How To Calculate Epf Contribution Malaysia

The epf by law has a minimum dividend rate of 2 5 but historically has had a much higher rate.

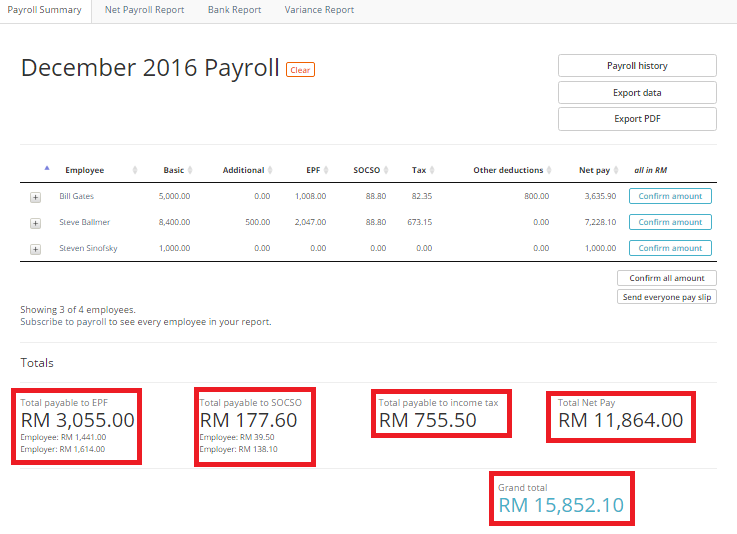

How to calculate epf contribution malaysia. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Kwsp epf contribution rates. Check eligibility check your eligibility. Enter the details and the calculator will do the rest.

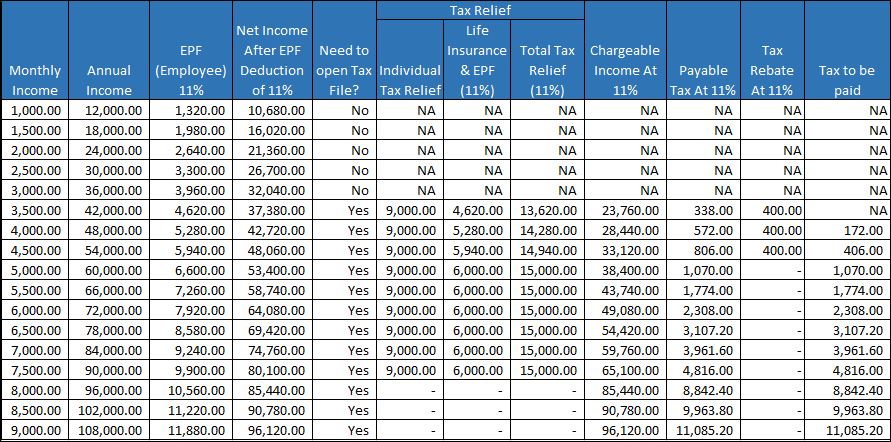

This calculator helps you to estimate your total savings in epf when you retire. For example in 2014 the dividend rate was 6 75. Your epf contributions are deducted from your income tax up to a maximum of rm6 000 per annum. How to calculate malaysia epf step 1.

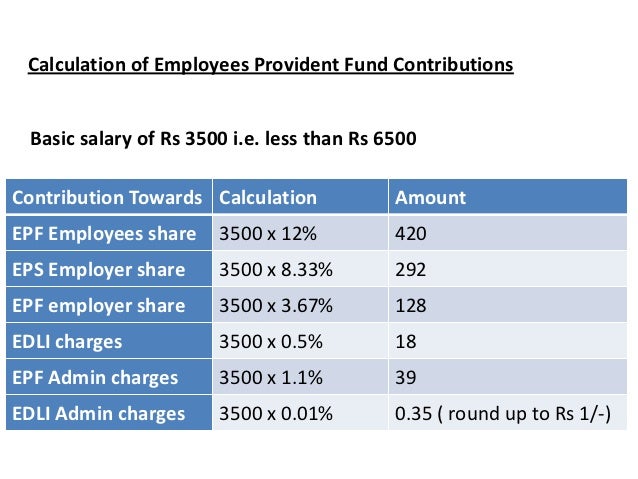

Employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Calculators try out our calculators for all your needs. Minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to 4 per month while the employees share of contribution rate will be 0. Divide the result from step.

Multiply your monthly balance by the yearly dividend rate. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. After the calculation the contribution amount shall be rounded to the next ringgit if the total contribution includes cents. Based on epf dividend of 4 5 per annum.

Record the amount of money in your epf account after every month and the dividend rate for that year. Your estimated epf fund is 622763 upon reaching age 55. You only have 20 years to save. In the example you would multiply 1 000 by 0 0565 and.

For total wages less than rm20 000 basic salary bonus epf employee contribution needs to refer to the third schedule while epf employer contribution will need to be multiplied by the contribution rate.