How To Calculate Epf Dividend

To use the employees provident funds calculator key in the following informations.

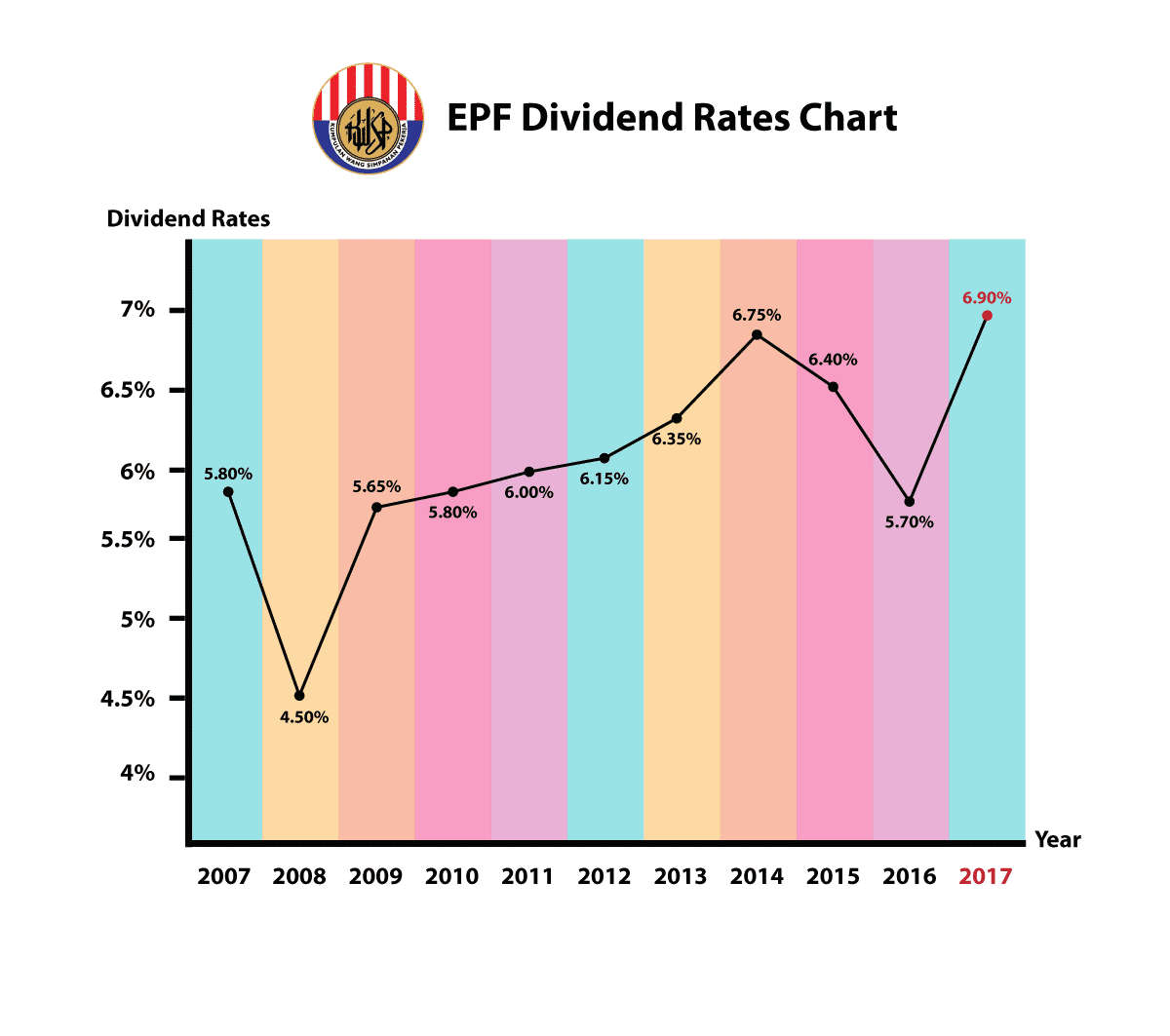

How to calculate epf dividend. The epf by law has a minimum dividend rate of 2 5 but historically has had a much higher rate. For example in 2014 the dividend rate was 6 75. How epf dividends are calculated under section 27 of the epf act 1991 the guaranteed minimum dividend rate is 2 5 per year on members savings. Pro rated monthly dividend 30 of contribution goes to account ii while 70 to account i note.

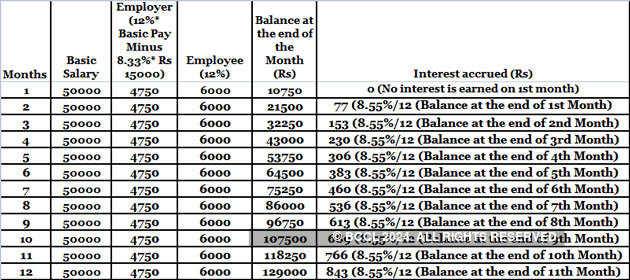

As an example your epf balance as of january was 1 000 and the dividend for the year was 5 65. Monthly contribution start earnings dividend only on the last day of the month irrespective the actual day the monthly. Rounding off to the nearest decimal place the figure comes to rs 4 750. Opening balance of account 1 and 2 from the previous year.

As such members are guaranteed to receive the minimum dividend rate in any situation. Epf dividend calculation epf annual dividend is calculated based on the opening balance of the member s savings up until january 1st each year. Epf s dividend payouts are derived from total gross realised income for the year after deducting the net impairment on financial assets realized losses on listed equity undistributable unrealised gains or losses investment expenses operating expenditures statutory charges as well as dividend on withdrawals. Year and dividend rate.

As for monthly dividends they are credited to the member s account based on the monthly contributions received. Dividend rate net income a x 1 total for a 1 dividend b where a net income. In you have withdrawal key in the date of withdrawal and respective amount in the. Number of days in 2015 365 days account.

Annual compounded dividend year 2015 dividend rate for 2015 6 40 p a. Monthly employer and employee contributions. How is epf dividend calculated. Step 1 record the amount of money in your epf account after every month and the dividend rate for that year.

Click here to use our epf calculator in lieu of the above steps if we use the formula used in method 1 that is 12 of basic pay plus da 8 33 of 15000 we get 12 50000 8 33 15000 4750 50. The epf declares its annual dividend payout based on its net realised income. How to calculate epf dividend. Your epf contributions are deducted from your income tax up to a maximum of rm6 000 per annum.

Investment income non investment income expenses b total for a 1 dividend is based on.