How To Buy Shares In A Company Australia

When shares are first put on the market you can buy them via a prospectus.

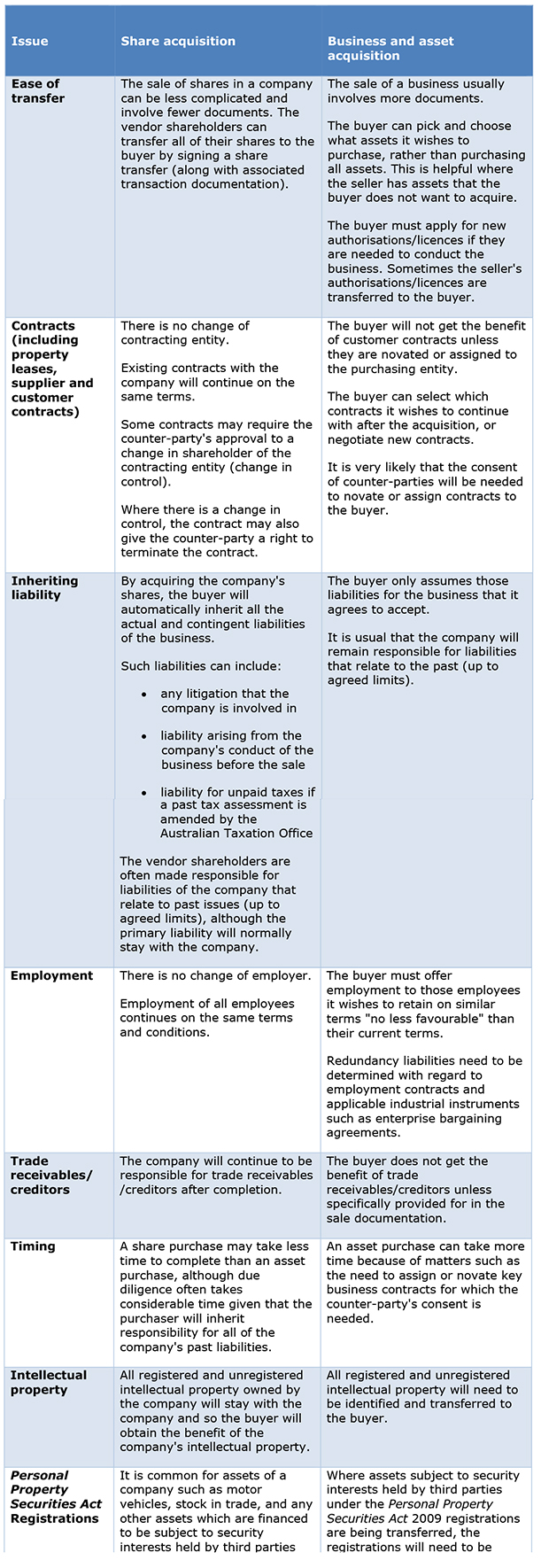

How to buy shares in a company australia. A less direct approach to investing in water could involve buying shares in webster ltd. Depending on the company s constitution and shareholder s agreement the board of directors of the company may be required to convene a board meeting and pass a resolution at the meeting for the company to enter into the sale share agreement. There are four main ways that you can access global shares from australia. Just because you can buy 5 000 shares at 0 20 each with your 1 000 doesn t mean this is better value than purchasing 15 to 20 shares valued at around 60 per share.

Jill is a practice leader at legalvision specialising in the legal needs of startups including business structuring capital raising shareholders agreements and employee share schemes jill has an extensive background in banking and finance law with over 15 years experience at top tier corporate law firms across europe asia and australia she draws on her knowledge in dealing with high. Buy now pay later bnpl shares have been running hot right now with apt both going gangbusters fully recovering from the correction in early 2020. Sign up for an account. Start investing in the stock market today using our 6 step guide.

The second is to enter into contract for difference cfd trading with a broker like etoro. Use an excel. How to invest in international shares. Webster is an australian agricultural company and while it does own the rights to a large amount of water.

You might be uncertain about investing at the moment. Living in australia you have two ways to invest in an international company like tencent. To sign up to a broker in australia you ll need to be at least 18 years old. Ways to buy tencent shares in australia.

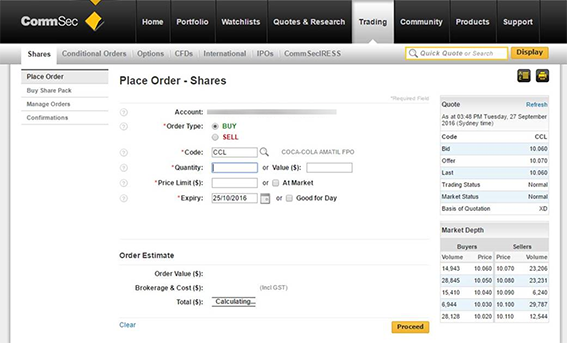

The company s constitution memorandum and articles of association may give other shareholders a right to buy shares that a shareholder proposes to transfer or a right of first refusal which means that the shares cannot be transferred to a third. While penny stocks for example might look cheap at 10 to 20 cents per share a small company with a shaky track record has the potential to wipe out your money fast. Flexigroup asx fxl is a financial services company based in australia. The most common way to buy and sell shares is by using an online broking service or a full service broker.

You can also buy through an employee share scheme or invest indirectly through a managed fund. Broker does it some online stockbrokers provide this for free while most full service brokers will charge a. You do it manually with pen and paper. You can invest directly in shares listed overseas such as facebook and apple.

You have two main options. External software sharesight is free if you own less than 10 shares and it takes care of all dividends.

/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)

/GettyImages-932632502-6ed2a9707d614b8f8d38174664c17cf2.jpg)

/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)