Gratuity In Malaysia Labour Law

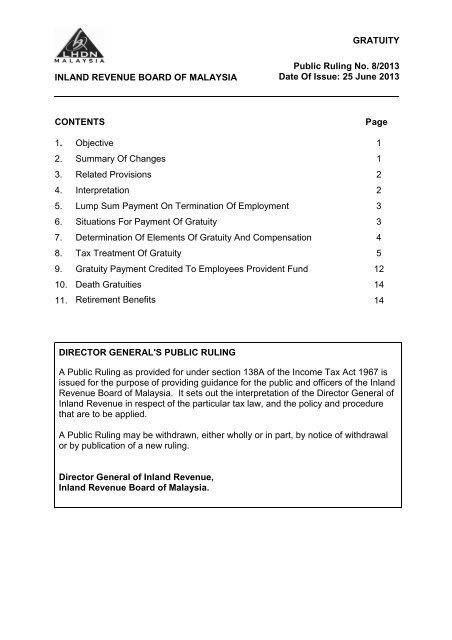

Effective year of assessment 2016 all employment income receivable for any particular period will be taxed in the year the payment is received by virtue of subsection 25 1 of the ita.

Gratuity in malaysia labour law. It is not a mandatory payment under the labour laws and therefore anyone expecting a gratuity should confirm that it is provided for in the contract. Important points to note about gratuity. The payment of gratuity act 1972 has divided non government employees into two categories. Involved in the management custody of gratuity funds.

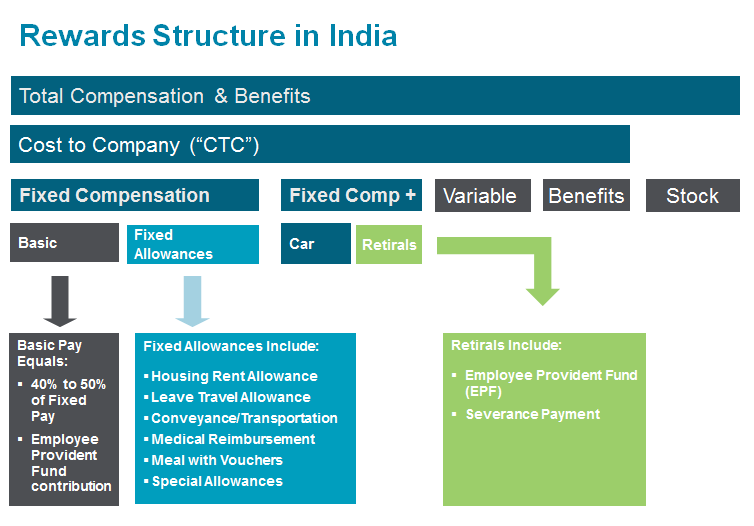

Gratuity is a monetary gift from an employer to an employee. 2 1 2 any employer that had a gratuity scheme prior to the. Iclg employment labour laws and regulations covers common issues in employment and labour laws and regulations terms and conditions of employment employee representation and industrial relations discrimination maternity and family leave rights and business sales in 51 jurisdictions. It is usually paid at the time of retirement but can be paid earlier provided certain conditions are met.

Gratuity is only payable if it is provided for in the contract. Pursuant to paragraph 13 1 a of the ita gratuity is specifically included in the gross income from an employment. If an employee has served between 3 and 5 years he is entitled to two thirds 2 3 of 21 days basic salary as gratuity pay. Employment labour laws and regulations 2020.

The lump sum of rm50 000 is considered to consist of an element of gratuity amounting to rm10 000 as specified by the employer and calculated by reference to the employer s normal rate and practice and an element of compensation for loss of employment of rm40 000. 2 0 the guidelines 2 1 establishing the gratuity fund 2 1 1 consistent with existing agreements between workers labour and employers the payment of gratuity shall continue under the current pension regime. No employer shall during any one month make to an employee an advance or advances of wages not already earned by such employee which exceeds in the aggregate the amount of wages which the employee earned in the preceding month from his employment with such employer or if he has not been so long in the employment of such employer the amount which he is likely to earn in such employment during one month unless such advance is made to the employee.