How To Calculate Car Loan Emi In India

Calculate how much emi monthly instalment you will have to pay for your car loan home loan housing loan.

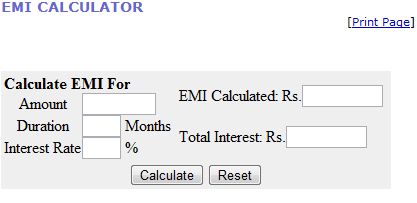

How to calculate car loan emi in india. With the car emi calculator you only need to input the necessary information whether you intend to buy a new car or a pre owned car the sanction loan amount required tenure of the loan interest rate and select calculate. They are also very easy to understand and calculate. The auto loan emi calculator offers you a detailed view of your yearly principal and interest repayment amounts. Easy steps to use emi calculator.

Next select the repayment tenure. This also means that the emi value will change every time you change any of the 3 variables. Select any of home loan personal loan car loan tab. With the help of a car loan emi calculator you.

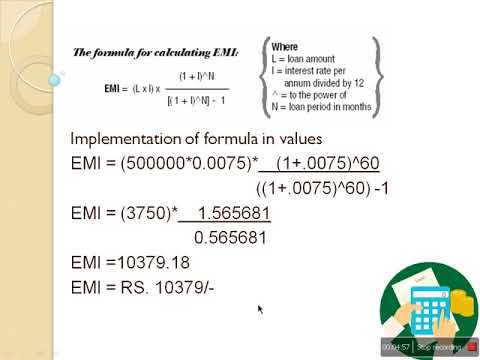

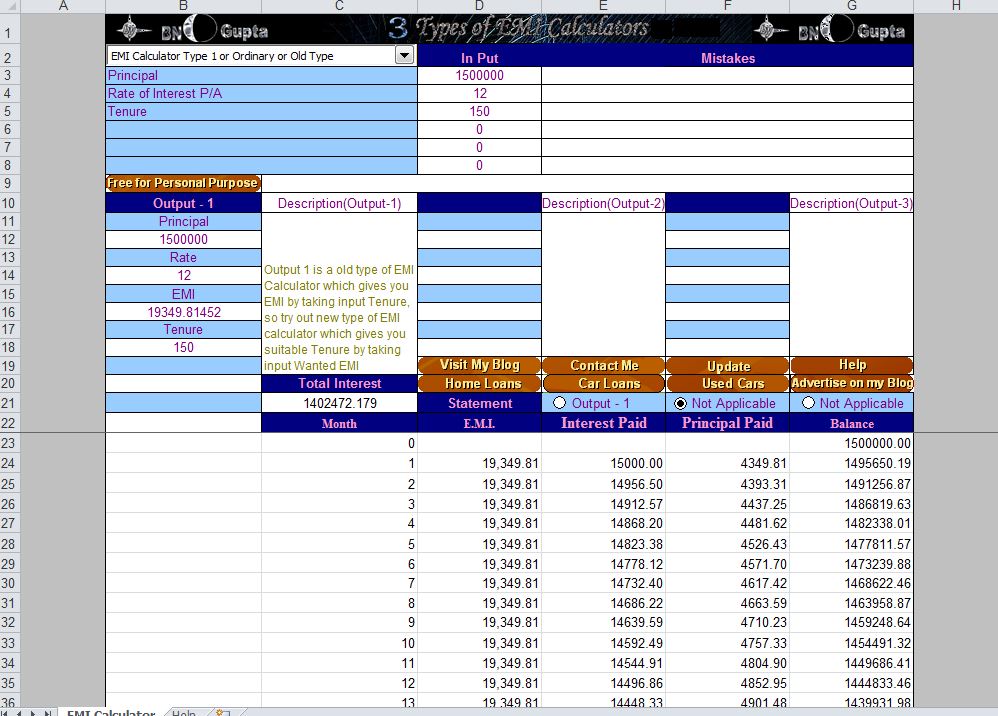

You can calculate your car loan emi on the basis of amount interest rate tenure. Enter principal loan amount in rupees. For example if you borrow 10 00 000 from the bank at 10 5 annual interest for a period of 10 years i e 120 months then emi 10 00 000 0 00875 1 0 00875 120 1 0 00875 120 1 13 493. I e you will have to pay 13 493 for 120 months to repay the entire loan amount.

If you ve finally decided to take out a car loan to purchase your dream set of wheels a car loan emi calculator should help you get your gears into motion. Get a loan up to 100 of ex showroom price. Enter the rate of interest and the processing fee. Whatever the case may be the evaluation of monthly car loan emi using the car loan emi calculator is indispensable.

Enter loan interest rate in percentage. The calculator can be found on the top of this page. Since the crucial decision of opting for a particular car loan scheme depends largely on the emi the emicalculator has become a necessity in order to apply for car loan. The first step would be to select the loan amount.

Use our car loan emi calculator to calculate equated monthly installments for your icici car loan. Process to use bankbazaar s car loan emi calculator. Car loans are extremely popular in india and one of the fastest growing set of loans in india.