Foreign Source Income Taxable In Malaysia

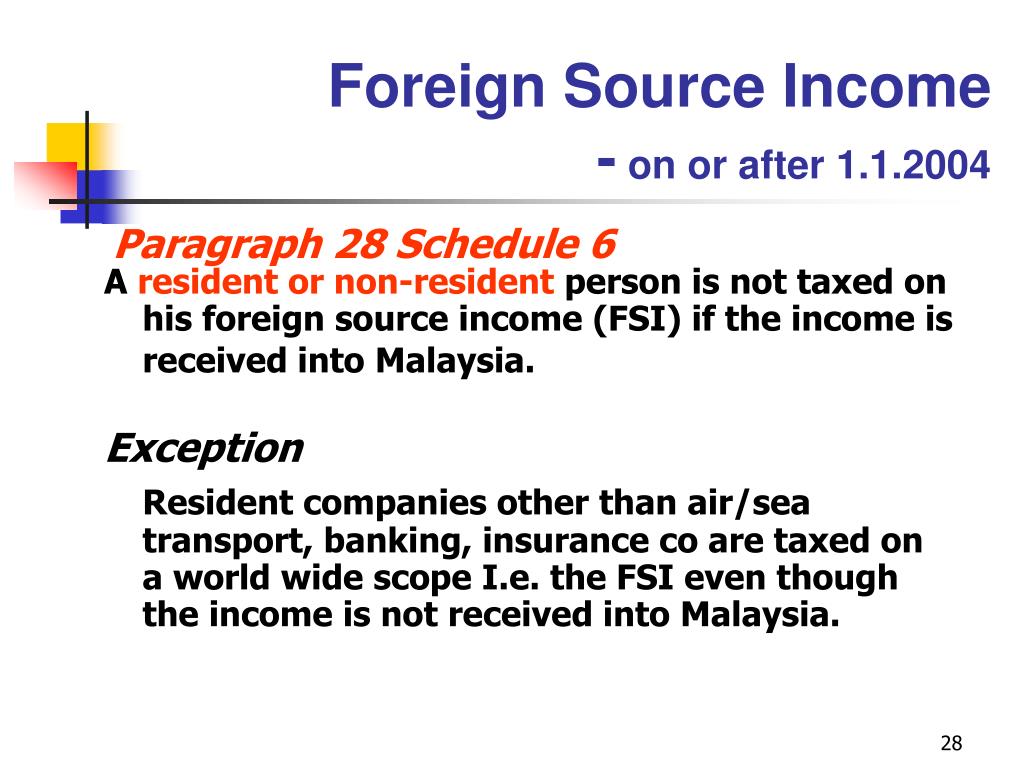

However income of a resident company from the business of air sea transport banking or insurance is assessable on a worldwide basis.

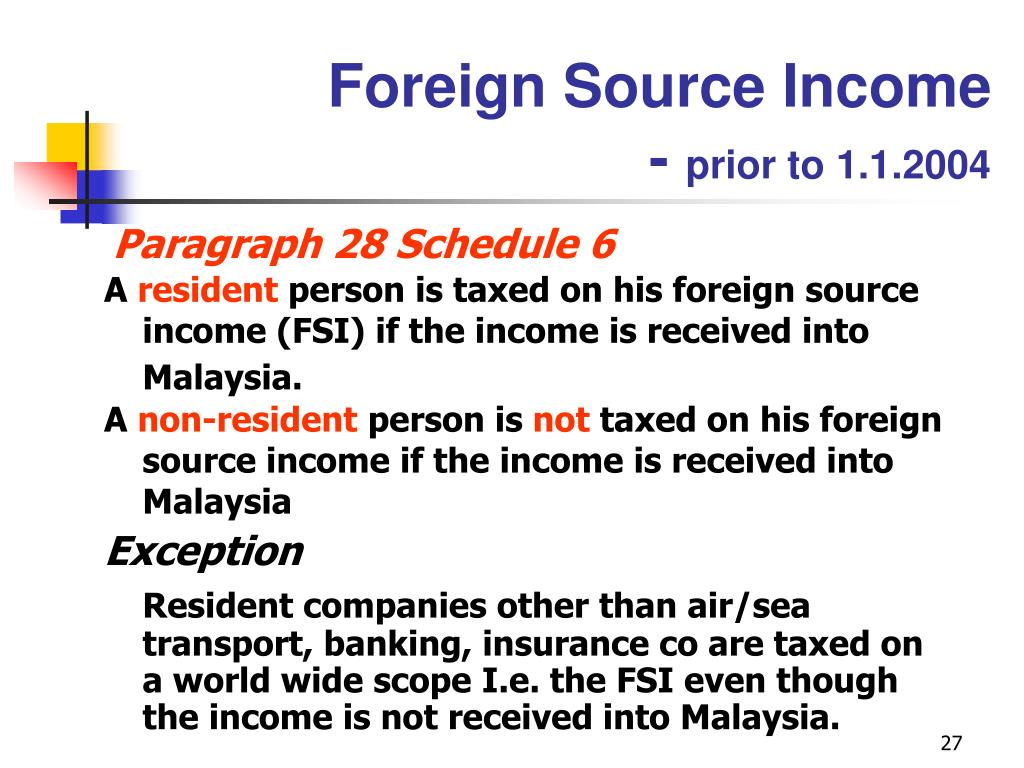

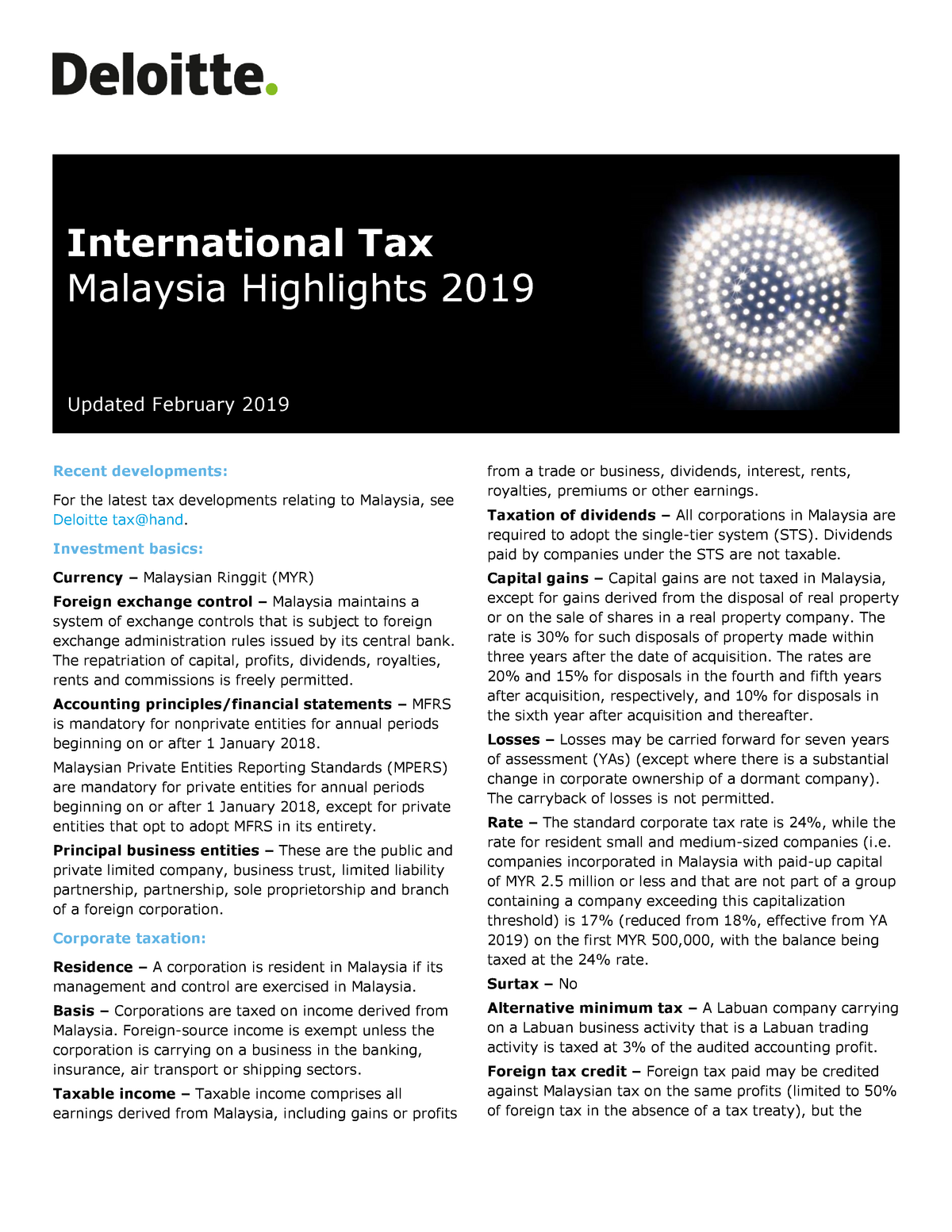

Foreign source income taxable in malaysia. Taxable income taxable income comprises all earnings derived from malaysia including gains or profits from a trade or business dividends interest rents royalties premiums or other earnings. Any income specified in part 1 of schedule 6 shall be exempt from tax part 1 schedule 6 para 28 1 income of any person other than a resident company carrying on the business of banking insurance or sea or air transport for the basis year of assessment derived from sources outside malaysia and received in malaysia. Any individual who has income accruing in or derived from malaysia or received in malaysia from outside malaysia for a year of assessment is liable to tax in malaysia. If income not capital gains derived from outside malaysia is remitted to malaysia that is sent back to or received in malaysia it is conceptually subject to tax in malaysia but malaysia has introduced law schedule 6 paragraph 28 to specifically exempt such income.

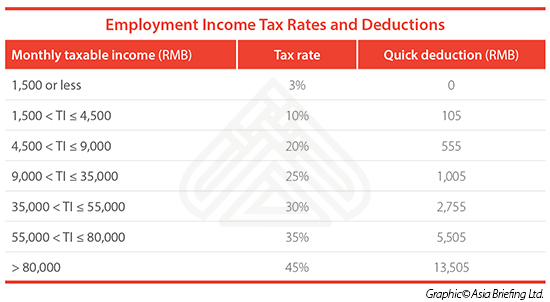

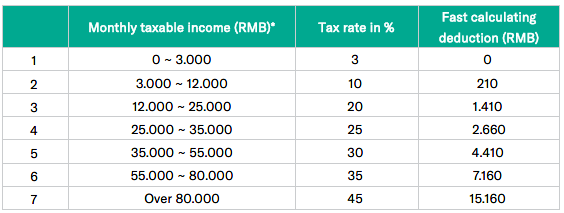

Section 12 of the income tax act 1967 is about the determining the source of income or derivation of income. Rates income tax is imposed at progressive rates up to 30 for resident individuals. Taxable income taxable income comprises all earnings derived from malaysia including gains or profits from a business employment dividends interest rents royalties premiums or other earnings. Employment income includes most employment benefits whether in cash or in kind.

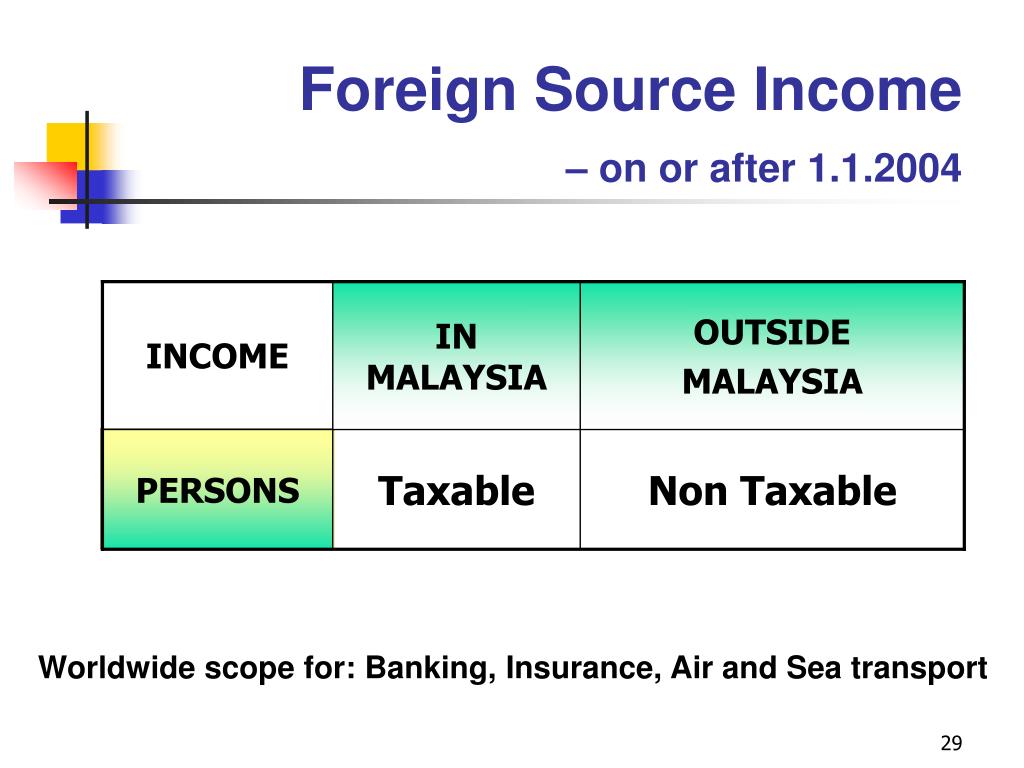

Income earned overseas is exempt but income earned in malaysia is taxable even though it s paid overseas axcelasia inc group chairman dr veerinderjeet singh pix told reporters at the malaysian. Foreign source income is exempt in malaysia. With effect from ya 2004 foreign source income derived from sources outside malaysia and received in malaysia by any person other than a resident company carrying on the business of banking insurance or sea or air transport is not subject to malaysian income tax. You can still take advantage of the rm6 000 tax relief you get under section 49 of the income tax act which covers insurance premiums and your epf contributions.

5 sources of income that are tax free in malaysia. The tax exemption is stated in the schedule 6 paragraph 28 of the income tax act 1967 click the link below for the pdf copy of the schedule 6. A resident individual is subject to tax on income accruing in or derived. With effect from ya 2004 foreign source income derived from sources outside malaysia and received in malaysia by any person is not subject to malaysian income tax.

Under the income tax act 1967 a malaysian tax resident company and a unit trust are not taxed on their foreign sourced income regardless of whether such income is received in malaysia. 3 company trips. This explains the last sentence of the statement. Taxation on a worldwide basis does not apply when income attributable to a labuan business activity of a labuan branch or subsidiary of a malaysian bank is subject to tax.