Hidden Cost Of Buying A House In Malaysia

I m just so happy and excited when i receive lots of emails from you guys regarding your investment journeys.

Hidden cost of buying a house in malaysia. There are people who make the mistake of underestimating the affordability of a property before they make a purchase. Upfront cost image credit. The difference of rm10 000 is the deposit which the purchaser pays in cash. Aside from considering whether to make repairs and renovations to the home before selling it you should also consider the cost of selling that property.

There are other or hidden costs involved. About 17 of purchase price is the money you need when buying a house in malaysia. If the house costs rm100 000 for example the loan amount is rm90 000. Setting a price based on the market value helps the purchaser to get a sufficient loan to buy.

The last hidden cost of buying a house in malaysia is assessment tax or in malay called cukai pintu. For the quite rent or cukai tanah it is a once a year thing. Although if you re are lucky you might only need to come out about 14 15 of purchase price as the valuation fee and loan documentation lawyer fees can be financed into the loan. However before you start counting the money you will make from the sale there are a few hidden costs in selling your property.

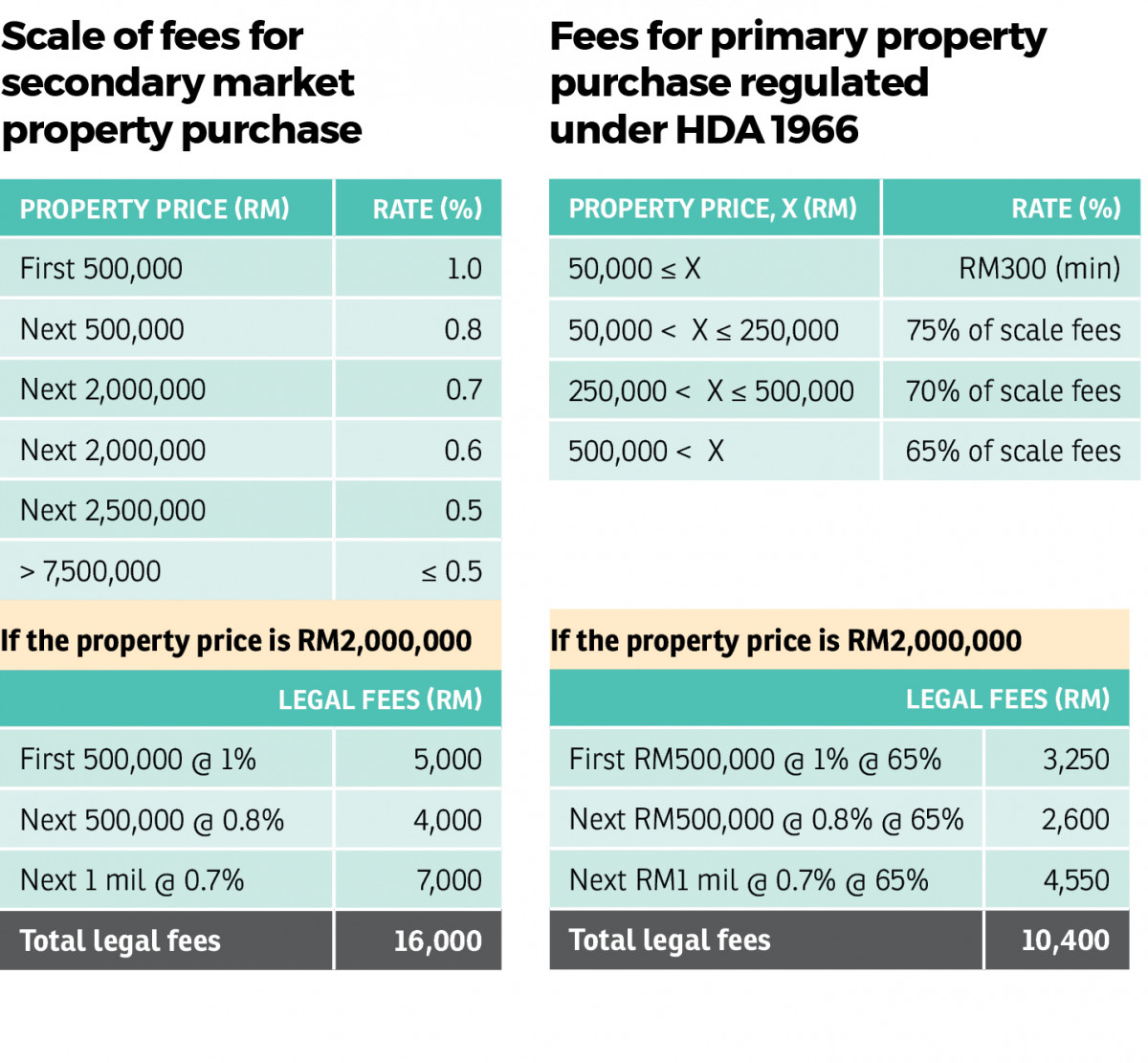

Cost is beared by developer and sellers in most instances. Assessment tax is charged twice a year. In malaysia most banks offer up to 90 of the property s price margin of financing for your first two residential properties. These include lawyer fees stamp duties sales purchase agreement spa fees and valuation fees.

Many home buyers do not anticipate the additional fees involved when buying a property in malaysia. You need to pay assessment tax to your municipal council. However as most of us are still new to this i. The tax will be calculated based on the property market value.

Go and check out the article here. In most cases it is the lack of knowledge regarding the hidden entry costs that causes complications. If you receive that 90 you need to prepare a 10 down payment to cover the rest of the property s price. Hey guys this week video is about hidden cost of buying a house.

When it comes down to the initial payments needed for buying a house the main one that most know about is the down payment price which is 10 of the total purchase price or the difference between the loan amount and the purchase price. So before you walks down that road or even before house hunting you should make sure you have that much of cash.