How To Calculate Effective Tax Rate

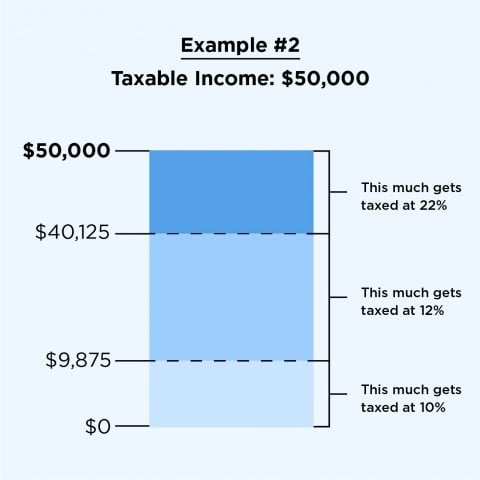

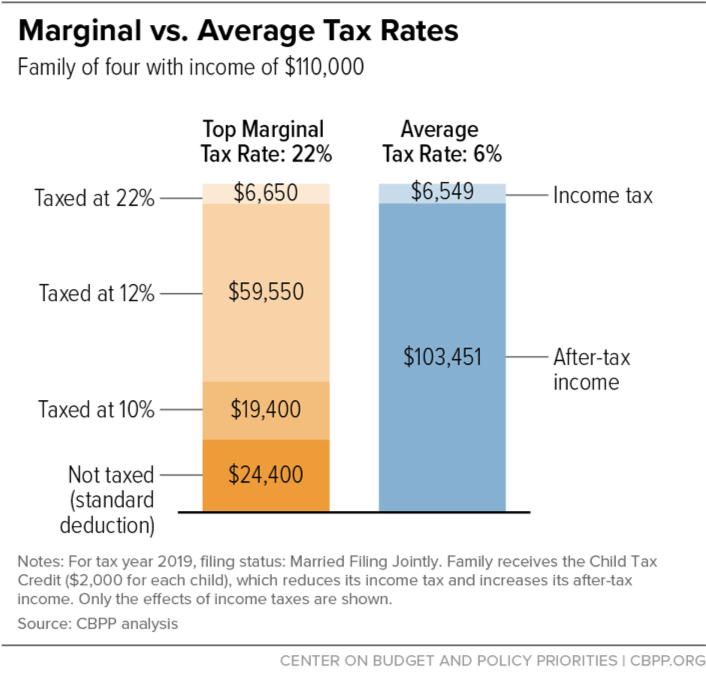

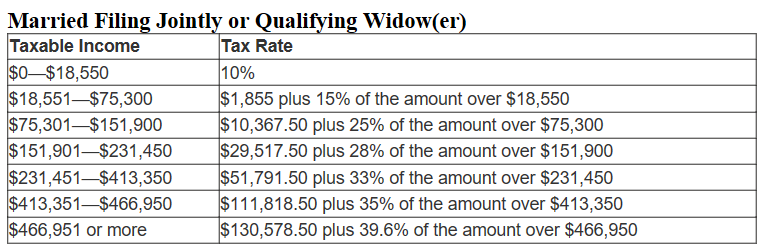

4 372 on the balance over 40 125 up to 60 000 at 22.

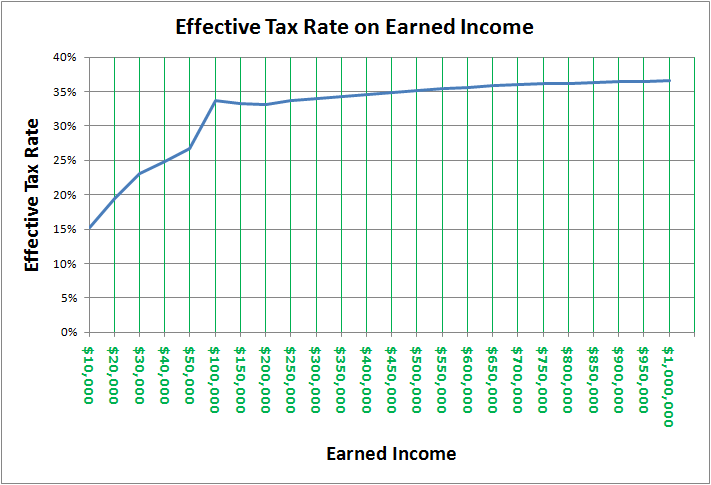

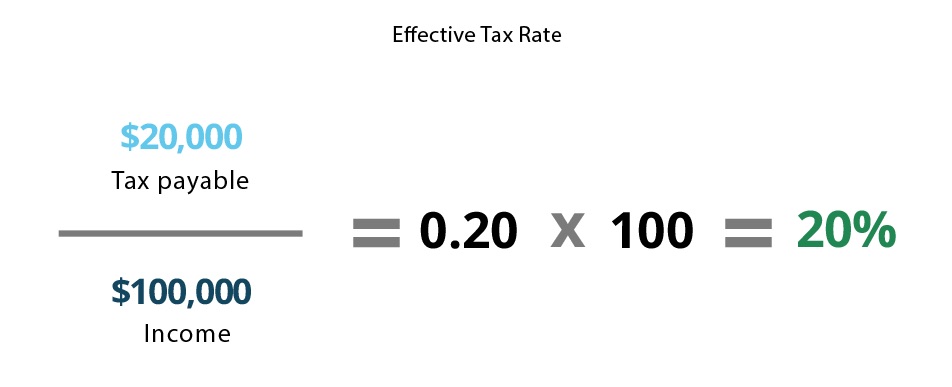

How to calculate effective tax rate. The first thing you should know regarding the calculation of the effective tax rate is that it is based on your taxable income which is your income after the standard deduction 12 200 single. 987 on the first 9 875 at 10. Line 15 on the new form 1040 shows the total tax you paid for this year. Simply divide the income tax expense sometimes called.

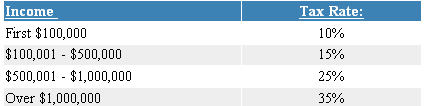

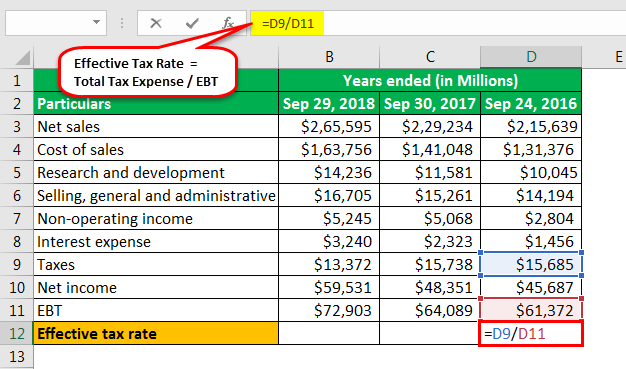

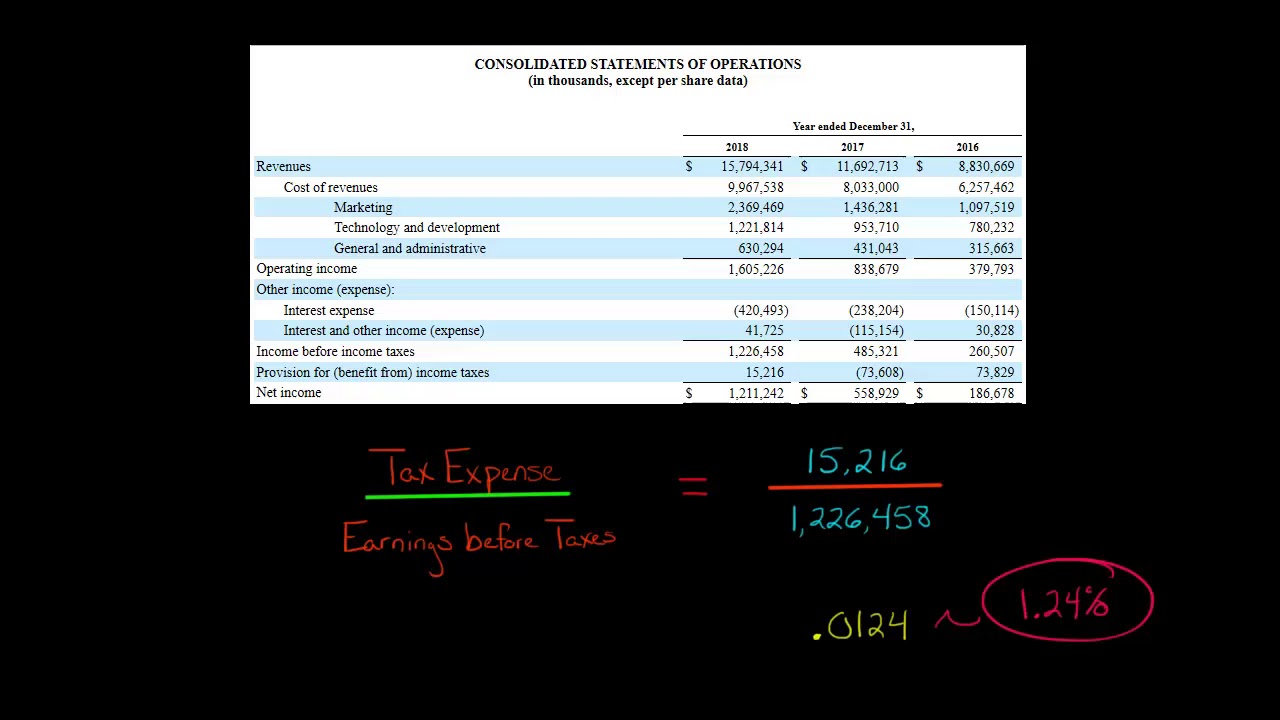

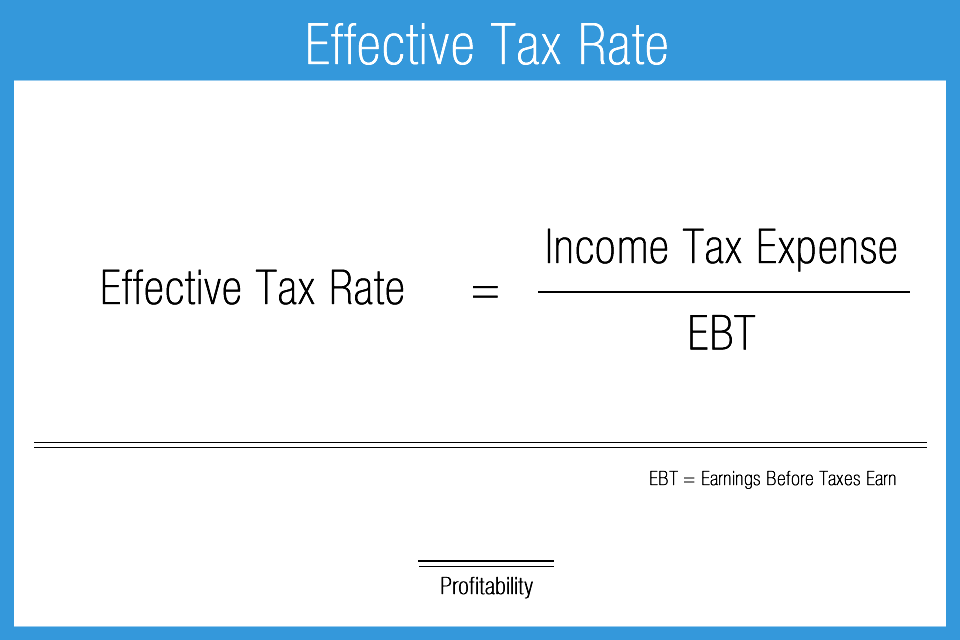

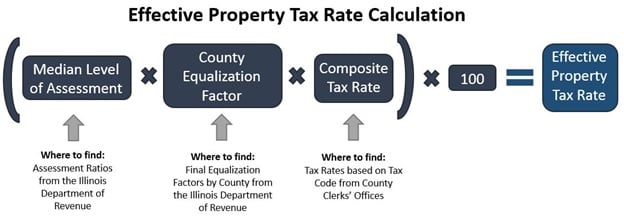

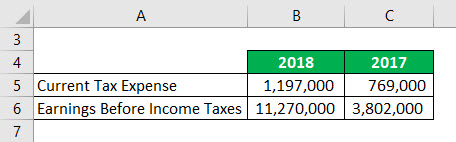

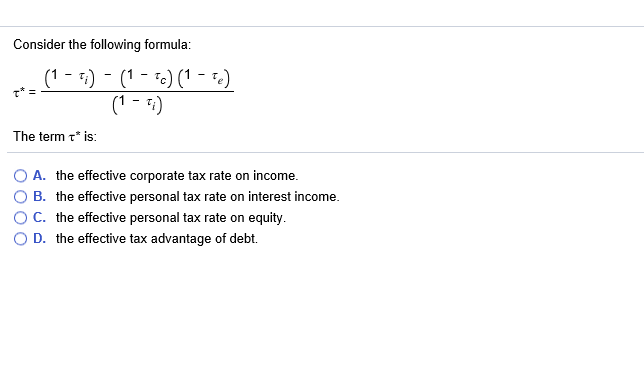

For example if a company earned 100 000 and paid. How to calculate the effective tax rate of a corporation statutory vs. Effective tax rate refers to the average taxation rate for an individual or a corporation wherein for an individual it is calculated by dividing total tax expense by the total taxable income during the period and for the corporation it is calculated by dividing total tax expense by the total earning before tax during the period. Calculating your income tax rate is fairly simple as long as you have all the information in front of you.

Statutory tax rate for corporations is mandated by federal tax law. How to calculate an effective tax rate you can calculate a company s effective tax rate using just a couple of lines on its income statement. 3 630 on your income from 9 876 up to 40 125 at 12.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)