How Much Salary Need To Pay Income Tax In Malaysia

Normally companies will obtain the income tax numbers for their foreign workers.

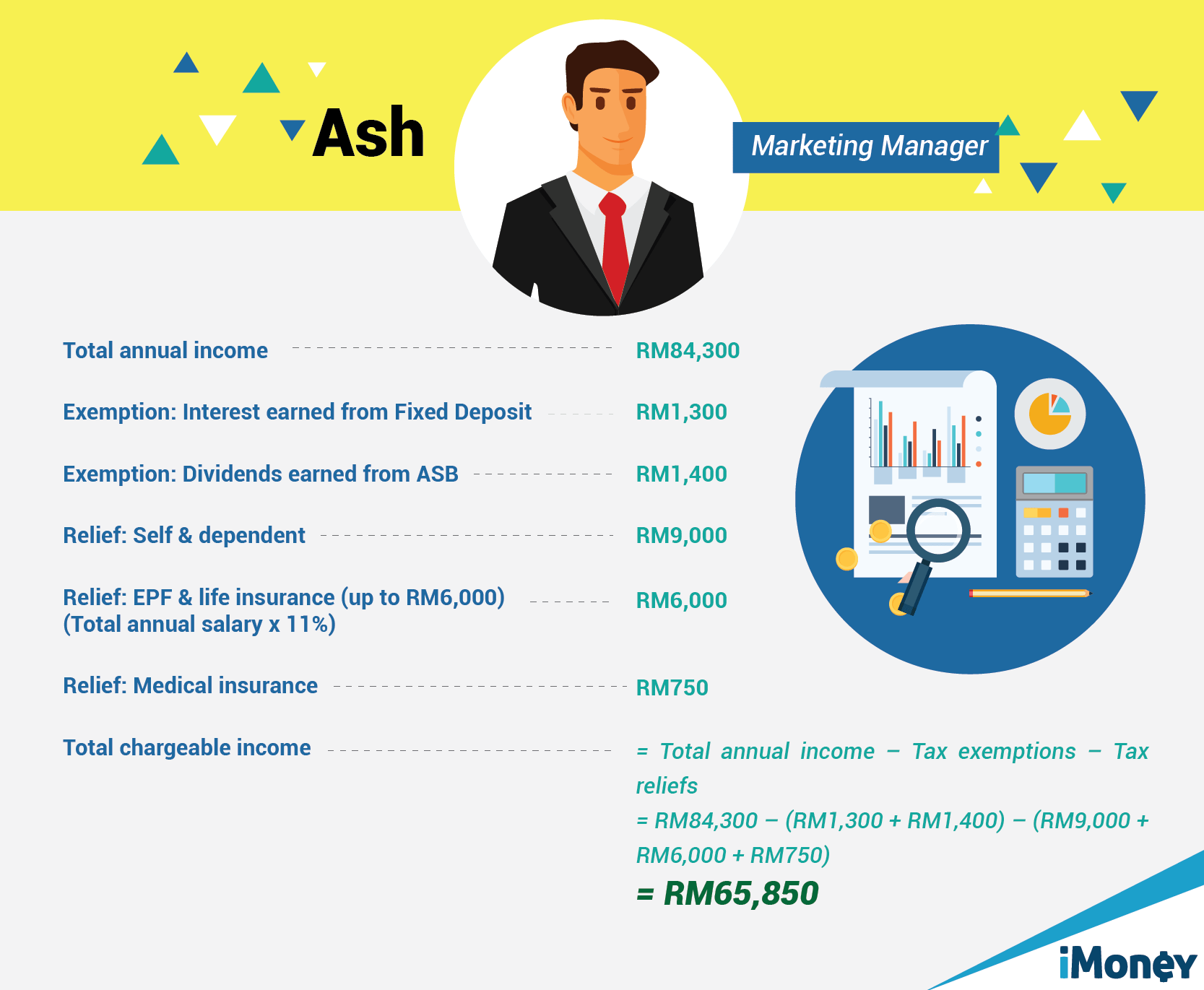

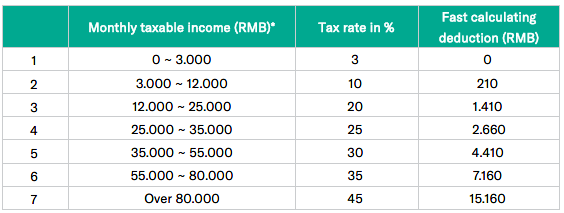

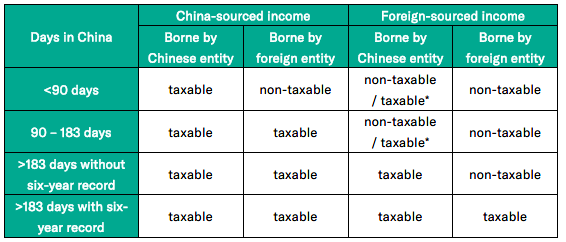

How much salary need to pay income tax in malaysia. Your average tax rate is 15 12 and your marginal tax rate is 22 50. If you re in malaysia for more than 182 days as set out above then you re likely to be considered a tax resident there even if you re away for some time. To file your income tax the expatriate will need to obtain a tax number from the inland revenue board of malaysia irb. Calculate your taxable salary taxable salary gross salary epf epf is equals to your 11 gross salary.

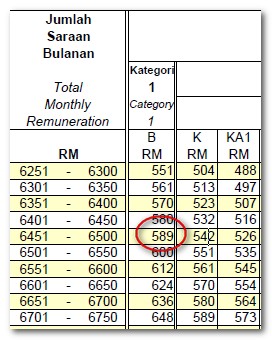

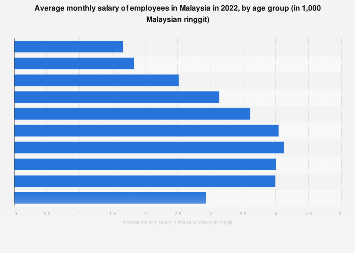

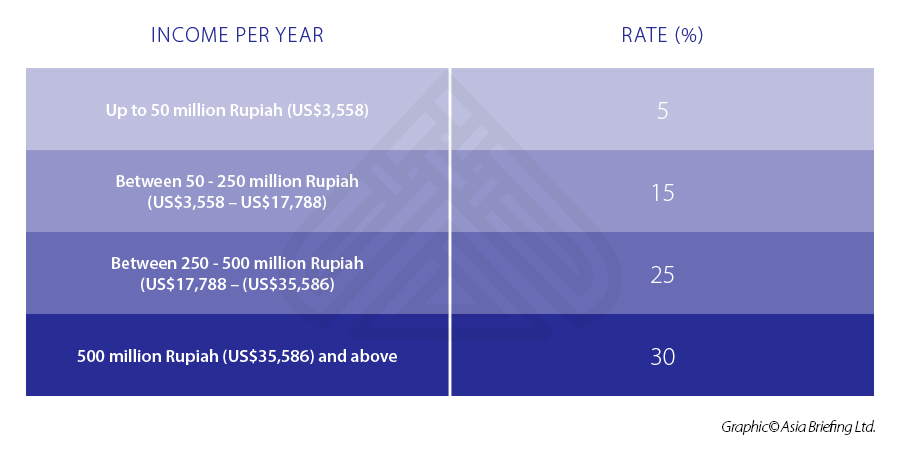

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductionshas to register a tax file. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. That means that your net pay will be rm 59 418 per year or rm 4 952 per month. Nevertheless with effect year 2015 an individual who earns an annual employment income of rm34 000 after epf deduction has to register a tax file.

1 pay income tax via fpx services. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. This marginal tax rate means that your immediate additional income will be taxed at this rate. The fpx financial process exchange gateway allows you to pay your income tax online in malaysia.

Epf deduction is restricted to rm500 only any amount above rm500 is consider lost. First of all you need an internet banking account with the fpx participating bank. In what instances do malaysian residents working abroad need to pay income tax. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. This depends on the circumstances and the local laws wherever you go to work. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582. However if the company has failed to obtain one the worker can register for an income tax number at the nearest irb office.

You don t have to pay taxes in malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside malaysia.