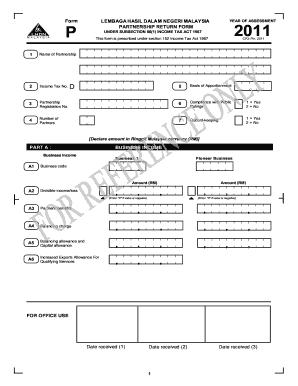

Form P Partnership Malaysia

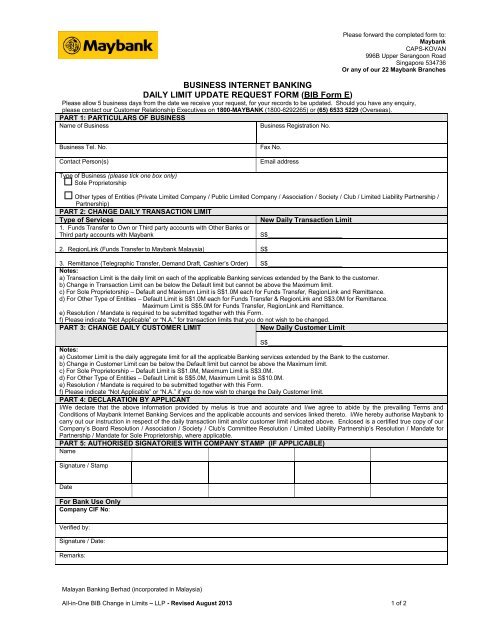

The registration of a local business can be completed at any of the ssm offices but investors also have the option of registering it using an online portal the ezbiz online services.

Form p partnership malaysia. In a partnership there are at least two partners or owners and a maximum of 20 owners. They differ because partnerships are to either have self created partnership agreements or be governed by the partnership act 1961. The form cp30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. A partnership in malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the ssm by following the above mentioned rules.

The precedent partner is responsible for filling out the form p and issuing the form cp30 to each and every partner. The form cp30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. It can be established on a small scale making it a viable option for start ups. 6lpso orj lq wr p 7d ludv jry vj iru rxu exvlqhvv wd pdwwhuv xvlqj rus3dvv lwk hiihfw iurp 6hs rus3dvv frusrudwh gljlwdo lghqwlw iru exvlqhvv zloo eh wkh rqo phwkrg iru rqolqh exvlqhvv wudqvdfwlrqv zlwk wkh ryhuqphqw i rx kdyh qrw uhjlvwhuhg.

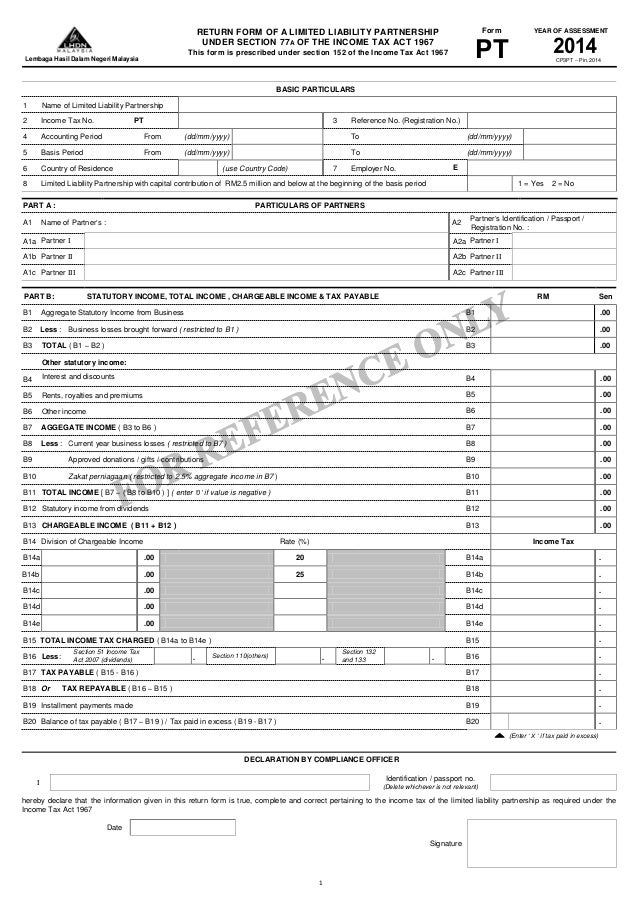

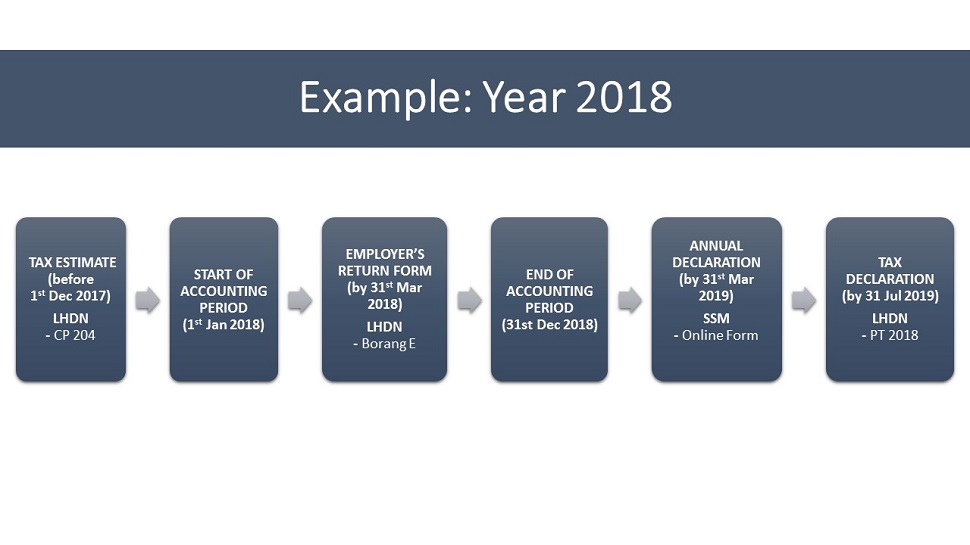

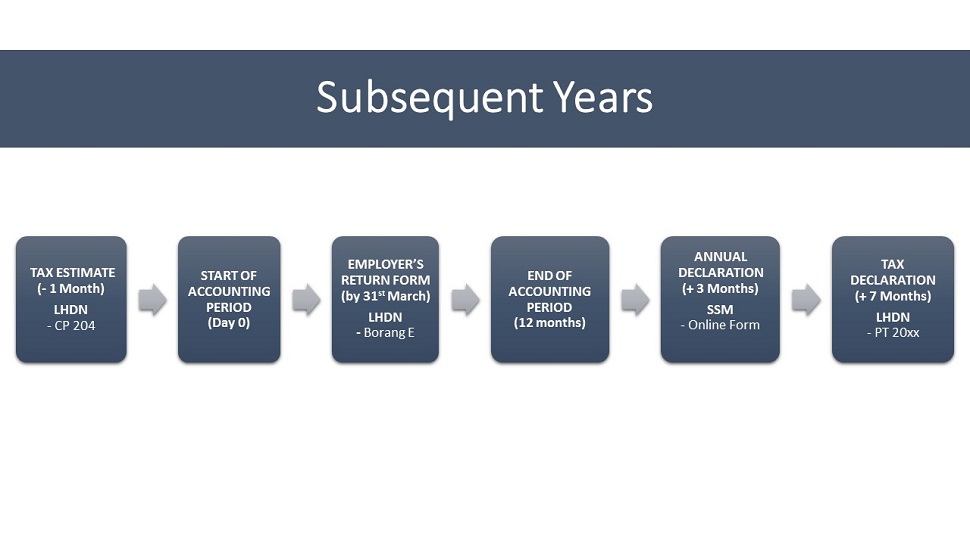

The deadline for filing form p is 30 june. Form b is tax return for malaysian tax resident individuals who are carrying business and deriving business employment and other income in malaysia. The following are the common forms of business organization in malaysia by an individual operating as sole proprietor by two or more but not more than 20 persons in partnership or by two or more persons in limited liability partnership or. While a partnership does not pay tax it still has to file an annual income tax return called the form p to show all income earned and business expenses deducted by the partnership during the year.

Generally these tax payers group are carrying business through sole proprietorship and partnership. Every partner has to report his share of partnership income in his form b. Form p is tax return for partnership in malaysia. The precedent partner is responsible for filling out the form p and issuing the form cp30 to each and every partner.

The partnership could file form p through paper form submission or e filling. Partnerships in malaysia partnership s are jointly owned by two or more individuals. Additional information on partnership the precedent partner is responsible for filling up form p and issuing form cp30 to each and every partner cp30 form. They have similarities to sole proprietorships but differ in two ways.

Lhdnm has to be notified in writing in case of any amendment to the form p already submitted.

.png)