Funding Societies Malaysia Lowyat

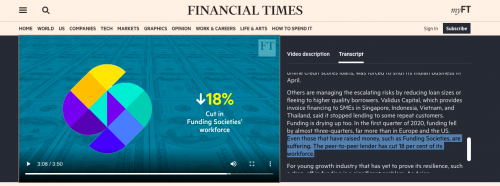

The most obvious reason is that funding societies is the first and largest p2p lending platform in malaysia.

Funding societies malaysia lowyat. Funding societies was launched in february 2017 as the first p2p operator in malaysia. It had successfully disbursed more than rm2 billion in aggregate regionally with a low default rate of below 1 5 across the region. The tenure of financing is also relatively short between 1 to 12 months. New to crowdfund talks.

It does not fall under the jurisdiction of bank negara malaysia. Funding societies do themselves vet through the various sme issuers through its rigorous and rigid scorecard based risk assessment. Meet ask questions and learn alongside alternative investment platforms investors and beginners. Sign up to invest at funding societies.

We pride ourselves with speed and flexibility offering the widest range of term loan trade finance and micro loan products. I wanted to try my hands at p2p lending by signing up with two of the more well known platforms fundaztic and funding societies. Therefore financing products of funding societies should not be constructed as business loan sme loan micro loan term loan or any other loans offered by banks in malaysia and it is to be deemed as an investment note as defined in the guidelines on recognised markets. Funding societies is a p2p financing platform registered with securities commission malaysia.

As smes are the backbone of our economies we are committed to solving the sme financing gap in the region while providing a convenient and short term fixed income investment option to individuals and. Funding societies is the leading peer to peer lending platform in southeast asia. To date their default rate stands at 1 14 which is relatively decent in my books. Welcome to the community.

The p2p lending space in malaysia has seen exponential growth with 2 000 funding campaigns run across the six licensed players in 2018 which was a 300 increase compared to 2017. Default rates are currently at around 1 5 across the countries funding societies operate in indonesia singapore and malaysia. Why i choose funding societies. As i write funding societies had progressed as they had funded a total of rm 643 71 million to local smes.

Thus if you are interested in investing via funding societies you may sign up via the link below. About funding societies launched in 2015 our mission is to uplift societies in southeast asia by creating financial opportunities for everyone. We specialize in all forms of short term financing for smes crowdfunded by individual and institutional investors. For local smes in malaysia as of december 2017 they had successfully funded rm18.

Here are some links to help you get started. Since its launch funding societies has crowdfunded rm 310 8 million regionally malaysia singapore an indonesia.

%20One2Pay_Lowyat.jpg)