Government Housing Loan Malaysia

There are a variety of government loans malaysia has to offer from banks to cooperatives conventional loans to islamic loans and secured loans to unsecured loans.

Government housing loan malaysia. Malaysia housing loan interest rates. These are the criteria to apply for a government glc personal loan. Base lending rate blr 6 6. Lppsa offers 7 types of loans to eligible civil servants.

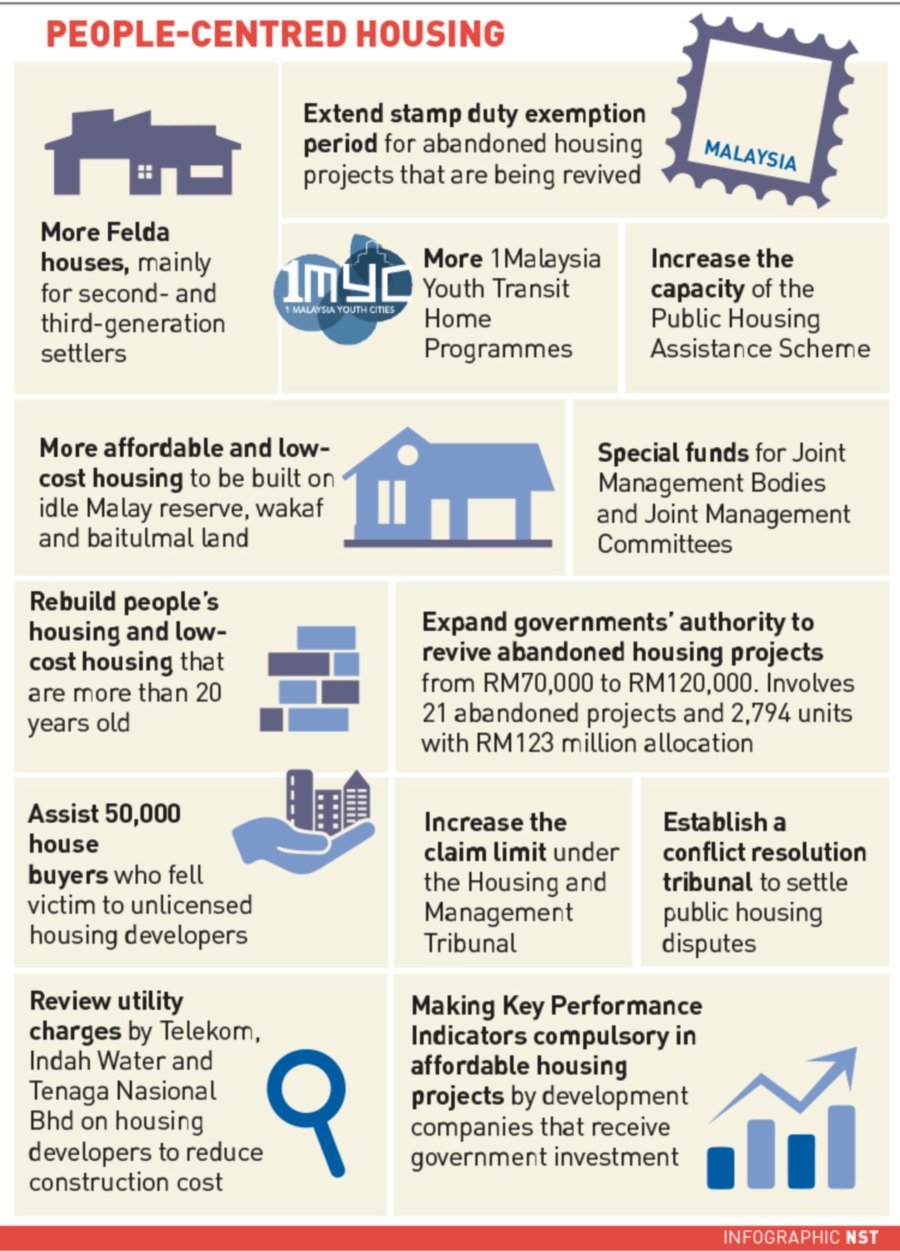

Part finance the purchase of your dream home via murabahah no lock in period no compounding profit and no penalty for early settlement. Established by the ministry of finance malaysia the lppsa formerly the housing loan division bpp was fully functional by the 1 st of january 2016. This facility also extends to employees of statutory bodies and local authorities. Who can apply for government loans.

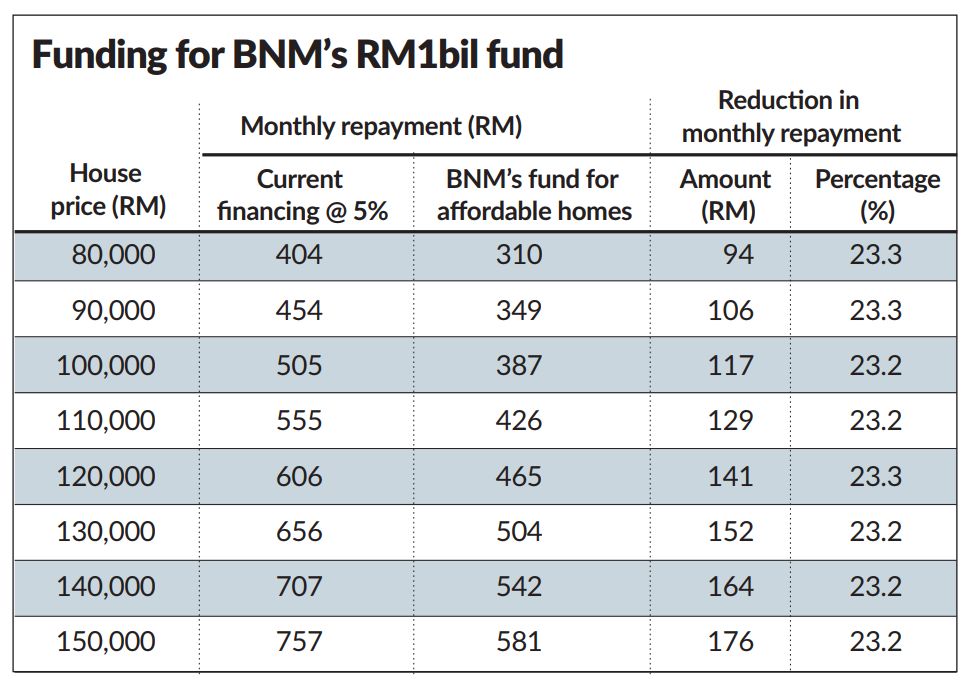

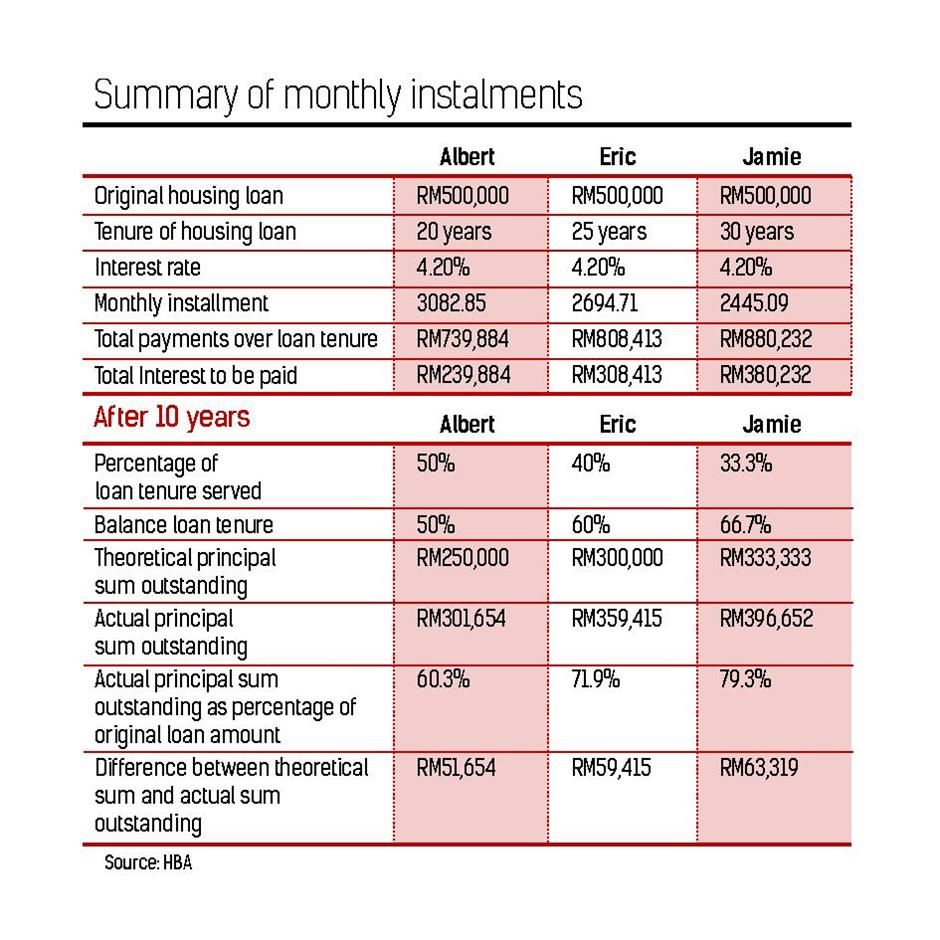

That scheme sources said should be looked at from the perspective of affordability. The amount of loan approved is based on the loan eligibility house price amount applied outstanding bank loan market value whichever is the lower. Purchasing a completed home or residential lot. You must have a minimum monthly gross income of rm1 000.

Interest rates for housing loans in malaysia are usually quoted as a percentage below the base rate br. To enjoy the benefits and use of the gehs services which include enrolment support education on credit health and assistance on how to rehabilitate an impaired credit record members should first enrol by clicking here. If you are employed by the federal and state governments chances to be approved are very likely. Enter down payment amount in malaysian ringgit.

For first time home buyers or those who don t earn much you can still make your dream of owning a house a reality. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45. You have to be a glc employee or a public sector employee. Government servants are entitled for government housing loans.

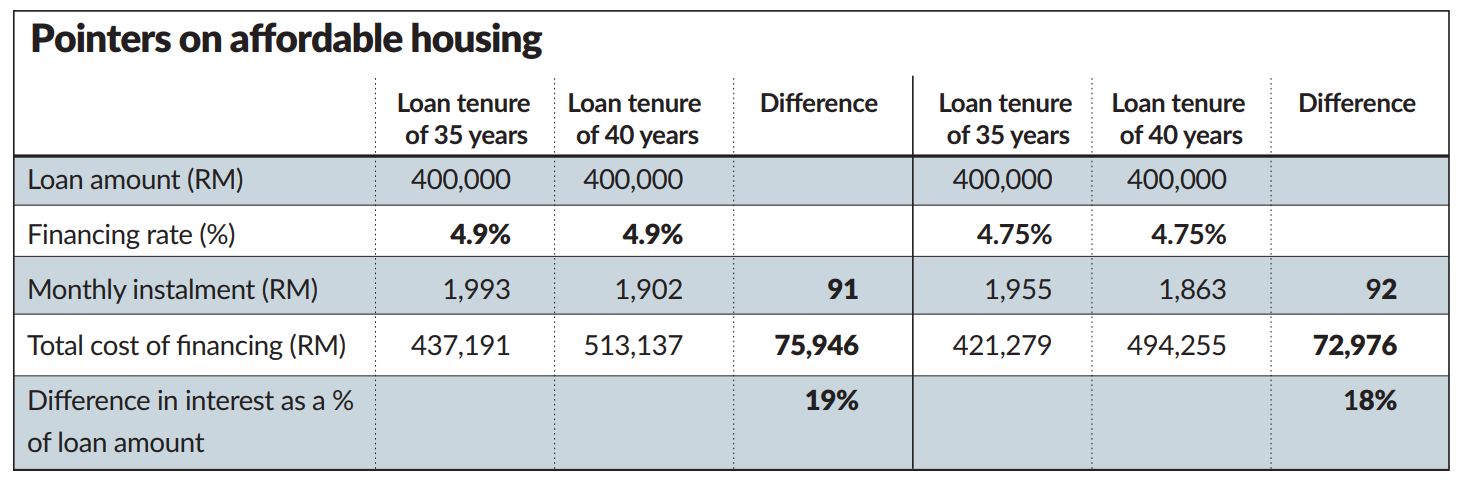

A 40 year housing loan is currently offered to buyers of affordable houses under a bank negara scheme that was announced in budget 2019. Enter property price in malaysian ringgit. No processing fee competitive profit rates and low monthly payments bsn ensures that you can move into your new home with peace of mind. You have to be 18 to 60 years old upon loan maturity.

For example if the current br rate is 4 00 update. Enter housing loan period in years. Government loans are meant for those working in the government sector only. Generate principal interest and balance loan repayment table by year.

Building a home on your own plot of land. Shop around for the best home loans or check out our list of government. This is done under the umbrella of the government employees housing scheme for which sa home loans is the home finance partner. Loans offered are as follows.

Some banks do offer government loans to the employees of statutory bodies police army and in some cases government.

/nuprop-production/b5e09bd7db25ebca744d9565e251b188_1200_630.jpg)