How Does Credit Card Payment Work

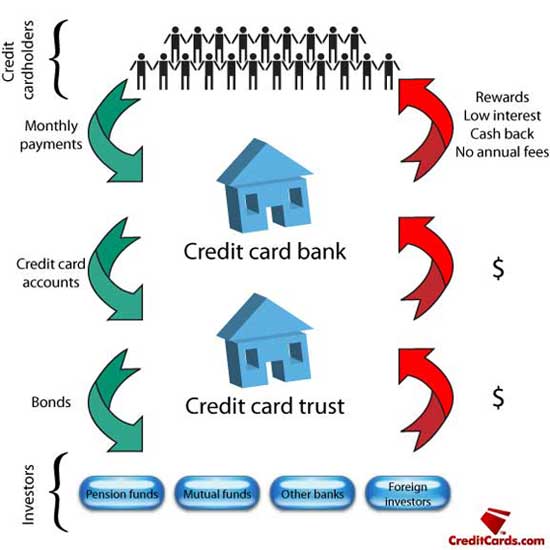

Your credit card issuer will specify the minimum payment you need to make each month as well as a due date for your payment.

How does credit card payment work. Credit cards offer you a line of credit that can be used to make purchases balance transfers and or cash advances and requiring that you pay back the loan amount in the future. If you don t make your minimum payment on time you ll probably face a late fee of about 25 to 35. This is how it works. You can think of a credit card like a short term loan from a credit card issuer.

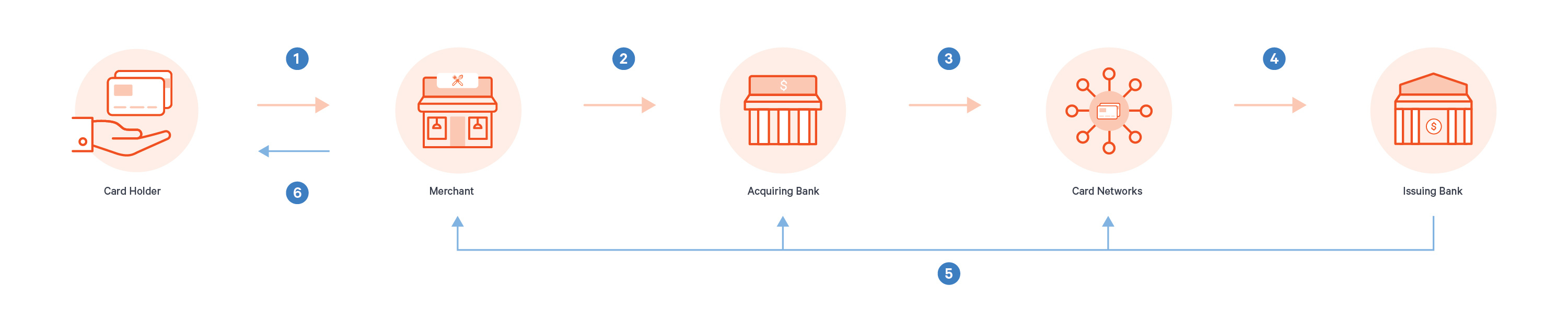

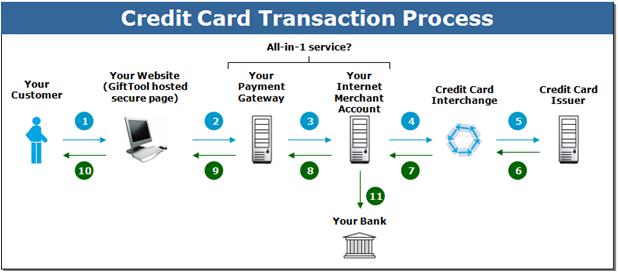

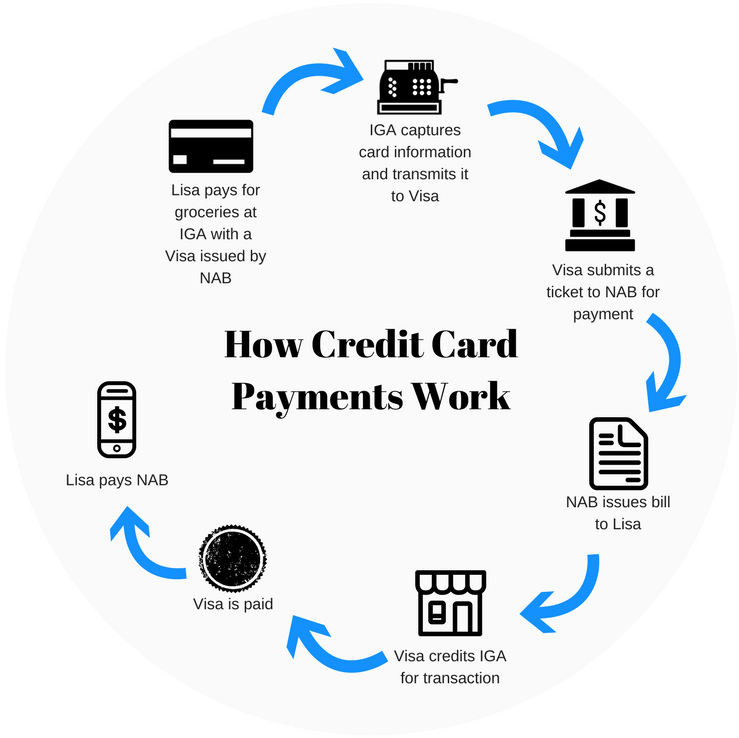

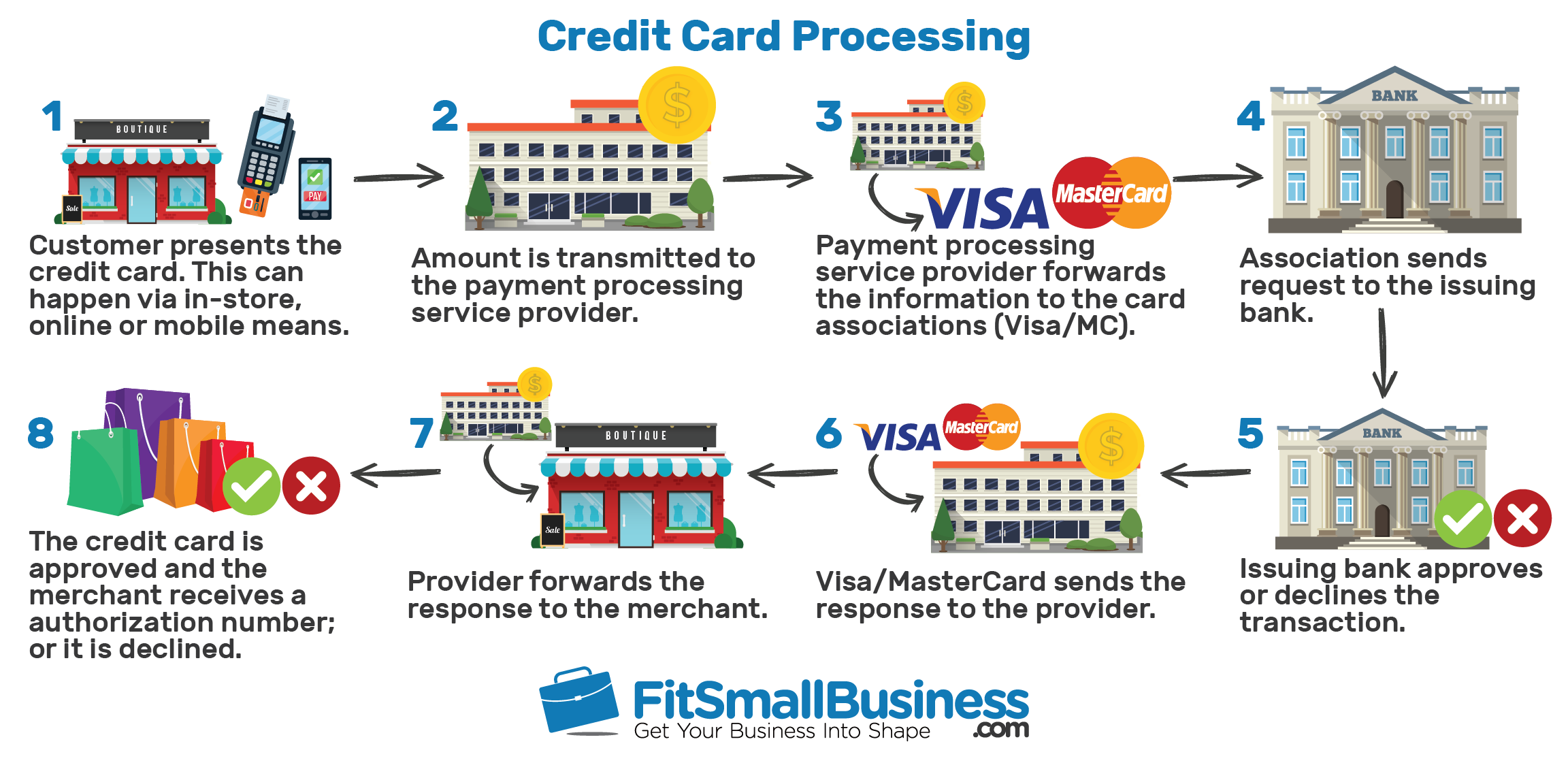

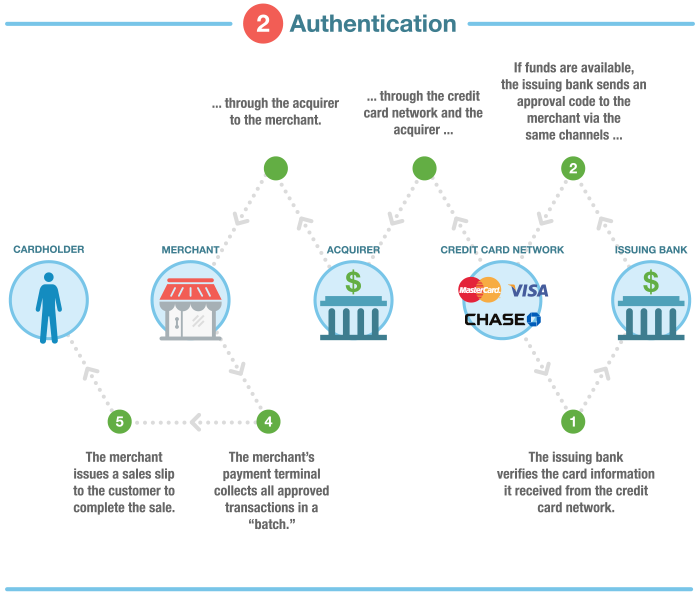

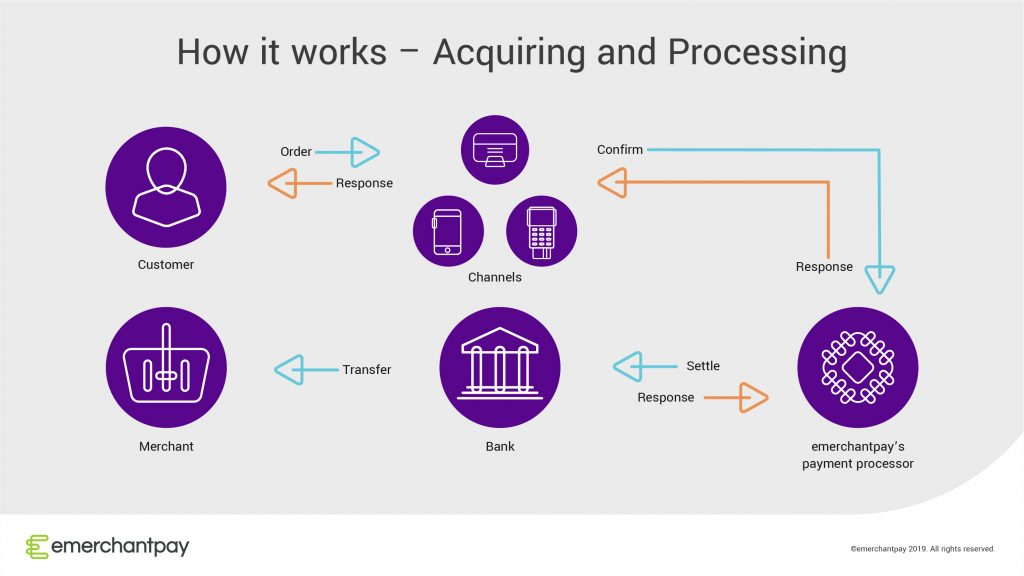

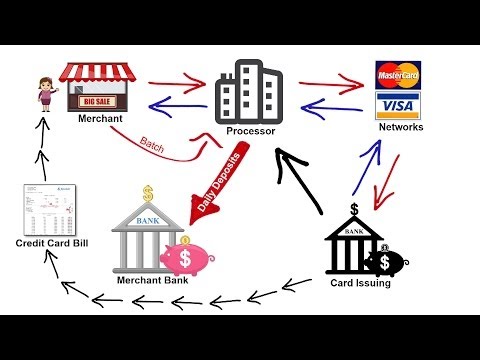

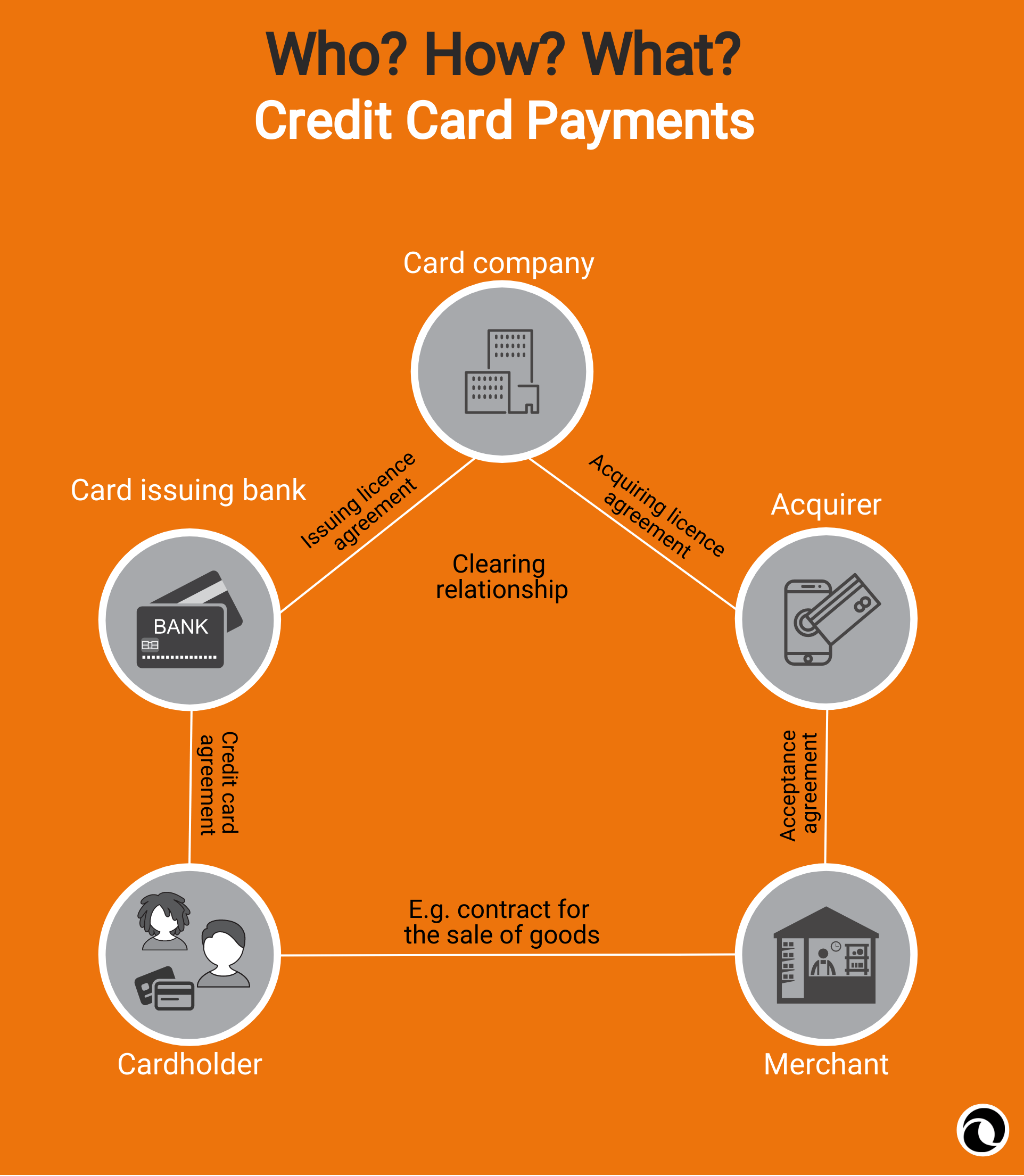

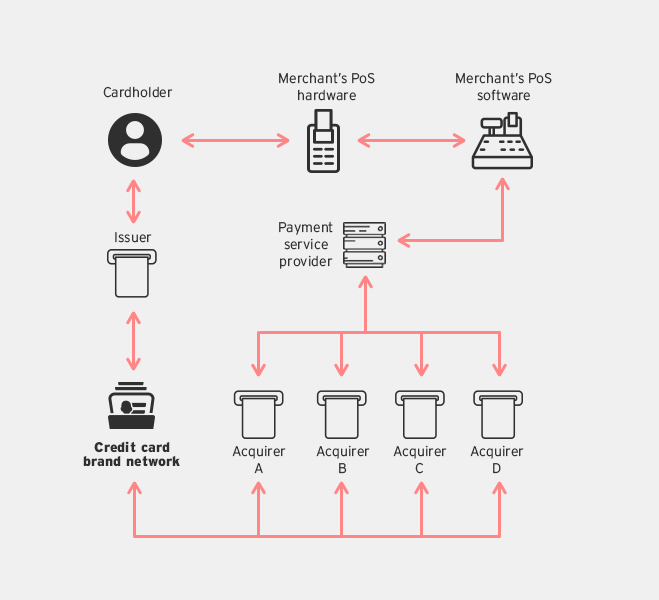

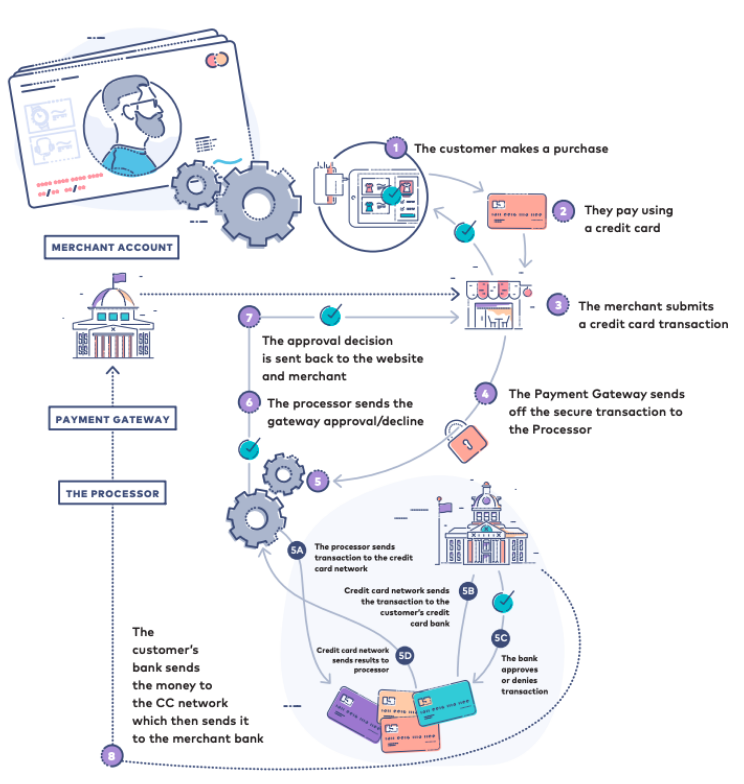

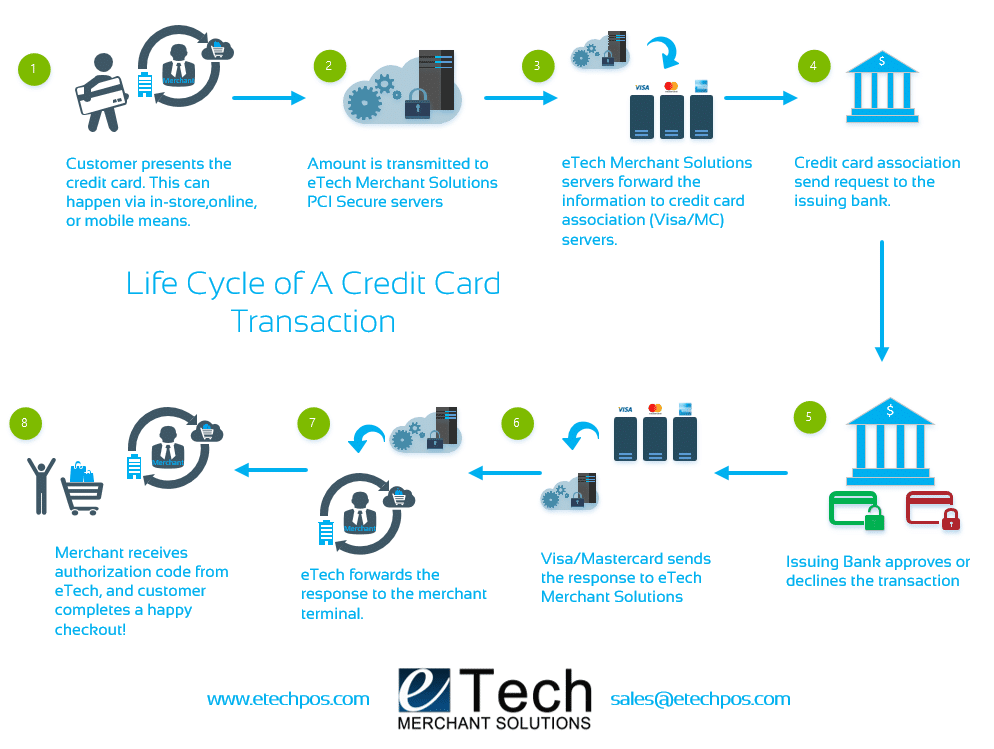

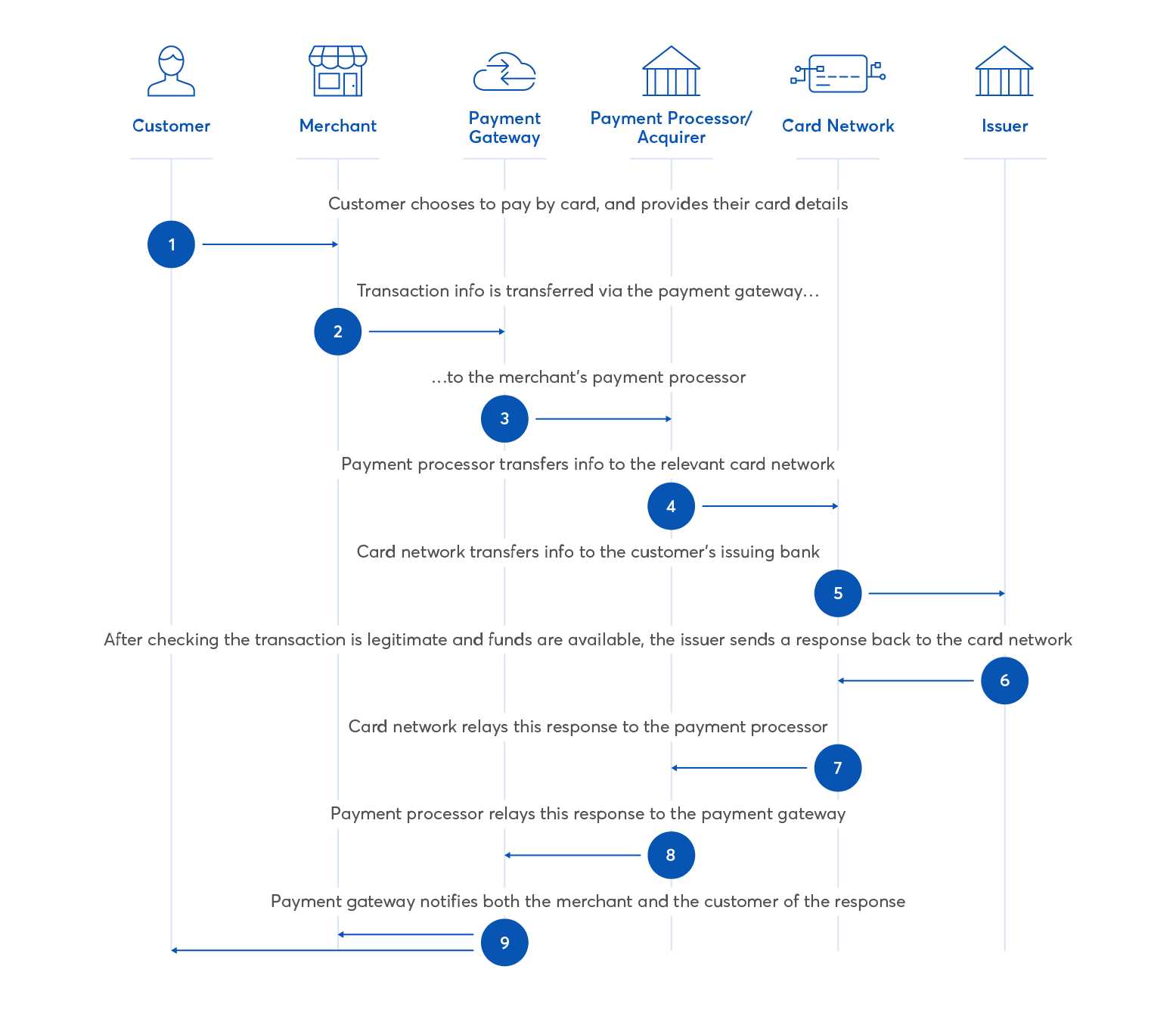

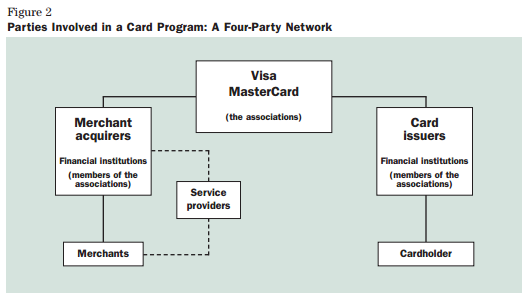

Well wonder no more as we explain the process below. Information is passed from the cardholder and flows through a merchant s processing company and credit card networks to the cardholder s bank. Your credit card company will require a minimum payment from you which usually ranges from 1 to 3 percent of your outstanding balance. Unlike a debit card which takes money from your checking account a credit card uses the issuer s money and then bills you later.

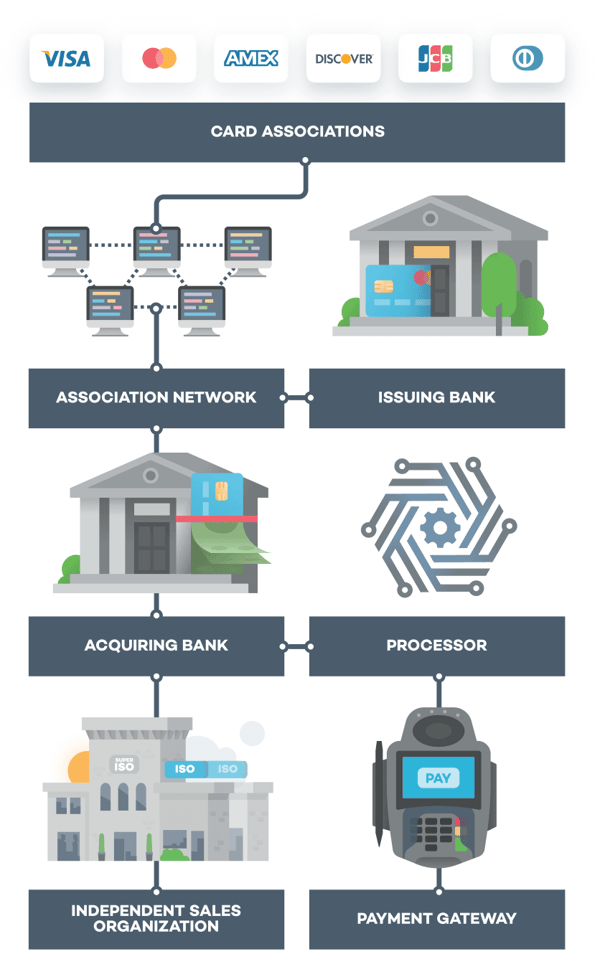

As a credit card holder you agree to certain terms and limits on your borrowing and pay interest on the amount you borrow. This secure and trusted system of card payment processing is where every transaction begins. For example if you have 10 000 in credit card debt your minimum payment will likely be between 100 and 300. Despite taking just seconds to complete credit card processing is an incredibly complex process that involves multiple steps to complete.

By paying at least the minimum and on time you ll build a good credit. This also makes them a stronger ally in cases of fraud. When using a credit card you will need to make at least the minimum payment every month by the due date on the balance.

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)