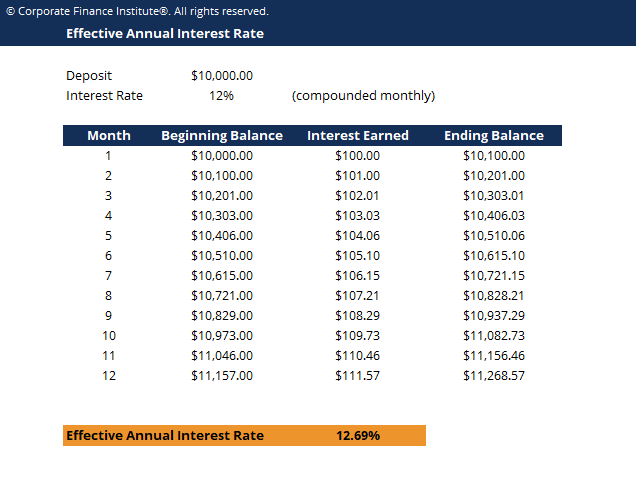

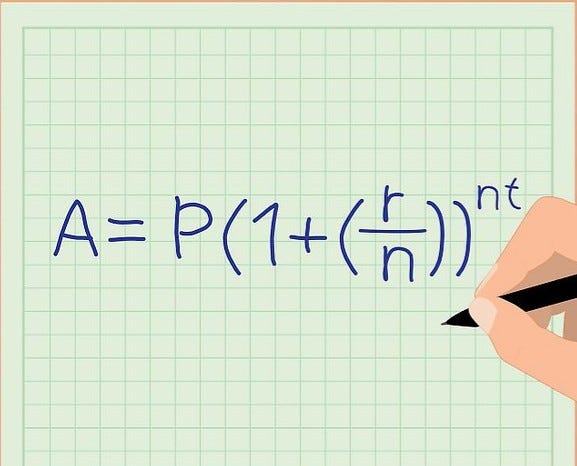

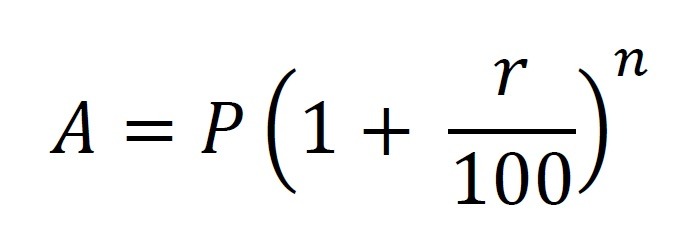

Compound interest arises when interest is added to the principal so that from that moment on the interest that has been added also itself earns interest.

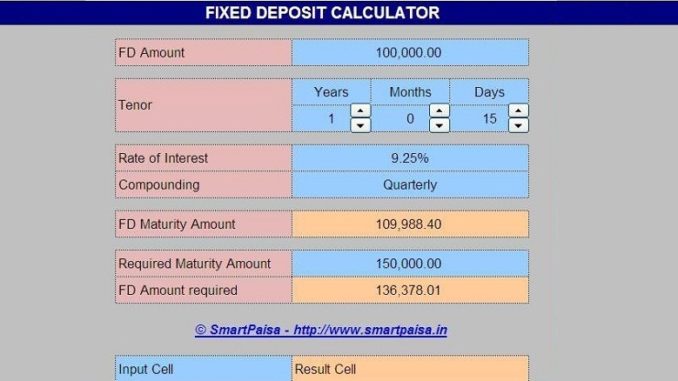

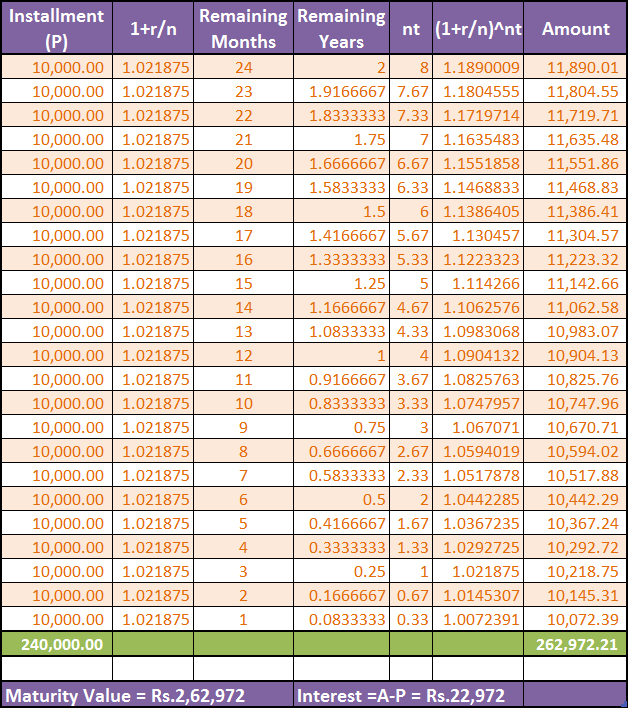

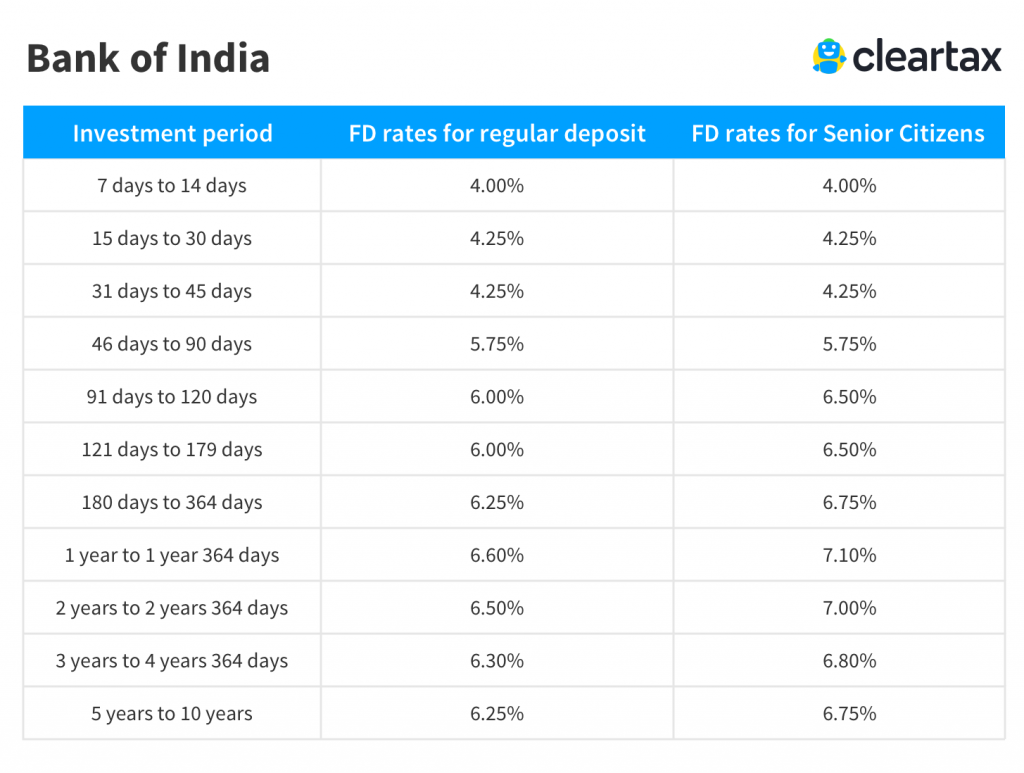

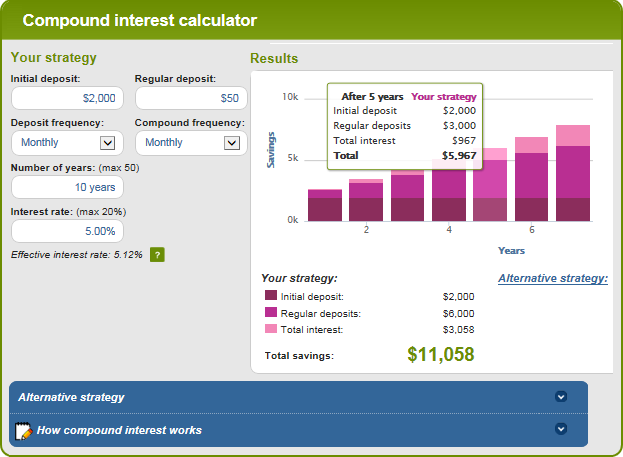

How to calculate fixed deposit interest formula. Longer tenor results in higher interest. The majority of people have no clue about calculating fixed deposit interest or total investment at maturity. That s completely wrong approach. You can input your basic details such as your deposited amount time period and the interest to calculate your returns once the deposit has matured.

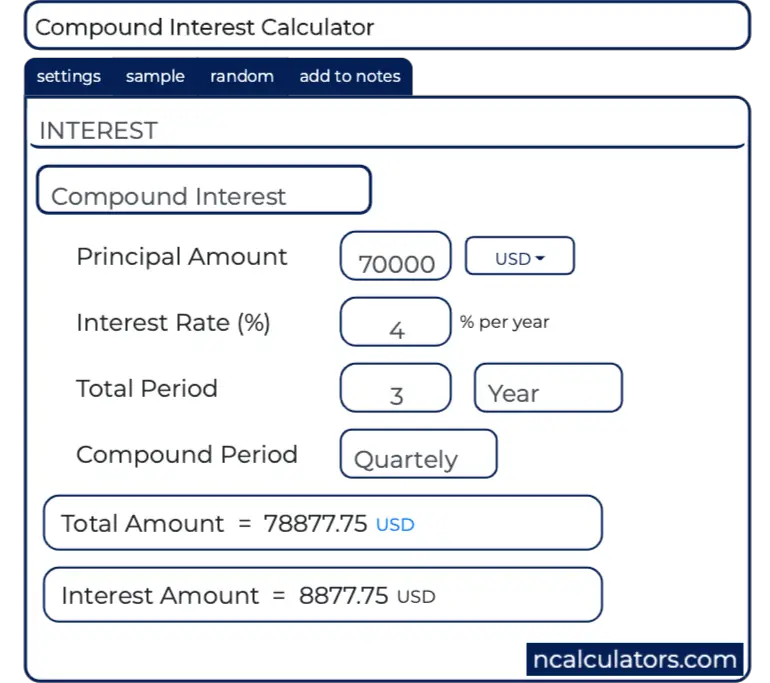

Deposit or principal amount. Higher percentage of interest rate yields greater interest amount. Because people simply use the percentage formula to find out interest earned. Enter the deposit amount in the first field fixed deposit amount enter the interest rate in the next field rate of interest enter the tenure duration the period for which you want fd to be active.

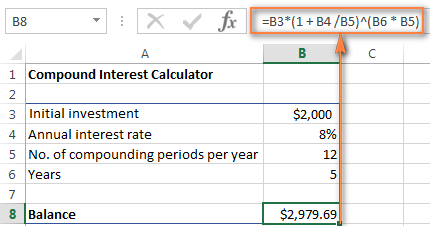

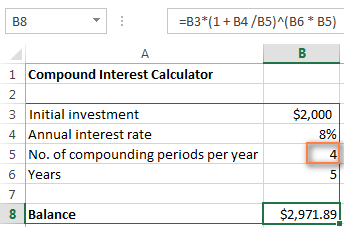

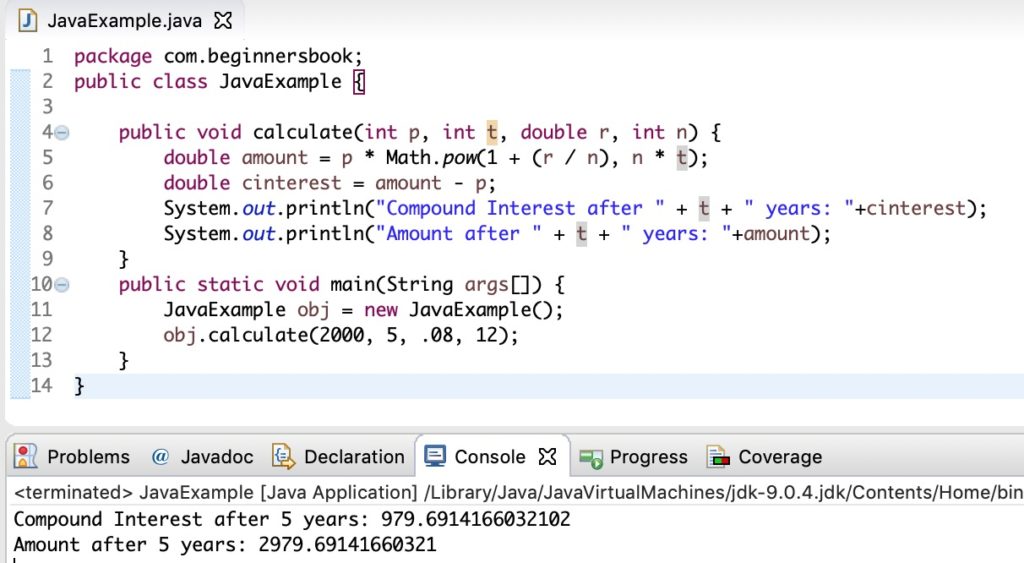

Compound interest formula how to calculate compound interest compounding of interest on fixed deposits explained. Malaysia fixed deposit calculator. Enter the deposit period in months. Enter the initial deposit amount.

A fixed deposit calculator is an online tool that investors can use to calculate their returns mainly regarding maturity benefits. Enter the bank interest rate in percentage. Before starting with the calculator you need to understand a concept of compound interest. Type of deposit cumulative or.

Higher deposit amount means higher interest. This addition of interest to the principal is called compounding.