Housing Loan In Malaysia

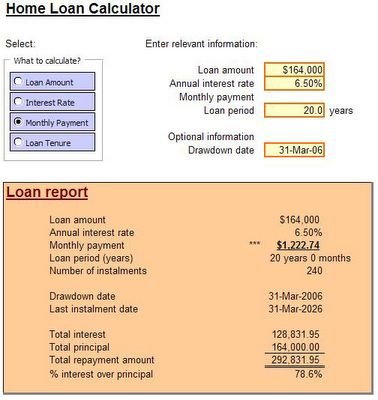

Enter housing loan period in years.

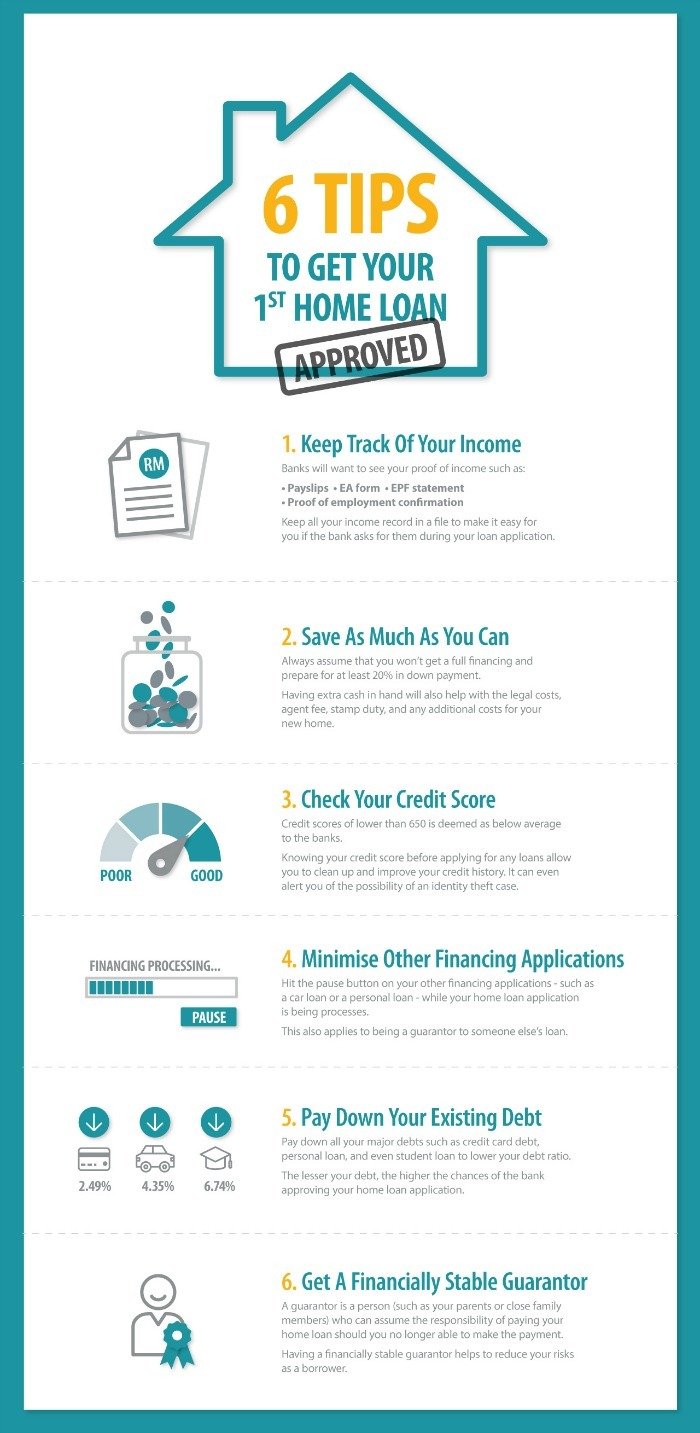

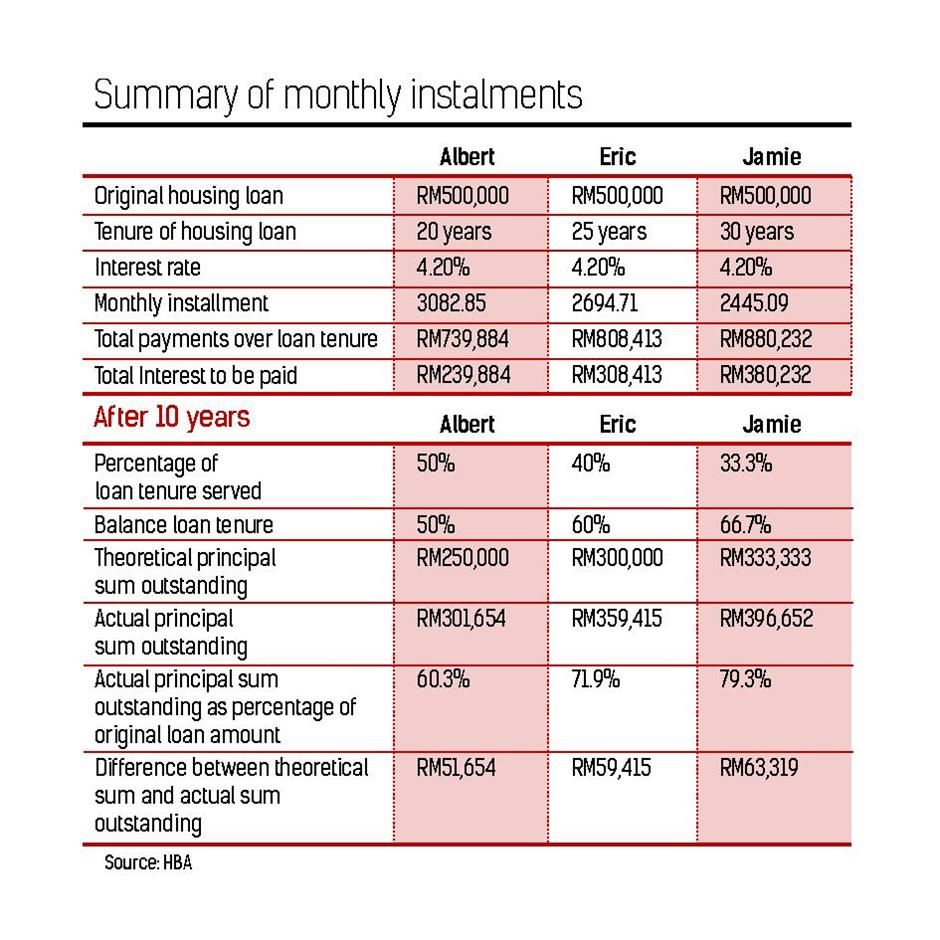

Housing loan in malaysia. The full flexi home save i package which appears with a linked current account is considered the bank s best product. I have a ptptn loan which i m still paying. Home loan interest rate. Making mortgage overpayments and you ll be able to reduce your home loan principal interest and tenure.

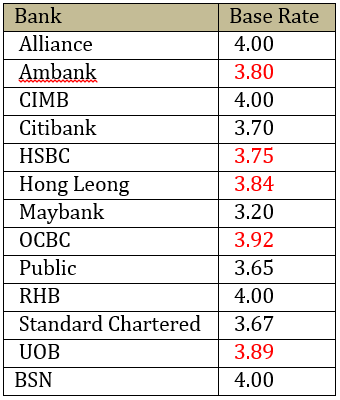

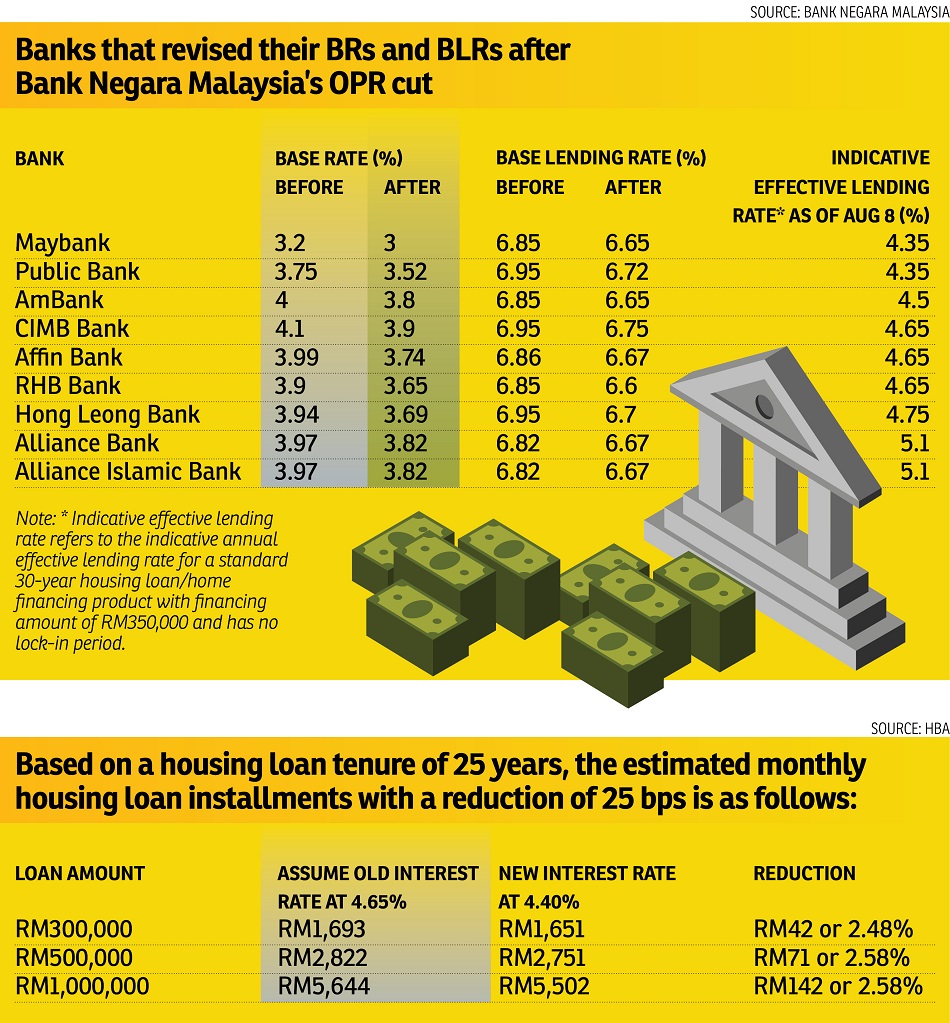

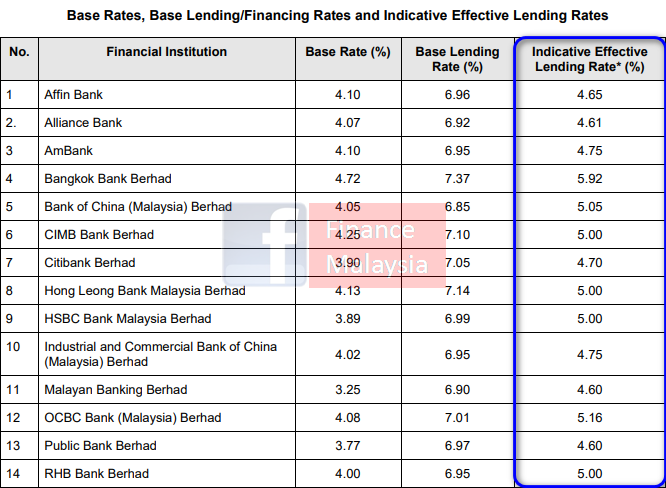

Housing loan eligibility malaysia. Maximum loan amount 90 of property price. Malaysia housing loan interest rates. Base lending rate blr 6 6.

Best flexi housing loans in malaysia flexi loans let you pay money into your home loan whenever you want and withdraw that cash whenever you like. Basic is 3200 with an allowance of rm150. This is my first home. Interest rates for housing loans in malaysia are usually quoted as a percentage below the base rate br.

Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. I have a net 3000 salary. Compare housing loans in malaysia 2020. Compare the cheapest home loans from over 18 banks in malaysia.

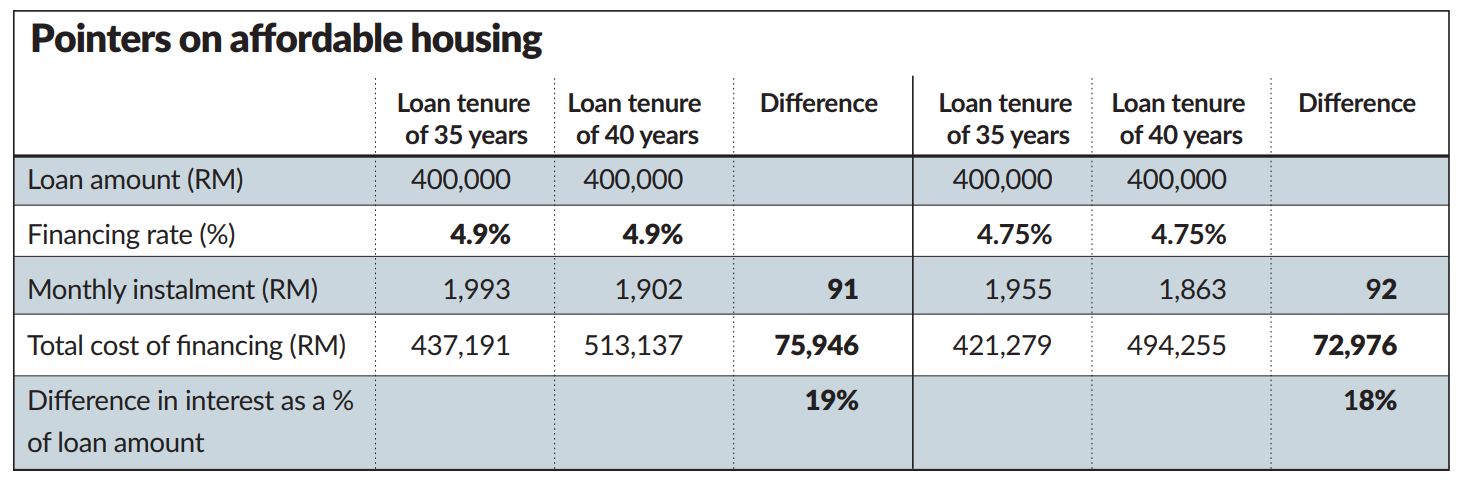

Interest rate as low as 4 15 p a. Terms conditions apply. They re among the best housing loans in malaysia too. A typical housing loan in malaysia would see the borrower making monthly payments for a certain period of time also known as the loan tenure until both the principal amount of the loan and interest are fully paid.

I wish to know am i eligible for a housing loan. Bank fixed rate home loan interest rates. Get interest rates from as low as 4 15 on your housing loan. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45.

Take the time to find a place that suits you. Question for housing loan eligibility. The home loan options provided by public islamic bank are islamic shariah compliant packages. Suitable for new financing and refinancing.

For example if the current br rate is 4 00 update. Enter down payment amount in malaysian ringgit. For the first time home buyer get the home you want up to rm 2 million with mrtt insured home financing. Enter loan interest rate in percentage.