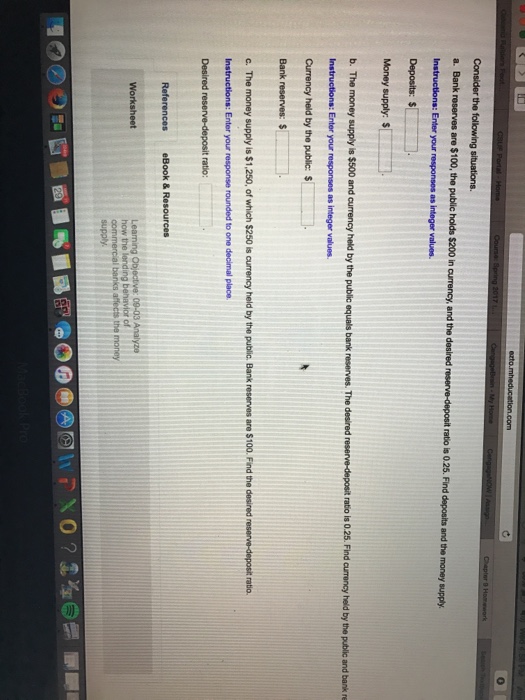

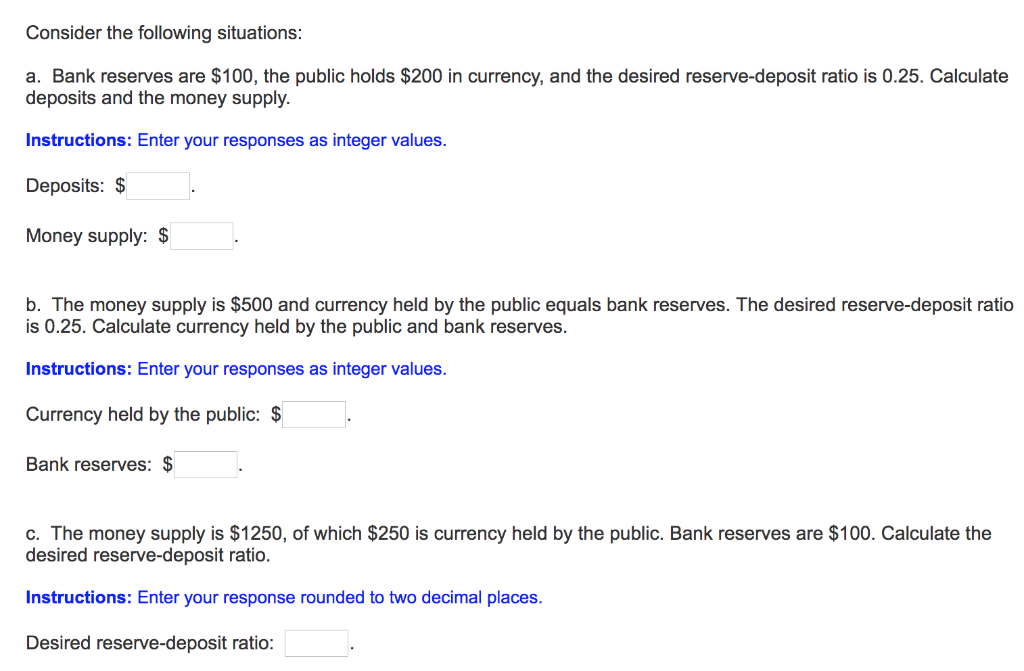

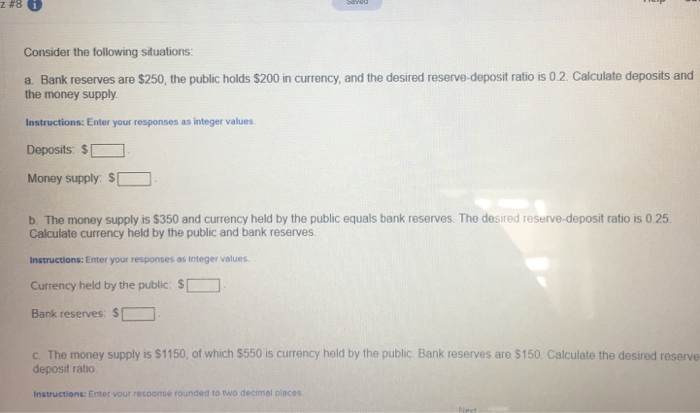

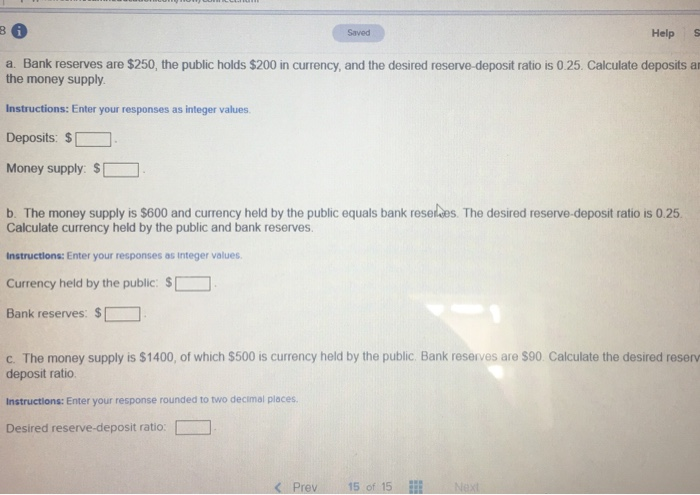

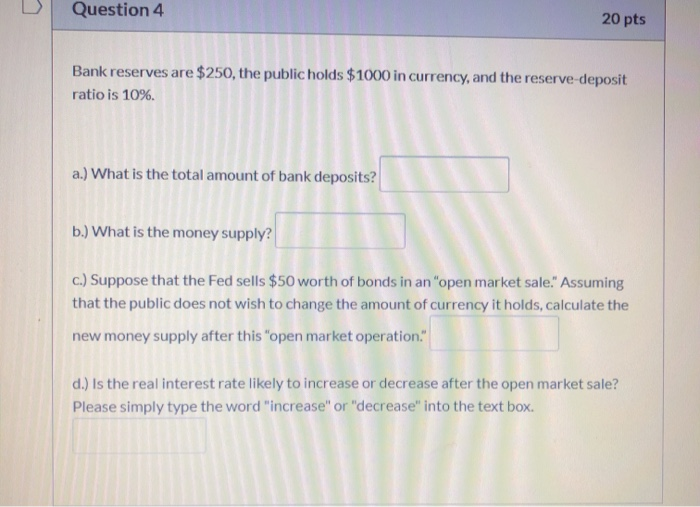

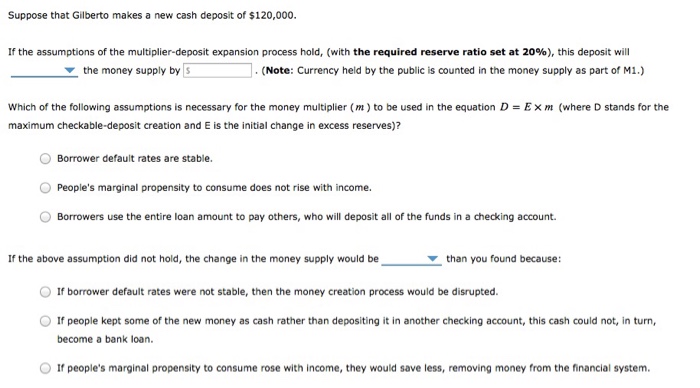

Hold Amount Public Bank

Banks may place nine day holds on checks in the aftermath of natural disasters and other events because the normal check handling process may be subject to disruption and delays.

Hold amount public bank. It might be a routine matter of waiting for a check to clear or the bank might be exercising its right of set off. For example when the checks are government checks cashier s checks or another low risk item the bank should make the first 5 000 available on the next. When a bank places an account on hold it usually does so to protect itself. A visa hold can t last more than 30 days while american express is typically no more than seven days.

Rm2 00 for amount of rm5 000 00 equivalent and below plus cost of advice to agent. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. If the check is particularly large or if it is from out of state then the bank is much more likely to place a hold on it. The teller will usually call the bank that the check is issued from to see if the funds are available.

Consequently banks can place seven day exception holds on checks that exceed 5 000. The money is there but you can t use it until the bank releases the hold. A balance hold on your bank account can prevent you from getting to your money. The bank shall release the amounts on hold of the corresponding card transactions are not presented to the bank for payment within such periods as the bank deems fit it being expressly agreed that the bank shall have the right to place a hold back on to the account and to debit the account if the card transactions are likely to be or are presented for payment subsequently.

To get a balance hold released you must know why the bank initiated it. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Holds are used when the total purchase amount isn t yet known and is not easy to return. Hold ctrl key and press the key to zoom in and to zoom out.

If you deposit more than 5 000 in checks the first 5 000 must be made available according to the bank s standard holding policy but a longer hold can apply to the remaining amount. Merchants set the amount of the hold although they only receive the final transaction. In the case of debit cards authorization holds can. Enter the amount and other details and click add to list.

3 a hold can last for several business days and the amount of time the funds are held varies by bank.

/why-did-they-place-a-hold-on-my-checking-account-2385973-v2-5bc4c05646e0fb0058bbfcc8.png)

:max_bytes(150000):strip_icc()/checking-account-hold-315305-v2-5b73414c46e0fb002c12a554.png)

/checking_account-603705403-5aa1cb8c8e1b6e0036053f34.jpg)